U.S. futures are trading higher as traders are still feeling comfortable in holding riskier assets. Asian stocks have also started the week on a positive note, but there are some concerns about Abenomics’ future.

Japan’s Abe resigned last week due to his health, and investors wonder what the country’s new monetary policy will look like. Abe played an active role in the country’s economic policy while serving as a prime minister.

Japanese stocks recovered their losses from Friday, and the Japanese Nikkei index advanced 1.24%. Overall, stocks in Asia were positive; the Shanghai index jumped higher by 0.64%. The HSI stock index also soared 0.69% while the Korean Kospi declined 0.86%. The Aussie ASX 200 index fell 0.12%.

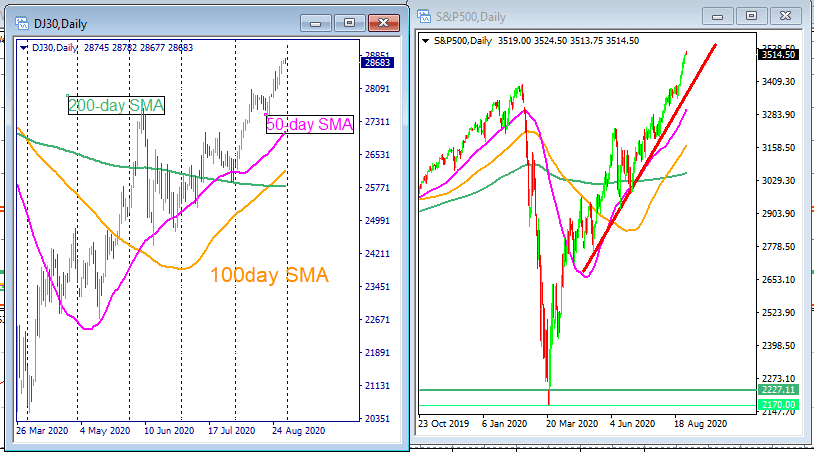

Market Breadth: Dow Index And S&P500 Index

The U.S. stock market‘s breadth remained the same on Friday as Thursday. 60% of the Dow Jones stocks traded above their 200-day moving average yesterday.

The S&P 500 stock breadth confirmed further improvement on Friday. 62% of the shares traded above their 200-day moving average yesterday.

Futures Today: Dow Jones And S&P 500

The Dow Jones futures are trading lower by 60 points. Berkshire Hathaway made a massive bet in five different Japanese companies, and this was one of the largest investments by Oklahoma’s Oracle, Warren Buffet, in Japan.

The economic activity over in China also continued to improve, which is also helping the risk sentiment among investors. Traders are somewhat anxious that the coronavirus cases are ticking up again in the U.S. while India recorded its worst-ever one day spike. The global coronavirus cases have surpassed the 25 million mark today.

The Dow Jones futures are moving closer towards their all-time high, and the momentum looks strong on a daily time frame. The Dow Jones’s 100-day simple moving average crossed above the 200-day simple moving average, which confirms the bull strength. In addition to this, the Dow price is also trading above the 200-day SMA. This is another positive sign for the Dow Jones index.

The S&P 500 futures, the broader picture of the U.S. equity market, scored another record high on Friday. The SPX index is trading above the upward trend line on a daily time frame, and as long as this trend line holds, the bull momentum isn’t likely to weaken. The price action looks overextended on a weekly time frame as the SPX price is trading over 6% above its 50-day week’s price, which means that a retracement can take place.

Stock Market Rally

The S&P 500 stock index advanced 0.67%. The energy sector led the index higher, and all the eleven sectors closed higher.

Weston Digital stock contributed the biggest gain, advanced 7.38%. The CenturyLink stock was the biggest drag; it fell by 3.09%. The S&P 500 stock index is up nearly 7.2% this month.

The Dow Industrial average index reached 1601 points on Friday and the Dow stocks moved the index higher by 0.58%. Twenty stocks of the Dow Jones Index increased in value, and ten shares of the Dow index moved lower. Visa stock jumped higher by 2.2% and was the biggest mover for the Dow, while Salesforce stock declined 1.89%, the biggest drag for Dow Jones industrial average index.

The NASDAQ composite, a tech-savvy index, advanced 0.58% on Friday.