-

CHINAH overtakes JP225 in year-to-date gains

-

Earnings from Tencent, Meituan, Alibaba etc. may cause CHINAH to climb/fall

-

Traders also watching China rate decision and US CPI

-

CHINAH at risk of technical pullback, despite bullish “golden cross”

- CHINAH forecasted to climb another 15.3% over next 12 months

There’s a new winner among FXTM’s Asian stock indices!

The CHINAH stock index has now overtaken the JP225 index, with the latter previously holding the most year-to-date gains among major stock indices worldwide throughout Q1 (January-March) 2024.

However, CHINAH has been on a tear, climbing as much as 19.75% since that mid-April trough.

NOTE: FXTM’s CHINAH stock index mirrors the performance of the underlying Hang Seng China Enterprises index.

It tracks 50 of the largest and most liquid stocks from Mainland China that are listed in Hong Kong.

Following the surge in recent weeks, CHINAH is now trading at its highest levels since August 2023.

For reference, here’s the current year-to-date standings among FXTM’s Asian stock indices:

-

CHINAH: +17.2%

-

JP225: +14.1%

-

TWN: +13.1%

-

HK50: +12.1%

-

CN50: +9.9%

- SG20: +6.7%

Why are China’s stock markets climbing?

Chinese stocks have been boosted by hopes that the government is stepping in to support the economy.

Much has already been made about how China, the world’s second-largest economy, have faltered in its post-pandemic recovery, lagging behind other major economies.

China’s sluggish economic performance in turn weighed down its stock markets, with the Hang Seng China Enterprises index posting 4 consecutive years of declines!

But now, with Beijing’s boosters on the way, such optimism is in turn fuelling a recovery in Chinese stock indices.

Just today (Monday, May 13th), China’s Ministry of Finance announced the sale of about 1 trillion yuan (about US$138 billion) in government bonds, beginning this Friday (May 17th) through November.

The 1 trillion yuan raised from this bond sales – only the 4th of its kind in 26 years – will be used to support China’s economic growth.

The news is sending CHINAH 0.6% higher today!

What could move CHINAH higher/lower this week?

1) Chinese stocks’ earnings: May 14th – 16th

8 of the CHINAH stock index’s 50 members are due to report their respective quarterly earnings this week.

This lineup includes 3 of the 4 biggest members of the Hang Seng China Enterprises index, namely Tencent, Meituan, and Alibaba.

These 8 reporting companies combined account for 30% of the entire CHINAH stock index!

Hence, the market’s overall reaction to these upcoming earnings announcements, either positive or negative, could move the broader stock index up/down as well.

2) China policy rate: Wednesday, May 15th

The People’s Bank of China (PBoC) is expected to maintain its one-year medium-term lending facility (MLF) rate unchanged at 2.5%.

Although the Chinese economy could do with even more support, from both the government (fiscal policy) as well as the central bank (monetary policy), the PBoC may want to hold off on lowering this rate so as not to further weaken the Chinese Yuan currency.

In the unlikely event of a surprise rate cut by the PBoC this week, that’s likely to jolt the CHINAH stock index even higher!

3) US April consumer price index (CPI): Wednesday, May 15th

The consumer price index (CPI) is a widely used gauge to measure a country’s inflation rate.

The US CPI is one of the most closely-watched economic data that could rock financial assets around the world, including FX markets, gold, and stock indexes!

After all, the world’s most-important central bank, the US Federal Reserve, currently finds itself in an ongoing battle in slowing down still-stubborn inflation in the world’s largest economy.

Here are the forecasts from economists for this week’s US CPI prints

-

CPI month-on-month (April 2024 vs. March 2024): 0.4%

If so, that would match March’s 0.4% month-on-month figure

-

CPI year-on-year (April 2024 vs. April 2023): 3.4%

If so, that would be slightly lower than March’s 3.5% year-on-year figure

-

Core CPI (excluding food and energy prices) month-on-month: 0.3%

If so, that would be slightly lower than March’s 0.4% month-on-month figure

- Core CPI year-on-year: 3.6%

If so, that would be lower than March’s 3.8% year-on-year figure

Higher-than-expected CPI figures may drag down stock indexes around the world, including the CHINAH (and vice versa).

Key levels this week

POTENTIAL RESISTANCE:

-

6877: cycle high from mid-June 2023

- 7000: psychologically-important level

POTENTIAL SUPPORT:

-

6417.9: May 8th intraday low (recent technical pullback)

- 6200: psychological round number; April 30th closing price; 21-day simple moving average

Beware of potential technical pullback

Note that the 14-day relative strength index (RSI) is already above the 70 level which marks “overbought” territory.

Hence, from a technical perspective, a slight pullback may be in order.

However, once CHINAH can clear some of the froth from its recent ascent, this stock index may well resume its uptrend, provided that this week’s fundamental events do support the upside scenario.

“Golden cross” offers technical bullish signal?

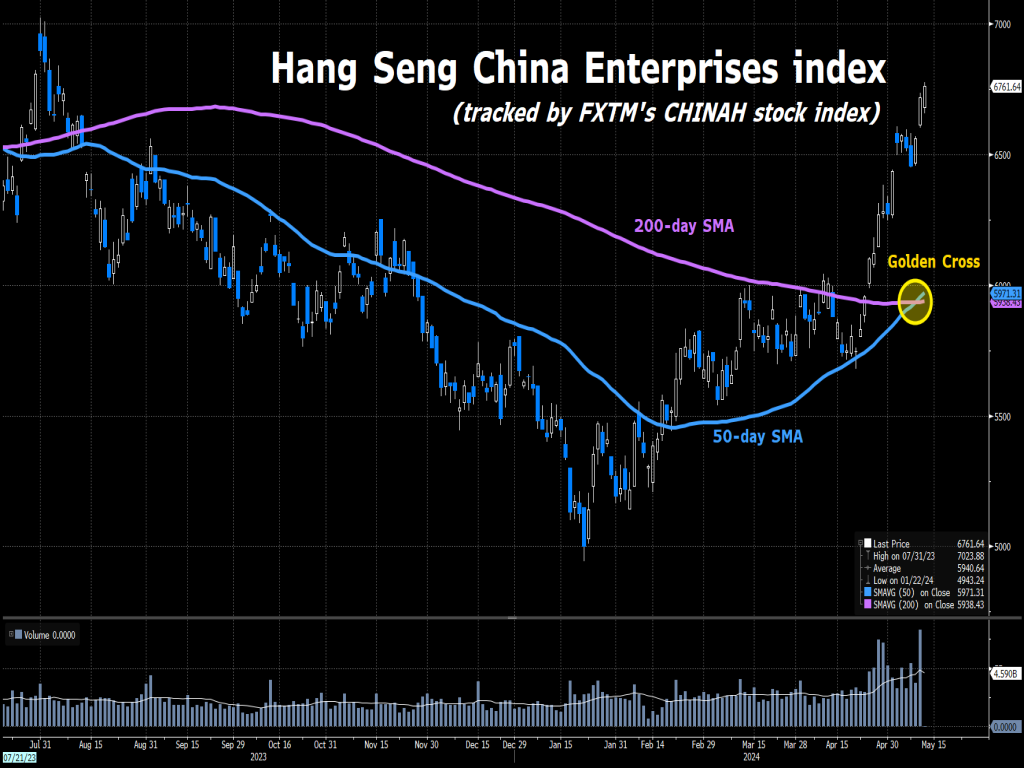

Looking at first chart above, the CHINAH recently formed a “golden cross”.

A “golden cross” is a technical pattern when an asset’s 50-day simple moving average (SMA) crosses above its 200-day counterpart.

A “golden cross” is often used as a technical sign that the asset’s prices can climb further: a “bullish” signal.

However, recent “golden crosses” had produced mixed results:

- Late January 2023

The last time that the Hang Seng China Enterprises index formed a “golden cross”, it didn’t go as planned.

This stock index fell by 36.4% in the 12 months (January 2023 until January 2024) after the last “golden cross” was formed.

- Late-November 2020

Still, the “golden cross” prior did adhere to the textbook scenario.

The Hang Seng China Enterprises index soared by 16.2% between November 2020 through February 2021.

How much higher can CHINAH go?

Analysts forecast that the Hang Seng China Enterprises index can climb by a further 15.3% and flirt with the 7800 level in 12 months from now (by May 2025).

If so, that would restore the CHINAH stock index back to its end-June 2022 peak!

However, the road back to such heights will be measured one step at a time.

This week’s events may well determine whether CHINA is firmly on the path upwards.