- EURAUD waits for directional spark

- Prices rangebound on M1 chart

- Incoming data could rock minor currency pair

- Technical indicators favour bulls

- Bloomberg model: 77% chance EURAUD – (1.64508 – 1.67710)

Were you able to catch your breath after such an intense trading week?

Well, at least the final week of March seems lighter in comparison with US and UK markets closed for Good Friday:

Monday, 25th March

- JPY: BoJ January meeting minutes

- USD: Atlanta Fed President Raphael Bostic speech

Tuesday, 26th March

- AUD: Australia consumer confidence

- USD: US Conference Board consumer confidence

Wednesday, 27th March

- CN50:China industrial production, Big China banks report earnings

- AUD: Australia monthly CPI

- EUR: Eurozone economic confidence, consumer confidence

Thursday, 28th March

- AUD: Australia retail sales

- EUR: Germany unemployment

- NZD: New Zealand business confidence

- GBP: UK Q4 GDP revision

- USD: US University of Michigan consumer sentiment, GDP, initial jobless claims

Friday, 29th March

- US and UK markets closed for Good Friday

- JPY: Japan unemployment, Tokyo CPI, industrial production, retail sales

- USD: US February PCE report

Nevertheless, traders may still be presented with fresh opportunities across the board due to key data from major economies.

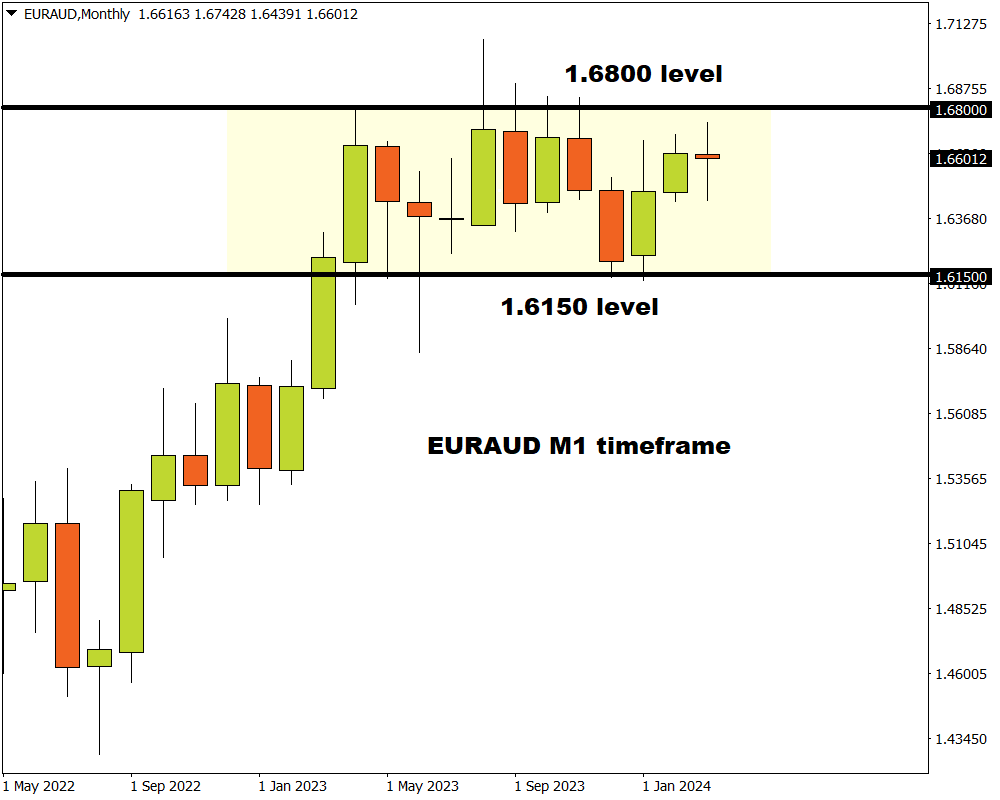

Our attention lands on the EURAUD which remains trapped within a wide range on the monthly timeframe. Key monthly resistance can be found at 1.6800 and support at 1.6150.

Note: The EURAUD has failed to secure a monthly close above or below this range since March 2023.

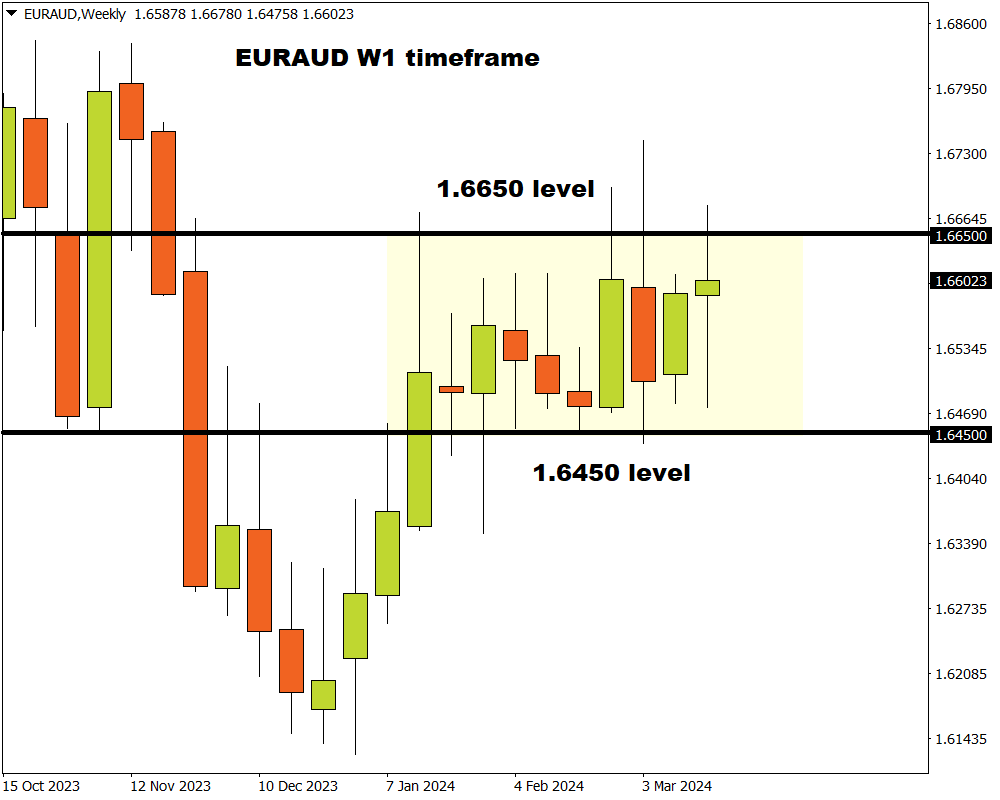

It is a similar picture on the weekly charts as prices trade within a tighter range with weekly support at 1.6450 and resistance at 1.6650.

Note: The EURAUD is up roughly 2.5% since the start of 2024.

After bouncing within a weekly range for the past 10 weeks, could a major breakout be on the horizon? Watch out for these 3 factors:

-

Key AU data

Now that the Reserve Bank of Australia (RBA) has moved to a more neutral stance on rates, much attention will be directed towards data which could provide clues on the central bank’s next move.

Australia’s consumer confidence, monthly inflation figures and retail sales may provide insight into the health of the economy while also impacting interest rate expectations.

Traders are currently pricing in a 37% probability of a 25-basis point RBA cut by June, with this jumping to 88% by August.

- EURAUD is likely to rise if overall AU economic data reinforces the case for lower interest rates and weaken the AUD as a result.

- Should economic data exceed market forecasts, this may hit bets around the RBA cutting rates – pulling the EURAUD lower as the AUD appreciates.

-

Top EU data

In Europe, it’s all about the latest Eurozone economic and consumer confidence which could impact sentiment towards the European economy and ECB rate cut expectations. Germany - Europe’s largest economy will also be in focus as it publishes its latest unemployment figures.

Traders are currently pricing in an 88% probability of a 25-basis point ECB cut by June, with this a move fully priced in by July.

Note: It has been roughly two weeks since the ECB decided to leave interest rates unchanged in March.

- The EUR could depreciate if overall data from the EU support the argument around lower interest rates in 2024, dragging the EURAUD lower as a result.

- A positive set of economic figures from Europe could push back ECB cut rates, supporting the EURAUD as the EUR strengthens.

-

Technical forces

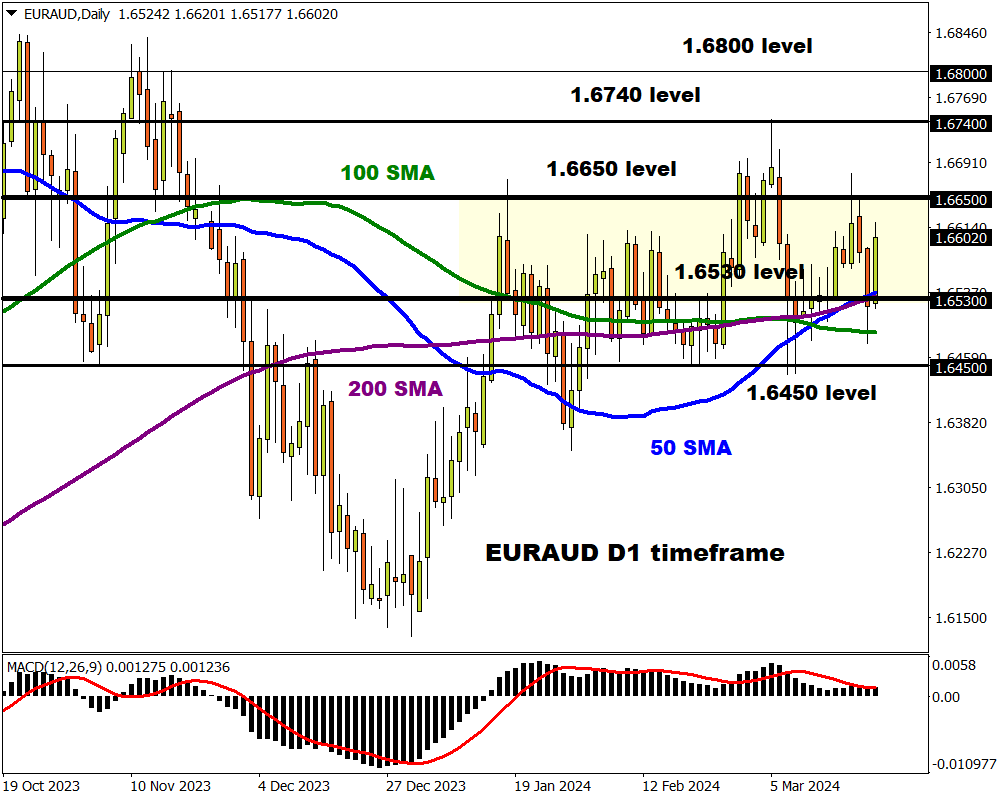

It remains a choppy affair for the EURAUD on the daily charts with prices trading within a 200 pip range. Although prices are trading above the 50, 100 and 200-day SMA, there seems to be a tough tug of war between bulls and bears.

- A solid breakout and daily close above 1.6500 may open the doors towards 1.6740 and 1.6800, respectively.

- Should prices slip back below the 200-day SMA, this could trigger a selloff towards 1.6450.