FXTM Review (2026)

Regulator

What is FXTM?

The FXTM or Forex Time company launched in 2011 with its headquarters in Cyprus (Limassol) also authorized by Financial Conduct Authority and other regulators, been named as one of the world’s fastest growing and best forex brokers. As in a relatively short time the firm showed great and rapid growth within Europe and beyond through its focus on Africa and Asia regions.

The broker establishes its core on reliable trading conditions and detailed education and brings trading across the world with its accessible trading around the globe, regardless of the trader’s knowledge. However, the chain of FXTM offices also established around Europe, located in the UK and maintaining entity in South Africa.

FXTM Pros and Cons

FXTM is a good broker well-known and regulated worldwide, there are numerous regulated entities of FXTM. Account opening is easy, FXTM has on of lowest deposit requirements and trading conditions are good with low spreads and excellent customer service and Forex education.

From the negative points there is withdrawal fee and Stocks spreads are rather higher.

10 Points Summary

| 🏢 Headquarters | Cyprus and entities around the world |

| 🗺️ Regulation | CySEC, FCA, FSCA, FSC |

| 🖥 Platforms | MT4, MT5 |

| 📉 Instruments | 250+ financial instruments, over 50 currency pairs, CFDs on Cryptocurrencies, Spot metal, Shares, Commodities and Indices. |

| 💰 EUR/USD Spread | 1.5 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 200$ |

| 💰 Base currencies | Various base currencies |

| 📚 Education | Professional FXTM Education Center |

| ☎ Customer Support | 24/5 |

Awards

From the fast client approval to the general trading process, comprehensive learnings and available features, FXTM proves its high ranking among the traders’ community with more than 90% of positive feedbacks.

The numbers are actually confirmed by the large community of traders with about 750,000+ active accounts that growing, numerous attractive opportunities and gained vast awards for excellence in trading.

FXTM also proudly takes an active social role while supporting and sponsoring various world Sports alike Sahara Force India Formula 1 team and regularly reveals in the media.

Is FXTM safe or a scam?

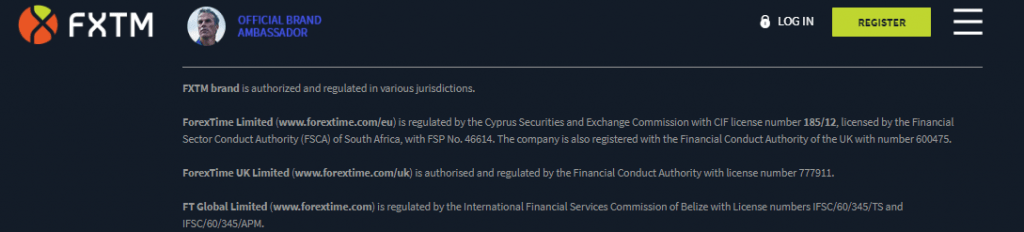

No, FXTM is not a scam, it is well regulated broker operation ForexTime Ltd, ForexTime UK Ltd and Exinity Limited three entities under the FXTM brand that provides trading services to more than 10,000 clients from over 135 countries around the world. And important to note comply with the necessary regulatory guidelines in every region FXTM operates, which gains a high score from us in terms of its trust.

This question is indeed the most crucial one, as investor accounts lose money and if you trade with the unregulated entity the high risk to lose funds is dramatically high.

Is FXTM a legit company?

Yes, FXTM is a legit broker, as each of the entities and brands that it serves is authorized and regulated by various global jurisdictions.

The main entity ForexTime Ltd is regulated by CySEC of Cyprus, authorized by FSCA of South Africa, and additional offshore authority FSC in Mauritius. Also, the FXTM UK brand is licensed by the Financial Conduct Authority known sharp regulator, which has principals built by European MiFID and ICF allowing cross broker activity.

| FXTM legal entity | Investor Protection FXTM License Number |

| ForexTime UK Limited | Regulated by FCA (UK) registration no. 600475 |

| ForexTime Limited | Authorized FSCA (South Africa) registration no. 46614 |

| Authorized by Authorized by Cyprus Securities and Exchange Commission registration no. 185/12 | |

| Exinity Limited | Authorized by FSC (Mauritius) registration no. C113012295 |

How are you protected?

Since FXTM license means its compliance with all the strict regulatory requirements, trader’s investment considered to be safe, as the broker completely segregates funds from the operational funds of the FXTM while kept in leading and reputable EU banks.

In addition, FXTM is a member of the Investor Compensation Fund that compensates in case of the company insolvency, as well as protected by the negative balance protection and other requirements that are audited on a regular basis by the authority.

Leverage

When you trading with FXTM you are able to operate with fixed or floating leverage. The leverage indeed a very useful tool, especially for the traders of smaller size, as it may increase your potential gains timely due to its possibility to multiple initial account balance in a particular number of times.

What is the risk level?

Yet, remember that correct leverage should be set to various instruments, as it may increase your risk level and potential loses as well. Therefore, FXTM leverage is determined by various measures and firstly set according to the regulatory requirement in the region or another.

And then is also based on the trader experience and knowledge, so always check with customer support team first which one is applicable for you.

So if you would like to operate under higher leverage ratios like 1:400, 1:500 or even 1:1000 you may open an FXTM account under a particular entity that allows such high leverage levels, which is offered by the global brand.

Otherwise, if you are a resident of Europe or UK, as well holding an account under European entity which obliges to ESMA regulation, the maximum current leverage ratio is set to a

- 1:30 on Forex instruments

- 1:20 Spot Metals, 1:10 XAG USD

- 1:20 Minor Currency Pairs

- 1:5 Shares

Accounts

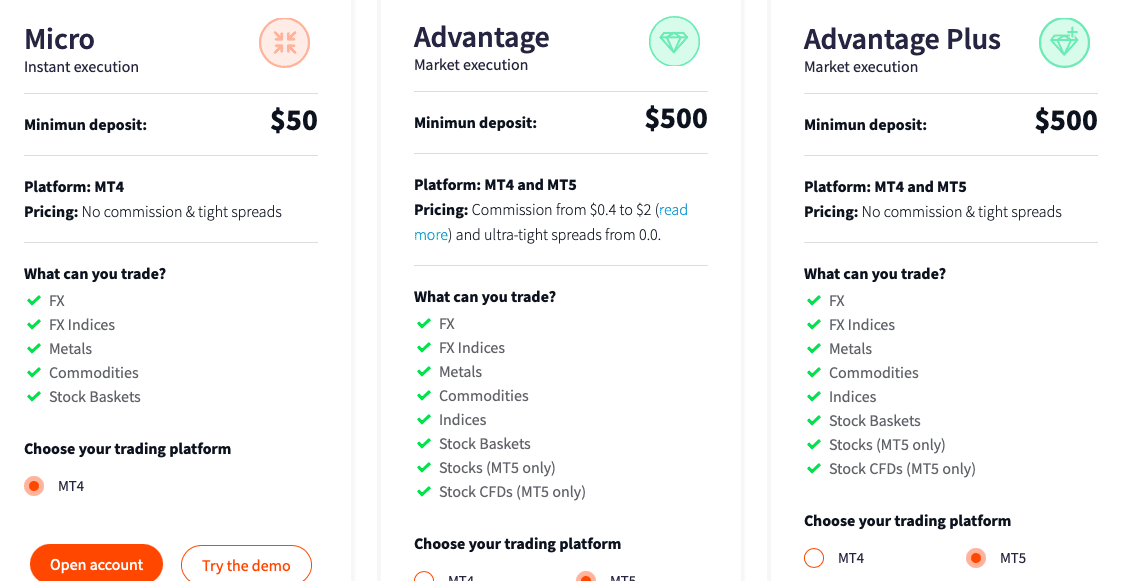

FXTM offers separate accounts for Forex trading and Invest Accounts. Then there is a further split to your preference of the trading transactions, instrument and the trading size, which all in all offers you 3 Account types – Micro, Advantage and Advantage Plus.

So now let’s get a closer look at FXTM Accounts which are divided into three options – Micro, Advantage and Advantage Plus

Micro Account – most accesible account offered by FXTM with low minimum deposit & instant execution, zero commission and spreads from 1.5 pips. See brokers with micro accounts.

Advantage Account – cheapest account type offered by FXTM with average commission of $0.40 – $2 based on volume and spreads from 0.0.

Advantage Plus Account – partner account with zero commission (spread only), and spreads from 1.5 pips.

However, always make sure to verify under which entity you will trade as FXTM offering may be slightly different for Forextime Limited, ForexTime UK or Exinity Limited. In this FXTM review we will cover Forextime offering in detail so you would understand conditions better.

How do I open an FXTM account?

FXTM accepts clients from almost every world country, however there are might be some restrictions due to regulations alike implemented for residents of Japan, USA, etc.

So step by step process of opening requires you to follow the FXTM sign-in link where you will be guided through a quite simple process of opening step by step.

Opening an account step by step

- Access FXTM Sign In page

- Enter your personal data First and Last Name, Country of residence, email, phone, etc.

- Answer online questioner about your trading knowledge and expectations

- Select the account type

- Verify your account by upload of your identity confirmation. These may include a residential proof, copy of your ID, bank statement etc.

- Once an account is activated and proved you may follow with the money deposit

Fees

FXTM costs are Fees are mainly built into a spread also defined by the account type you use. In addition, you should always consider other fees like non-trading fees, withdrawal fees which we will see in detail further.

Generally, FXTM offering built through tight floating spreads while Standard MT4 spreads start from 1.6 Pips and from 0.1 pips for ECN accounts available on both platforms MT4 or MT5, but will add on a commission charge per order.

| FXTM Fees | eToro Fees | XM Fees |

|---|---|---|

| No | No | No |

| Yes | No | No |

| Yes | Yes | Yes |

| Average | Low | High |

An overview of the Non Trading Fees

These fees should be considered also, as FXTM will charge you 5$ per months in case you didn’t show any trading activity for a period of six month or more, this is known as FXTM Inactivity fee.

Despite this, there is no deposit fees or some of withdrawals are free as well, which we will see in our FXTM review further, so all in all FXTM fee structure is quite transparent and well built.

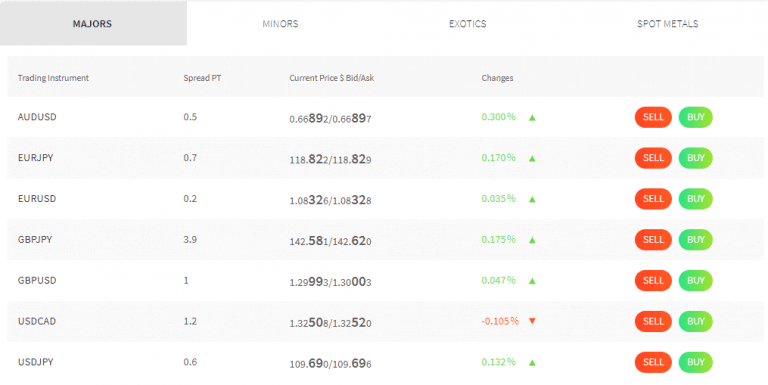

FXTM Spreads

Forex fees offered by FXTM spread only with no commission in case you use Advantage Plus and Micro Account, see FXTM spreads below This type of fees brings you the simplicity of the calculation and is the best suitable option for many traders despite the strategy.

– FXTM three Accounts offering various fee conditions, so the standard spread starting from 1.5 pips for USD / EUR / GBP / NGN.

| Asset/ Pair | FXTM Spread | eToro Spread | XM Spread |

|---|---|---|---|

| EUR USD Spread | 1.5 pips | 3 pips | 1.6 pips |

| Crude Oil WTI Spread | 4 pips | 5 pips | 5 pips |

| Gold Spread | 9 | 45 | 35 |

| BTC USD Spread | 20 | 0.75% | 60 |

Shares Fees

If you wish to trade Shares, the spreads leverage will be the only charge, which is a quite competitive and very pleasant offering compared to the industry. Below you may see some comparison between other trading CFDs brokers, yet remember this is the standard proposal that seems to be average and high at FXTM.

But, as we see FXTM proposal is very flexible so with account types and depending on the instrument you trade FXTM may bring you almost the best proposal in terms of its fees.

Demo Account

New traders or the ones who would like to try the platform can learn to Trade via Demo account, featuring $1,000,000 available to trade, detailed step-by-step tutorials and online webinars, individual support by the account manager in 16 languages.

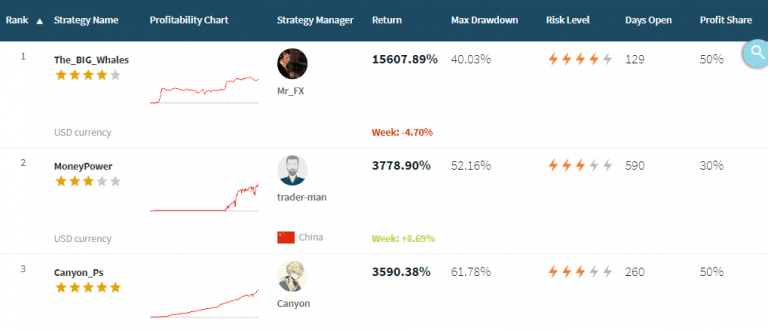

Moreover, there is an additional feature for FXTM Invest Account, a quite simple profile that including copy trading tool supported by the Top Strategy Managers and suitable for the traders of almost all degrees.

For accurate and updated information please check the official FXTM website, as well as you may compare fees to FXTM peer BDSwiss.

Deposits and Withdrawals

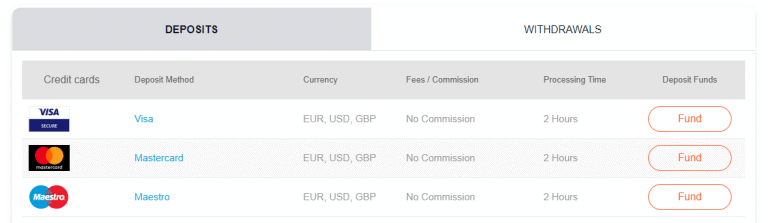

In terms of the funding methods, FXTM made it quite simple and straight forward process with a truly wide range of funding options that will assist you to find a suitable money transfer provider.

Deposit options

In order to fund an account or to send money to it you may choose among the following methods, which may also vary according to your country of origin. Also, FXTM is really quick with your deposit processing, as it mentions within 2 hours money will be available at your account so you may start trading instantly.

- Credit cards

- Bank wire transfers also with the possibility to perform a local bank transfer. Alike you can choose transfer via Deutsche Handelsbank (accepting deposits in EUR) and Rietumu Banka (using GBP, PLN, USD, EUR, RUR)

- E-wallets (Neteller, Skrill, Alfa-Click, WebMoney, Western Union, Dotpay, Yandex money, Qiwi wallet, Bitcoin via Skrill, and counting)

FXTM minimum deposit

FXTM minimum deposit requirement is $/€/£ 100 for Account Standard and only 10$ for a Cent Account. Also, all deposit fees are covered by the company which is great for your smart money management.

FXTM minimum deposit vs other brokers

| FXTM | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawal

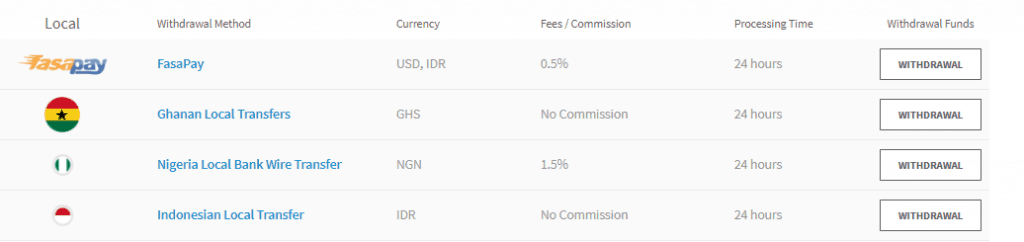

FXTM withdrawal options is widely available including bank transfers, e-wallets and cards. The withdrawal fee varies from one option to another. As an example, Credit Cards withdrawal features 3$ fee, while Bank Transfer will cost 30$, and WebMoney will charge 2% above the requested amount. However, these withdrawal fees still considered to be on a low level comparing to other industry offerings. applied to some of the payment methods, while others may be provided with 0% commission.

How do I withdraw money from FXTM?

Once you decide to withdraw money from you account you obviously should submit an online request and follow with the required procedure. To make it short you simply should follow the following steps

- Login to your account in MyFXTM and go to Withdraw page through My Money

- Select the withdrawal method, required amount and click ‘Withdraw’

- Complete the withdrawal request along with PIN that will be sent to your email or phone via SMS

- Confirm withdrawal and Submit

How long does it take to withdraw from FXTM?

From the moment you submit and confirm the request to withdraw money from your account the accounting department of FXTM typically processed and confirm withdrawal within 2 business days.

Yet, you should always consult with customer service and confirm data, as various jurisdictions may apply slightly different rules. Also, give it some days for the payment provider to process the transaction that also depending on particular international or provider rules.

Bonus

Another great possibility offered by FXTM is an option to get Bonus through frequent promotions and cashback programs broker offers.

Does FXTM have Bonus?

Yes FXTM offers Bonus programs. However, the Bonus program is strictly available only for the international brand of FXTM and those clients that are trading or holding an account with Exinity Limited, registered under the laws of Mauritius.

How do I claim my FXTM bonus?

So if you open an account with the international entity of FXTM you may claim your bonus according to the recent promotions FXTM runs.

At the time of the FXTM Review writing, you may claim Welcome Bonus and earn 30$ tradeable credit, while you should register for an account then select the 300$ bonus promotion, deposit funds and start trading. Also note, every bonus program applies specified terms and conditions on how it should be used or accessed.

Market Instruments

Generally speaking, FXTM offers good range selection of markets and account features among the industry brokerage offering.

The trading markets include 250+ financial instruments, Forex products with over 50 currency pairs including attractive FXTM CFDs on Cryptocurrencies such as Bitcoin, ETH, Litecoin, Ripple. Also, you may select spot metal CFDs, share CFDs on over 170 major companies, CFDs on Commodities and CFDs on Indices.

FXTM Markets compared to similar Brokers

It is also good to compare FXTM to other industry offerings, so in the table below you may see available assets and instruments.

| FXTM | XM | AvaTrade | |

| Forex | 57 | 57 | 55 |

| Indices | 11 | 18 | 18 |

| Commodities | 6 | 15 | 17 |

| Cryptocurrency | 4 | 5 | 6 |

| Shares | 174 | 1294 | 63 |

FXTM Trading Platforms

FXTM trading technology and toolbar use the industry’s leading software third party providers, which doesn’t require a presentation, as these platforms are MT4 and MT5. However, a progressive technology of the MetaTrader was combined with FXTM’s unparalleled trading services that allowing smooth operation and enhancing your trading capabilities all in all making trading powerful processes.

Web Trading Platform

Since the FXTM platform is MT4 or MT5 software both offers various versions available either as WebTrading platforms or the one that can be installed directly at any device. Web trading software is a great option if you are a beginner or regular size trader, as platform accessible right from the browser, does not require any installation, easy save and navigated.

Look and feel

Desktop Trading Platform

If you require more tools along with powerful customization you better choose Desktop version. MetaTrader supporting all kinds of devices including PC, MAC as well as accessible Multi Terminal that is useful for money managers. Hence you will always have access to your account at personal convenience.

All necessary and useful tools are also included into the package, from risk management to analysis, as well as a unique developed trading tool like – Pivot points strategy and trading signals. Along with converters, calculators that designed to make trading to the trader of any level more professional.

| Pros | Cons |

|---|---|

| Customer friendly design | No proprietary platform |

| The Comprehensive range of tools | |

| Automated trading capabilities | |

| Clear look and fee report | |

| Industry leading software that does not require familiarization | |

| Tons of education material and automated strategies available |

Mobile Trading Platform

Of course, FXTM offers applications for mobile or tablet devices, so you will always have access to your account at personal convenience. Design is clear and customizable which is always good, yet app packed with tools and alerts so you always remain updated.

| Pros | Cons |

|---|---|

| Good design | Two step verification not offered |

| Full control over your trading account | |

| Price alerts | |

| Good charting |

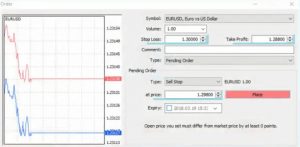

Placing orders

Social Trading

In addition to its powerful feature and clear possibility to monitor markets the FXTM platform also enables automated trading which is the execution of orders automatically according to the implemented strategy.

Or you may use the powerful capability of Social Trading alike becoming an investor, this option allowing you to follow ranked strategy managers which you can choose through numerous criteria or filters to follow. In reverse, professionals may become managers and gain extra income by being copied.

Customer Support

Another good point in its client-oriented philosophy of FXTM operation is a competent customer service that is available through various sources including Online Live Chat, Phone, emails, Messenger applications etc.

Apart from the positive and high regard from the clients in terms of its good reputation, FXTM also supports a great range of languages, so you always may count on help whenever you needed it.

There are established centers in Asia region including Indonesia, Malaysia, Thailand, China, as well as Africa region, Europe and more, so it is true to state FXTM covers the global needs of traders.

Education

Overall, the main approach of the FXTM we can characterize as a client oriented broker, mindless the trader’s trading capital, experience or style FXTM have a solution to meet a particular need and provide outstanding service in almost every way.

In terms of education, FXTM hosting regular educational events in various cities around the world while satisfying the demand to start the trading journey and supporting with learning material everyone who would like to engage into trading.

There are webinars, seminars, platform tutorials, trading tools, research tools, superb glossary, Forex news, Economic Calendar, Market outlooks and Analyst analysis all remaining at your disposal.

Eventually, FXTM education is one of the best we see in the industry, so this point is definitely well organized and highly recommended for your attention. Research

Research

What is more, Forex Contest is established by FXTM competition held regularly and is one of the ways to test strategy, polish skills and grow confidence. A truly challenging experience available in both Demo and Live accounts hence is an ideal for both experienced and “fresh” traders, which is definitely another Pro point for FXTM. For recently available contests check the official FXTM website.

Conclusion

Concluding FXTM Review, FXTM gives a quality trading potential for both beginners and experienced traders or investors. Moreover, there are other advantages with ForexTime too, the accounts variety is very impressive that allows any trader best suitable option either with flexible or floating leverage – leverage which determined based on the trader experience and knowledge, tight spreads from 0.1 pips and low deposit requirements.

Reviews

I want to invest and trade how should I do it

You need to go to the registration page on the FXTM website and fill in all the needed information to proceed. Also, if you would like to get more knowledge about trading you can go and check our FXTM webinars

I am interested in investing and trading

Please, follow this link to open account with FXTM and start trading.

someone mislead me to join through these link and after swindling my investment they have me hard to withdraw even my capital I don’t know if the links belong to the same company they need to protect us from these hungry tigers

Hello, same here, did you recover your money?

This is not the real FXTM website… I have been trade with them on and off for 5 years. I never have problem with withdrawal.

I have started with only 100$. In the beginning i was sceptic, as i was scammed a lot. What i liked is the fact that there is a safety button, which secures you from losses, plus i have made a deposit to a broker, which unknowingly the minimum deposit was more than 610$, i clicked withdraw, and it was back in my wallet instantly! Online help was quite helpful and fast! i can definitely recommend FXTM . Just make sure when you pick a broker, to check out his trading days, P/L daily, etc.

May I know your broker sir.

Dear

With regards to this i already trade in your company, then supposedly the time withdrawing the money i recieved an email stated that my account is at stop level limit and you need an account upgrade and signal service upgrade and i should pay about $1500.

Is it neccesary to pay that or i have the right to have my profit without paying it.

Need a good and reasonalble feedback from your management as im funding and trading my money to your company.

did you receive any replay on this