Tickmill Review (2026)

Regulator

What is Tickmill?

Tickmill is a new player among the brokers and online trading world since the company established in 2014 with its headquarter in London, UK as well as offices in Seychelles. Tickmill strives to innovate a unique trading experience to its clients while understanding traders’ rights as the major part of the trade, for this purpose company, continuously facilitates trading conditions.

Indeed, the broker develops rapidly and their yearly achievements are quite impressive. Recently Tickmill management responsibilities expanded, since additional part to “Tickmill family” been added in the name of a Tickmill Europe Ltd (ex Vipro Markets Ltd).

Tickmill Pros and Cons

Tickmill is a heavily regulated Broker with good reputation, globally recognized and offering good trading conditions for Professional or regular size traders. Tickmill has one of the best learning and research materials, and is great for EA trading.

On the negative side proposal vary according to the entity and there is no 24/7 support, spreads for Forex are little higher than average.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA, FSA, CySEC |

| 📉 Instruments | 62 currency pairs, Cryptocurrencies, Bonds, CFDs and Precious Metals, Stock indices |

| 🖥 Platforms | Mt4, WebTrader |

| 💰 EUR/USD Spread | 0.3 pips |

| 🎮 Demo Account | Available |

| 💰 Base currencies | USD, GBP, EUR |

| 💳 Minimum deposit | 100 USD |

| 📚 Education | Professional education center with Trading Blog |

| ☎ Customer Support | 24/5 |

Awards

Tickmill as a new company has grown rapidly throughout only a few years so that the broker has been recognized by industry publications already, which is definitely great for the building of a successful portfolio.

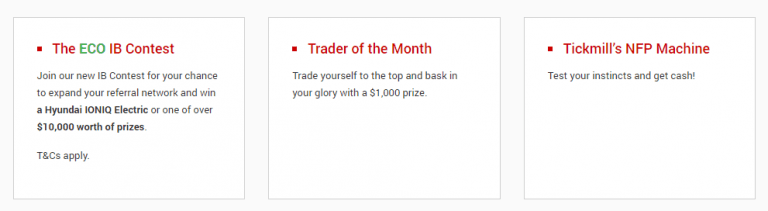

Along with that Tickmill constantly runs a range of fascinating promotions, which helps to boost trading and enhancing even beginning traders’ possibilities.

Is Tickmill safe or a scam

No, Tickmill is not a scam, is a secure broker with good reputation and low risk Forex and CFD trading environment.

Is Tickmill legit?

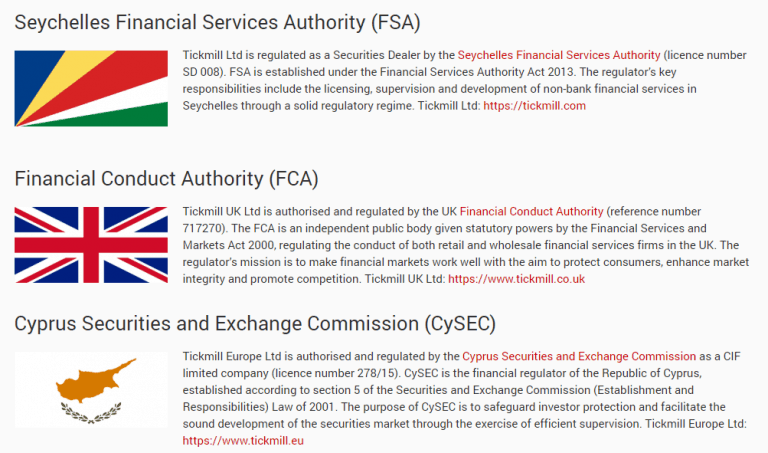

Tickmill is a multiply regulated broker is various jurisdictions, thus considered a safe broker to trade with. Tickmill trading name of a Tickmill UK Ltd and Tickmill Ltd Seychelles regulated as a Securities Dealer.

The broker authorized and regulated by two major UK Financial Conduct Authority and by the Financial Services Authority of Seychelles, hence either entity includes strict regulations. Besides, Tickmill now grows to Asia region as well and establishes its entity to cover the proposal.

In addition, newly added to the company line Tickmill Europe Ltd (ex Vipro Markets Ltd) is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) and is a Member of the Investor Compensation Fund (ICF).

Customer Protection

To ensure security and transparency of transactions Tickmill keeps clients’ funds in segregated accounts with trusted financial institutions, as per FCA regulations. In addition, clients are covered by the FSCS with investments up to £50,000.

Leverage

Being a UK and European based regulated broker Tickmill follows strict guidelines set by the European authority ESMA. A recent update from the European regulator set a limitation towards maximum offered leverage levels, as ESMA recognized a potential risk in case very high leverage is used.

- Clients of Tickmill Europe may use leverage up to 1:30 for Forex products, 1:5 for CFDs and 1:10 for Commodities.

- International traders since Tickmill serves entity through Seychelles and other entity as well, so the clients with the opened account under this jurisdiction may enjoy high level of leverage.

Account types

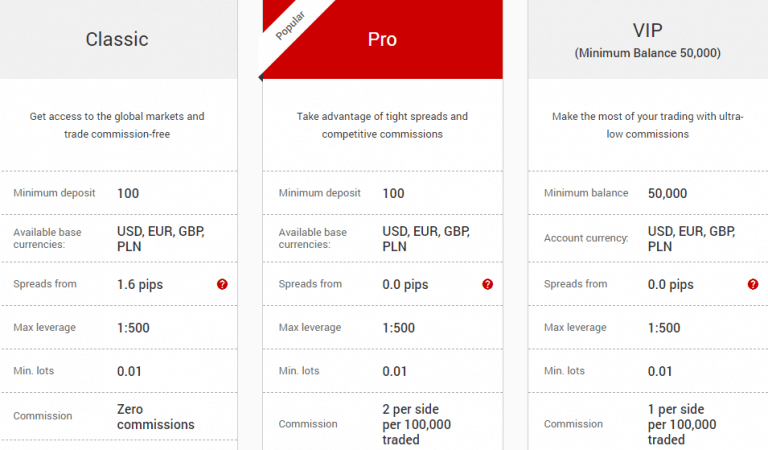

There are 3 main Account types in TIckmill’s proposal, where you can choose either account based on spread only Classic Account or with commission per trade Pro Account. The third account is designed for high-volume traders and is named VIP Account where conditions are tailored and defined as per agreement.

Additionally, Islamic or Swap-Free Account, been added to the broker features recently too. These accounts comply with the Sharia law, which has exactly the same trading conditions and terms, but there is no swap or rollover interest on overnight positions, that is against the faith.

How to open account at Tickmill

Fees

There are different price modes according to the account type you choose. Besides, fee conditions always vary according to the regulatory rules authority impose and broker obliges to. So be sure to verify specific conditions as well. Here we will check a brief of spreads and commission charges that are defined by the account type.

| Fees | Tickmill Fees | GO Markets Fees | XM Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | High |

Spreads

Tickmill pricing model and spread see the table below, set according to the type of account trader will enjoy lower costs along with some commission per trade. In the tale we compare Standard spread conditions, while Pro accounts are based on a commission of 2 per side and interbank spreads from 0 pips.

The overnight fee should be considered as a cost as well, e.g. EURUSD swap for long position is -11.742 while for short is 6.693 US$.

You can also compare Tickmill trading fees to another popular broker Pepperstone.

Comparison between Tickmill fees and similar brokers

| Asset/ Pair | Tickmill Fees | GO Markets Fees | XM Fees |

|---|---|---|---|

| EUR USD Spread | 0.3 pips | 1.2 pips | 1.6 pips |

| Crude Oil WTI Spread | 4 | 1.9 | 5 |

| Gold Spread | 20 | 1.4 pip | 35 |

Trading Instruments

Tickmill Europe Ltd is fully licensed to provide the investment services of Agency Only Execution which deliver high-grade trading instruments 62 currency pairs, Cryptocurrencies (opportunity to trade CFD on Bitcoin, with margin 20% and 0 Commission per side, per 1 CFD).

Stock indices, Bonds, CFDs and Precious Metals, with a minimum deposit requirement of only 25$, fluctuating spreads from 0.0 pips, some of the lowest commissions in the industry and no requotes, delays or interventions policy.

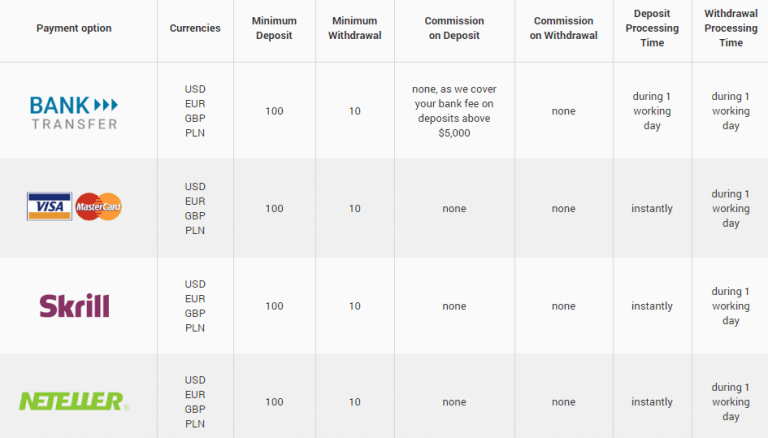

Deposits and Withdrawals

For the Deposit or Withdrawal options broker using convenient methods with perform payments with ease and diverse.

Deposit Options

Payment options including popular Bank Transfers, Credit/ Debit Cards, E-wallets Neteller, fasapay, UnionPay, dotpay, NganLuong. vn (only for clients of the Tickmill Ltd Seychelles) with available currencies USD, EUR, GBP, PLN.

What is the Tickmill minimum deposit?

The Tickmill minimum deposit is 100$, which is a fantastic opportunity for the trader of even very small size, in reverse 10$ is set for withdrawals.

Tickmill minimum deposit vs other brokers

| Tickmill | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawals

Tickmill withdrawals, deposits or requests are submitted via your online account area. While Tickmill process withdrawals within 1-2 business days as per regulatory obligations. Tickmill hasa zero fee policy, where no charges or fees applicable to monetary transactions. All deposits from 5,000$ also including zero fee policy and all fees up to 100$ will be covered.

Trading Platforms

Like most brokers the broker using as mainstay trusted and well-tried MT4. Trading platform available on desktop or tablet, in web or on the go with a smartphone. As well, though many among the brokers do not allow stop and limit orders placing close to market prices, Tickmill allows so, so it is another good point in Tickmill’s proposal.

| Pros | Cons |

|---|---|

| MT4 and WebTrader | No alternative platform or proprietary software |

| Copy Trade, Social Trading and Technical Indicators | |

| No restrictions on strategies | |

| Fast execution | |

| Available in various languages |

Web Platform

Web platform is very useful to any size of the trade since does not require any installations, but is reachable right from your browser. Yet, this platform is rather limited with tools and drawing instruments so for comprehensive analysis you would definitely need a desktop version.

Desktop Platform

It is fact that every platform is different even you trade MetaTrader4, as it is a broker decision what to include and propose in its software. Good news that Tickmill platforms have been enhanced with the span of useful tools including:

- Autochartist – powerful technical analysis tool with automatic recognition feature

- Myfxbook AutoTrade – allows following of the strategies developed by the successful trader

- One Click Trading – trading through EAs (by the company statistics about 63% of the executes are placed by algorithms and EAs)

- Tickmill VPS – keeps EAs and signals active even while the trader is offline

- Forex Calendar – plugging market insights and news

- Forex Calculators – displays currency converter, margin calculators, etc.

Tickmill striving to reach success trading among their client, hence they do not impose restrictions on profitability and allows all trading strategies including hedging, scalping and arbitrage. Nevertheless, be sure to verify conditions with particular entity regulatory restrictions as those may apply.

Mobile Platform

Customer Support

Also good to consider Customer Support, where Tickmill shows a professional team available around the clock and supporting international languages accessible via Live Chat, email, and phone lines in various regions including the UK and International as well.

Yet, customer service isn’t available during the weekends, so you can leave your request via the contact form to be advised.

Education

Another good point to note in Tickmill proposal and offering is established Learning Center along with professional Trading Blog where traders can find recent updates, various educational materials and educational programs designed to develop skills and knowledge.

Online webinars, live market analysis, technical analysis, regularly held seminars and traders community of minded traders all is a very good level and available for all.

Conclusion

Overall, Tickmill inviting clients with their attractive features such as a low minimum deposit, technical solutions, a great range of instruments and interesting promotional campaigns, also we found some of the low spreads for Forex trading. Moreover, the company’s strive to achieve targets quickly and effectively while posing Tickmill as a high-tech and trustable Forex broker, either to start or to gain new apex with.

Reviews

Hi I’m interested in opening a Pro Account I’m looking for a broker managed account that will give me hourly updates on my managed account and information regarding stop losses how do that work?

What are the requied documents for withdrawal