Stratton Markets Review (2026)

Regulator

What is Stratton Markets?

Stratton Markets is a new brand or trading name of F1Markets investment services company that specializes in trading CFDs, Shares, Commodities, Indexes and Currency Pairs with fixed spreads on more than 180 top-class assets with the latest news and market insights. The company located in Cyprus and was established in 2017 which combined a modern trading need and investment expertise.

Therefore, according to its location the broker is authorized by the local authority CySEC and able to provide services to international and across European Union. Also, F1Markets previously run another brokerage firm Wise Trader, which is recently not active any more.

The broker supports both types of traders, novice and experienced ones with the necessary information, access to advanced tools and the required support to trade in the markets. Through its collaboration with multiple liquidity providers, Strattor offers the best available spreads with no-requotes or extra commissions on orders.

Education

As One of the main goals of Stratton is to help in trading skills development, the education delivered by free eBooks and webinars divided by the Basic, Intermediate, Expert and Premium levels. Moreover, the constant support delivered by the trading coaches and support teams that will explain, advise and guide the trader or investor through all the stages.

Is Stratton Markets safe or a scam?

Stratton Markets is owned and operated by F1Markets Ltd, a Cypriot registered company that is fully regulated and licensed by CySEC. Therefore, the company operates in accordance with the rules and regulations of the European Union, due to its location within the EU.

The above regulations include also provisions that protect Clients funds and financial investments by various steps, alike keeping funds in segregated accounts within reputable Banks, participation n to compensation scheme, automated monitoring transaction systems and risk management, and more. In addition, WiseTrader is subject to strict financial control, which includes regular internal and external auditing.

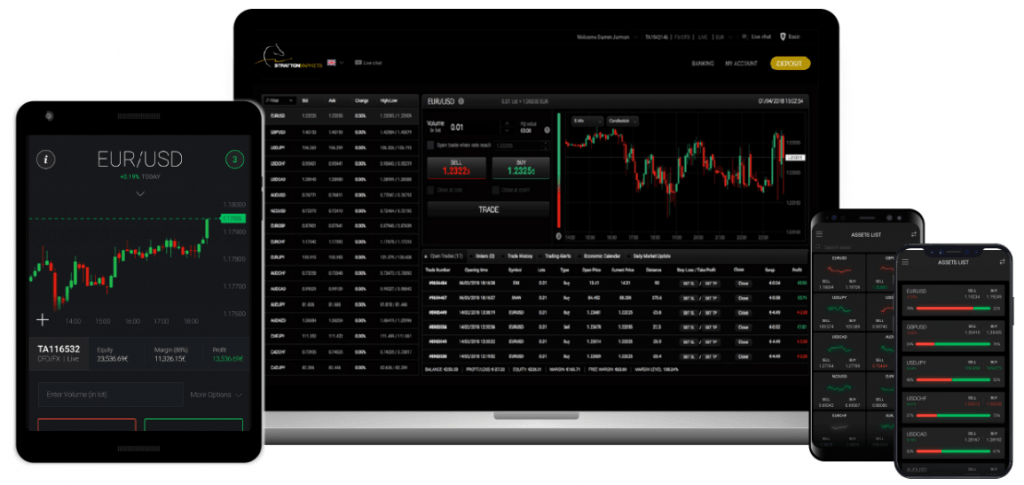

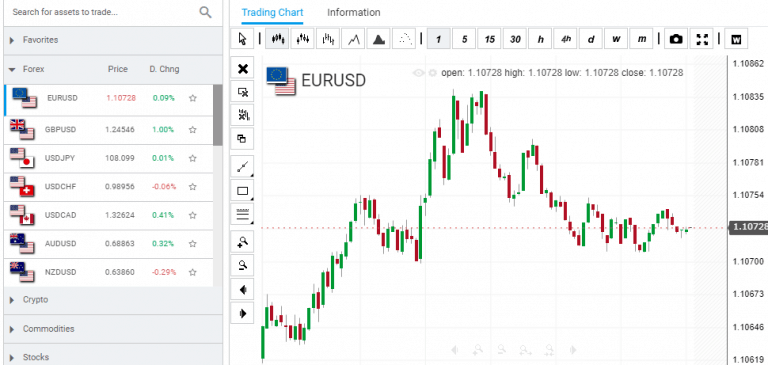

Trading Platforms

Award-Winning Platforms offered by Stratton including a choice between two, either Stratton Markets WebTrader or industry known MetaTrader4. Both allow a smart connection with access to global markets 24/5, a user-friendly and easy to use interface. There is no need to install or to download any program or software, the Stratton platform is web-based, thus accessible from any device through the browser with an internet connection.

In terms of the tools and instruments, both platforms bringing all ranges of necessary additions, yet the only missing part in Stratton Markets platform is a possibility to automate the trading, while you may cover this need through MT4. Yet, the company constantly works on the platform improvement and soon planning to present additional platforms, mobile applications and even more.

Accounts

The Stratton Markets offers 5 different account types so that you can make the most of the trading experience. The account choice is diverse by the available information and support along with more competitive pricing, which are presented by the spread only basis and deposit requirements from 250$ to 25,000$ initial balance. The higher account you maintain, the more information, tools and resources you will get along with the possibility to define right moves at the right time.

The range of Account Types includes Basic, Silver, Gold, Platinum and Diamond types with constant support from the company and a slight difference between the spread offerings.

Fees

Trading costs are built through the fixed spread policy, e.g. typical spread for GBPJPY 0.08 with instant access to global economies. In addition, Stratton delivers the possibility to make the most of the extensive training resources and cryptocurrencies trading with the leverage up to 1:5, and spread on BTCUSD of 200. Let’s also take as an example EURGBP pair and differences between costs according to the account type, so the Basic Account spread is 0.0007, Silver – 0.0005, Gold – 0.0004, Platinum – 0.0003 and Diamond – 0.0002. Moreover, the Diamond account includes a Free VPS service, News Alerts and Dedicated Account Manager.

As well compare fees to another popular broker Pepperstone.

Stratton Markets rollover

In addition, always consider Stratton Markets rollover or overnight fee as a cost, which is charged on the positions held longer than a day. Each instrument has a different condition for overnight positions and may be checked directly from the platform.

Leverage

As Forex trading is known for its great opportunity to use powerful tool leverage, as it may increase your potential gains with its possibility to multiple initial accounts balance. Stratton Markets also allows you trading with leverage, while its levels depending on a few issues.

First of all, leverage applies according to the regulatory restrictions and then to your personal level of proficiency. Therefore, being a retail trader the maximum level you may use defined by European ESMA to 1:30 for major currencies, 1:20 for minor ones and 1:10 for commodities. So, the professional traders may apply for higher levels up to 1:400 for currencies.

Funding Methods

Stratton Markets payment methods including and accepting all major credit and debit cards, electronic wallets and wire transfers through the leading third-party payment providers. The basic currency of the account is remaining at your choice, making it a great opportunity for easy finance.

Minimum Deposit

While the minimum deposit amount is set to only 250$ with quick transaction processing and further withdrawals transferred within 1 day. Yet, minimum deposit at first also defined by the account type you are planning to open as the margin requirement varies from 250 up to 25,000$.

Withdrawal

The minimum withdrawal is 50$, or any other available base currency, with applicable fees by the company that processes the fund withdrawal. What is amazing, Stratton Markets covers transfer internal fees for the payment it provides, however, make sure to check with the payment provider himself in case they wave any fees for your side.

Conclusion

Stratton Markets review presents a company, which was trading before as a Wise Trader, as the broker relies on the experience and expertise of the mother company which is the investment firm authorized by CySEC. Overall, the company provides reliable trading conditions with the range of the instrument to choose from, 5 accounts of different size and a powerful proprietary trading platform. The platforms are packed with tools and features, that enable seamless trading and extensive analysis.

Furthermore, one of the comprehensive designed services is Stratton education that is divided by the trader’s level and delivers a unique opportunity to learn the best practices and understand markets deeply. The broker sticks mainly to the fixed spread, which enables stability during the trading process under any market conditions. The experienced traders can also enjoy more competitive trading conditions along with extra services that enhanced trading capabilities, alike Free VPS, signals and more.

Yet, we would be glad to know your personal opinion about Stratton Markets, you may your experience in the comment area below, or ask us for some additional information.

F1Markets Update

Strattong Markets is no longer active. The warning as of 28 May 2020 took place towards F1Markets that uses StrattonMarkets or Wise Trader as its trading name.

F1Markets received a warning from the UK’s FCA and imposed specified requirements to stop and no longer run any marketing promotions in the United Kingdom or provide trading service. F1Markets is actually accused in its aggressive and not compliant marketing materials that are not fair, clear and misleading to the public, that resulted in numerous complaints and loss of money.

“F1Markets Ltd is not permitted to provide regulated financial services to residents of the United Kingdom.” – FCA mentions, read more by the official warning link.