XTB Review (2026)

Regulator

What is XTB?

XTB is a trusted UK and European market leading brokerage providing online trade solutions, through its headquarters in Poland and London (UK). XTB broker was actually the first firm which introduced forex trading in Poland, and now became 4th listed largest stock exchange company.

XTB withholds global providers of FX and CFDs with offices in 12 countries in Czech Republic, Hungary, Italy, Turkey, Chile, Belize, Poland, Germany, Slovakia, Portugal, Romania, Spain and France, providing dedicated service and support on a 24 hours basis.

XTB Pros and Cons

XTB is a reliable broker with good regulation, also is one of the best Poland Forex Brokers. Operating for many years XTB provides good conditions for beginning and professional traders, with low costs and excellent support, including learning and research materials. XTB platforms and mobile app are packed with tools and good for CFDs trading or day trading..

On the other hand, there is no 24/7 support and conditions may vary according to entity rules.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA, KNF, FSC |

| 📉 Instruments | Over 1500 global markets Forex, Indices, Commodities, Crypto, Equity CFD, ETFs |

| 🖥 Platforms | MT4, xStation5 |

| 💰 EUR/USD Spread | 0.8 pips |

| 🎮 Demo Account | Available |

| 💰 Base currencies | EUR, USD, GBP |

| 💳 Minimum deposit | 250 GBP |

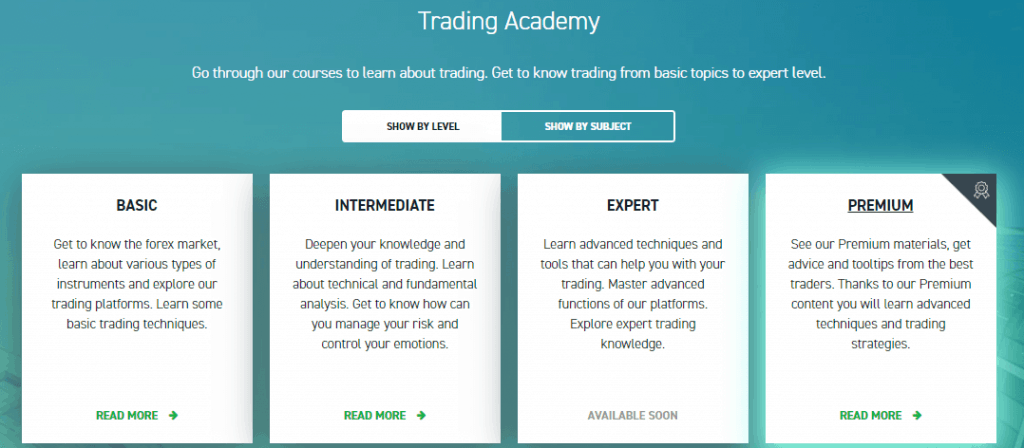

| 📚 Education | Provided via Trading Academy |

| ☎ Customer Support | 24/5 |

Awards

The broker performing its operation as a group, which has also won a notable amount of awards for both technology and service they develop. Some of the latest recognitions including awards as Highest rated FX & CFD Broker voted by Wealth & Finance International Awards, and others, which all in all proves company good standing and professional approach.

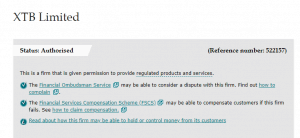

Is XTB safe or a scam

No, XTB is not a scam, being European established brokerage accordingly follows and holds necessary registrations and regulations including top tier FCA license, considered low risk trading broker.

Is XTB legit?

Considering a strong reputation and sharpest guidelines of the regulation (read more about why trade with FCA regulated Brokers), XTB bringing confident trade with high protection. And actually, this is the main topic you should stick to while choosing a broker to trade with, means check carefully authorization of the company, as this is the only criteria that delivers a safe trading environment.

How are you protected?

At XTB Limited, the safety of funds is paramount, therefore all client funds are held in a segregated account at all times while also checked for compliance regularly by FCA, as well protected by the FSCS up to £50,000 per person in the unlikely event of insolvency.

Even though XTB serves additional entities in offshore zone Belize, together with its establishment standards we would consider broker a safe trading environment. While solely offshore firms are not recommended due to high risks to be scams.

Leverage

Being a European based broker, the XTB does not offer high leverage ratios recently due to the updates from the EU regulation ESMA.

- The traders may use a maximum of 1:30 level towards Forex instruments, 1:5 towards Stocks and even lower to some additional assets.

Nevertheless, these restrictions are definitely done to protect trading orders and accounts themselves, as the higher leverage ratios may impose a significant risk for any trader towards money loss. Thus, 1:30 is still a good level to maintain potentially successful trading, yet with lower risks involved.

Besides, XTB international entity may offer high leverage up to 1:500 for international clients in case your residence allows so. You may check more details through the official website in this regard.

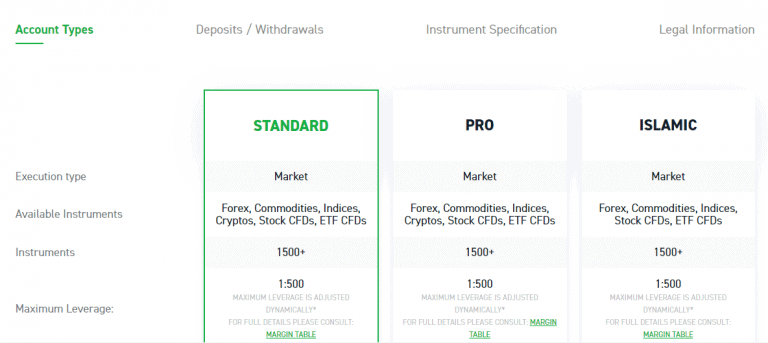

Account types

XTB provides three types of trading accounts.

Available accounts divided into Standard and Pro Account where you can choose either to trade with all costs built into a spread, which is Standard Account or Pro Account with commission basis.

Besides, there is a specified Islamic Account for traders following Sharia laws with suited conditions and applicable laws available once traders’ status is confirmed.

Fees

XTB operational strategy shows a good value for money. The offering is based on tight spreads from 0.3 pips on market level execution along with bonuses for the active trader. However, be sure you check a correct proposal, since FCA regulated trading conditions and international proposals vary.

| Fees | XTB Fees | GO Markets Fees | XM Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Low | Average | Average |

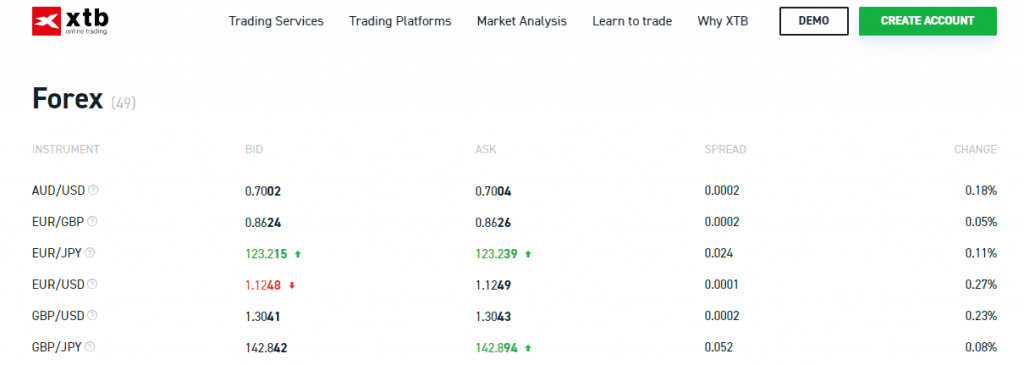

Spreads

XTB accounts featuring approximately the same options and benefits provided by XTB, apart of the difference on swap rates and spread level which diverse from 0.35 pips for Standard and 0.28 for Pro Account accordingly, where Pro account fees are charged as a commission of $3.50 per lot.

Generally considering average fees offered by XTB, we would say they stand at a quite average level and are rather competitive and low. Also, there are good conditions for Stock CFDs trading offered for both Pro and Standard account.

For better understanding check out typical spreads at Standard accounts mentioned as reference below and also compare XTB fees to another popular broker Eightcap.

| Asset/ Pair | XTB Spread | GO Markets Spread | XM Spread |

|---|---|---|---|

| EUR USD Spread | 0.8 pips | 1.2 pips | 1.6 pips |

| Crude Oil WTI Spread | 4 | 1.9 pips | 5 |

| Gold Spread | 35 | 1.4 pips | 35 |

| BTC USD Spread | 1% | 20 | 60 |

Overnight fees

For the XTB overnight fee or knowns as a swap rate, the broker charges a differential determined between the two currencies involved in the pair and whether the position is a buy ‘long’ or sell ‘short’. The fee originally varies from the currency to another, as example, EUR/USD rollover on buying position is -12.037 while selling will let you gain 5.795.

Trading Instruments

The general trading service offering includes a wide selection of opportunities, through a range of global markets over 1500, including Forex, Indices, Commodities, Crypto, Equity CFD, ETFs.

Another separate mentioning worth a Crypto trading which includes trade on Bitcoin, Ethereum, Dash, Ripple or Litecoin by CFDs on 24/7 basis, with no requirement to hold wallet, leverage till 1:5 and quite cheap swaps – long 0.08% a day, short 0.04% a day and spread calculated only by 1% from target.

Deposits and Withdrawals

There are several ways to deposit funds into the trading account, which includes the most popular and secure payment methods, so you can transfer funds quite easily. Yet, always be sure to verify conditions and methods with customer service as various conditions apply according to regulations.

What is the minimum deposit for XTB account?

XTB minimum deposit start at 250 US$, while active traders and PRO account may require some more balances in order to cover all necessary margins.

XTB minimum deposit vs other brokers

| XTB | Most Other Brokers | |

| Minimum Deposit | $250 | $500 |

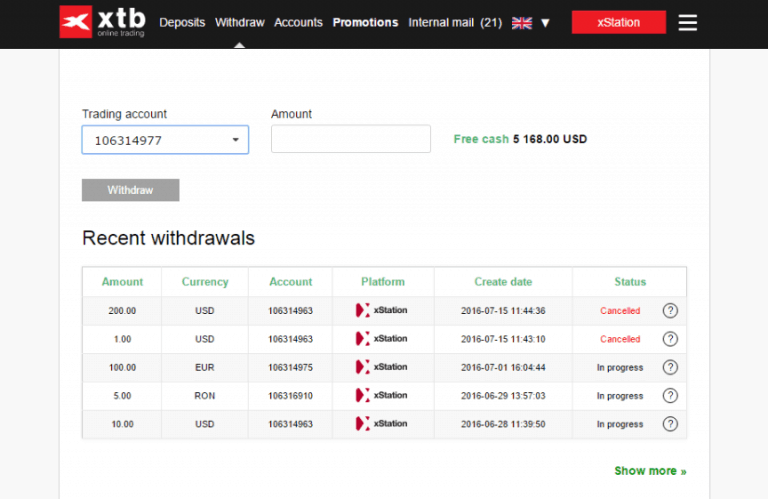

Withdrawals

For the XTB withdrawal options and funding fees, Bank transfers and payment for both withdrawals and deposits by Credit Cards are free of charge and accept the following currencies EUR, USD, GBP. Yet, other payment methods incur additional charges – 2% of the deposited amount, these are PayPal and Skrill.

How to withdraw money from XTB?

To withdraw funds from your account, the client has to proceed with online request and choose where to transfer the money (nominated bank). Another pleasant feature that XTB does not charge an inactivity fee.

Trading Platforms

XTB offering two main platforms that client is able to choose from, as a mainstay XTB uses xStation5, which been recognized as an efficient choice and gained multiple awards for total trade transparency, real time commentary, execution speeds and very comprehensive charting package.

- xStation 5 voted ‘Best Trading Platform’ by Online Personal Wealth Awards

- Forex Magnates | Best proprietary fx platform

| Pros | Cons |

|---|---|

| MT4 and proprietary xStation5 Numerous tools included into free package | None |

| Copy Trade, Social Trading and Technical Indicators | |

| No restrictions on strategies | |

| Fast execution | |

| Available in various languages |

Web Platform

Nevertheless, the platform is fully customizable and very fast, including useful tools like calculators, advanced charts, trader statistics, bulk order closing, traders talk and progressive technical analysis. However, always be advised that Web Platform is easily accessible via any browser but less comprehensive and packed with tools as a desktop platform.

Desktop Platform

So for day trading and professional traders definitely you would need a desktop platform with all the settings available, that includes also watch lists and workspaces are accessible from desktop, smartphone, laptop, tablet and even smartwatch.

XTB platform includes also a useful Market sentiment and displays the current situation of selling or buying trend of each market, as well Top mover showing which markets gaining or losing. Another addition equity screener that filters stocks and searching for new opportunities.

Second offered by XTB platform is known to all trading world MT4, however, XTB enhanced features by fast, reliable trade execution, multi-asset coverage, No dealing desk execution, no requotes and all supported by Expert Advisors.

Mobile Platform

Customer Support

Being an XTB trader so you can count on relevant and fast answers from the Customer Support, since Broker’s team available around the clock and supporting international languages accessible via Live Chat, email, and phone lines in various regions including the UK and International as well.

Yet, customer service isn’t available during the weekends, so you can leave your request via the contact form to be advised.

Education

Since XTB Review sees brokers’ goal to help develop each and every trading strategy so that clients can become profitable over the long-term.

The XM provides a comprehensive educational program designed to develop skills and knowledge for every step with video tutorials and guides from Trading Academy, online webinars and live market analysis, a community of minded traders – XTB’s Trading Club, one-to-one mentoring and development managers.

Conclusion

Overall, XTB as a multi-asset broker provides a well-balanced trading experience while regulated in several major financial centers, hence considered a reliable broker. Beyond quality service, the broker’s powerful platform and offerings to the clients earned excellent ratings and regards. Being a client of XTB you will enjoy the benefits of a long-term relationship that building durable cooperation with active traders as one of the company’s main objectives.