VT Markets Review (2026)

Regulator

What is VT Markets?

VT Markets is an Australia-based subsidiary of VT Markets LLC (VIG), bringing more than 10 years of experience and expertise in global financial markets to offer easy and transparent market access and help its clients pursue their financial goals.

Founded in 2016, VT markets has been adhering to the concept of “Innovation makes the difference” and has applied advanced technical support in retail FX market to provide clients with superior trading experience, including true ECN account with raw spreads, mobile trading/payments and powerful client portal, etc.

VT Markets Pros and Cons

VT Markets is considered to be a reliable broker due to its regulation by top-tier ASIC. The Vantage Group itself is a popular and reputable entity with good trading technology, range of instruments and low variable spreads. There is excellent variety between available platform including MT4 and MT5, investment account also MAM accounts.

On the other hand, VT Markets has limited portfolio for trading instruments as well as limited education tools.

10 Points Summary

| 🏢 Headquarters | Australia |

| 🗺️ Regulation | ASIC, CIMA, SVGFSA |

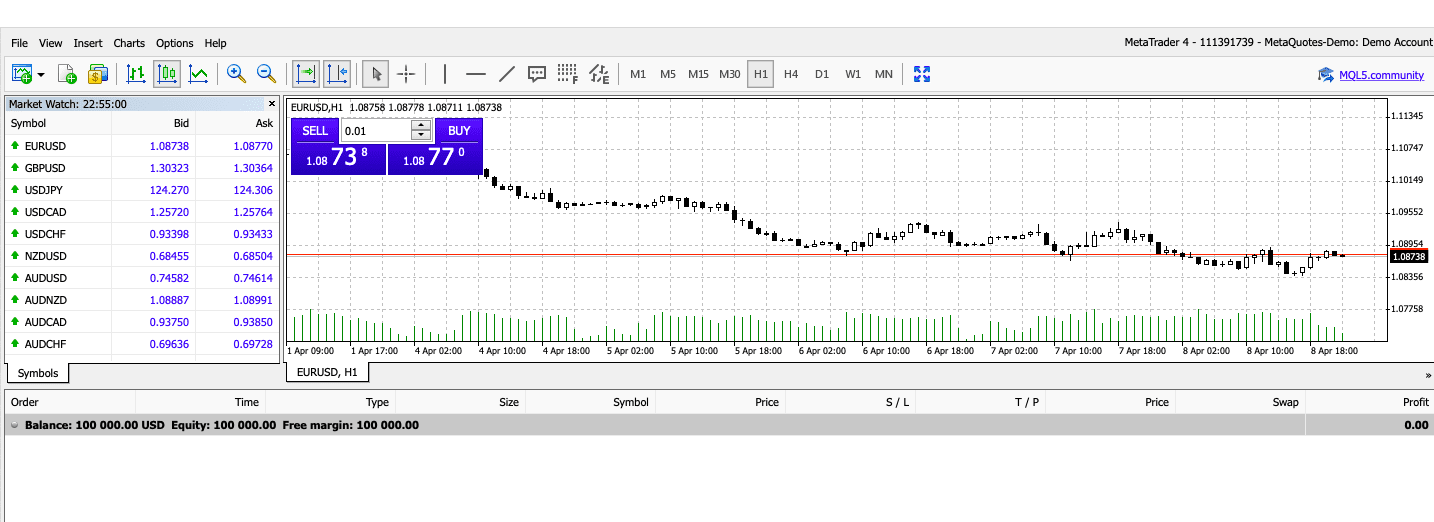

| 🖥 Platforms | MT4, MT5, WebTrader |

| 📉 Instruments | Currency pairs, Commodities, Indices, and Crypto |

| 💰 EUR/USD Spread | 1.2 pips |

| 🎮 Demo Account | Provided |

| 💳 Minimum deposit | 200$ |

| 💰 Base currencies | Several currencies offered |

| 📚 Education | Included with analysis and research |

| ☎ Customer Support | 24/5 |

Awards

VT Markets have also garnered collective recognition from award-giving bodies in the industry:

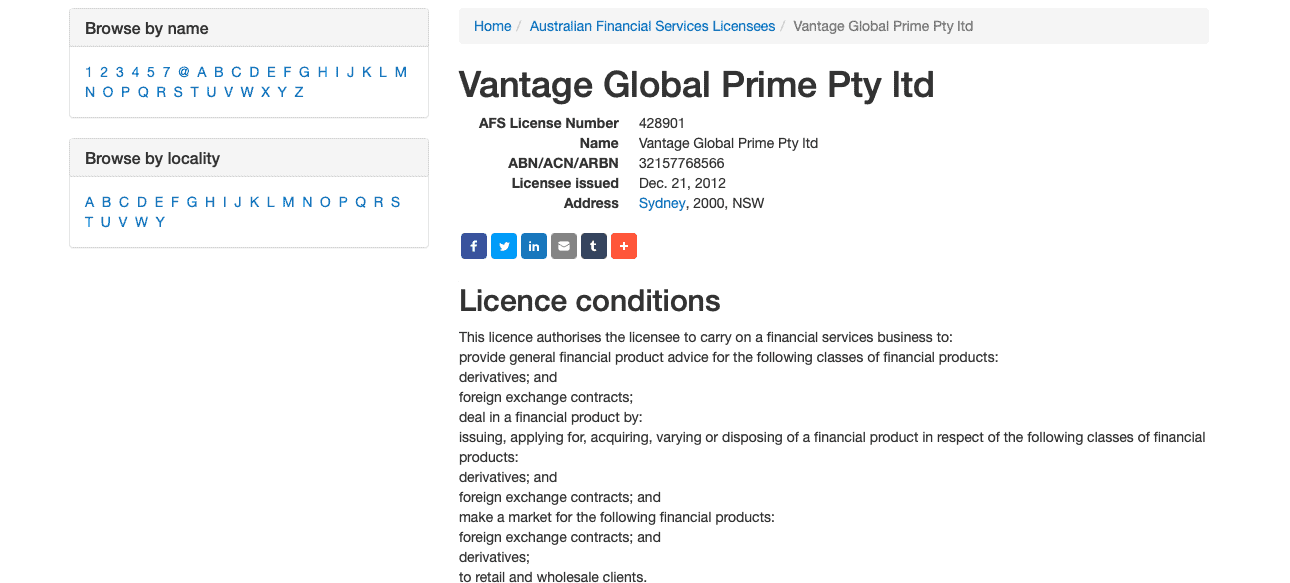

Is VT Markets safe or a scam?

Yes, VT Markets is safe to trade, it is an established Australian broker Vantage Global Prime Pty Ltd that respectively complied operation according to the world-known regulation Australian Securities and Investments Commission (ASIC), learn more why trade with ASIC Brokers by the link.

Also, VT Markets serves additional entity that serves global clients from its offshore branch based in the Cayman Islands. Of course, we never recommend trading with offshore brokers, however, since VT Markets following also reputable licenses from ASIC it means the broker is sharply regulated in terms of its operation.

In accordance with ASIC Regulatory Guides, the company provides Professional Indemnity Insurance in place which covers the work done by their representatives, employees and authorized representatives. Also, clients’ funds are held in a segregated account with Australia’s AA rated Commonwealth Bank of Australia (CBA).

Leverage

Leverage is a quite known instrument, which obviously multiplies the initial capital you trading with and can be a very useful tool to magnify your potential gains, but in case you use it smartly. However, always note that high leverage can work in reverse too.

Due to multiple regulations from various jurisdictions, VT Markets broker falls under particular regulatory restrictions which may apply differences between the offered leverage. Therefore, trading through the global/offshore entities of VT Markets you may enjoy high leverage levels up to 1:500 for major currency pairs. For the Australian clients the leverage remains the broker allows the following:

- 30:1 for forex

- 20:1 for stock index CFDs

Trading Instruments

The marker range includes access to trading instruments, however, only CFDs and Forex. CFDs include Indices, Energy Soft Commodities, Precious Metals, US and HK Share CFDs. Cryptocurrencies also can be traded the same way as major currencies. Overall, the broker covers the most demanding markets to trade, however, popular asset classes like real stocks or ETFs are not available.

Broker’s leveraged share CFDs enable clients to trade both long and short in some of the biggest US companies from just $6 per trade. And, traders can take advantage of 33:1 leverage, which means they can get started with just a small initial margin.

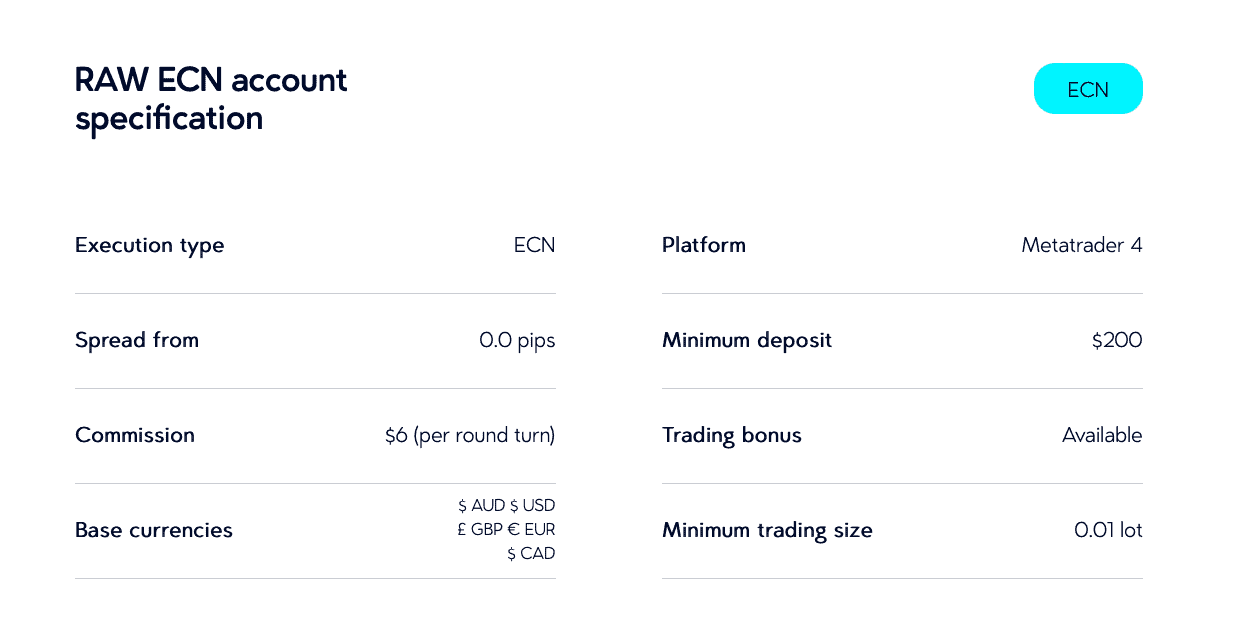

Account types

VT Markets offers two account types with STP and ECN execution models accordingly available through MT4 or MT5 platforms. Along with some diversification between the proposal, some differences between the pricing model may take place as well, so be sure to check the most suitable one for your need.

Islamic accounts or Swap-free are available at the broker too, to those who are following the Sharia rules and require specific trading conditions.

Fees

There are some specified conditions between VT Markets pricing that may occur in different account types, also consider funding fees and other fees like inactivity. See fee table below.

| Fees | VT Markets Fees | AvaTrade Fees | XM Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | No | Yes | Yes |

| Fee ranking | Low | Average | High |

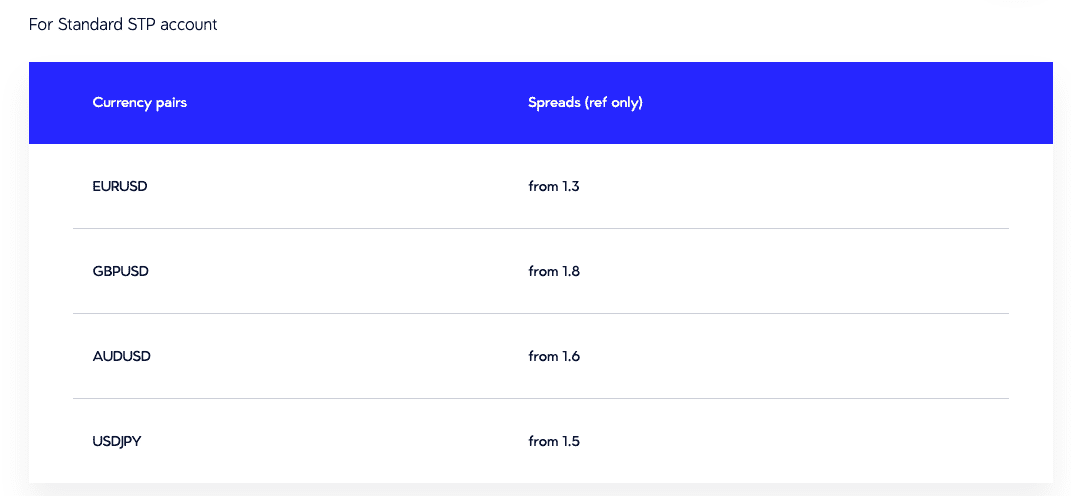

Spreads

VT Markets spread its level depends on the trading account you choose, while Standard account has slightly higher spreads or ECN account with a raw spread offering. Thus the STP account EUR/USD floating spread is averaged 1.2 and the ECN proposes only 0.0 for the same pair.

Also, VT Markets Standard STP Account boasts some of the tightest spreads across the Forex trading industry. All RAW ECN account holders at VT Markets will experience competitive spreads, and only $6 commissions per standard lot, per round. See below a comparison of spread in Standard account below, for instance also well compare fees to another popular broker BlackBull Markets.

| Asset/ Pair | VT Markets Spread | BlackBull Markets Spread | XM Spread |

|---|---|---|---|

| EUR USD Spread | 1.2 pips | 0.9 pips | 1.6 pips |

| Crude Oil WTI Spread | 4 pips | 6 pips | 5 pips |

| Gold Spread | 30 | 25 | 35 |

Rollover

In addition, always consider rollover or swap rate as a trading cost, since the broker charges a small fee for the position being held longer than a day and is defined by the instrument. Moreover, there is an option for Muslim trader to trade through Swap-Free account, which is suitable for followers of belief and tailored according to the strictest rules.

Deposits and Withdrawals

VT Markets clients having various options to fund a trading account, a number of ways including domestic bank transfers, international bank transfers, BPAY, Skrill, Neteller, Broker to Broker transfer, POLi, fasapay, and credit or debit card payments. VT Markets clients can also deposit with Bitcoin.

VT Markets minimum deposit

Minimum deposit for VT Markets Standard account is 200$ as a start, which is a good option for the beginner or regular size traders.

VT Markets minimum deposit vs other brokers

| VT Markets | Most Other Brokers | |

| Minimum Deposit | $200 | $500 |

Withdrawal

Withdraw funds on VT Markets supporting various payment options and VT Markets does not charge internal fees for electronic deposits or withdrawals. Some additional methods may charge fees important to note with your payment provider in case any charges are waived for processing.

Trading Platforms

As for the trading platforms, VT markets offers a choice between intuitive yet comprehensive software designed for traders of different sizes and combining simplicity for manipulation.

All trading accounts are accessible across all devices and all offered platforms, as one of the main aims to have fast and stable access to the trading account. This includes the enhanced MetaTrader 4, MetaTrader 5, WebTrader and multiple mobile trading apps for iPhone and Android devices.

VT Markets offers its traders the official MetaTrader mobile apps, allowing you to trade anywhere, anytime. EAs are allowed for all styles of automated traders. The ones who hold multiple accounts the integrated software tool Multi Account Manager (MAM) is the great and available solution, which lets placing of large orders in bulk with speed and no limitation.

The VT Markets MetaQuotes WebTrader intuitive design is identical to the MetaTrader desktop version and enables access to your trading account without the need for the platform to be downloaded or installed on your computer

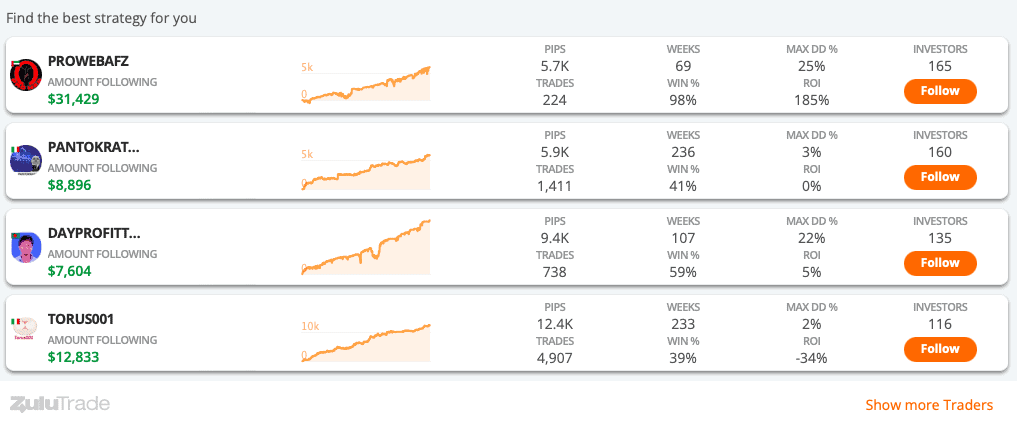

Social Trading

In addition, VT Markets brings an opportunity to automate trading through ZuluTrade. Through the ZuluTrade social trading platform, clients of VT Markets will gain exclusive access to a vast pool of professional traders and profitable trading systems.

Education

VT Markets provide their clients with quite limited education materials and tools. Its learning section includes Educational guides, MT4 guide and Trading Central tools guide. There are also Daily Market Analysis and Daily Video update available for the traders.

VT markets will support only with good research tools that are inbuilt into the platforms and available for free use. Also, there is Demo Account option so you can get some trading ideas as well.

Conclusion

Overall, VT Markets continuously strives to ensure its service is better and quite competitive to anything else on the market proves its great advantages for you as a trader. Also, being an ECN broker, the company stands for strong integrity and great execution through its numerous liquidity providers and the Interbank Forex market. The traders of any level can find their benefits with VT Markets, either the beginning traders, since the opening of the account is an easy process with a quite small deposit requirement and trading options to choose from, along with provided education.