X Open Hub Review (2026)

What is X Open Hub?

The core mission of the X Open Hub is to deliver liquidity and trading technology to financial institutions and retail firms around the world. The X Open Hub is the trading name of XTM Limited and is a part of One Capital Group, a broker headquartered in London, while the operational and technology centers also based in Warsaw, Poland.

The company, along with its group activities has proved strives and achievements in many ways, while delivering the ultimate level of trading solutions to retail or institutional clients and was also awarded numerously.

In order to provide tailored liquidity, the broker heavily invested and developed the technology, which delivers low-latency execution with improved pricing and tight spreads.

Indeed, computer technology has changed the way financial assets are traded, thus X Open Hub delivers access to Robust IT Departments in the largest banks and brokerage houses working 24/6 directly connected to stock exchanges, ECN banking systems and other STP brokers.

X Open Hub Pros and Cons

X Open Hub has strong background and top-tier regulation for transparency. Its model provides great trading conditions for institutional, professional traders, banks and brokerages. The costs and spreads are among lowest in industry and there are numerous supported platforms, software, APIs and trading solutions.

For the negative points, X Open Hub is not designed for regular or small size traders, is solely tailored solution.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation and License | FCA |

| 📉 Instruments | 3000+ global instruments forex, indices, cryptocurrencies, commodities, shares and ETF |

| 🖥 Platforms | MT4, XOH Traders |

| 💰 Costs | 0.3 pips |

| 🎮 Demo Account | Provided |

| 💰 Base currencies | EUR, USD, GBP |

| 💳 Minimum deposit | 0 $ |

| 📚 Education | Two levels education for beginners and advanced investors |

| ☎ Customer Support | 24/6 |

Is X Open Hub safe or a scam

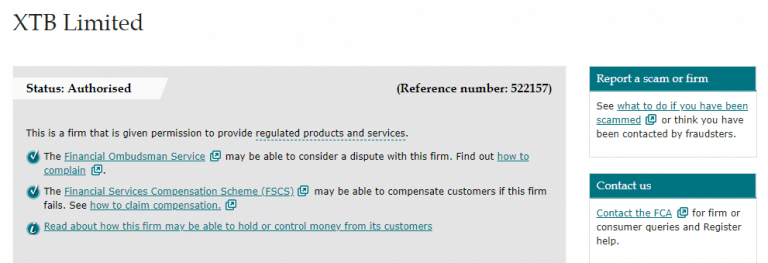

No, X Open Hub is not a scam as a part of the XTB Broker and the group itself makes every effort to meet all European standards, as the company authorized and regulated by the UK Financial Conduct Authority (FCA), the Polish KNF, CySEC, IFSC in Belize, CMB in Turkey and hold cross border passport to over 10 EU countries.

In fact, the obligation towards authorities that regulate Forex and trading services is a first thing to check while choosing a reliable broker. Along with the strict requirements that are set by the regulators, the company obliged to cater secure environment to their partners and clients at all times.

The security of funds provided in a comprehensive manner, while the broker also established negative balance protection. Means, that investor who possess losing positions will not get into negative balance, thus institutional partner’s and accounts are fully protected with strong risk management feature making X Open Hub a solid choice to trade with.

Trading Instruments

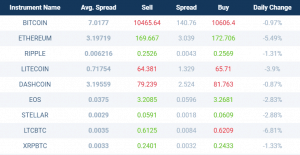

The broker provides access to 3000+ global instruments on deep liquidity forex, indices, cryptocurrencies, commodities, shares and is an ETF Broker too. Therefore, a number of instruments allow X Open Hub’s partners and clients to invest in various, most traded or exotic markets with low spreads starting from 0 pips with no requotes.

Education

Moreover, the company supports you by education about the market and finance industry itself, which is always a plus as enhanced skills across every stage of trading is one of the crucial factors. The knowledge base delivered by two levels for beginners and advanced investors with in-depth category details through webinars and other sources designed to suit own needs.

Leverage

While trading with X Open Hub you also offered to use tool leverage, which may increase your potential gains through its possibility to multiple initial accounts balance. Particularly leverage levels depending on some factors, including prof level in trading itself, on the instrument you trade, as well as defined by the regulatory restrictions.

- Since, X Open Hub is a UK and FCA authorized firm it demands lower leverage level the maximum you may use as a retail trader goes to 1:30 for major currencies, 1:20 for minor ones and 1:10 for commodities.

And of course, always learn how to use leverage correctly, as leverage may increase potential loses together with great opportunities it offers.

Account types

As a supplier of trading solutions to institutions and established corporations, the X Open Hub mainly diverse their offering to Solution for Banks, for Brokers and for Startups, while each of them designed specifically for a particular need.

Therefore, either institution is a Bank or Brokerage firm it is enabled to expanded trading offering to their clients by an improvement of operational results through outsourcing strategy. With a deep understanding of what the brokers want to differentiate to meet client demands, the XOH brought a trading environment where third-party companies can build and create a completely new trading system based on XOH APIs.

The account offers flexibility on markups on the influence charts or swaps, fully customizable settings and clients support, reporting tools and no security group limitations along with integrated systems alike IB, MAM, multi-asset, flexible netting and gross management diversifies the front-end offer.

Fees

X Open Hub fees are defined by the account type and offering you will use, but mainly built into a spread. Also, consider additional fees like funding fees which are depending on the institution you are or inactivity, see fee table below.

X Open Hub rollover

X Open Hub rollover or overnight fee consider as a cost, which is charged on the positions held longer than a day. Each instrument has a different condition for overnight positions and may be checked directly from the platform, and of course due to nature of X Open Hub business all conditions are negotiable and designed to meet specific needs.

| Fees |

|---|

| Deposit Fee |

| Withdrawal Fee |

| Inactivity Fee |

| Fee ranking |

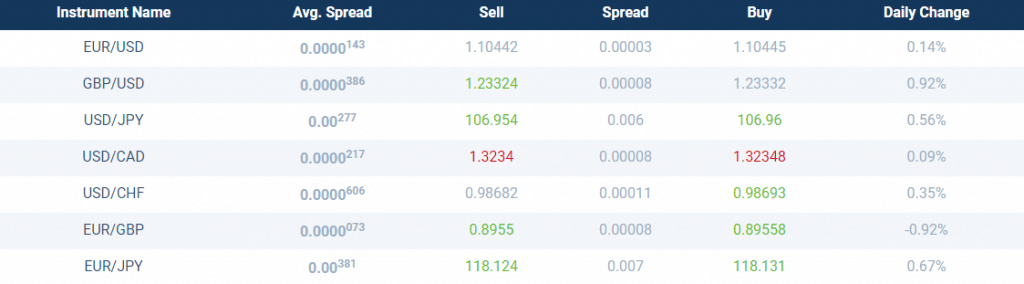

X Open Hub Spread

X Open Hub spreads as defined are truly delivering very competitive pricing model, with a highest grate interbank spreads also designed to meet the most demanding needs.

X Open Hub spreads are floating spreads with a number of additional tools to adjust better pricing and of course featuring tailored solutions according to each investor or institution particular need. For instance see typical X Open Hub spreads for Forex instruments below, as well you may check BDSwiss spread to know better retail pricing of the company.

| Asset | X Open Hub Spread | Dukascopy Spread | ActivTrades Spread |

|---|---|---|---|

| EUR USD Spread | 0.6 pips | 0.2 pips | 0.63 pips |

| Crude Oil WTI Spread | 2 | 5 | 3 |

| Gold Spread | 28 | 30 | 35.75 |

Trading Platforms

XOH created complete offering through its proprietary multi-asset trading XOH platform that suite brokerage needs that are also empowered with the MAM capability to advance tools and features. Along with numerous additional features, X Open Hub provides full risk management systems integrated with liquidity and executors.

XOH Trader offer trading capabilities through various versions in the range of devices: HTML5 platform version and Mobile Application. The platform performs advanced trading with various types of execution and powerful analysis and visual features.

Furthermore, XOH Trader enhanced portfolio with robust risk management tools, various capabilities and with Smart Executors that automatically controls even the smallest trades solving many B-Book problems with scalpers or high-volume traders with NDD model.

Along with that, there are vast of other capabilities while each of them is tailored and advanced with necessary figures defining the particular nature of the business or institutional need. Therefore, White Labels, x APIs with ultra-low latency and unique feature of MT4 – Expert Advisors for automated trading from the MQL4 community remaining possible.

Also, X Open Hub partners with various strategical providers including social trading platform ZuluTrade, MetaQuotes, third parties of FX analysis and global researches and more.

Conclusion

Overall, X Open Hub operates with full compliance according to the FCA regulations and established business offerings within the One Capital Group. The company provides ultimate technology solutions with access to deep liquidity on multi-assets mainly for institutional clients, start-ups and brokers. Among the company proposal’s proses not only the comprehensive features of technology-driven solutions with NDD model but also one of the leading and competitive pricing models designed for institutions or STP/ ECN Brokers that are brought by the selective liquidity providers, which definitely worth consideration.