Spreadex Review (2026)

What is Spreadex?

The company Spreadex was established back in 1999 and focused on a financial trading service providing, as well spread betting and sports betting, through its maintained office in London. Firstly, Spreadex launched an online sports betting service in 2006 and then followed by the financial online trading platform. Generally, the company shows its positive growth and strives in terms of quality service delivery and presents itself as one of the biggest spread betting firm brokers within the UK.

The company base of clients counted by over 60,000 account holders, which chooses to trade with attractive Spreadex conditions and access to over 10,000 global markets including indices, shares, FX (also with Bitcoin), commodities, bonds, options, Exchange Traded funds and interest rates. Moreover, the company offers the widest selection of AIM stocks in the industry starting with a low 20% margin.

Eventually, by its continuous development of trading offering that walks together with the technology development and necessity to access trading with the latest developments, Spreadex shows its various enhances and additional specifications.

Thus, in 2012 Spreadex revamped its online trading platform to include advanced features like one-click trading, standard/ pairs view and customizable trading windows. A few years later, Spreadex released also its new financial fixed odds markets, referred to as “Speed Markets”, allowing to place fixed risk bets on financial markets.

Spreadex Pros and Cons

Spreadex has good regulation and quality trading conditions with variable or fixed spread, mainstay on MT4 with good tools, research and support with education materials.

For the Cons, check carefully trading conditions they are different depending on trader residence, there is no 24/7 support and fees are higher for fixed spreads (Read about fixed spread brokers).

Is Spreadex safe or a scam

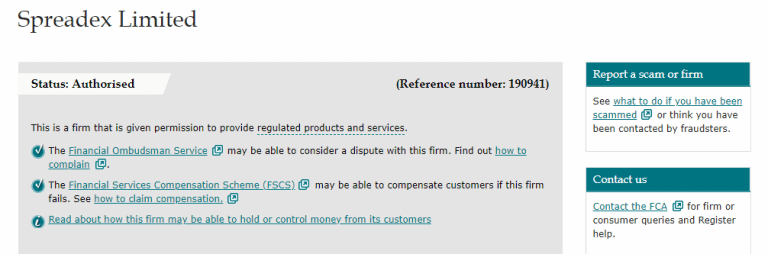

No, Spreadex is a UK based brokerage and sports betting firm that is fully licensed by the FCA (Financial Conduct Authority), with low risk Forex as it’s an essential part of any financial or investment company operating in the UK.

Therefore, Spreadex trading offering and opportunity also fully complies with the necessary regulatory requirements and the manner the company is operated. In other words, the only stability you may get from a trading broker is its proven record of reliability through the regulatory framework and the transparency the company may provide, which happens only within the authorized services the company may provide.

Overall, Spradex stable and profitable track record along with sufficient capital requirement proves the company reliability, also bringing you confidence. The customer protection enabled according to the FCA rules as well, while clients can invest knowing that money are safe and kept segregated top-tier bank accounts.

In addition, one of the main parts of the requirement is to enable every client participation in the FSCS Scheme that compensates up to 50,000£ in the unlikely event of the company insolvency.

Leverage

As for the Leverage levels within our Spreadex Review, we see that being a UK brokerage firm the broker thus obliged towards its restrictions and on how the company should operate. Therefore, the maximum offering available for retail traders goes to 1:30 for major currency pairs and lower for other instruments.

As for the professionals, they may access higher leverage ratios once the status is confirmed, along with specified conditions towards spread betting and trading service Spreadex may provide.

Account types

Spreadex has single account with easy application where you should fill the application form and proceed with further steps alike funding to start live trading. The Spreadex accepts international applications, however, some territories may be restricted due to legal and regulatory reasons.

The account interface allows viewing online history, statements, to receive instant bet confirmations, as well as to set suitable trading preferences.

Fees

Spreadex fees are mainly built into a spread, however important to check other fees like funding or inactivity, see fee table below.

| Fees | Spreadex Spread | City Credit Capital Spread | INGOT Brokers Spread |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | Low |

Spread

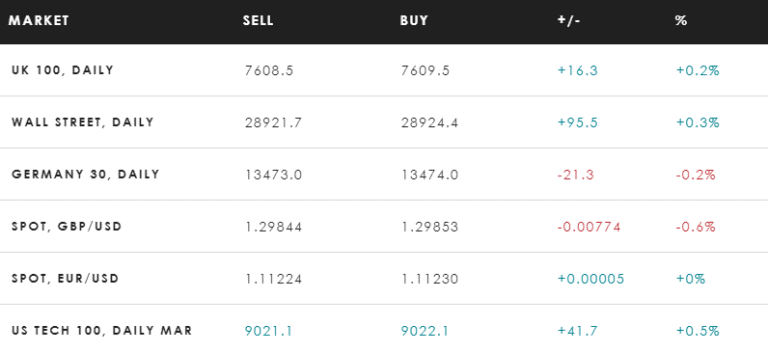

Spreadex costs are mainly built into the spread, which are fixed tight spreads for indices, shares, commodities and might be variable for Forex instruments. Thus, the spread is from 1pt n UK100, Germany 30 and 1.7 on Wall St, also see more examples below and explore forex brokers with low spreads.

As for the Financial spread betting as a fast (See spread betting brokers), simple and cost-effective trading within the global markets, you may get spreads from 0.6 points and one of the leading margin rates with the specialized provision on UK AIM stocks.

| Asset | Spreadex Spread | City Credit Capital Spread | INGOT Brokers Spread |

|---|---|---|---|

| EUR USD Spread | 0.6 pips | 1.2 pips | 1.1 pips |

| Crude Oil WTI Spread | 3 | 3 | 3 |

| Gold Spread | 25 | 35 | 29 |

What funding methods Spreadex offers?

Spreadex account can be operated on a pay-as-you-go basis, by funding the account by Credit/Debit Cards, Direct Bank transfer or cheque. The basis currencies are an optional choice in GBP, USD or EUR currency.

Spreadex minimum deposit

Spreadex account has no minimum deposit requirement, any obligation to trade or joining fees, however you should check margin requirement for the instrument you will be trading.

Spreadex minimum deposit vs other brokers

| Spreadex | Most Other Brokers | |

| Minimum Deposit | $0 | $500 |

Spreadex withdrawal fee

Spreadex withdrawals are cleared with a minimum of 50£ with the rule to withdraw only onto the card that was used to deposit funds (as per the regulatory). The CHAPS same-day transfers are also available at the charge of 25£. Spandex does not charge for making payments using UK cards, yet, a 2% administration fee for all credit card payments is applicable, along with a 2.5% flat fee on all card transactions that are not in sterling.

Trading Platforms

Spreadex’s trading platform is a fully-customizable, fast and reliable proprietary platform that is available through web or mobile application versions. From a single account Spreadex traders getting access to spread bets and CFDs with advanced charting tools, award-winning execution, price alerts and watch lists. The platform is constantly under development in order to stay up-to-date with modern tools and advanced trading capabilities.

The technical analysis also presents sophisticated drawing tools, extensive price history, powerful indicators, pattern recognition feature and automated Pro Trendlines. So even though there is no availability of MetaTrader4, you would not regret using Spreadex software either.

Along with its technical capabilities, there is a range of assistance tools enabling the clearest vision of the markets that bring the possibility to evaluate or predict further movements for its own better. There are analysis tools with pattern charts, trading updated, candlestick recognitions and indicators that are free to all customers.

The vastness of opportunities brings hints for beginners or tools to control the risks, one-click trading, various order types with guaranteed stops and spread-betting strategies along with the comparison to CFDs.

Customer Support

Furthermore, there is an alternative way to trade directly by making a call to the company team ready t assist in every possible way. Eventually, Spreadex provides not only award-winning support, but also enables education materials, allowing you to learn better through knowledge of the latest trading strategies.

Together with that, Spreadex provides market tools and analytics on a regular basis, economic indicators and more, which all assists in your better knowledge and market vision so important in the trading process.

In fact, Spreadex is a company that gained numerous awards as the Best Spread Betting Firm for Customer Service along with other recognitions and listings as the UK’s top 100 most profitable companies etc.

Conclusion

The Spreadex review presents a company, which showed a significant growth within the UK market for its achievement in Spread Betting and Sport betting services. The range of financial instruments and markets are widely presented, along with convenient fees and a possibility to enlarge the trading portfolio. A proprietary platform is also a powerful software that is packed with tools and capabilities through OTC execution. Overall Spreadex is an interesting combination for those who are interested in Spread betting, however, the clients from other countries (apart from the UK) should check the trading possibility according to their country of residence as it may vary.