Skilling Review (2026)

Regulator

What is Skilling?

Skilling is a fintech company based on STP performance and was started as an accessible, simple to trade and navigate the trading platform and brokerage allowing either beginners or professionals to engage. Founded by a Scandinavian tech team it was firstly incorporated in Malta and then moved its offices to other destinations.

While Skilling headquarters in Cyprus, they also serve the legal branch in the UK and enlarge its proposal through an international entity operating in Seychelles.

The broker maintained a balanced trading proposal with over 800 instruments and availability of the popular and powerful trading software including MT4 and cTrader. Besides, Skilling developed its own software Skilling Trader so the technical solutions stand on a good level, where conditions are transparent and allowing traders to focus on performance.

Skilling Pros and Cons

Skilling provides a good range of trading instruments, and technical solutions for low-risk trading. We admit great range of trading platforms, and advanced research tools with easy account opening.

On the negative side, there is no multi-currency accounts so fees for funding might be applicable, there is no education, also international proposal is different from EU regulated one.

10 Points Summary

| 🏢 Headquarters | Cyprus |

| 🗺️ Regulation and License | CySEC, FSC |

| 🖥 Platforms | MT4, cTrader, Skilling Trader |

| 📉 Instruments | Currency pairs and CFDs on Stocks, Indices, Energies, Metals, 10 Cryptocurrencies |

| 💰 Costs | EUR USD 1 pip |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 100$ |

| 💰 Base currencies | Several currencies |

| 📚 Education | No education provided. Research tools. |

| ☎ Customer Support | 24/5 |

Awards

Skilling eventually being a quite new player in the brokerage world, since 2016, already gained good reputation and is currently sponsoring Fulham F.C. as a principal partner.

Is Skilling safe or a scam

Skilling is a safe broker due to its licenses and legal matters, making sure that the company’s operations comply with the relevant trading requirements and internationally recognized financial standards that protect clients.

Is Skilling legit?

Skilling as first was established in Malta and then moved its headquarter to Cyprus also before its operation received a Forex trading license from CySEC, which also comply its standards and protective measures according to European ESMA.

Besides, due to its presence in various countries and established branch in the UK, Skilling received authorization to operate legally in the UK as well. So all in all, Skilling is regulated in each jurisdiction it offers its trading service.

Also, there is a license from an offshore Seychelles, which rather provides just registration than serious regulation, yet additional licenses from reputable authorities make the Skilling operation a reliable one.

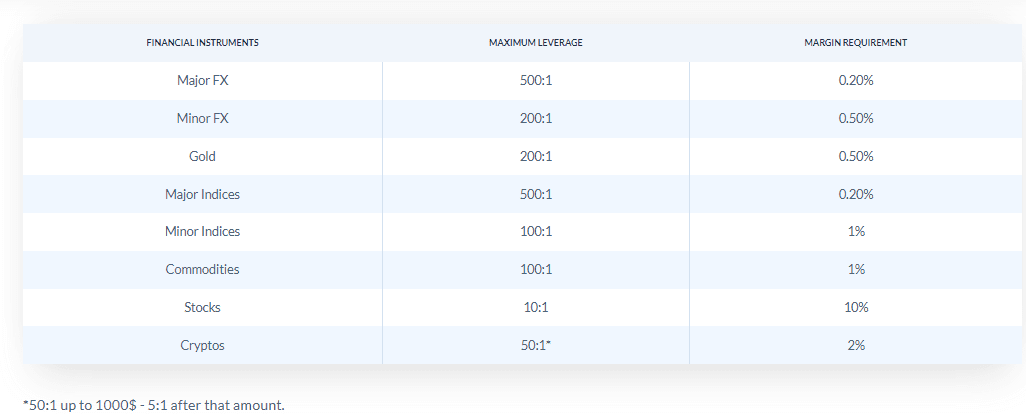

Leverage

Regulated Forex brokers are also known for the option to leverage positions with the potential to increase your gains and profits. Yet, leverage works in both ways making profits and losses bigger likewise. For this reason, worldwide regulations restrict leverage to particular levels.

Leverage levels are also defined by the Skilling entity you will trade through, as European regulation significantly lower allowed leverage for retail clients for 1:30, while professionals are entitled to use higher levels up to 1:200. More examples for European clients and from the UK you may see below.

Nevertheless, since Skilling made its proposal global via an international branch located in the Seychelles opening account with that entity will allow you to use higher leverage levels up to 1:500. Yet, be sure you learn well how to use leverage smartly and manage the high risks involved.

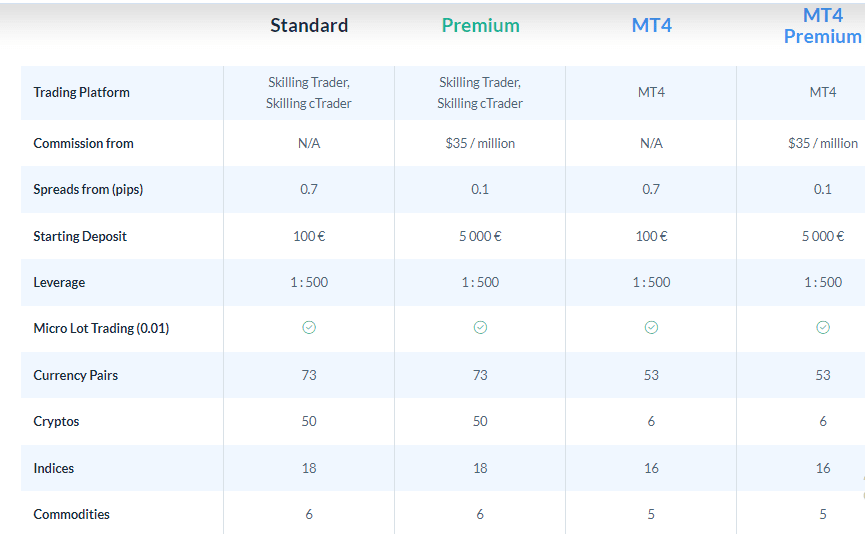

Account types

There are defined Standard Account with a spread basis and Premium accounts that are based on ECN Account execution with raw spread offering and commission charge per million traded. What is also great, you will open only one account and can use any platform of your choice for Standard account offering including MT4, cTrader, and Skilling Trader which we will cover in detail further in our Skilling Review.

Yet, the Premium account excluded MT4 from the proposal but we think it is not a serious limitation as cTrader and proprietary platforms might be even better for active trading or day traders.

How to open your Skilling account

Fees

Skilling trading fees and pricing model mainly based on spread charge, however, be sure to verify correct conditions as fees are based on the account type you select, as well may be slightly different according to the platform you will use for trading.

| Fees | Skilling Fees | AvaTrade Fees | BDSwiss Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low/ Average | Average | High |

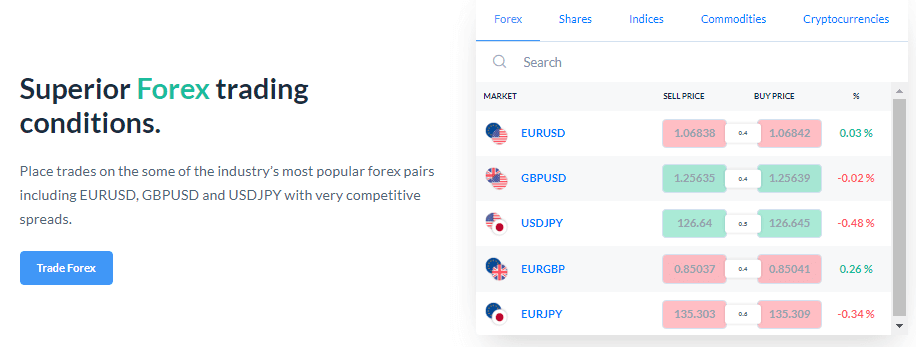

Spreads

Standard account conditions, as the majority of traders will go for this selection where all costs are built into a spread and starting from 0.7 pips. Actually, Forex and currency pair fees are competitive compared to the industry where typically EUR USD stands at 1 pip.

A Premium account will offer interbank spreads from 0.1 pips and charges a commission of 35$ per million traded, which is quite competitive as well.

CFD fees

As for the CFD fees, they might be slightly higher if to consider other brokers alike you may see below for Gold and Oil spreads. However, dependent on the instrument some spreads might be good ones, some slightly higher, so you better consider all points and see if Skilling is good for you in general, as the quality of a broker is not only about trading costs.

Comparison between Skilling fees and similar brokers

| Asset/ Pair | Skilling Spread | AvaTrade Spread | BDSwiss Spread |

|---|---|---|---|

| EUR USD Spread | 1 pip | 1.3 pip | 1.5 pip |

| Crude Oil WTI Spread | 7 | 3 | 6 |

| Gold Spread | 59 | 40 | 25 |

Instruments

The markets that you can trade with Skilling include popular currency pairs, including minor ones, and CFDs on Stocks, Indices, Energies, and Metals also including 10 Cryptocurrencies with Ripple, Ethereum, Litecoin, Bitcoin, etc.

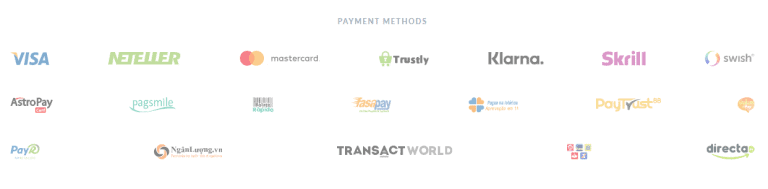

Deposits and Withdrawals

Skilling supports various instant deposits and withdrawal methods also offered with no commission charges, yet it does depend on the jurisdiction and particular method as some fees might be applicable. Besides deposit methods vary according to the regulations as well, while some are available only for international clients so be sure to learn more about money transactions.

Deposit Options

Skilling typically does not charge any deposit fees or internal charges, also deposits are visual within 1 hour, accept the Trustly or Bank wire which may take up to 3 working days to process the transaction.

- Bank Wire Transfers, Trusly

- Credit Cards, Debit Cards

- e-wallets Neteller and Skrill

International traders will be able to use more methods including fasapay, AtroPay, swish, directa, etc.

Skilling minimum deposit

Skilling Standard account’s first deposit is 100$, the Premium account will demand 5000$ Also, check on the necessary margin requirements that are usually set for each trading instrument separately.

Skilling minimum deposit vs other brokers

| Skilling | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

How to make a deposit?

- Select account

- Choose payment method

- You will receive an email confirming the deposit

Withdrawals

Skilling withdrawal options allow to use so far most used Bank transfers and Credit cards, also e-wallets are withdrawal option.

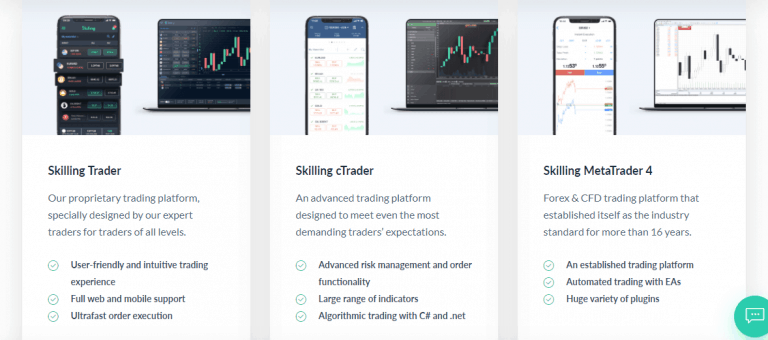

Trading Platforms

The trading platform choice offers the selection between industry leaders MetaTrader4 and powerful cTrader, also Skilling Trader a proprietary software developed in-house which is quite advanced as well.

| Pros | Cons |

|---|---|

| User friendly trading software | Premium account does not support MT4 platform |

| Offering MT4, cTrader and Skilling Trader | |

| Platforms supporting Web, Mobile and Desktop platforms | |

| Fee Report | |

| Technical analysis and no limitation on strategies | |

| Great research tools | |

| Suitable for professional and regular use | |

| Supporting various languages |

Web trading

So the selection between platforms is truly good, as you may choose the most suitable one for your need, while all platforms are available through a single account credential. Yet, the Premium account does not support the MT4 platform.

Skilling Traders is specially designed by expert traders software and is a fully web-based platform, also it has its mobile application allowing to stay updated on the go. cTrader and MT4 are also supporting Web platforms, but for more comprehensive analysis is recommended at desktop versions.

Desktop platform

MetaTrader4 will be a good choice for any trader since it is the most used software for more than 16 years allowing to run automated trading and has a huge variety of plugins.

Skilling cTrader is more good for advanced traders as it is also known for its sophisticated and powerful capabilities, large range of indicators and professional risk management with an algorithmic trading option via C#.

Mobile Trading Platform

Free and simple to use apps suitable for iPhone and Android devices, supporting all offered platforms and allowing to stay in control whenever you are. All in all, Skilling definitely satisfies all trading demands whenever size or style of the trader you may be, and this is marked as a bit plus within our Skilling Review.

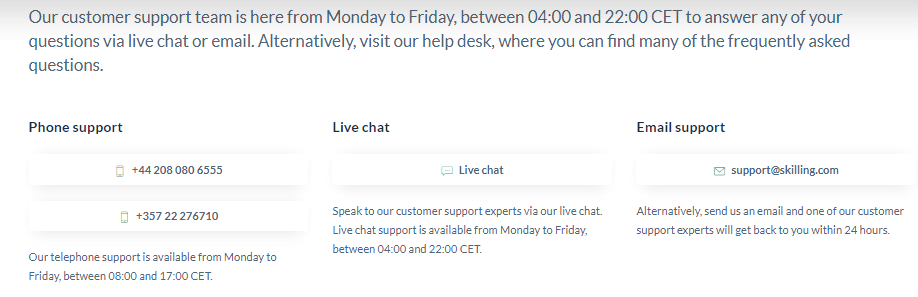

Customer Support

Together with the quite advanced trading conditions, you will get the support that brings customer service in various languages available 24/5, also supporting international phone lines, live chat, and email support. Actually, we test Skilling quite a good ranking for its support quality and responds quickly.

Education

Skilling provides a free Demo account and included some good research tools that are inbuilt into the platforms that you select for trading, also with News Feed. Each of them features different capabilities, so you better place your strategy at the test and see which tools are more suitable for you, but we rank it as a highly good one.

Nevertheless, very beginning traders will not get the necessary education support, learning courses, webinars or fundamental analysis at Skilling, so if you still prefer to trade with the broker we recommend signing for an extensive education course with other providers or check brokers for beginners.

Conclusion

Overall, Skilling being a relatively new player among brokers, has already obtained quite a good reputation and competitive trading conditions. One of the best points in its proposal is a great selection between the trading software including industry-leading platforms or a proprietary one, which is available through a single account. Professionals will get an advanced proposal with tailored solutions as well, while the support center is quite responsive. However, the only con could be lack of education sources and materials, so complete beginners would need to search for webinars and courses somewhere else.