Valbury Capital Review (2026)

What is Valbury Capital?

Valbury Capital is a financial investment firm established under laws of the UK operating though a world financial hub – London. Valbury Capital bringing a flexible, yet responsive model to operate in the trading world as the broker combines client service together with powerful trading technology.

Valbury Capital investment service and proposal is also suited to the investors of different size and portfolio, with tailored solutions and personalized service which we will cover further in our Valbury Capital Review.

Valbury Capital Pros and Cons

Valbury Capital is a reliable broker with top-tier license, the account opening is fully digital and trading environment is good, there are tailored solution to spreads, platforms and conditions good for investors.

For the Cons there is no 24/7 support and proposal might be more suitable for advanced traders.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA |

| 📉 Instruments | 170 Forex pair, CFDs, Futures and Options, Commodities, Equities, Fixed Incomes, and ETFs |

| 🖥 Platforms | MT4, IRESS, CQG Trader, PATS J-Trader |

| 💰 EUR/USD Spread | Custom Tight spread |

| 💳 Minimum deposit | 10,000$ |

| 💰 Base currencies | USD, GBP, EUR |

| 🎮 Demo Account | Provided |

| 📚 Education | News and opinion section |

| ☎ Customer Support | 24/5 |

Is Valbury Capital safe or a scam

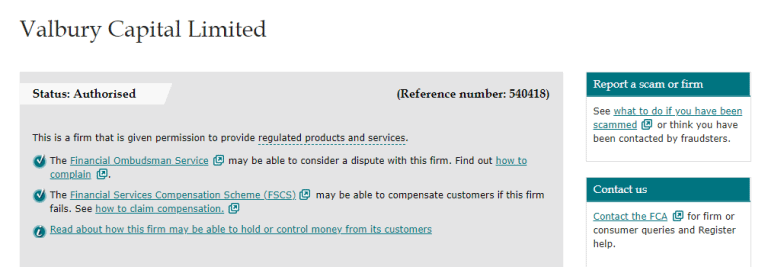

No, Valbury Capital is not a scam.

Valbury Capital, as based in the UK company is authorized by the Financial Conduct Authority. Eventually, almost all firms operating in the financial industry within the UK should be authorized and regulated by the FCA, with a purpose to harmonize offering and ensure integrity. Therefore, Valbury Capital clients are treated decently with respect and by providing transparent trading conditions.

One of the main tasks of the regulation is to provide a safe investment to either retail, professional or institution, which is rather prerogative of a reputable jurisdiction. And this is the reason why you should choose only well-regulated brokers in order to be sure of its trading environment and your investment itself.

As a part of its framework clients money are held in segregated accounts, fully covered by the FSCS compensation fund in case of brokers insolvency and managed in the interest of the client first.

What is Valbury Capital Leverage?

Another important topic to cover in our Valbury Capital review is leverage levels that may bring you bigger exposure to the markets and maximize profits.

- Actually, authorities recently restrict the use of high leverage for retail traders so by trading with a UK broker the leverage set up to 1:30 for Forex instruments, 1:20 for minor currency pairs and even 1:10 for Commodities.

Yet, and since Valbury Capital mainly offers a professional and corporate trading solution the professionals may access higher ratios up to 1:100.

Trading Instruments

One of the great offering Valbury Capital offers, in an extensive range of industry powerful trading platforms with Direct access to Markets through transparent NDD execution through multi-source liquidity.

As for the range of instruments, you may get multi-asset product range structured to worldwide exchanges and including over 170 Forex pair, CFDs, Futures and Options, Commodities, Equities, Fixed Incomes, and ETFs.

In addition, you may count on the support, news and opinion section provided by Valbury Capital and supporting your daily decisions.

Account types

As Valbury Capital tailors its solution according to the trader’s need, the account types are solely defined by the type of investor you are.

Fees

Valbury Capital fees are based on a spread plus inactivity fee, funding fees and other charges that may occur. Instruments available through its leading technology and connectivity, along with voice execution options that are traded in world exchanges. The broker uses multiple liquidity providers, therefore, its ECN system chooses the best available quote and execute your order at that price.

| Fees | Valbury Capital Fees | City Index Fees | CIX Markets Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Tailored fees | Yes | Yes | Yes |

| Fee ranking | Low | Low | Low |

Spreads

Valbury Capital offers tight spreads, but as the broker mentioned on its website there is no one the same trader as other, thus its trading spreads and conditions are defined by the account balance you maintain, an instrument you trade, as well which volumes you operate. Therefore, Valbury Capital will offer a 100% tailored solution based on tight spreads and competitive commissions. Also, compare fees to another popular broker BlackBull Markets.

How to Deposit funds to Valbury Capital?

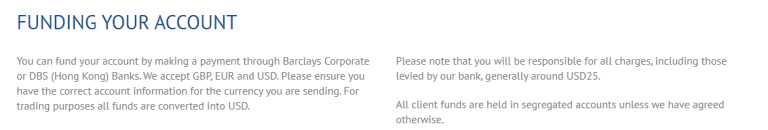

Valbury Capital funding methods that will allow you to send money into your trading account. Valbury Capital maintains only Bank Wire Transfer, as a payment method due to its proved reliability and best convenience.

Minimum deposit

The minimum deposit Valbury Capital is 10,000$. Even though the amount is very high for beginning traders, Valbury Capital indeed targets and relies more on professional offering and traders of high volumes.

Valbury Capital minimum deposit vs other brokers

| Valbury Capital | Most Other Brokers | |

| Minimum Deposit | $10,000 | $500 |

Withdrawal fee

Valbury Capital withdrawal options are only Bank Wire. Also, the broker mentions that the client is responsible for all charges occurring upon the money transfer which are generally around $25.

Trading Platforms

Another good point at Valbury Capital Review is brokers’ platform technology, while there is no commitment to a single provider but a range or reliable gateways. The offered software includes industry-leading platforms MT4, PATS J-Trader, CQG Trader, IRESS, etc all ensured with transparent and competitive pricing.

That is indeed a great proposal, while each of the platforms allows you to select the best suitable one according to the trading strategy you deploy. While MT4 does not require an introduction, it still remains the industry standard and the most used platform worldwide with its powerful capabilities and user-friendly interface.

Also, Valbury Capital includes Trading Technologies with a simultaneous possibility to trade multiple markets, as well as TraderTools as a transparent source of liquidity aggregation through Unique Liquidity Network.

Pats J-Trader and PATS Pro-Mark is one of the most advanced platforms for professionals trading futures. And CQG QTrader, CQG Trader or CQG Integrated offers the high-performance trading capability for multiple asset classes. Lastly, IRESS Pro or IRESS Trader as a flexible information program gathering comprehensive pricing and trade data all in one.

So indeed, Valbury Capital truly brings you great and even further choice between technology and software to use in reverse enhancing your capabilities and possibilities while trading.

Conclusion

Our final thoughts about Valbury Capital are good, but broker is suitable for traders of bigger size, professionals or corporates. Due to its high minimum deposit, Valbury might be inaccessible for beginners and indeed it is better to start small in your first steps in Forex. As for the general offering, Valbury Capital proposes some of the very powerful industry platforms accompanied by great execution and range of liquidity providers they use in reverse bringing best quotes. Also, its tailored and one to one approach to each client is another point to admit and take into consideration while choosing.