Z com Review (2026)

Regulator

What is Trade Z?

Trade Z.com or Trade Z is the service name of GMO-Z.com Trade UK Limited, which is an affiliated company of GMO CLICK, the firm established in Japan. Actually, the company is one of the leading forces within the Internet industry offering. Since 2006 it started to offer FX trading services while quickly spread their services from Japan to global coverage by opening offices in London and Hong Kong.

Currently, Trade Z is recognized as the world’s largest retail forex provider by their operating volumes and achieved heights. The global trading offering was rebranded to Z.com in 2015 and is listed on Tokyo Stock Exchange. And only two years later the broker became World’s Largest retail Forex Provider by volume for 6th consecutive year.

Z com Pros and Cons

Z com is a low riks Forex and CFD broker due to regulations, there is god trading software and technology offered, Z com is great for currency trading and instrument range.

On the flip side trading fees for Forex are higher, and there is no 24/7 support.

10 Points Summary

🏢 Headquarters

UK, Japan

🗺️ Regulation

FCA, SFC, JFSC

🖥 Platforms

MT4

📉 Instruments

FX, Commodities and Indices, Bulions, Binary Options

💰 EUR/USD Spread

2.6 pips

🎮 Demo Account

Provided

💳 Minimum deposit

50$

💰 Base currencies

Several currencies offered

📚 Education

Educational service and Analytical Resources

☎ Customer Support

24/5

10 Points Summary

| 🏢 Headquarters | UK, Japan |

| 🗺️ Regulation | FCA, SFC, JFSC |

| 🖥 Platforms | MT4 |

| 📉 Instruments | FX, Commodities and Indices, Bulions, Binary Options |

| 💰 EUR/USD Spread | 2.6 pips |

| 🎮 Demo Account | Provided |

| 💳 Minimum deposit | 50$ |

| 💰 Base currencies | Several currencies offered |

| 📚 Education | Educational service and Analytical Resources |

| ☎ Customer Support | 24/5 |

Is Trade Z safe or a scam

No Trade Z or Z com is not scam, it a reliable broker with top-tier FCA regulation and low risks.

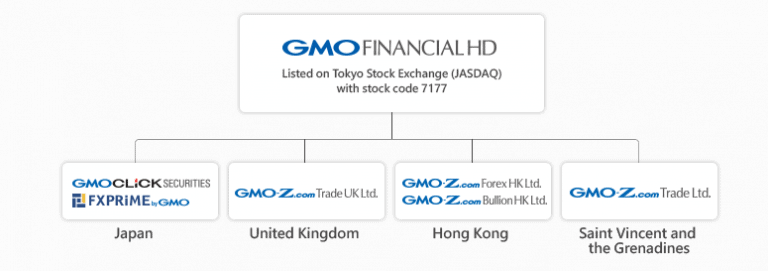

The parent company of Trade Z is GMO-Z.com Trade UK Limited which is authorized and regulated by the Financial Conduct Authority. It means the broker following the strict regulatory requirements and complies with transparent practices. In addition, other entities of the broker which are located in Japan, Hong Kong and Saint Vincent and the Grenadines are respectively authorized by the local authorities.

In simple words, a client’s money are held in a segregated bank account in accordance with Client Assets rules, completely separately from the company’s own funds. In the unlikely event that GMO-Z.com Trade UK Limited became insolvent, a client of Z.com Trade covered by the Financial Services Compensation Scheme (FSCS), which protects eligible claimants up to £50,000. Yet, other entities may comply with slightly different regulatory requirements but are strictly regulated too.

Trading Instruments

Since the parent company is the technology-driven one that offers sophisticated internet solutions, the main reason for its achievements is their high-grade technological infrastructure. Trade Z systems are hosted in Equinix LD4 London bringing professional Straight to Process ECN environment, as well through access to deep liquidity and ultra-tight pricing.

Their markets range includes offer of 59 FX major, minor and exotic pairs, 7 Commodities and 11 Indices, Bulions and even Binary Options.

Leverage

The maximum leverage offered by Z com goes up to 1:400 for Forex instruments, however depending under which entity of Z.com you opening an account. It means that every entity operates under the regulatory restrictions, while a recent update from the European regulatory bodies restricts leverage to a maximum of 1:30 for Forex instruments and even lower for other ones.

Account types

The traders can choose between four account types that allow suiting needs and requirements, while the choice goes to either MT4 platform, as well as professional level or Auton along with an account for Binary Options trading. All accounts are available in multicurrency USD, EUR, GBP and performed via STP NDD execution.

Fees

Z com trading costs offers to choose between fixed spread and floating spread, ECN account fees are built into a commission charge, full fee structure including funding fees see in the table below.

| Asset | Z com Fees | ATC Brokers Fees | FXOpen Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | High | Low | Low |

Spreads

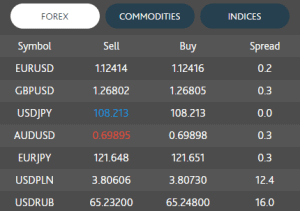

Z com spreads are offered with margin closeouts at 30% while trading size can be minimized to 0.01 lot. The deep liquidity pools ensure the tightest spreads across a range of products, from 0.0 pip spreads on ECN Accounts, or 1.5 pips fixed with Classic Account.

See the comparison for Classic account spreads below, as well you can compare Trade Z costs to another popular broker BlackBull Markets.

| Fees | Z com Spread | ATC Brokers Spread | FXOpen Spread |

|---|---|---|---|

| EURUSD Spread | 2.6 pips | 0.3 pips | 0.5 pips |

| Crude Oil WTI Spread | 4 | 3 | 13 cents |

| Gold Spread | 50 | 7 | 11 |

| BTC Spread | 58 pips | - | - |

Additionally, you should always consider an overnight or rollover fee, which also goes to your trading costs in case you hold long position. For example for EURUSD selling position, you would gain 6.47$, while buying will cost you -9.69$.

Deposits and Withdrawals

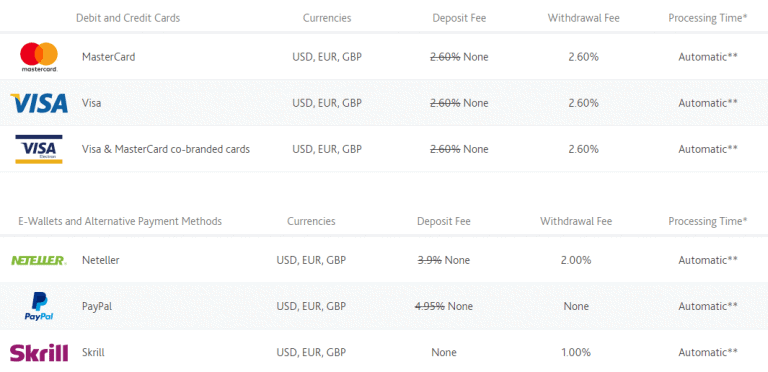

There is a multitude of payment methods at clients’ portal area that allow to Choose from a range of local and international payment options to securely deposit and withdraw funds to and from the trading account.

Available methods include

- Credit and Debit Cards,

- Bank Transfers,

- E-wallets and alternative payments alike Neteller, POLi, Moneta, iDealm Giropay, Boleto, Skrill, Trustly, Webmoney and YandexMoney.

Minimum deposit

At Z com there is no minimum deposit requirement, means you can open an account with any amount you find suitable. However, the minimum transaction amount for deposit is set to a 50$.

Z trade minimum deposit vs other brokers

| Z Trade | Most Other Brokers | |

| Minimum Deposit | $250 | $500 |

Withdrawal

Trade Z does not charge fees for deposits, however, withdrawals will be entitled to additional fees that are depending on the payment method (e.g. Card transaction requires a 2.6% fee).

Trading Platforms

Z.com uses as a mainstay an industry proved MetaTrader4 platform that enables trading through almost any device with ease and convenience. In addition to the powerful MT4 platform’s features, the traders can connect their FIX APIs, as well as to choose true Multi Asset and Algo-ready platform Auton.

Auton accommodates different financial products and allows retail traders to trade range of instruments in one single trading platform. The trading products supported by Auton include FX, Bullion, CFDs, Binary Options.

While MT4 does not require an introduction, however, its technology varies from one broker to another. The Z com one’s featured with full support with no restriction of EAs, advanced charting tools and numerous technical indicators that allows creating an ideal for each one trading environment.

Customer Support

There are many traders who chose Trade Z, while a number of the company’s clients exceeds 500,000 active customers that proved the company strives. The customer support remains on hand for any client’s need through various communication options, as well through educational service and Analytical Resources with a range of resources for instant news updates, events, trading signals and strategies.

Conclusion

The fact that Trade Z is a part of a well-established internet solutions company that achieved the world’s largest volumes and is also listed in Tokyo Exchange, brings a clear state that you will trade with a reliable broker. The main part of the competitive offer from Z com is their technology, since the broker uses both NDD and STP practices means all trades performing in real-time without any intervention, hence there is no any conflict between the trader and the company can appear.

On top of it, the company offers a small amount to start practice and can be considered as no minimum deposit requirement, which allows new traders to try out the trading at Z com easily. And that is part of the attractive offer to active traders, which will find numerous benefits, from the pricing to the tools driving.