-

FXTM launches brand new SG20 stock index

-

SG20 has highest dividend yield of all FXTM stock indices

-

SG20: most stable Asian stock index within FXTM universe

-

SG20 has strong positive correlation with spot gold

- Wall Street forecasts that this stock index could rise by another 14%

FXTM’s new SG20 index may be enticing for range traders who enjoy consistent cash payouts.

What is a stock index?

Imagine a stock index being a basket of many different stocks.

The index measures the overall performance of those stocks inside that “basket”.

What does the SG20 stock index track?

FXTMs SG20 stock index tracks the performance of the MSCI Singapore Index.

Note that this MSCI Singapore index is not the same as the benchmark Straits Times index, which is maintained by the FTSE.

This MSCI Singapore index aims to capture the overall performance of 22 different large- and mid-cap stocks in Singapore.

Together, those 22 stocks make up about 85% of the entire Singaporean stock market.

3 key things to know about the SG20 index:

1) Singaporean banks are the largest members of this index

Singapore is a city-state that is also known for its status as a “safe haven”, especially for the Asian region.

As a result, its financial sector tends to attract outsized fund inflows, benefitting its banks.

No surprise then that DBS Group, OBCB Bank, and UOB, combine to make up nearly half (48.17%) of the entire SG20 index.

2) Least volatile Asian stock index within FXTM universe

Of the 6 different Asian stock indices, the SG20 index has the lowest 30-day volatility figure, as of today (Tuesday, March 19th).

-

SDG20: 10.9

-

TWN: 13.2

-

JP225: 15.8

-

CN50: 17.1

-

HK50: 23.6

- CHINAH: 27.5

Here are more data points to showcase the SG20 index’s relative stability:

- SG20 index is faring better than Singapore’s benchmark Straits Times index

The SG20 index is up 1.25% so far in 2024.

Compare that to Singapore’s benchmark stock index (FTSE Straits Times index), which has dropped by by more than 2% so far in 2024.

While the performance of Singaporean stocks are in stark contrast to the many stock indices around the world that have printed fresh record highs this year …

SG20 index appears to putting in a relatively steady shift so far this year.

- SG20 index has a strong correlation with gold

To buffer the notion of Singapore as a “safe haven”, this SG20 index tends to mirror the performance of another famed “safe haven” asset: gold.

Over any given 5-day period from the past 20 years, both XAUUSD (gold) and this SG20 index have moved in the same direction 51% of the time (positive correlation.

NOTE: According to Bloomberg data, gold and SG20 have a positive correlation of 0.51, over a rolling 5-day period from the past 20 years. A number of 0.5 or higher indicates a strong correlation.

3) SG20 has highest dividend yield of all FXTM Stock Indices

Over the past 12 months, this SG20 index has paid out a dividend yield of 4.7% (based on current prices).

That’s significantly higher than the dividend yields currently offered by other popular stock indices (based on current prices):

-

UK100: 4%

-

EU50: 2.9%

-

JP225: 1.6%

-

US500: 1.4%

- NAS100: 0.8%

But wait, there’s more!

Over the next 12 months, Wall Street analysts forecast that members of the SG20 index will pay out EVEN MORE dividends.

This is expected to bring the forward 12-month yield up to 4.9%.

What is a “dividend yield”?

Dividend yield is a % number representing how much money an investor gets for buying and holding an asset.

The higher the yield, the more dividends the investor receives, as a ratio of what was originally invested.

Dividends are cash rewards that are given by companies (in this case, companies that are included in the SG20 index) to its shareholders.

Hence, holders of assets linked to the SG20 index, such as Exchange-Traded Funds (ETF) or even Contracts for Differences (CFD), often are entitled to similar dividends as well.

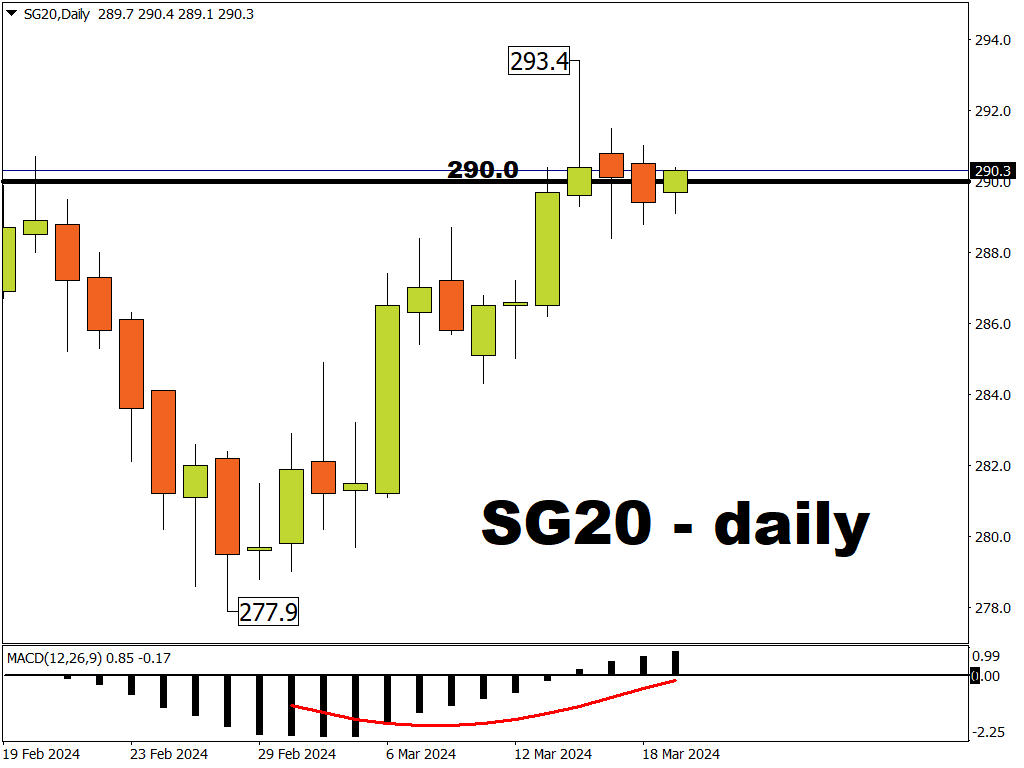

Where’s SG20 headed next?

Over the next 12 months, Wall Street analysts predict this SG20 index could return to the 330 mark.

From current prices, this implies about 14% in potential gains.

For proper context, a number around 330 would only restore the SG20 index to levels not seen since 2022.

That would still pale in comparison to the SG20 index’s all-time intraday high of 481.23 posted 10th October 2007, before the Global Financial Crisis.

SG20 bulls (those hoping that prices will rise) will be hoping that the Asian "safe haven" economy can continue registering steady growth, benefitting the city-state’s financial sector along the way.

If such an outlook proves true, then ...

Traders and investors may yet enjoy more gains amid less-volatile prices, while collecting healthy dividends along the way.