Trade Nation Review (2026)

Regulator

What is Trade Nation?

Trade Nation was established in 2014 under the brand name Core Spreads. This was eventually has been changed to Trade Nation in 2019 as a trading provider with products and services for online foreign exchange and CFD trading. The broker has offices in the UK, Australia, South Africa and Bahamas.

The company’s aim has always been to make online trading more accessible, enjoyable and profitable, which also confirms its worldwide presence and what is more important is heavy regulation. Nevertheless, the broker offers its services globally and carries out local entities with the purpose to support traders in the UK, Australia, and other international destinations.

| Pros | Cons |

|---|---|

| Fully regulated broker | Trading proposal and conditions vary according to regulation |

| Free deposit and withdrawal | Offshore entity |

| Fixed spreads | |

| MT4 | |

| Good educational tools |

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA, ASIC, FSCA, SCB |

| 🖥 Platforms | CoreTrader2, MT4 |

| 📉 Instruments | FX, CFDS |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 0 US$ |

| 💰 Base currencies | Several currencies offered |

| 📚 Education | Included on a free basis |

| ☎ Customer Support | 24/5 |

Is Trade Nation safe or a scam?

When it comes to online trading, security is paramount to understanding that your capital is secured and protected by the law regulations.

| Pros | Cons |

|---|---|

| FCA and ASIC regulated international broker | International proposal runs through offshore entity |

| Global coverage and years of operation | |

| Negative balance protection |

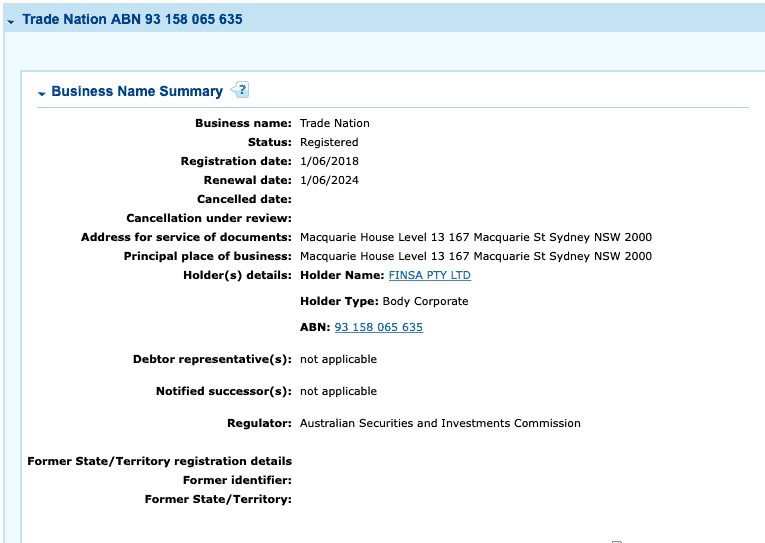

Is Trade Nation legal?

Trade Nation is regulated by the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA) in South Africa. Trade Nation operates out of the United Kingdom, Australia, South Africa and the Bahamas.

Also, Trade Nation serves an additional entity that serves global clients from its offshore branch based in the Bahamas. Of course, we never recommend trading with offshore brokers, however, since Trade Nation also follows reputable licenses from ASIC and FCA (Learn about FCA Regulated Broker Infinox Minimum Deposit) it means the broker is sharply regulated in terms of its operation.

How are you protected?

Trade Nation is heavily regulated in 4 jurisdictions, including ASIC in Australia (Forex Brokers in Australia) and the FCA in the UK. This regulatory status means Trade Nation is required to always treat customers fairly, in accordance with the strict requirements of each regulator.

Moreover, the broker is also regularly audited and keeps all clients’ funds in segregated trust accounts along with compensation schemes in case of insolvency to ensure money is protected. All funds are held with top-tier banks, such as Barclay’s in the UK and Westpac in Australia.

This broker also offers negative balance protection to all retail client trading accounts.

Leverage

Another great feature while trading Forex is an allowance to use leverage, which may potentially increase your gains. However, in order to minimize risks as well, which work in both directions, it is necessary to learn how to use leverage smartly.

Trade Nation is offering leverage up to 1:200 that opens the path to the forex market for Retail traders with a quite low or small initial deposit to cover margins. The use of leverage can magnify gains but you should always remember that losses can also exceed your initial deposit.

- 1:30 allowed for the UK and Australian traders

- 1:200 for an international proposal

Accounts

The broker offers Individual, Professional and Corporate account types.

Certainly, broker’s practice and learn accounts are there for clients to get used to using its platform and trading its markets.

The broker provides its traders with a trading simulator which is basically a demo account. This gives an opportunity to either test out your strategies without risking any money via a practice account or set up a live account to access all the platform features and start trading for real.

| Pros | Cons |

|---|---|

| Fast Account Opening, fully Digital | None |

| No minimum deposit |

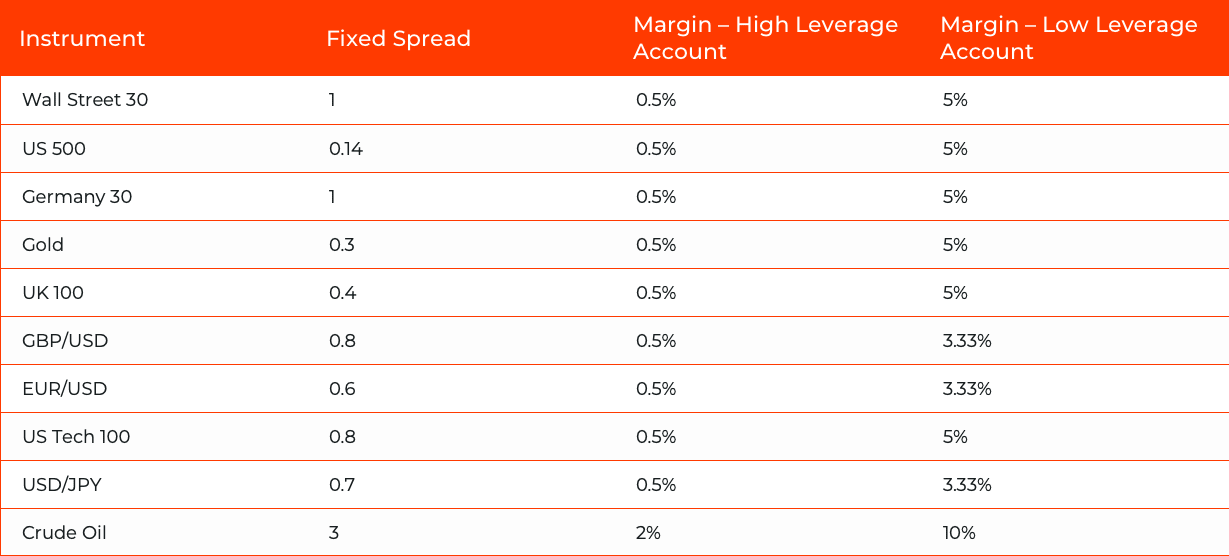

Fees

Trade Nation offers low fixed spreads. Their spreads remain low and fixed regardless of whether there are market fluctuations. Unlike variable spreads that could potentially be much wider by the time you exit your position, their spreads stay exactly the same from start to finish.

Pros

Cons

No inactivity fee

High forex fees

0$ Deposit and Withdrawal fee

Low stock and index CFD fees

| Pros | Cons |

|---|---|

| No inactivity fee | High forex fees |

| 0$ Deposit and Withdrawal fee | |

| Low stock and index CFD fees |

Overnight Fee

Traders trade on margin with Trade Nation, which means they can open a position with just a small percentage of its total value. Basically, the broker lends traders the full amount so they can make the trade, and in return, they pay a little each night their position remains open. The amount depends on the market traders are trading and the direction of the trade.

Deposits and Withdrawals

There is no minimum deposit for the new Trade Nation investors. Traders only need enough funds to cover the margin requirements of their trade.

The broker accepts debit cards, credit cards and bank transfers. They can also receive deposits via Skrill. Payment with the credit/debit cards are instant, while bank transfers may take several days to be processed.

Trade Nation offers accounts in GBP, USD, EUR, AUD and ZAR. They also offer DKK, NOK, SEK.

The minimum withdrawal amount is 50 of the currency of your account, for example, 50 USD.

There’s no minimum deposit to trade with Trade Nation and they don’t charge any fees for deposits or withdrawals either.

| Pros | Cons |

|---|---|

| No deposit fees | Conditions may vary according to regulations |

| Withdrawals free of charge | Few minor account base currency available |

| Wide range of payment methods supported by an international entity |

Trading Platforms

Trade Nation users can Spread Trade on The Trade Nation platform CoreTrader2 and they also can trade CFDs on the MetaTrader4 platform.

Nevertheless, the company still offers as an option popular MetaTrader4, which is accessible through various versions for desktop, web and mobile accordingly. The platform features leading indicators, oscillators, EA strategies and automated desktop stations that all in all bring numerous options for smart investment and trading processes.

Of course, all platforms feature mobile trading app, so you can use Mobile devices that are bringing absolute freedom to trade.

Customer Support

Another good point in its client-oriented philosophy is a competent customer service which is available through various methods including Online Live Chat, Phone, emails, etc. Broker’s team is available 24/5 and supports international languages accessible via Live Chat, email, and phone lines in Australia, UK and International as well.

| Pros | Cons |

|---|---|

| Quality customer support with live chat | No 24/7 support |

| Phone support |

Education

Trade Nation provides great research tools with comprehensive analysis suitable for beginning traders and also supporting everyday trading, while features including news and analysis, trading tips from experts, beginner guides with video platform guides. Also, the broker offers signal centre – FCA regulated trading signals and ability to create custom market watchlists.

| Pros | Cons |

|---|---|

| Demo account | None |

| Free Education | |

| FCA regulated trading signals | |

| Market news & analysis |

Conclusion

Concluding Trade Nation Review we couldn’t find too many details about trading conditions provided by the broker itself, overall the company seems to be a reputable brokerage firm. It is not only regulated in one entity but in various world leading financial hubs, which confirms a strong establishment base.

The good points are low deposit to start and up to date market information is a helpful tool for the new to trading, while professionals will find numerous solutions to their trading needs.