- NAS100 bulls pocket 4000 points!

- FXTM's Robusta Coffee hits record high

- USDCHF secures all bearish targets

It has been an eventful week thanks to corporate earnings from the largest companies in the world.

And things could liven up further due to more earnings releases and high impact economic reports.

Here are how these discussed instruments performed this week:

1) NAS100 bounces from 17,000 level

- Where and when was Target Price (TP) published?

In our week ahead article published on Friday, 19th April:

We cautioned that more volatility could be on the horizon and highlighted that “should 17,000 prove to be reliable support, this may open a path back towards the 100-day SMA at 17,400….”

- What happened since TP was published?

After testing the 17,000 level last Friday, the NAS100 rebounded earlier this week due to soft US data and optimism around tech earnings.

The Index rallied on Tuesday evening as Tesla stocks surged in pre-market after publishing its earnings. However, bears were back in action on Wednesday evening after Meta shares tumbled in after-hours trading.

Note: NAS100 could see more volatility due to earnings from Microsoft & Alphabet after US markets close on Thursday.

- How much in potential profits?

A handsome 4000 points for traders who entered NAS100 from the 17,000 level.

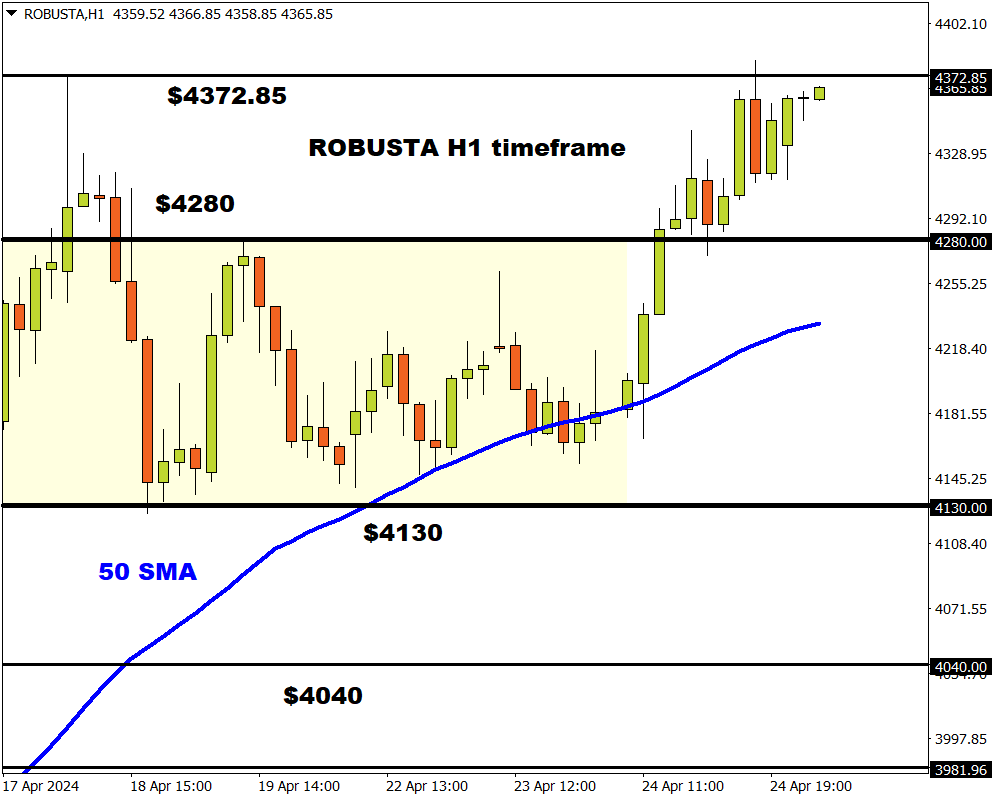

2) Robusta Coffee hits fresh all-time high

- Where and when was Target Price (TP) published?

Earlier in the week, we discussed how fundamental forces were powering Robusta Coffee higher.

We identified how “prices seem to be in a range on the H1 charts with support around $4130 and resistance at $4280.”

- What happened since TP was published?

Robusta Coffee soared to a new record high on Wednesday as crop concerns in Vietnam and Brazil fuelled concerns over tight global supplies.

Prices charged past the $4280 resistance level, punching above $4372.85 to create a fresh all-time high.

- How much in potential profits?

Traders who took advantage of the breakout and exited at $4372.85 would have caught a 2% move to the upside.

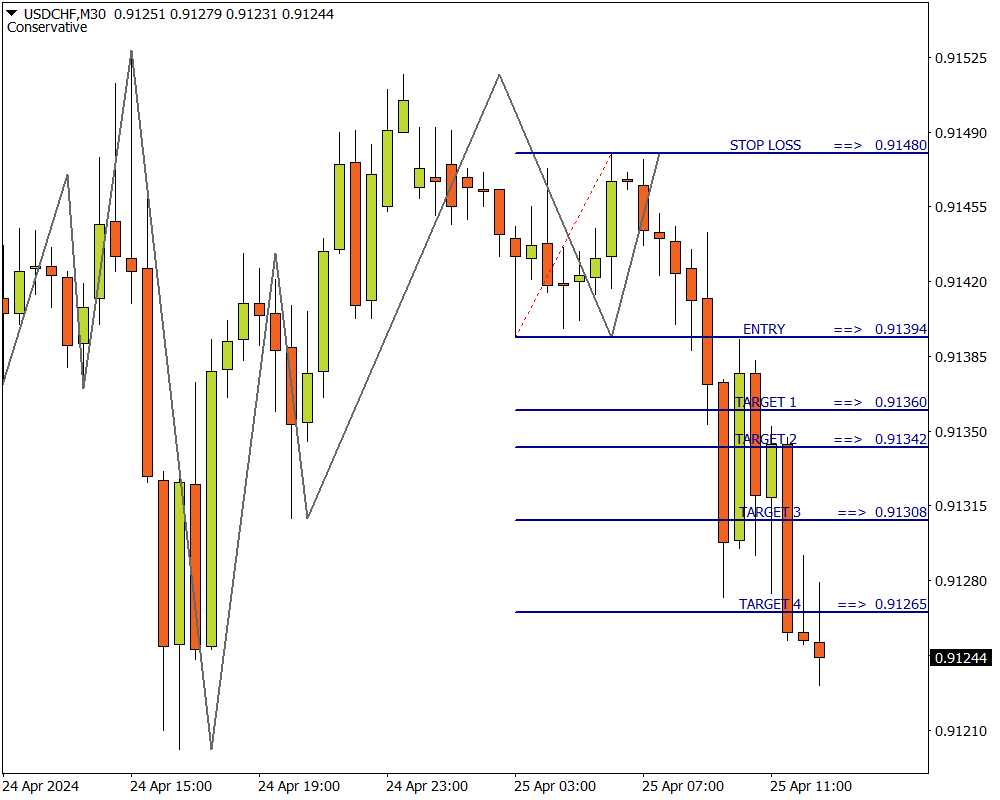

3) USDCHF secures all bearish targets

- Where and when was Target Price (TP) published?

This technical scenario (USDCHF) is based on the FXTM Signals that are posted twice a day (before the London and New York sessions) for all FXTM clients to follow.

It can be found in the MyFXTM profile under Trading Services... FXTM Trading Signals.

- What happened since TP was published?

The USDCHF slipped this morning as the Dollar weakened against most G10 currencies.

- How much in potential profits?

USDCHF has hit all bearish targets.

Traders who entered at 0.91394 and exited at the final target level of 0.91265 would have gained 13 pips.

Feel like you missed out on these profits?

You can keep following our "Daily Market Analysis" for fresh trading ideas and opportunities across global financial markets.