USGFX Review (2026)

What is USGFX?

USGFX is an Australian based brokerage company that operates through transparency and respect to their clients, values and principles. The broker provides Forex and CFD trading solutions to trade currency pairs, indices, and commodities. Due to its enhancement in client services USGFX maintain also an office in Shanghai and a satellite office in Hong Kong.

Going to the trading process itself, the company establishes a technology-driven execution through optical fiber connections to their servers that are located in London and New York and thus provide Interbank connectivity with the ultra-fast speeds. In a result, numerous liquidity providers bringing access to deepest liquidity pools and allow to get trading experience through relatively low costs or spreads.

10 Points Summary

| 🏢 Headquarters | Australia |

| 🗺️ Regulation and License | ASIC |

| 📉 Instruments | Forex and CFD trading solutions to trade currency pairs, indices, and commodities |

| 🖥 Platforms | MT4, MT5, WebTrader |

| 💰 EUR/USD Spread | 2.2 pips |

| 💳 Minimum deposit | 100$ |

| 💰 Base currencies | USD, AUD |

| 🎮 Demo Account | Provided |

| 📚 Education | Market analysis, risk management along with regular contests, seminars |

| ☎ Customer Support | 24/5 |

Education

Also, broker understands that good education and knowledge of the market processes is the key factor in successful trading, for that reason, USGFX developed its unique project TradersClub. The TradercClub provides extensive education programs for the traders of different level and includes not only materials but market analysis, risk management along with regular contests, seminars and much more.

Awards

Overall, through the years of operation, the broker gained not only trust from the global traders, and by the support of social events but has won multiple awards that reward them among the industry for their excellence.

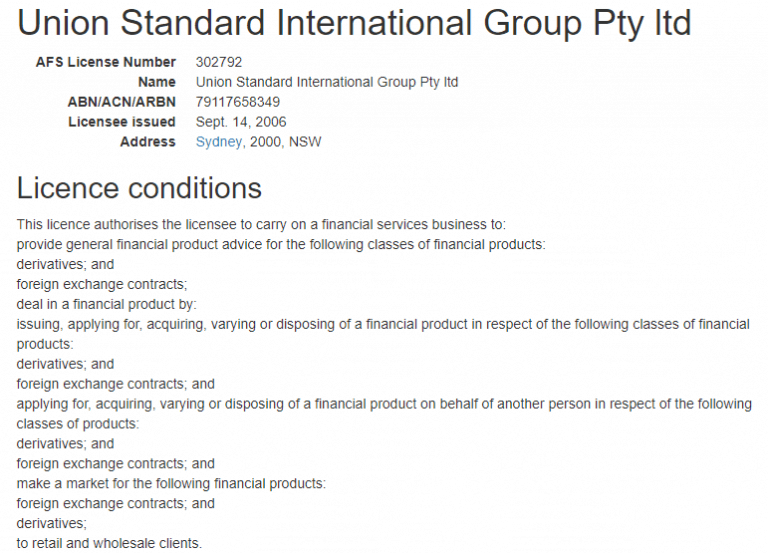

Is Usgfx regulated?

Union Standard Group, which uses trading name USGFX is regulated forex exchange and CFD broker, authorized by the Australian Securities and Investment Commission (ASIC) and holds an Australian Financial Services Licence (AFSL).

As we timely say, the regulatory follow of guidelines and reputable license is a first thing to check while choosing a broker. Simply, strict regulation requires numerous ways to protect clients’ funds, as well to provide healthy competition and deliver of transparent environment, which is never a fact at non-regulated brokers.

Apart from the provided security as per regulation requirements, USGFX also implemented Negative Balance Protection that brings a confidante peace of mind while the losses cannot exceed the account balance.

Trading Platforms

Now lets check which software and trading platforms USGFX use, well broker chose the reliable trading platforms MetaTrader4 and MetaTrader5 that complies with technological solutions and bringing endless possibilities.

Desktop trading

MT4 and MT5 are slightly diverse platforms that offer a powerful trading experience, with the difference that MT4 is the most commonly used platform and MT5 is an advanced version with some more sophisticated features. Both of the platforms are computable to various devices, along with access through WebTrader platform which does not require a download, and offers multiterminal.

Research

In addition to that, USGFX partners with Trading Central that is a leading provider of research data providing accurate technical analysis, market news, insights that are based on years of experience of cooperation with leading institutions. Also, you are able to use Recognia Trading System that gives ultimate trading through intra-day trade ideas built according to personal and very own trading skill.

And last, but not the least opportunity is a Social Trading, which allows traders that don’t have time to monitor and stay continuously on top of the markets, simply follow one of the professional traders strategies. These options are available at USGFX from the two leading social trading providers ZuluTrade and MyFXbook.

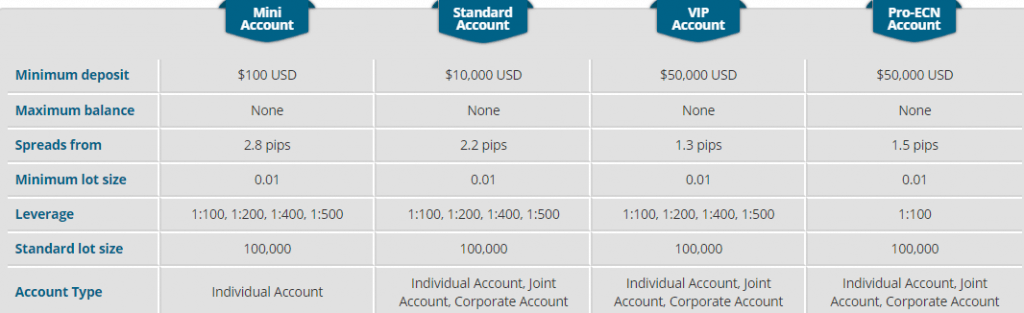

Accounts

There are four account types developed by USGFX while each presents diverse of needs for the trader, thus there is an option to choose between Mini Account, Account with Standard conditions and then options of Pro-ECN Account for professionals and VIP Accounts.

A Demo account included in the company offer also and bringing 100k$ virtual to practice trading or test strategies, indeed recommended as a start.

Fees

USGFX spreads as mentioned diverse by the account type you trade through, as an example you may refer to the table below and see average spread. Also, always consider rollover or overnight fee as a cost, which is charged on the positions taken overnight alike -0.8 for short and 0.18 for a long position on EUR/USD pair. As well you may compare fees to another Australian broker FP Markets.

| Asset/ Pair | USGFX Spread |

| EUR/USD | 2.2 |

| Gold | 5 |

| BTC/USD | 10$ commission |

Leverage

Trading with USGFX you automatically access flexibility to choose leverage from 1:20 to 1:500, which is considered high leverage. Leverage tool indeed is a powerful feature, which is designed to magnify your potential gains and trade bigger size, yet you should learn carefully how to use it smartly in order not to face the opposite effect.

Nevertheless, USGFX being an Australian ASIC regulated broker, follow its guidelines and still allows high leverages for retails traders, which may be a great advance to your trading strategy.

Deposits and Withdrawals

To deposit or withdraw the funds from the trading account you may choose among the multiple convenient payment methods including

- Bank Wire Transfers,

- Credit or Debit Card payments,

- WebMoney,

- MoneyPolo,

- Perfect Money,

- fasapay,

- Skrill, Neteller

- Online banking systems in Thailand, Malaysia, Indonesia, Vietnam and MoneyNetint.

Withdrawal fee

In addition, USGFX covers all deposit fees while withdrawals may require some fees, alike credit cards are eligible for 3.5% fee or Skrill, Neteller method will add on 1.5%.

Minimum deposit

As for the minimum deposit amount, you may start trading through a convenient 100$ which will allow accessing the trading account of the first grade – USGFX Mini Account. While higher rate account types require various conditions to start and can be checked above.

Conclusion

After all, the USGFX Review concludes the broker, trusted partner to invest and perform trading. The technological execution base brings endless possibilities for strategies and traders of any size. In addition, the broker developed an advanced account proposal through a variety of conditions, trading sizes as well start capitals.

However, the spread is just too high. You can trade with ASIC regulated Australian forex broker FP Markets with much better trading condition.

And of course, we would be glad to know your personal opinion about USGFX, share your experience in the comment area below or ask us for some additional information.

USGFX Updates

USGFX went into liquidation since September’20. We recommend to do own research and stay allerted in case there are any active proposals from USGFX.

Reviews

Its been well over a month since I requested a withdrawal and the best i get is “Due to the change in regulation, the process of withdrawl has been delayed. Sorry for your inconvenience, We have contacted our department to assist, we appreciate your patience, thank you.”

I am struggling to get my money from them.

Hi, would like to know had you received your fund now? I got same scenario. Please advise.