Swissquote Review (2026)

Regulator

What is Swissquote?

The beginning of the company started back in 1990 by set-up of Marvel Communications SA, a business specializing in financial software and web applications. Further on, the business model became Swissquote through the launch of the first financial platform in 1996, which offered free access to private investors real-time prices for all securities traded on the Swiss stock exchange and with the mission to democratize banking.

And actually, until now Swissquote is visited 2 million times per month and is still Switzerland’s largest financial portal.

Swissquote Group Holding Ltd is Switzerland’s leading provider of online financial and trading services listed on the SIX Swiss Exchange and has its headquarters in Gland (VD) with offices in Zürich, Bern, Dubai, Malta, Hong Kong and London.

Is Swissquote a good broker?

Well, for sure the broker hold a strong establishment and good reputation, while its trading conditions as we will see further in Swissquote Review are quite competitive.

Through their milestones, Swissquote takeover of MIG Bank Ltd, one of the leading Forex worldwide broker, also behaves as a strategic pather with PostFinance and numerous other world leading financial institutions like Goldman Sachs, UBS, Commerzbank, Vontobel, etc.

Swissquote provides mainly range of online trading services, yet the user-friendly platform also offers solutions for eForex, ePrivate Banking, eMortgage and flexible saving accounts. In addition to a low-cost service for private clients, Swissquote also developed specialized services for independent asset managers and corporate clients.

Swissquote Pros and Cons

Swissquote provides quality trading conditions and is multiply regulated broker with global recognition and audit. There are good platform in Swissquote offering including MetaTrader with no restrictions in strategies, costs are low and learning material are great for beginning traders. Funding methods are widely offered, traders can benefit from online banking via Swissquote Bank.

From the cons, conditions are different in each jurisdiction, also spreads might be higher for some instruments like Currency pairs.

10 Points Summary

| 🏢 Headquarters | Switzerland |

| 🗺️ Regulation | FINMA, FCA, MFSA, SFC, DFSA |

| 🖥 Platforms | MT4, MT5, eTrader, Swiss DOTS |

| 📉 Instruments | Shares, Warrants and Derivatives, Options and Futures, Funds, ETFs, Indices, Forex, Commodities, Bonds and Cryptocurrencies |

| 💰 EUR/USD Spread | 1.7 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 1,000 US$ |

| 💰 Base currencies | USD, EUR, GBP |

| 📚 Education | Provided with research tools |

| ☎ Customer Support | 24/5 |

Awards

There are many industry awards that recognized the strive and achievements of Swissquote.

In addition, the firm takes an active part in social contribution and support. Since 2015 Swissquote is in a global partnership with Manchester United, one of the most popular football teams in the world.

Is Swissquote safe or a scam

Swissquote is considered safe broker, the broker is regulated by multiple top-tier authotiries lke FCA in UK, FINMA Switzerland, etc.

Is Swissquote legit?

First of all, Swissquote Bank Ltd holds a banking license issued by its supervisory authority the Swiss Federal Financial Market Supervisory Authority (FINMA) and is a member of the Swiss Bankers Association.

Furthermore, world established branches are the subsidiaries of the Swissquote Bank and respectively authorized by the relevant to the country regulators.

Thus the reputable regulation from Switzerland along with other authorities bringing a clear state on transparent and trustful operation Swissquote performs.

| Swissquote entity | Regulation and License |

| Swissquote Group Holding Ltd | Authorized by FINMA (Switzerland) |

| Swissquote Ltd | Authorized by FCA (UK) registration no. 562170 |

| Swissquote MEA Ltd | Authorized by DFSA (Dubai) |

| Swissquote Asia Ltd | Authorized by SFC (Hong Kong) |

| Swissquote Financial Services (Malta) Ltd | Authorized by MFSA (Malta) registration no. C 57936 |

How are you protected?

In general words, the sharp regulation of the broker means that every transaction and action it does is overseen and reported strictly. In addition, the broker and bank at the same time do not only acting fairly towards the clients, since authorities may fine entity in case of a breach but also compensating and covering clients risks by various means.

And actually, this is the main reason why every trader should consider only well-regulated brokers and do not fall under offshore trading, which lacks any guideline.

Leverage

Swissquote mentions on its website a Standard Leverage level of 1:100. However, according to the regulation particular entity falls under the specific requirements, therefore the rates may change, as well as the level of trader professional or retail always affects the rate too.

- Therefore, European clients entitled to use a maximum of 1:30 for major currency pairs and even lower for other instruments.

- Entities in Dubai (See the best forex broker in UAE here) and Hong Kong may be entitled to higher 1:200

Nevertheless, every trader should learn how to use leverage smartly, as high rates increasing risk levels too, which may cause loss of money.

Account types

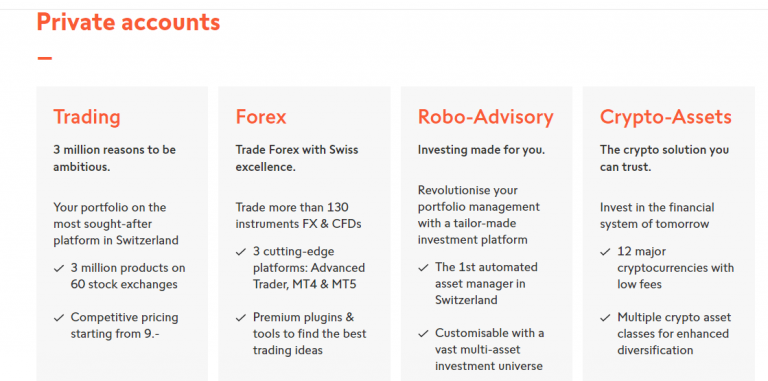

There are Swissquote four different trading accounts optimized according to the trader type and can be either private or B2B accounts. While here in Swissquote review we will more cover retail or private trading account for a business account you can check the official website.

So for private account, there are four trading accounts all designed for particular conditions or need you would need. First is Forex account brings a choice of multi-asset platforms including MT4, MT5 and advanced trader with availability to trade FX and CFDs. Trading account brings an option to optimize portfolio via Stocks trading with over 3 million products and 60 exchanges.

Robo-Advisors account is an investment account with revolutionary portfolio management that Swissquote is a quite known for.

Lastly, Crypto-Assets account is a solution to trade 12 major cryptos with quite low fees. Of course, all above mentioned accounts available in demo version too, to practice and get familiar with the systems.

Trading Instruments

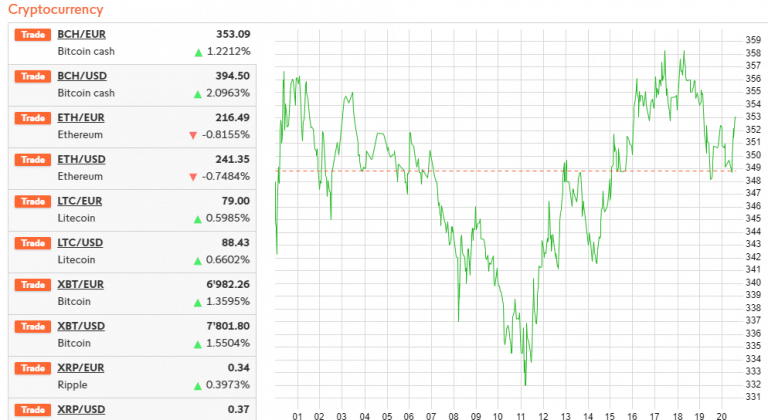

Experienced or either starting traders will find the instruments best suited for optimal investment and need, the choices diverse to Shares, Warrants and Derivatives, Options and Futures, Funds, ETFs, Indices, Forex, Commodities, Bonds and Cryptocurrencies.

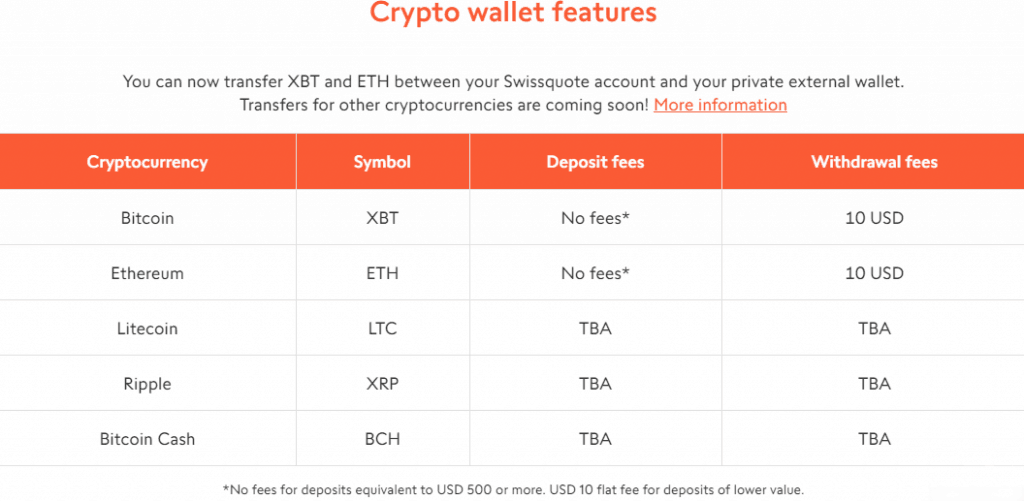

The attractive rates presented for Funds, ETFs and Swiss DOTS starting from 9 pips, Options and Futures from 1.5 CHF. While, the cryptocurrencies trade has quickly established itself as a leader that brings an infinity opportunity to trade through 5 available instruments Bitcoin, Ethereum, Litecoin, Ripple and Bitcoin Cash.

Fees

Swissquote trading cost for all instruments diverse according to the trading size and trader’s activity, while generally considered to be on a low spread level. Total swissquote fees are based on spread plus funding fees, inactivity fees and swap fees (also see swap-free trading account). See below Swissquote costs comparison.

| Asset/ Pair | Swissquote Spread | CMC Markets Spread | Dukascopy Spread |

|---|---|---|---|

| EUR USD Spread | 1.7 pips | 0.7 pips | 0.2 pips |

| Crude Oil WTI Spread | 5 | 3 | 5 |

| Gold Spread | 28.6 | 3 | 30 pips |

| BTC/USD Spread | 1% | 0.75% | 60 |

Spreads

Sqissquote spreads are different for each account feature its own fee structure, while costs can be inbuilt into a spread only basis like with Forex trading or with a commission for Stocks or investment.

E.g. while trading Cryptocurrencies for amount equivalent 5 – 10,000 CHF 1% fees will be charged, as long as the size goes above it can reach 0.75% fees or even 0,5% only.

See below Swissquote typical trading fees for popular instruments, while you can see that fees are rather averages for all brokers listed, where each defines its separate structure. You can also compare Swissquote trading fees to another Swiss broker BlackBull Markets.

| Fees | Swissquote fees | CMC Markets Fees | Dukascopy Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | Yes | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Average | Low | Low |

Deposits and Withdrawals

Transaction of funds is an easy and quick process at Swissquote, as the funding options including the most major one’s Wire Transfer, Credit Cards Deposits, China UnionPay and now use even recently presented Crypto Wallets.

Minimum deposit

Swissquote minimum deposit is 1,000$ for a Standard forex account and goes higher according to the trader’s size, or the account you may use.

Swissquote minimum deposit vs other brokers

| Swissquote | Most Other Brokers | |

| Minimum Deposit | $1000 | $500 |

Withdrawals

Swissquote withdrawals processed through unique Swissquote eBanking services that allow to add or withdraw funds and manage account simply and conveniently. Being a Swiss bank you can issue your very own Swissquote Card with all the benefits to pay and withdraw right from the cash-machine.

The fees are depending on the payment method but generally, Swissquote does not charge deposit or withdrawal fee, as well deploy 0 account maintenance fees.

Trading Platforms

The Swissquote direct access to the markets provided by the highly secured and powerful platforms which the company chose to offer, that are also divided by the financial instrument client trades or investor’s profile.

| Pros | Cons |

|---|---|

| Proprietary trading platform Swiss DOTS User friendly design and login | None |

| Price alerts | |

| eTrader, MT4, MT5 offered too | |

| Supporting many languages | |

| Technical analysis | |

| Great mobile trading apps |

Web trading

The choice comes to eTrading platform, Swiss DOTS, Themes Trading and Mobile applications, so you are able to choose and cover your particular need. Actually, the proposal is truly impressive so see below do general info and choose the best for you.

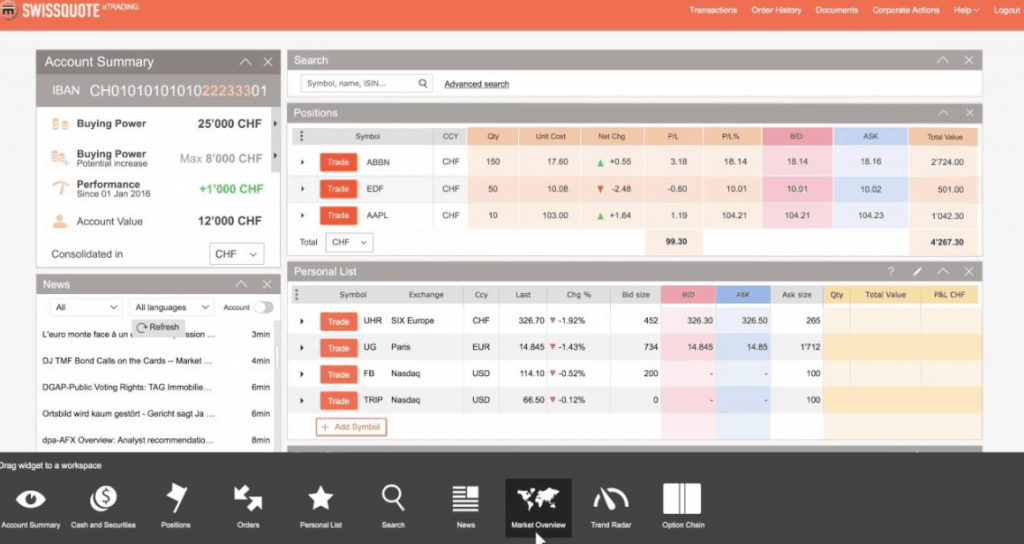

– eTrader is a multi-asset platform suitable for all traders, enable to achieve objectives in a simple and intuitive way. Widgets on eTrading platform bringing account overviews, ratings and analysis along with daily analysis through Trend Radar.

– Swiss DOTS a platform for derivatives with more than 90,000 OTC products offers competitive conditions at 9.- flat with range of extensive tools

Desktop platform

From the download center you can select the platform you need according to your device settings as well. In addition, Forex and CFDs trading available via the MT4 and MT5 platforms as well, so if you prefer its popular technology Swissquote got you covered.

Mobile trading

Moreover, free applications designed for any device iPhone, Android, Smartwatch and even Apple TV, offering sophisticated technological solutions. Various tools can be connected to the platform, exclusively to swiss clients’ availability to trade with a virtual reality headset, or through MacOS screensaver or TV and more.

Robo trading

Another great Swissquote feature is autonomous investing that requires a separate look. Without an emotional impact developed and brought by robots that deliver precise results, increase of performance and saving time.

The robo-advisor is an electronic asset manager that creates a portfolio and monitors around the clock.

The Robo-Advisors works with the same algorithm applied to the Swissquote Quant Fund, which received the Lipper Fund Award for the best performance over three years in 2016.

Customer Support

Another good point in our Swissquote review goes to qualified customer support available around the clock through Live chat, phone lines or emails. Customer service defined by the region with available hours and hotlines as well, which is a quite well organized structure allowing traders to stay always in touch.

Education

Through Swissquote’s education center you can access detailed and professionally prepared education materials with key elements, analysis, courses, webinars and e-books. In addition, of course Dem account is at your disposal together with powerful analytical, technical analysis inbuilt into the platforms, together with news fed and price alerts.

Conclusion

Overall, Swissquote review sees a company with strong establishment according to Switzerland strict financial laws, also broker withholds all necessary licenses and follows sharp regulations in each global jurisdiction. The traders who require a multi-asset solution the Swissquote bank is a good option, through access across a vast array of exchange-traded sides. The technical solution from the company is quite impressive too, in addition, any trader can benefit from the leading online-bank solutions for your comfort and need. Along with educational materials, worldwide supporting offices and trustworthy offers all in all worth consideration.