-

Dogecoin, Bitcoin Cash each climbed over 10% on March 31st

-

Futures for Dogecoin, BitcoinCash, Litecoin to start trading on US exchange this month

- Bitcoin “halving”, due in late April, may boost other cryptos

Of the 11 crypto CFDs offered by FXTM, Bitcoin Cash is leading the pack with about 160% in year-to-date gains.

That 160% is far superior compared to the "OG" Bitcoin's 64% year-to-date gains.

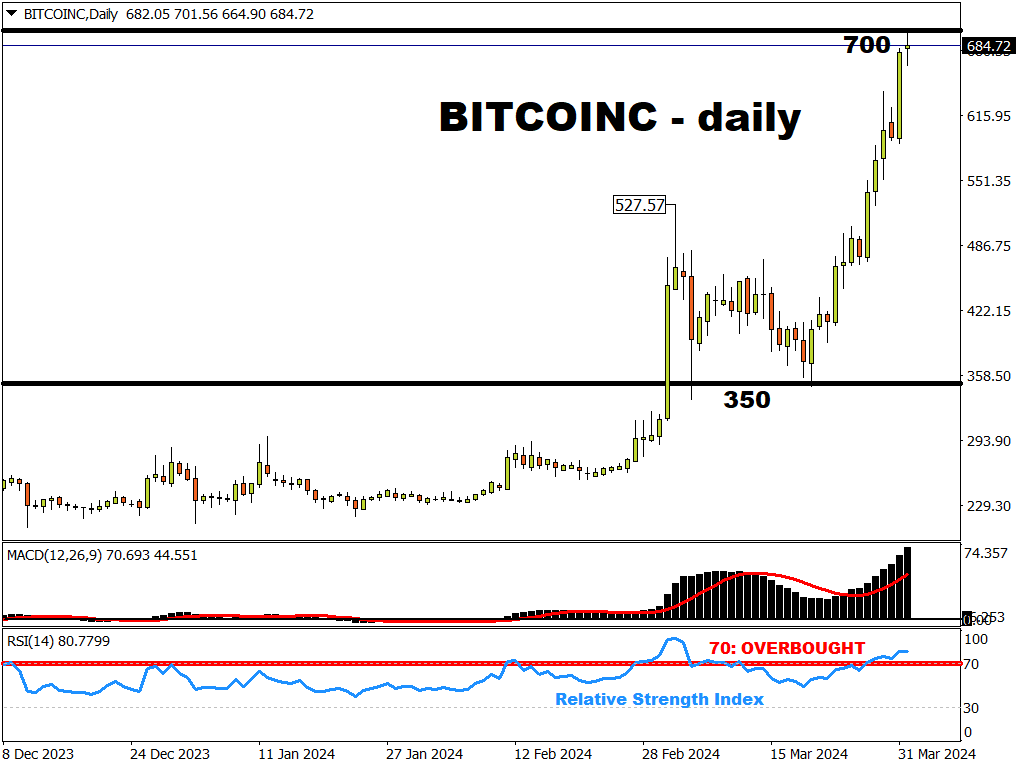

BITCOINC (Bitcoin Cash) has now touched the $700 mark for the first time since November 2021, before the crypto world fell into the infamous crypto winter of 2022.

What is Bitcoin Cash?

According to CoinGecko data, Bitcoin Cash is the world's 14th largest cryptocurrency, with a total market value (market capitalisation) of US$13.4 billion.

Created in August 2017, Bitcoin Cash is an offshoot of the original Bitcoin, with the former intended to be the faster and cheaper version of the latter.

Dogecoin is not far behind in 2nd place (for now), having soared about 140% so far in 2024.

What is Dogecoin?

Dogecoin is now the 9th largest cryptocurrency in the world, according to CoinGecko.

It now has a market cap of nearly US$30 billion.

Created in December 2013, this cryptocurrency began as a “joke” off the popular meme featuring the Shiba Inu dog.

Today, it is mainly used as a tipping system on some social media sites, positioning it as the “internet currency”.

More recently, in March 2024, Elon Musk hinted that Dogecoin could be used to buy Tesla cars “at some point”.

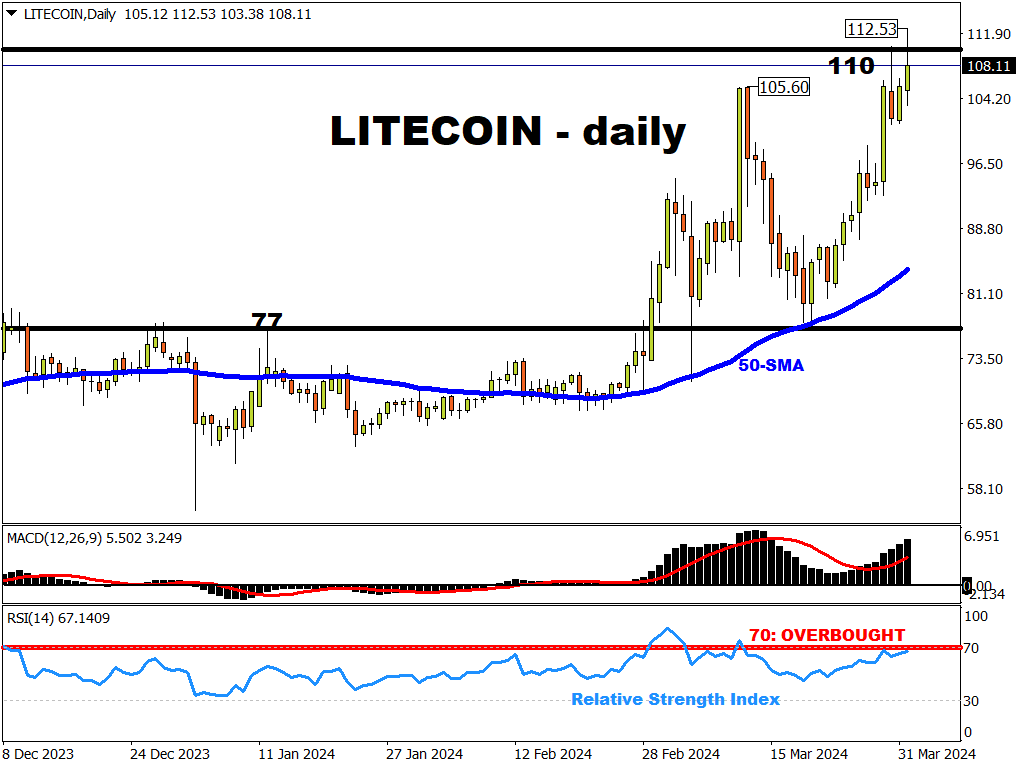

Even Litecoin has had an Easter weekend to remember.

This crypto has punched its way to a 9-month high, now trading above the psychological $110 level for the first time since July 2023!

Why are Dogecoin, Bitcoin Cash, and Litecoin soaring?

1) Futures contracts to begin trading this month

The derivatives arm of US-based crypto exchange, Coinbase, has obtained approval from the Commodity Futures Trading Commission (CFTC) to launch futures contracts for Dogecoin, Bitcoin Cash, and Litecoin.

And those futures contracts are set to begin trading this month (April 2024)!

Since last month’s announcement, note from the charts above how Dogecoin, Bitcoin Cash, and Litecoin prices have been awakened from their respective slumbers.

These cryptos may have also been jolted by the revived excitement and mania surrounding memecoins and altcoins.

How could the futures contracts impact the underlying crypto’s prices?

Having a futures contract go live could boost the underlying cryptocurrency’s prices.

Here’s how Bitcoin and Ether prices fared when their respective futures contracts went live:

-

Bitcoin prices rose 45.5% in December 2017, the month when Bitcoin futures first started trading.

That added to the gains already garnered in the prior months (51.4% in November 2017, and 52.9% in October 2017).

- Ether prices rose over 9% in February 2021, the month when Ether futures first started trading.

Ether then went on to climb even higher in the ensuing months: up 37% in March 2021 and up another 42.5% in April 2021.

In short, the rollout of futures contracts has historically proven to be a price booster for the underlying crypto.

And this could be due to a varierty of reasons, such as:

-

increased demand for the underlying cryptocurrency for arbitrage/hedging purposes by institutional investors

- increased liquidity, legitimacy, and transparency stemming from CFTC’s approval, ultimately boosting the appeal for these cryptocurrencies

But wait, there’s more …

Bitcoin “halving” could push wider crypto prices even higher!

Of course, the much-anticipated Bitcoin “halving” is due later in April 2024.

Bitcoin’s “halving” occurs once every 4 years, and tends to push Bitcoin prices higher.

A “halving” is when the rewards for mining new Bitcoins are halved, which in turn reduces incoming new supply.

And if demand for Bitcoin holds up post-halving, coupled with lessened supply, such dynamics tends to push prices higher.

Note also the positive correlation between Bitcoin and Dogecoin, Bitcoin Cash, and Litecoin.

This means that, where Bitcoin prices go, these 3 cryptos tend to follow.

Over any 5-day rolling period over the past 5 years, these cryptos have moved in the same direction as Bitcoin:

-

Dogecoin: 90% of the time

-

Bitcoin Cash: 54% of the time

- Litecoin: 48% of the time

Overall, if these futures contracts, as well as the Bitcoin halving", have the expected impact on crypto prices ...

this should lead to further gains for Dogecoin, Bitcoin Cash, and Litecoin!

Of course, if the ongoing meme-mania persists, buffered by risk-on sentiment, that should lend a helping hand for these crypto bulls.