The U.S. Stimulus Package

The U.S. stimulus package remains the main focus among investors as the sparring continues between U.S President, Donald Trump and House Speaker, Nancy Pelosi. The Fed made it quite clear last week that the U.S. economy needs more support by way of a fiscal package, and a smaller package is only likely to cause more damage to the U.S. economy. Nancy Pelosi and Steven Mnuchin are expected to hold more talks this week.

Stock Market Today

The Asian stock market was led higher by Chinese stocks. The Shanghai index gained 2.23%. The Koran Kopsi stock index also moved higher by 0.39%, while Hong Kong’s HSI jumped higher by 2.21%. The Australian ASX 200 advanced 0.49%.

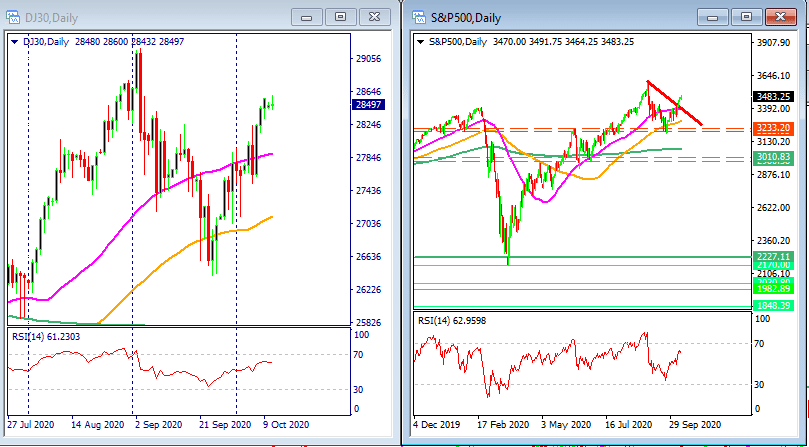

Dow Jones and S&P500: Market Breadth

The Dow Jones’ market breadth remained unchanged on Friday. 77% of the Dow Jones stocks traded above their 200-day moving average.

The S&P 500 stock breadth added more strength. 72% of the shares traded above their 200-day moving average. This is a change of +2% from a day earlier.

Dow Jones Futures Today

The Dow Jones futures are trading higher by 61 points. The market will focus on the CPI and Core CPI numbers, which are due tomorrow. As for today, the focus will be on the Bank of England Governor’s speech. He is expected to speak at 17:00 today.

The Dow Jones futures are starting the week on a positive note, and this is despite the fact that the Dow has recorded two consecutive weeks of gains.

The Relative Strength Index is also trading to the upside, and it is flashing warning signs. This is because the RSI is near the 70 mark, which represents an overbought zone.

Traders usually start selling their positions when the RSI gets closer to 70. Nonetheless, the bull trend is still immensely strong as the Dow Jones Futures are trading above the 50, 100 and 200-day SMA on the daily time frame.

The S&P 500 index, which represents the wider stock market, is also trading above the 50, 100 and 200-day SMA on the daily time frame. The S&P 500’s price is nearly 4% below its all-time high, which was formed back in August.

Given the current upward momentum in the price, it is likely that the price will continue its bull trend, and the next appropriate resistance is the all-time high of 3586.

Stock Market Rally

The S&P 500 stock index is continuing its back-to-back weeks of gains, and on Friday, the index advanced 0.88%. The information technology sector led the index higher, and eight sectors out of 11 closed higher.

The Dow index closed in positive territory on Friday; the Dow stocks moved the index higher by 0.57%. 11 shares of the Dow fell, and 19 shares closed higher.

The NASDAQ composite, a tech-savvy index, advanced 1.51% yesterday.

S&P 500 Leaders and Laggards: Xilinx and Vontier

Xilinx stock contributed the biggest gain, soaring 14.1%. Vontier crop. stock was the largest drag; it fell by 16.1%. The S&P 500 stock index is up 7.61% so far this year.

Dow Jones Leaders and Laggards: Salesforce and IBM

Salesforce stock advanced higher by 2.21% and was the biggest mover for the Dow, while IBM stock dropped 2.88%, the biggest drag for Dow Jones Industrial Average index.