Scandinavian Capital Markets Review (2026)

What is Scandinavian Capital Markets?

Scandinavian Capital Markets is a pure ECN broker which uses STP model of execution and delivers its reliable trading environment to the Swedish market, due to its headquarter in Stockholm and beyond.

The broker is operating since 2011 and is a Prime Broker with custom liquidity feeds, tailored pricing and general flexibility over the trading process. Scandinavian Capital Markets offers access to Forex exchange and over 50 currency pairs with connectivity through Equinix NY4 Center resulting in its powerful global infrastructure.

Scandinavian Capital Markets Pros and Cons

Scandinavian Capital Markets account opening is easy, trading conditions are with good technology while spreads are average.

From the negative side, there is no good education and instruments range might be limited.

10 Points Summary

| 🏢 Headquarters | Sweden |

| 🗺️ Regulation | Swedish FSA |

| 📉 Instruments | Access to Forex exchange and over 50 currency pairs |

| 🖥 Platforms | Currenex, cTrader, MT4 |

| 💳 Minimum deposit | 10,000 US$ |

| 💰 EUR/USD Spread | 1.7 pips |

| 💰 Base currencies | USD, GBP, EUR, SEK |

| 🎮 Demo Account | Available |

| 📚 Education | Daily news, regular webinar |

| ☎ Customer Support | 24/5 |

Is Scandinavian Capital Markets safe or a scam

No, Scandinavian Capital Markets is not a scam but a regulated broker with low risks.

As a Sweden financial investment company operating from Stockholm also apply all the necessary legal procedures towards its secure trading conditions. The authority which oversees and regulates trading firms in Sweden is the Swedish Financial Supervisory Authority or Finansinspektionen. So Scandinavian Capital Markets is also respectively registered according to mentioned conditions, also fully compliant to European ESMA regulation and MiFID directive.

Therefore, trading or investing with Scandinavian Capital Markets there are applied guarantees on transaction transparency where no conflicts of interests appear due to its technological basis. Also together with its authorized status, there are numerous rules applied towards how the client is treated, his money operated and kept, which is never a case of an offshore firm.

Besides European regulation provides cross boarding regulated status and participate broker into a compensation scheme in case of its insolvency.

Leverage

Being a European Broker, Scandinavian Capital markets, therefore, obliges to its regulatory restrictions, which also recently significantly lowered possible leverage levels due to risks involved. While retail traders may access a maximum of 1:30 for major currency pairs and even lower for other instruments, while professionals, once the status is confirmed, may use the leverage of 1:100.

Accounts

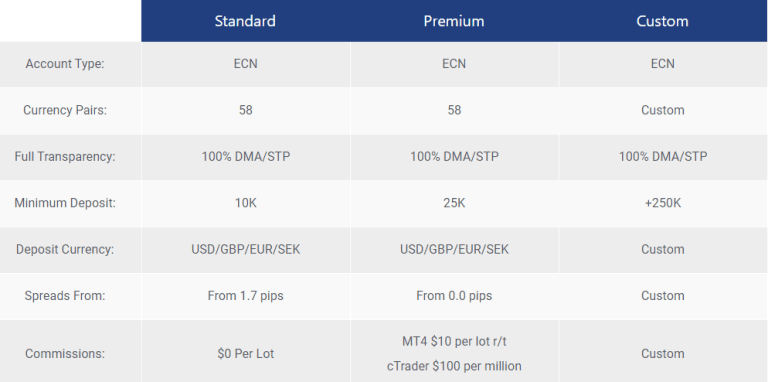

Scandinavian Capital Markets provides traders with a range of prime account packages defined by the operated trading size, eventually offering better conditions for higher grade traders. Therefore, there are three account types all featured with quite competitive low costs based on a raw spread and commission charges. Yet, the Standard account offers you conditions with all costs built into a spread.

Lastly, Custom accounts for institutions or big-size traders will define 100% custom conditions for those who maintain 250+$ as a start amount. Also, you may compare fees to another popular broker FBS so that the conditions will be more clear according to your particular need.

It is a fact the beginning either sophisticated professional will find correct conditions to apply for with Scandinavian Markets, along with Islamic traders who are able to open swap-free account more known as Islamic account.

Fees

Fees are defined by the account type you would you and are either based on a spread or commission charge. Also, consider other fees, see the fee table below.

| Fees | Scandinavian Capital Markets Fees | Goldwell Capital Fee | Lirunex Spread |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Average | Average | Average |

Spreads

Scandinavian Capital Markets spreads obviously vary according to the account type you use. Standard account spreads starting from 1.7 pips, while Premium account is based on a raw interbank spread with a commission charge of 10$ per lot for MT4 platform and 100$ per million traded through cTrader.

| Asset | Scandinavian Capital Markets Spread | Goldwell Capital | Lirunex Spread |

|---|---|---|---|

| EUR USD Spread | 1.7 pip | 1.8 pip | 1.5 pips |

| Crude Oil WTI Spread | 4 | 4 | 4 |

| Gold Spread | 50 cents | 50 cents | 50 cents |

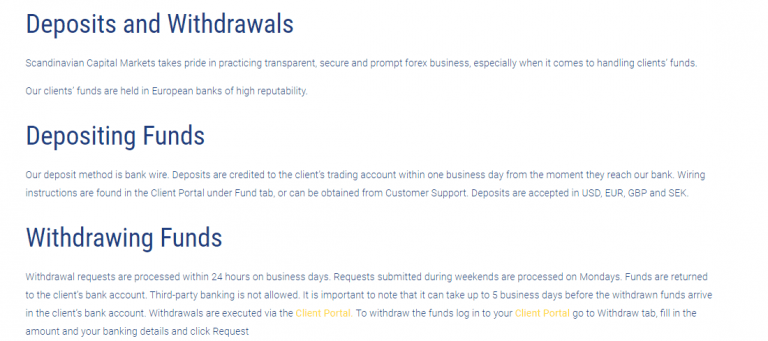

Deposits and Withdrawals

The last point of our Scandinavian Capital Markets Review is funding methods or how to send money to or from your trading account. Eventually, Scandinavian Capital Markets uses only deposits via Bank wire which may seem like a limitation, yet is the most reasonable and safe to send money.

Scandinavian Capital Markets minimum deposit

Scandinavian Capital Markets minimum deposit is 10k$, while higher grade accounts will demand bigger amounts. Actually, this amount might be unaffordable for beginning traders, yet considering Scandinavian Capital Markets trading offering and professional nature the broker still is a good option for active traders.

Scandinavian Capital Markets minimum deposit vs other brokers

| Scandinavian Capital Markets | Most Other Brokers | |

| Minimum Deposit | $10,000 | $500 |

Scandinavian Capital Markets withdrawal

Scandinavian Capital Markets withdrawal process requests quickly and does not wave any additional commissions for both deposits or withdrawals. Yet, your bank or particular jurisdiction conditions may submit some fees to your side which of course are solely yours.

Trading Platforms

Scandinavian Capital Markets trading technology shows unparalleled and powerful performance accompanied with a great choice of foreign exchange platforms. The technology basis provides customized liquidity for both institutional, professional or retails trades with the ability to tailor a solution and define its flexibility.

As for the option of the trading platforms themselves, you are able to select between proven software cTrader, Currenex and an industry-standard MT4.

Each platform utilizes intelligent trading technology and is a full-featured software with risk management, trade activities, and full settlement packages included.

So it is solely based on your preference and personal choice which platform to use with no restrictions and hedging allowance. Also, important to note Scandinavian Capital Markets gives access to auto-trading and API connectivity with Myfxbook tool through seamless replication of the positions.

Another important part of the Scandinavian Capital Markets offering is a solution for money managers through MAM accounts and offering specified for institutional traders.

Education

Although we will get to Scandinavian Capital Markets trading conditions and software in detail further, also broker provides necessary data required for trading success. These cover daily news, regular webinars and highly responsive customer support, which Scandinavian Markets is quite regarded of.

Conclusion

Overall, Scandinavian Capital Markets is fully compliant with necessary laws and regulations broker. Trading conditions might be a good option for either seasoned traders or active ones due to quite a high minimum deposit. In addition, the brokers trading solution defines sophisticated platforms and tools, also more necessary and suitable for professional or high-level trading required for fund managers or institutions. Yet, together with its learning materials from Scandinavian Capital Markets you may sign in for further development of the trading strategy you deploy.