eToro Review (2026)

Regulator

What is eToro?

eToro was founded in 2006 by three partners, who aimed to create a financial trading platform suitable to the traders of all levels, offering easy and convenient trading tools. In fact, nowadays the parent company became the largest and one of the most popular brokers along with eToro social trading network that serves more than 6 million users from around 150 worldwide countries.

eToro specializes mainly in CFD assets trading and is a social trading community, also is a fully regulated broker including respected FCA and authority of Australian securities (ASIC).

View full reviews of forex brokers in Australia here.

eToro offers both live accounts and demo one with advanced trading capabilities.

In fact, every day thousands of new traders continue connecting to eToro expanding community globally, so let us get closer and understand a reason for that.

eToro Pros and Cons

eToro is a secure broker with good reputation and is top social trading broker. The account opening is easy, platform is seamless and easy to use, also eToro is number one for copy trading for the number of traders and available portfolios.

On the negative side platform is rather basic, spreads for some instruments are high and there is no 24/7 support.

10 Points Summary

🏢 Headquarters

Cyprus and offices in UK, Australia

🗺️ Regulation

CySEC, ESMA, ASIC, FCA, USA FinCEN

🖥 Platforms

Proprietary web-based software

📉 Instruments

Stocks, CFDs, Forex, Commodities, Portfolios, Metals, Cryptocurrencies

💰 EUR/USD Spread

1 pips

🎮 Demo Account

Available with no limit

💳 Minimum deposit

200$

💰 Base currencies

Standard is USD

📚 Education

Offered

☎ Customer Support

24/5

10 Points Summary

| 🏢 Headquarters | Cyprus and offices in UK, Australia |

| 🗺️ Regulation | CySEC, ESMA, ASIC, FCA, USA FinCEN |

| 🖥 Platforms | Proprietary web-based software |

| 📉 Instruments | Stocks, CFDs, Forex, Commodities, Portfolios, Metals, Cryptocurrencies |

| 💰 EUR/USD Spread | 1 pips |

| 🎮 Demo Account | Available with no limit |

| 💳 Minimum deposit | 200$ |

| 💰 Base currencies | Standard is USD |

| 📚 Education | Offered |

| ☎ Customer Support | 24/5 |

How does eToro work?

Since its launch, eToro has gone a path of innovation, creation and introduction of features that moved investment technology and online trading to a new level. Apart from the fact that eToro traders obtaining fast and convenient access to the world financial markets, it provides the ability to copy successful traders from around the world without any commission.

So the way it works being a brokerage firm that uses modern technology to execute orders and provide you with live quotes available from the word exchanges also enables a trading solution to international traders despite its size and experience. Eventually, eToro trading platforms with social trading capabilities that acts as a market maker and gaining its profits from the charges of spread.

Further on we will cover how to use its platform and how to trade on eToro step by step.

Awards

Actually, it is a highly rewarded broker too, which gained not only great reviews from the global traders but also timely rewarded by the world reputable editions or international magazines, expeditions, etc. Eventually, eToro Review found that the broker holds awards as Best Broker for Cryptos, Best Broker for Social Trading and many more “best” titles are in its list.

Is eToro safe or a scam

Yes eToro is safe and not a scam, due to heavy regulation and licenses from CySEC, ASIC, FCA with high trust. Thus, it is secure and low-risk to trade Forex or social trading with eToro.

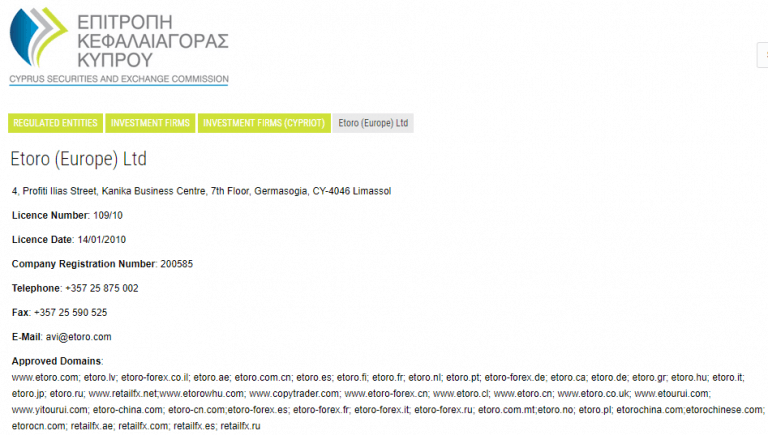

How is eToro regulated?

eToro provides its trading service through headquarters in Cyprus and its additional entities eToro Europe, eToro United Kingdom and eToro Australia Capital. While entities are authorized by three separate jurisdictions FCA, Exchange Commission CySEC (Check out CySEC regulated Forex broker LegacyFX Review) and ASIC.

Therefore it means the trading account and financial services fully comply with the measures and regulations set by the respected authorities. According to MiFID that serves European clients and provided by Cyprus Securities and Exchanges Commission (CySEC) and UK Financial Conduct Authority (FCA) licenses eligible to trade.

Besides eToro has entity in the US available for US residents only, which offers CryptoExchange and trading services.

In regards to Australian clients, eToro entity operates and provides live trading with authorization and compliance of ASIC license.

| Legal entity | Country, Regulator and License |

| eToro (UK) ltd | UK FCA registration no. 583263 |

| eToro (Europe) ltd | Cyprus CySEC registration no. 109/10 |

| eToro AUS Capital Pty Ltd. | Australia ASIC registration no. AFSL 491139 ACN 612 791 803 |

How are you protected on eToro?

Additional level and amount protection is also provided to eToro clients through investment protection coverage. Which is a regulatory rule that assures the traders’ accounts by the compensation scheme in case things go wrong with the company. Yet, this rule is different in each jurisdiction, therefore the clients under UK’s FCA eligible to eToro compensation of GBP 50,000 through FSCS and EUR 20,000 for the CySEC clients.

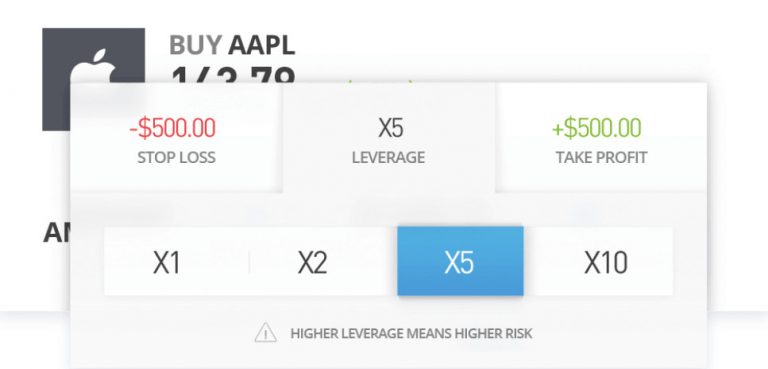

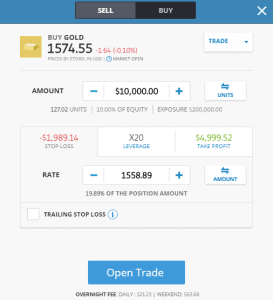

Leverage

Leverage, known as a loan given by the broker to the trader is another important point in our eToro Review, as leverage enables trading with a larger size than the initial invested capital is. As the leverage significantly increases the potential to higher gains, in reverse it does increase high risk of losing money too.

Eventually, it may be quite risky at the point you set leverage wrongly or too high depending on the strategy you deploy, so you may lose money when trading CFDs with this provider.

What is risk level?

Trading with a particular leverage level sets your risk level at eToro. However, as of the involved risk regulatory update in Europe and its ESMA regime also mandated brokers to lower a maximum leverage level to 1:30 with a purpose to protect European clients from lose money.

Thus, Europe eToro traders can use a leverage multiplier with a maximum of

- x30 for major currency pairs

- x10 for commodities

- x5 for CFD stocks

- x2 for Cryptocurrencies

However, if you are holding an account with another eToro entity that complies with ASIC regulation, as an example, you may access higher leverage ratios as the authority defines so.

Account types

eToro offers a single account, with simple account opening and access to Demo account. The traders account may be entitled to Premium services along with VIP club membership, with access to professional tools, unique promotions, exclusive multi asset platform, funding benefits as well as the personal account manager. This offer, available for traders who maintain balances from a min $5k. Besides, trading conditions and account may be different depending on the eTOro entity you would trade, alike US clients can open only CryptoWallet and trade Cryptos with completely different conditions compared to European account.

Can you open an eToro account in South Africa?

If you are South African resident you may open an account as our eToro Review found. The entity which is eligible to offer its service holds an Australian license and also authorized Financial Service provider in South Africa. Moreover, there is even the South African eToro Community which is full of discussions between the traders.

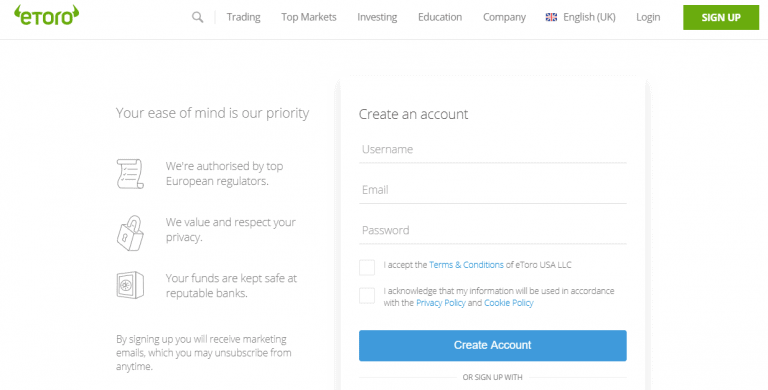

How to open an account step by step?

So in order to sign up on eToro, you should follow the process with an online application form, or simply sign with you Facebook and access free demo account instantly. Obviously for opening an account with real money, you will need to submit all the necessary proves of your identity and registrations. This means you need to verify your account through a process that is clear to understand or follow.

Once your account is activated you may go to eToro login page to sign in, perform initial deposit of funds (see more details on how to fund your account in our review further) and enjoy powerful trading capabilities.

Account opening process

1. Select and Click on the Sign In page

2. Enter the required personal data (Name, email, phone number, etc.)

3. Verify your personal data by upload of documentation (residential proof, ID, etc.)

4. Complete the electronic quiz confirming you trading experience

5. Once your account is activated and proved, follow with the money deposit.

Fees

eToro trading CFD fees and Forex fees are average. To get full picture for eToro fees important to check additional fees like commission for deposits or withdrawal also non-trading fees. See eToro fees below.

What are Fees?

Fees are always defined by several points, which are typically consisted of the spreads as the main fee charged on each position you take, commissions if applicable, inactivity and non trading fees. Typically CFD Brokers and eToro among them eToro charges no commissions, their fees are generated and built into a dealing spread (Check the list of best fixed spread brokers), which is a difference between bid and ask price.

| Fees | eToro Fees | Plus500 Fees | AvaTrade Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | Yes | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low, Average | Low | High |

Non trading fees

Lastly, there is an inactivity fee, which exists too when depositing account deemed inactive for 12 months, a monthly fee to the sum of $10 will be charged. There are no account charges if you remain active, also additional fees will be charged as deposit fee and withdrawal fee which you may read about further in our eToro Review.

Spreads

Spread table and comparison between the competition on the most traded instruments is good example of minimum spreads. Typically EUR USD spread is fixed around 1 pips, Ripple price eToro about 50 pips and BTC eToro 100 pips while we considered eToro low CFD fees and Forex fees among the industry. See eToro Spread below:

| Asset/ Pair | eToro Spread | Plus500 Spread | AvaTrade Spread |

|---|---|---|---|

| EUR USD Spread | 0.97 pips | 0.6 pips | 1.3 pips |

| Crude Oil WTI Spread | 5 pips | 2 pips | 3 pips |

| Gold Spread | 4.5 | 2.9 | 4 |

| BTC/USD Spread | 102.71 | 0.35% | 0.75% |

Fee conditions upon opening of trade

Why is this comparison important?

It is always important to see and know what you should pay and compare other industry offerings. Even though eToro costs are quite high, they are still bearable with our point of view and considering other great points we saw in etoro Review.

You don’t choose a broker only based on a spread. So along to numerous other eToro investment benefits, you’re still winning. For instance, you may check out and compare this broker with its peer BDSwiss.

Costs are not guaranteed and presented for reference only, the fee may vary according to market conditions and liquidity.

eToro overnight fee

You should consider also overnight fee charged by the broker in addition to the traditional spread, in case you hold a leveraged position for more than a day. The fee given by this broker is rather to be high, yet still among the competitive ones in comparison to a similar offering, e.g. eToro EUR USD fee is 3.7%.

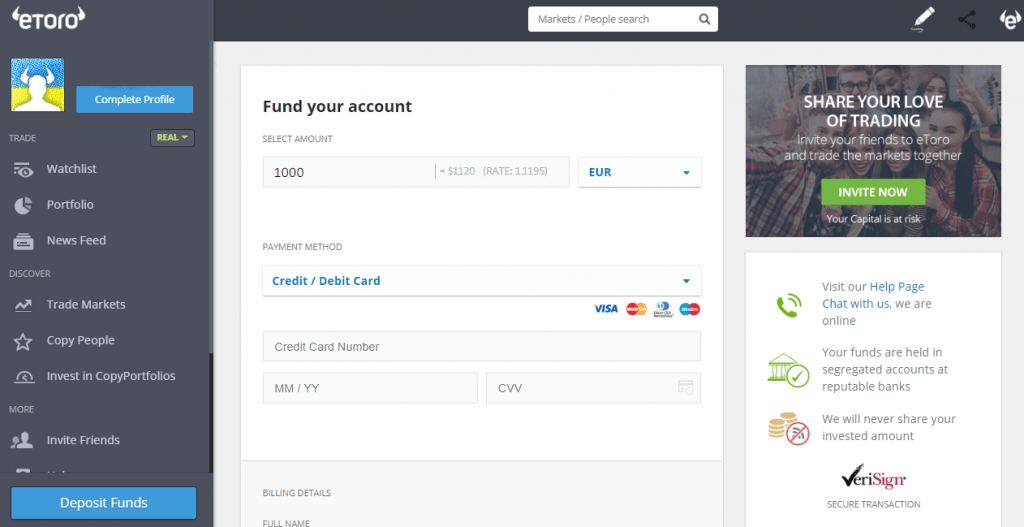

Deposit and Withdrawal

The money management and funding methods at eToro are also quick and simple, which is very pleasant and important for your account management convenience.

Deposit

Pros

Cons

Fast digital deposits, including Neteller

Withdraw money fee – 5$

0$ deposits

USD is the only one base currency

Withdrawal requests take up to 3 days

| Pros | Cons |

|---|---|

| Fast digital deposits, including Neteller | Withdraw money fee – 5$ |

| 0$ deposits | USD is the only one base currency |

| Withdrawal requests take up to 3 days |

Deposit Options

Money transfer may be performed through the following methods, while all transactions are made as secure as possible and protected by SSL technology. However, methods may vary according to the regulatory obligations in the region or another.

- Credit Card or Debit Card

- Bank Wire Transfer

- Payment systems PayPal, Giropay, Skrill, WebMoney, Yandex, China Union Pay

Account Base Currencies

eToro account base currency defines only USD as its measure.

So an additional conversion fee will be applicable while transferring the money either by the broker or by the bank account you use.

Minimum deposit requirement

Minimum deposit depending on clients’ region and country regulations and varies from $200 for Europe clients and up to $10,000. See some of the examples below, yet you should always check with particular entity customer support in terms of its conditions.

- Russia citizens also the one from Taiwan, China, Hong Kong or Macau should process a minimum of 500$

- Australia and USA traders (Find out Forex Brokers for US Traders) may start with first deposit of only 50$

- Israel residents may start with a minimum of 10,000$

| eToro | Most Other Brokers | |

| Minimum Deposit | $50-200 | $500 |

Deposit fees

Deposit fees are set to a 0 fee, so whatever amount you deposit also according to the chosen account base currency, it will be all available as your eToro dividend, which is, of course, an advantage.

Deposit Option Comparison

| eToro | Plus500 | AvaTrade | |

| Bank Transfer | V | V | V |

| Credit Card, Debit Card | V | V | V |

| Electronic Wallets | V | V | V |

| Base Currencies | 1 | 10 | 5 |

Withdrawal

eToro withdrawal options offering popular bank transfer, credit cards and some electronic wallets. Requests are usually processed quickly, while you shouldn’t have any withdrawal problems. Also, since February 2020 eToro significantly improve its withdrawal policy and establish a Withdrawal Dashboard, with full tracking of the withdrawal process.

Is it a long process to withdraw your money from eToro?

So in order to withdraw funds from your trading account you should proceed with a withdrawal request available from your account management area. Also note, you can withdraw money only to account with your name, third party transactions are restricted and never allowed by any regulated broker.

How do you withdraw money from account?

1. Select and Click on Withdraw Funds’ at the menu tab

2. In the form enter the withdrawn amount

3. Choose the withdrawal method either Credit Card, Debit Card, Electronic wallets etc

4. Complete the electronic withdrawal with necessary requirements

5. Confirm withdrawal fee and Submit

6. Check the current state of withdrawal through your Dashboard

Upon confirmation, you will receive notification about the withdrawal request along with updated statuses to your email. The broker will process the withdrawal transaction request within a few business days. In addition, you should allow your payment provider to process funds into your account, which also takes a few days and depending on international laws or requirements.

Withdrawal fees

However, you should count eToro withdrawal fee is now only – $5, which is subject to every withdrawal request from your eToro wallet, while the minimum withdrawal limit is $50. This is a great improvement, as before eToro charged 25$ but now significantly lower its fee, which is definitely fantastic.

In addition, eToro Club members of the Platinum tiers and above pay no withdrawal fees.

Trading Instruments

eToro markets range is generally among the most advanced in the industry, as offers a truly wide range of products through thousands of different financial multi-asset platform which offers categories with flexible eToro market hours. Each class has own characteristics and can be traded by a strategy suitable to your style or through a choice of the successful strategy to follow using eToro copy trading.

The eToro products range include Forex, commodities, eToro gold, investing in stocks indices, eToro CFD and a recent growing trend of eToro Bitcoin or other cryptocurrencies as well based on CFD basis trading.

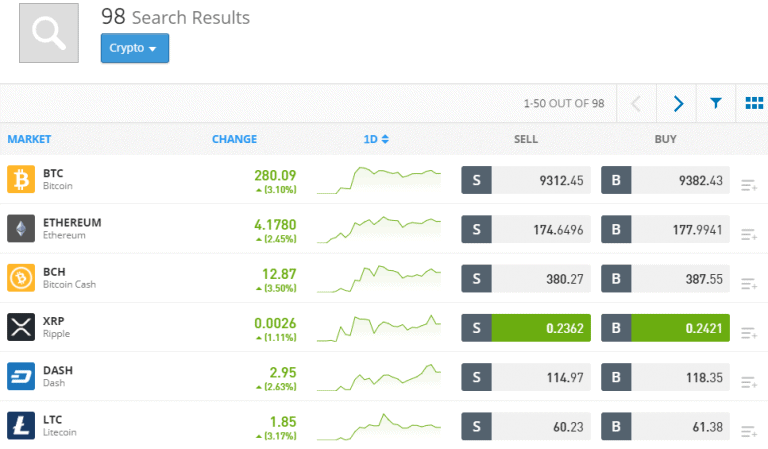

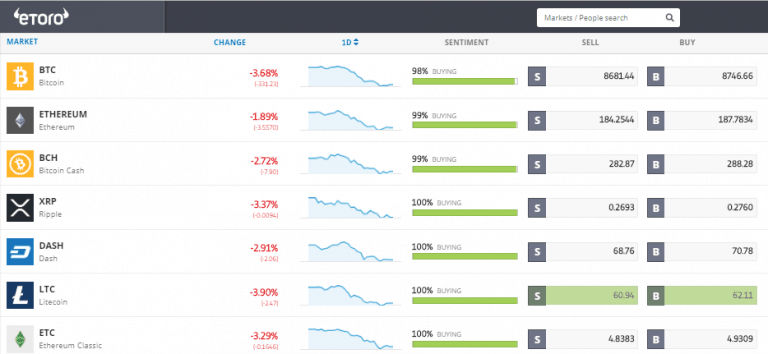

Can I trade Cryptocurrencies on eToro?

Yes, you can trade Cryptocurrencies on eToro, eventually, the platform offers popular cryptocurrencies through CFDs, yet always sick for CFD trading tips to know how to make best out of it. Cryptocurrency CFD indeed is a great instrument as it fluctuates widely and brings big advantage due to its affordable and secured nature that allows trading Bitcoin, Ethereum Classic, Binance Coin, Dash, eToro Ripple, eToro Litecoin etc.

US clients can trade Cryptos via eToro Exchange.

eToro strives constantly develops not only its huge selection of assets while including more and more eToro Crypto pairs alike eToro xrp, or other instruments. But also advances controls, features and other innovative tools that enhance its already strong trading technology timely. Nevertheless, along with the regulatory framework and investor protection, Cryptocurrency is not regulated in some jurisdictions which remains your responsibility to be verified.

Trading Platform

Pros

Cons

Great proprietary Social trading platform

No MetaTrader4 offered

Customer and User friendly

Limited range of tools and analysis

Different platforms Web, Mobile available

Only Web Version of the platform

Web and Mobile App for iOS and Android

Clean and simple to use

Comprehensive search between portfolios

Simple and quick to navigate

Fee Report

Available languages: Polish, Dutch, English, Thai, Arabic, Portuguese

| Pros | Cons |

|---|---|

| Great proprietary Social trading platform | No MetaTrader4 offered |

| Customer and User friendly | Limited range of tools and analysis |

| Different platforms Web, Mobile available | Only Web Version of the platform |

| Web and Mobile App for iOS and Android | |

| Clean and simple to use | |

| Comprehensive search between portfolios | |

| Simple and quick to navigate | |

| Fee Report | |

| Available languages: Polish, Dutch, English, Thai, Arabic, Portuguese |

Web Trading platform

It is a fact that the eToro company rapid reveille started with the presentation of the freshly created platform called eToro OpenBook, the first platform with the concept of social trading, which offered clients to connect to trading communities and successful investors.

- Best of Show 2015 & 2017 | eToro innovative platform has received multiple awards and vast recognition as a leader in the Financial Technology industry.

Look and feel

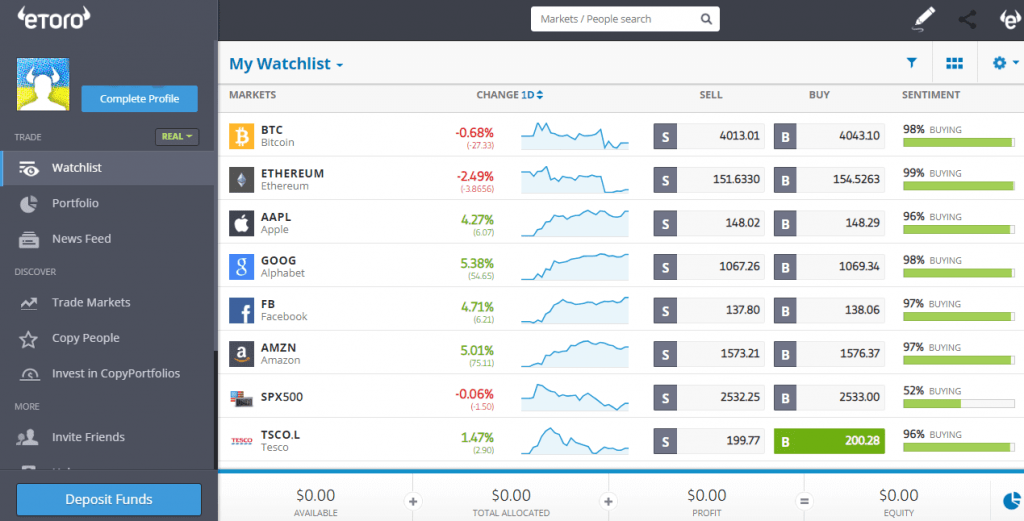

As for the platform features themselves, the software is simple to use and understand, you can make transactions at the eToro trading platforms with no need to download or install the software. Everything happens right through the eToro website, also as a Cryptocurrency trading platform or through eToro mobile App.

So once you made a security login, you’ll see an interface with watchlists and options to manage your account, search, Portfolio settings and Fee reports with all-time statistics, which is very necessary.

Search Functions

One of the great features is eToro is its search function, with a comprehensive detailed search between the traders to copy, which we will see in detail further in eToro Review. Also, you may find defined instruments to trade, communities and other searches organized and easy to use.

Alerts and Notifications

Together with a set of price alerts, notifications and browser notification you may stay updated about the direction you set, which is very useful as it offers easy tracking of the price movements.

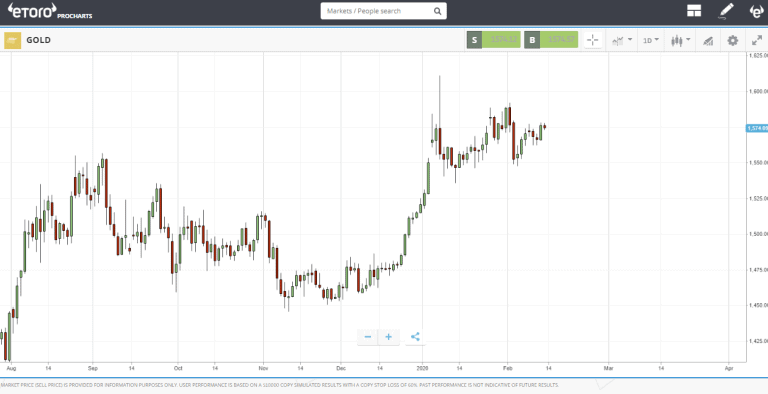

Charting

The charting itself is clear with good visual characteristics and numerous tools to use for better analysis. Also, the platform offers different tools, eToro API, including a separate schedule for each asset, featuring a number of settings with a large number of indicators for efficient functionality.

Order types

Also together with its clean charts and other functions, there are various orders along with stop-loss configurations that make the trading process under good control. One click trading or icon trade also may be enabled.

Portfolio

So in order to trek your portfolio performance, there is a full portfolio and fee report available, here the historical data is in order and detail. On the ‘Portfolio” tab you will find all the data defined by month, year or specified timeframe including fees, cash flows and orders history.

Mobile Trading Platform

Pros

Cons

Customer-friendly layout

Standard login without Face ID option

Supporting Android and iOS

eToro mobile trader, which been integrated through two platforms OpenBook and WebTrader allows you to stay connected at any time through one single application eToro App. All features available: checking real-time feeds, copy other traders or to perform any permitted by platform action. Both Android and iOS devices are supported, which is a great way to trade at any time and under any conditions.

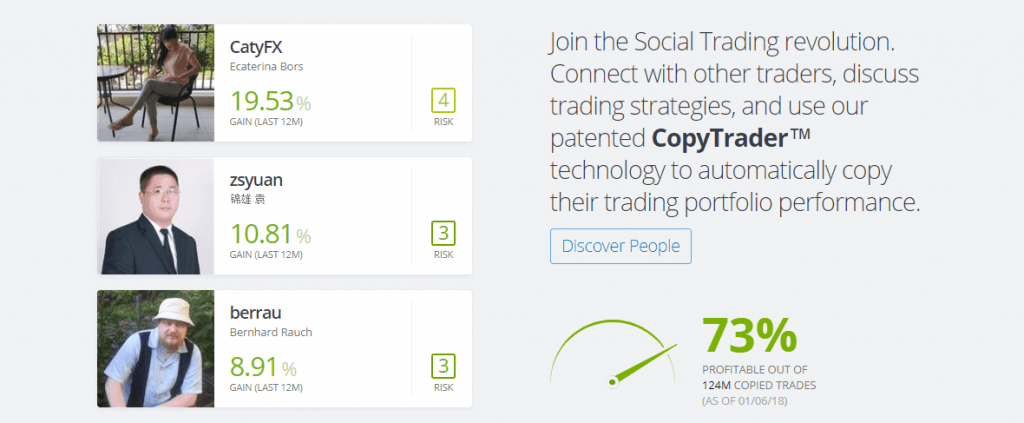

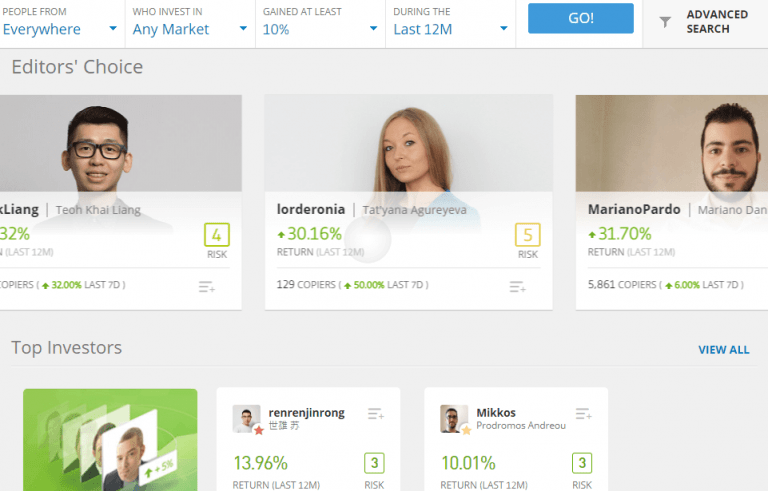

CopyTrader

Recently, the proprietary program for trading CopyTrader, CopyFund are extremely popular and is one of the largest trading communities, which allows newly joined traders to “search” the best ranked traders.

How does eToro Copy trade work?

So let us get into the essential details on how exactly eToro Copy trade works. Once you sign in and confirm all the necessary data for Live account opening you may join millions of traders from around the globe available at eToro community.

There are two options, either to invest into someone else’s by seamless automatic copying of selected eToro popular investor, or particularly developed trading portfolios specifying some layer of industry or group of instruments, traders, etc. Also, you are always defining all the necessary risk levels yourself, the amount you wish to invest and still with the capability to manage orders, see snapshot below.

Or if you are a professional you may get copied yourself and earn additional income through a commission received from your copiers.

Also, eToro measuring criteria to choose among the traders consistent with the comprehensive research based on risk level, stable weekly indicators, trading volumes, leading trades, etc. So you always may choose the most suitable trader or a portfolio, defining the most working option for you.

It is also interesting that not only transactions of individual traders can be copied, but various investments into some industry portfolio or groups too, which all in all brings truly great investment advice.

How to make money on eToro?

Well, eventually this is the most interesting and alluring question any trader is asking. As in order to make money on eToro, or with any other broker, you should either deploy your own strategy or may use Copy Trading capability as eToro offers. The copy option is definitely perfect if you just beginning with trading as it may be good investment advice if you do not wish to spend time trading yourself.

Once you found a trader you like to copy you decide how much you will put into copy account also which measures of risks to use. And of course, in parallel, you may copy as much as you find it suitable, also may gain commission from other traders that would copy you.

Nevertheless, in the trading process the most important remains the same and this is the smart management of risks, as trading is a quite tricky business that involves sufficient risk if you didn’t manage your positions correctly. eToro itself provides you will all the necessary tools to succeed in trading, yet the final result always depends on you.

You should stick to discipline strategy with eToro pending close orders and management of your close trade positions with eToro stop loss or eToro take profit limit, etc.

Desktop trading platform

So does eToro have a desktop trading platform? Eventually no, you can’t login through desktop as the only options are either Web based platform or mobile application. Also, if you prefer to use industry leader MetaTrader4 you should find another broker available from the list, as eToro does not offer MetaTrader4 as a trading platform.

Customer Service

As for the assistance, Customer Support is available 24/5 excluding weekends and available in various languages, with live chat, phones and emails. Indeed, eToro takes client satisfaction quite a priority, therefore, created web based ticketing system so whatever concern or question you may have customer service remains at your disposal.

Education

Also, all traders may use numerous features like eToro education and eToro guide also with eToro’s research that provides tutorials and education videos about a platform called all in all eToro learning Lab.

Demo Account

Support content is intended to make you a better trader also, it is recommended to use Demo Account to run trials and test strategies in a risk-free environment, which is easily accessible and available by the simple switch between live or demo account through your accounts area.

You may visit also eToro website and check on best practices, live webinars and the most recent data or updates. So you will learn how to sell on eToro and manage your trading positions smartly, which is crucial for trading success.

Even though, as we see eToro education materials and videos are not super comprehensive and rather medium or basic level, it is best to include some other detailed guides from leading providers in case you’re very beginner.

Research

Also, with educational purposes and better decisions, you will stay updated with eToro’s research through updated research tools and research features with fundamental analysis too. In addition, you may get trading ideas from the community or its diverse portfolio along with analyst recommendations.

Together with education eToro users may benefit from news feed by the use of common technology including social streaming through twitter, etc.

Conclusion

Overall, eToro is a winner top social trading broker for number of copy traders and transparency of trading. Why did 6 million customers choose this platform and is eToro good or is eToro worth it? There are several reasons flexibility of eToro platform, thousands of other trading participants for social trading. Besides, if you would add to this the advantages and possibility of traders teamwork and high deal bonuses, it becomes obvious that cooperation can bring a good impact to all. In fact, though there are other social trading platforms available, eToro has become today the best and leading in its class.