Trade360 Review (2026)

Regulator

What is Trade360?

Trade360 is an international brokerage firm that was previously established in the offshore island only, Marshall Islands, while further since trading word become more popular and traders looking for regulated entities established its branches in Cyprus and Australia.

Trade360 was founded in 2013 by a group of trading entrepreneurs and technology experts that wanted to democratize the trading environment and offer trading access to the world.

Eventually, the step which Trade360 made by acquiring previously established financial brokers in entities like Cyprus and Australia, made it possible for European and Australian traders (Best Forex Trading Platform Australia) to engage in safe trading activity since those entities are regulated and overseen by the local authorities. Therefore are considered safe investment opportunities.

For more of the trading details we will look further in our Trade360 Reviews, but be sure you learn all the details deeply as we would advise trading with only entities under serious regulations.

Trade360 Pros and Cons

Trade360 provides quality trading conditions via its Australia and Cyprus entities, with good costs and trading options like social trading. Account opening is easy and smooth.

On the negative side, there are also some negative responses about the broker that happened with the international entity.

10 Points Summary

| 🏢 Headquarters | Cyprus |

| 🗺️ Regulation and License | CySEC, ASIC, MFSC |

| 🖥 Platforms | MT4 and CrowdTrader |

| 📉 Instruments | CFDs on Currency Pairs, Commodities, Stocks and Indices |

| 💰 Costs | EUR USD 3 pips |

| 🎮 Demo Account | Offered |

| 💳 Minimum deposit | 100$ |

| 💰 Base currencies | Several Currencies |

| 📚 Education | Not provided |

| ☎ Customer Support | 24/5 |

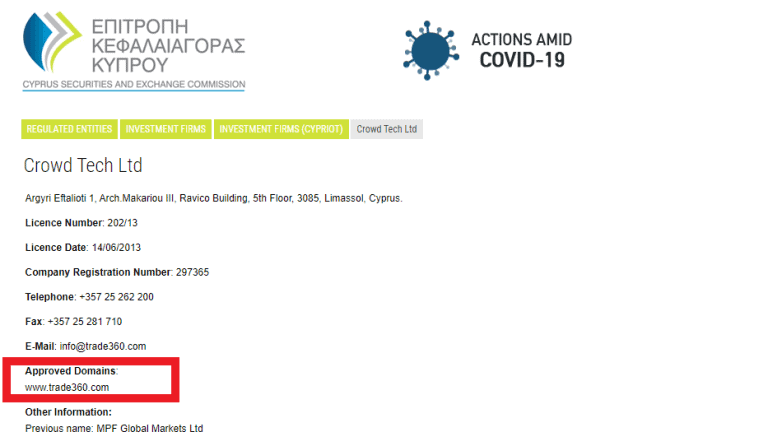

Is Trade360 safe or a scam

Trade360 is not a scam, it has a quite long history of operation while previously it was solely an offshore firm now it has regulated CySEC (See CySEC regulated TriumphFX’s review) and ASIC licenses with lower Forex risks.

Is Trade360 legit?

Concerning the most important question, we now found that Trade36 operates through three entities, while one is still based in the offshore Marshall Islands where requirements and audit from the authorities are rather basic.

While another entity is now again located in Cyprus since Trade360 operates through Crowd tech company established under necessary laws and particular obligation to ESMA rules and customer protection. In addition, there is an Australian entity that is also regulated and registered with ASIC, the authority that oversees Forex and the trading industry.

So overall we would again mention that you better open account under-regulated entities of Trade360 where conditions are aligned to customer protection rules so you get layers of safety.

Leverage

Obviously leverage levels depend on the entity and regulatory obligations that are set by the authority in particular jurisdictions. Alike, European traders will use lower leverage due to restrictions, while Australian traders can still access high leverage ratios available even for retail traders and professionals.

The international proposal also allows high leverage, but beware of how you use leverage and better learn how to apply it correctly as your losses may multiply the same as potential gains.

- 1:500 which is mainly offered for professionals,

- Retail traders through the Cyprus entity may access ratios like 1:30

- Australian traders entities for a maximum of 1:500

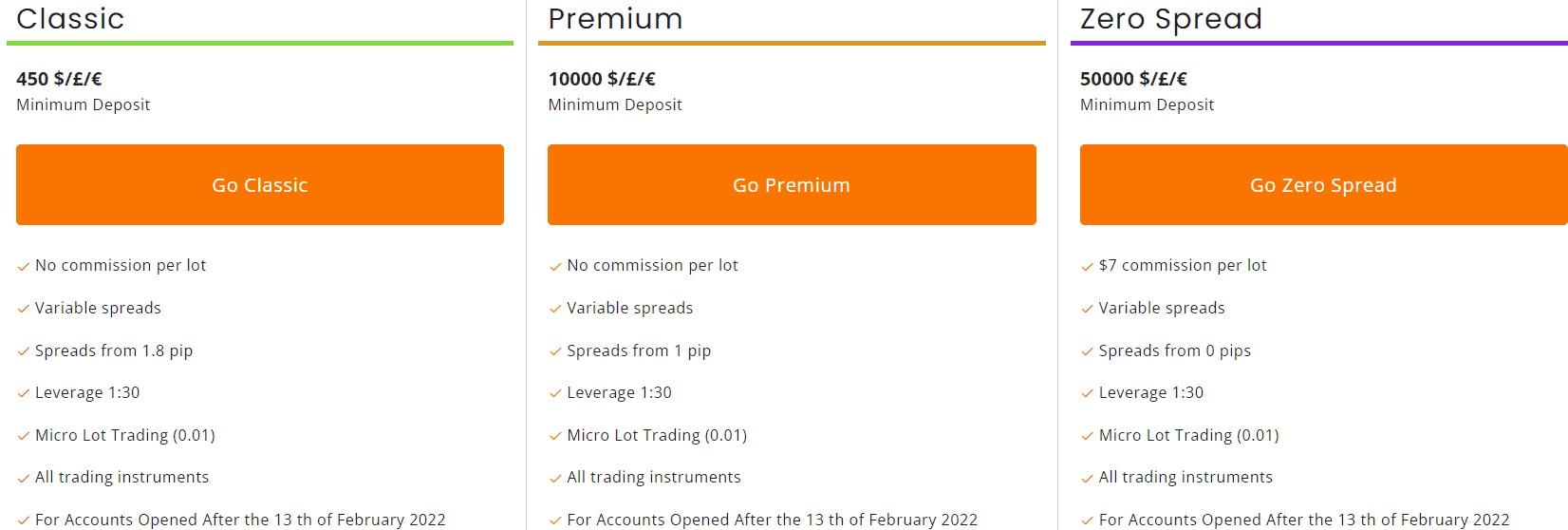

Account types

There are 5 account types defined by the first deposit starting from 250$ and up to 50,000$ for the Diamond account, plus the Islamic account available upon request, but demanding a minimum of 10k$.

Mini account though does not support the MT5 platform for trading, while further on the client can choose the platform and will get push notifications and personal exclusive market updates as a benefit from the broker.

Trading Instruments

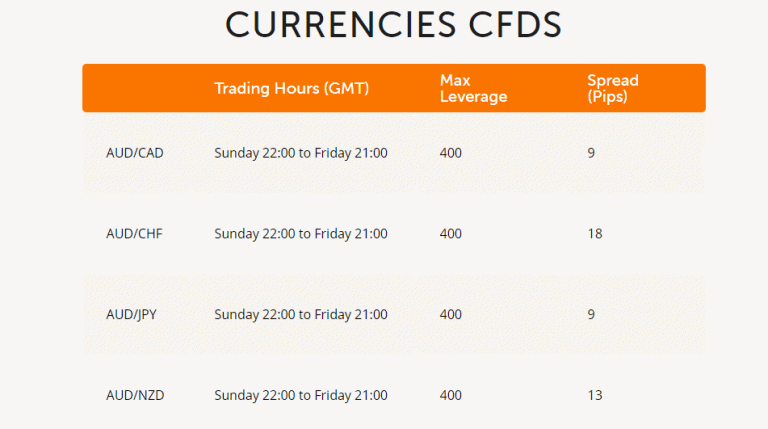

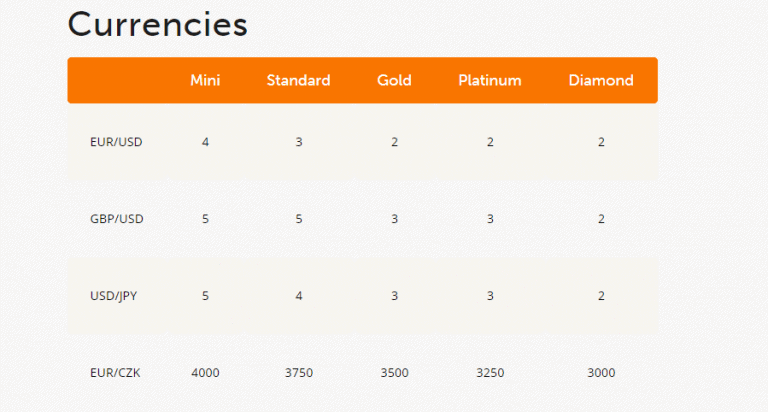

Trade360 as based on technology solutions offering trading CFDs on Currency Pairs, Commodities, Stocks and Indices. Even though CFD trading is a rather simplified version of asset trading, be sure to learn more about how this instrument works especially while using leverage.

Fees

Trade350 fee terms and what exactly the costs are which you will need to pay for trading service mainly built into a variable spread available for all account types. Higher grade accounts get lower spreads also there is an option to get a tailored solution for your trading need. In addition, consider other fees like funding or inactivity, see the Trade360 fee table below.

| Fees | Trade360 Fees | JP Markets Fees | FXTM Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | High | Average | Average |

Spreads

Trade360 Spreads are variable and based on market conditions, while spreads get lower as long as the account type is a higher grade. Nevertheless, we realize that Trade360 spreads are rather high if to compare it to the industry competitors. Even the highest grade account type offers spreads higher than the Standard account of competitors.

However, there is no clear information about spread conditions provided through the website, you can see an example of spread defined by account type below. Yet, we couldn’t see clear statistics on its spread, better to check out conditions through the Demo account through.

Also, compare fees to another popular broker BlackBull Markets.

| Asset/ Pair | Trade360 Spread | JP Markets Spread | FXTM Spread |

|---|---|---|---|

| EUR USD Spread | 3 pips | 1.7 pips | 1.5 pips |

| Crude Oil WTI Spread | 7 pips | 5 pips | 9 pips |

| Gold Spread | 195 | 26 | 9 |

Snapshot of Spreads

Deposits and Withdrawals

The last point within Trade360 Review is funding methods that will allow you to send money into your trading account.

Deposit Options

There are various deposit options available for deposits, where the most common methods are supported. Yet be sure to verify conditions and laws in the particular jurisdiction, as methods, as well as minimum deposits may vary according to entity rules.

- Bank wire transfers

- Credit and Debit Cards

- Skrill and ewallets

Minimum deposit

Trade360 Minimum deposits demand 100$ for a Standard account, and the international offering demands a minimum of 250$ for Mini account, meaning conditions vary. Also, each account type has a specified minimum line, where the account size is defined.

Trade360 minimum deposit vs other brokers

| Trade360 | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawals

Trade360 does not mention charges for deposits or withdrawals, however, your bank or payment provider may waive some fees due to international policies, so you better check with the provider for its fees. Withdrawal options include bank transfers, e-wallets, and cards.

Trading Platforms

| Pros | Cons |

|---|---|

| CrowdTrader and MT5 | None |

| Customer friendly design | |

| Good range of tools | |

| Mobile App | |

| Clear look |

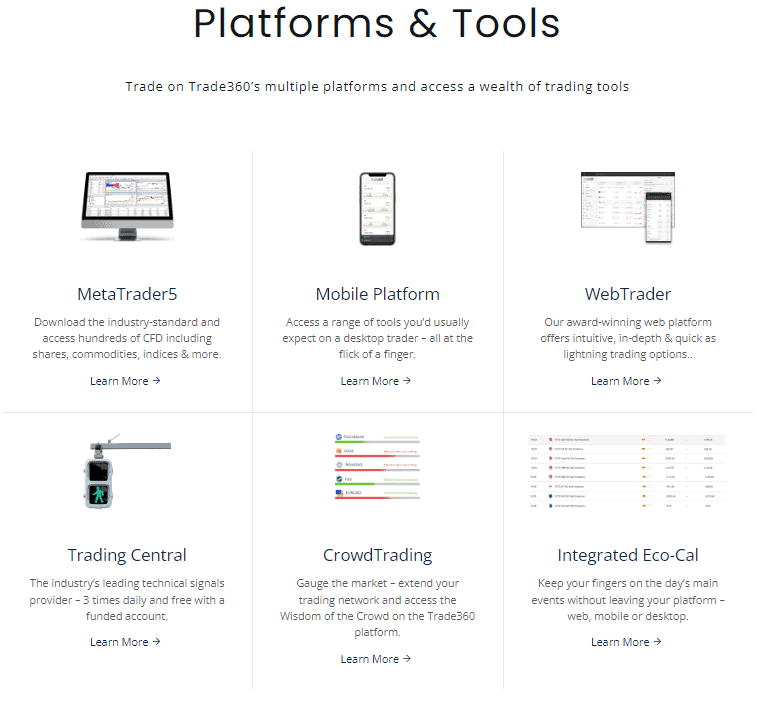

Web Trading

Trade360 since based on a fintech company also developed an intuitive interface platform based solely on online CrowdTrader. There are numerous assets available for trading also with good customization tools so the software indeed is remarked.

Nevertheless, if traders wish to use the popular version MetaTrader5 they are still able to do so, apart from the traders using Mini accounts since it does not support MT5.

Mobile Platform

To remain updated on the go Trade360 developed its Trade360 app suitable for iPhone, iPad ad Android which is a super comfortable software allowing you to take control over your trading at any time.

Desktop Platform

So besides trading markets in a manual or automatic way, you may also engage in Social Trading with Copy Trader or Copy Master accounts accessible via Desktop Platform. This means that you may copy master accounts and profit from trading without any knowledge or interruption just by a simple copy of orders. Mainly MT5 platform offers a trading experience with innovative trading features also with virtual servers and professional level analysis available for traders.

Customer Support

In terms of the Customer Support Trade360 establish customer support service available in each region it operates with the purpose to provide traders with relative answers and quality answers. You can contact the team within working hours through Live Chat, Emails, or phone lines.

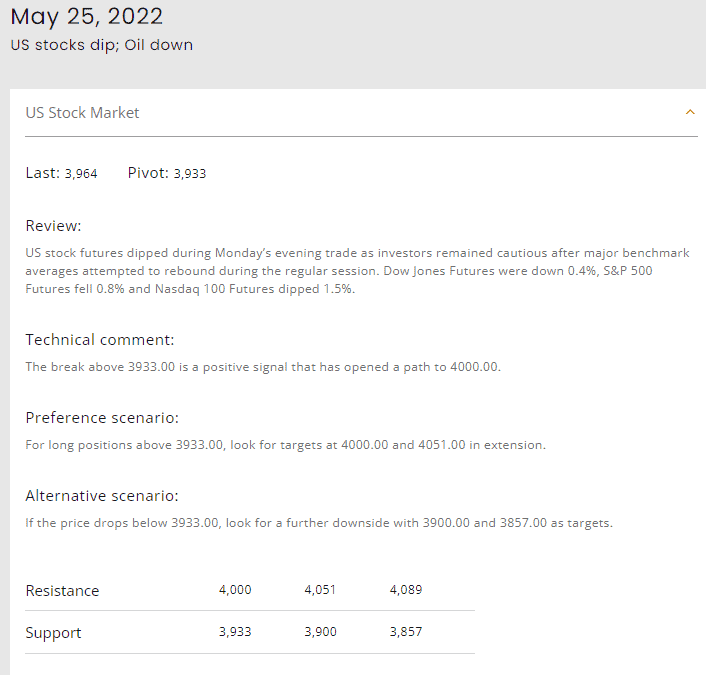

Education

Actually, Trade360 does not provide education or courses that are essential for beginners. There are no online trading courses or Webinars with education materials. The only material available to traders is research tools included in the platforms, as well as the Daily Market report that you can find online. Yet, there is a social trading option where trading ideas are available.

Conclusion

Trade360 Review brought us an understanding that brokers’ trading conditions are suitable for traders who prefer trading CFD instruments, and also engage in social trading through the proprietary platform or popular MT5. There there are options either to trade manually or to copy trades from the Copy Accounts, making investment opportunities better, yet if you need education you better look for another regulated broker.

Nevertheless, there are also some negative responses and experiences with the broker as well, particularly happened with the international entity. So we would strongly advise investors to do their comprehensive checking before opening an account with Trade360 and better sign in only with regulated entities of Trade360 either in Cyprus or Australia.

Reviews

TRADE 360 are Crooks and operate illegally therefore prosecutable which I’m going to do and some of the Directors and CEO etcetera will go to jail.

Don’t go anywhere near TRADE 360.

I worked for this company and ultimately the idea was to get as many people to deposit vast sums of money. The more you deposit the more the agent would receive in commissions. Which is the only objective for this company and the job role.

After you deposit and place a trade you would be passed onto a PTS (personal training specialist) who can’t be called a personal trading specialist as they have no personal trading experience themselves whatsoever, but will talk jargon to novices to convince them they’re experts, and have them deposit even more funds (again increasing those commissions). They’re just another sales agent who has likely been in the company 6 months longer than the other phone agents.

Usually the calls will be based around trying to show you the trading platform (I suggest you outright reject these offers as the platform is very basic, remember the idea at the end is for you to deposit a lot of money). They’ll try to show you an opportunity with oil, gold, silver or a currency pair. Then they’ll show you some old chart information and make you feel like you missed so many opportunities to make profits. They’ll then do some calculations using the professional level multipliers (levarage) which you won’t have access to anyway to show potentially how much you could have made. Which is all irrelevant as you won’t have access to that level of levarage with your personal accounts, this part is solely designed to make you greedy and make you feel like you could have made these profits yourself. Then with that fresh in the mind it’s off to the deposit centre..

Throughout the call they might mention 3rd party analysts, as the company itself has no analysts (this should be a red flag). Who they refer to as 3rd party analysts are bloomberg or reuters, they are news channels that are playing in the office. You could also just put these news channels on your own TV’s at home and you have access to trade 360s analysts..

The tools they offer are the personal deposit agent (PTS), which we have covered.

For experienced traders I’ve seen spreads on trending markets be at 128 pips!

Crowd trading (which every brokerage has but might be called something different, even unregulated brokers have crowd trading) is where you can see what other traders are buying or selling. This is not new or something only one brokerage has, they all have it. Usually one main brokerage will have upto 7 different trading brands, and you will be able to see what all traders are trading with on their platforms. You have to remember 90% of new traders lose all their investments, so why would you follow other peoples mistakes?

Best advise is to learn to trade yourself through materials online, baby pips is a good place to start.

If you choose to learn through a broker like this then you will have to pay thousands for information that is available online freely or worst case scenario you won’t learn anything and just be given bad investment advice.

Remember if a company has to try to convince you to join them and go through all that process just to get you to deposit money with them (the point of the 1hr call is solely to get you to deposit money) then are they that great of a platform to use for trading? You’d be better off going with a professional broker who couldn’t care less if you deposited or not, and doesn’t ring you 5 times a day trying to convince you to see their platform (being shown the platform is the deposit pitch)

When I started this role we were all made to create fake names to use, and the view was that our clients were idiots who have no idea what to do with their money, so it’s better off in our pockets as commissions.

In summary, I would avoid trade 360 as its essentially a gambling site rather than a professional brokerage. Remember even gambling sites have to be regulated in Europe, so this isn’t something that should be used as a reason to deposit your money with them. If they surgest to you to deposit with them because they’re regulated in Europe I would just laugh at them.

Traders have access to 48 currency pairs, providing ample, if not slightly basic coverage of the market. Only five commodities are available, which fails to adequately complement the Forex market selection. Equities represent the bulk of assets, where 462 liquid names are listed; only seven index CFDs are listed, unfortunately. Completing the asset list are 41 ETFs; cryptocurrencies are notably absent. New traders will find the selection adequate and committed equity traders have an acceptable choice. More advanced traders will discover limitations, especially in the Forex and commodity sectors, however

in my opinion

I have had a pleasant experience with trade360, it is an incredible company.

I was with them recently and it was favorable. They treated me very well and I was able to make a profit.

A close friend told me about trade360, he said he had a cool experience with trade360 and it is an incredible company. He told me how they treated him very well and how he was able to make cool cash. He referred me and I’m willing to take the bold step with them