- UK election 24 hours away

- Opinion polls show Labour win

- Watch out for potential surprises

- Pound & UK100 could see volatility

- Bloomberg FX model: 77% GBPUSD – (1.2569 – 1.2800)

Millions of voters in Britain will be heading to the polls tomorrow!

And the outcome may shape the UK’s outlook over the next few years.

Here, we’ll break down what exactly is going on and how it could impact your trading.

What is happening?

On Thursday 4th July, Britons will elect the 650 MPs who sit in the House of Parliament.

The political party that wins at least 50% of seats will form the new government, and its leader the Prime Minister.

Polling stations open at 7am until 10pm UK time.

The lowdown…

On May 22, 2024, UK Prime Minister surprised the public by announcing elections will be held on July 4th despite having until January 2025.

Who are the major players?

- Rishi Sunak: Conservative leader

- Keir Starmer: Labour leader

- Ed Davey: Liberal Democrats

- Nigel Farage: Reform UK

- John Swinney: SNP party

- Carla Denyer: Green party

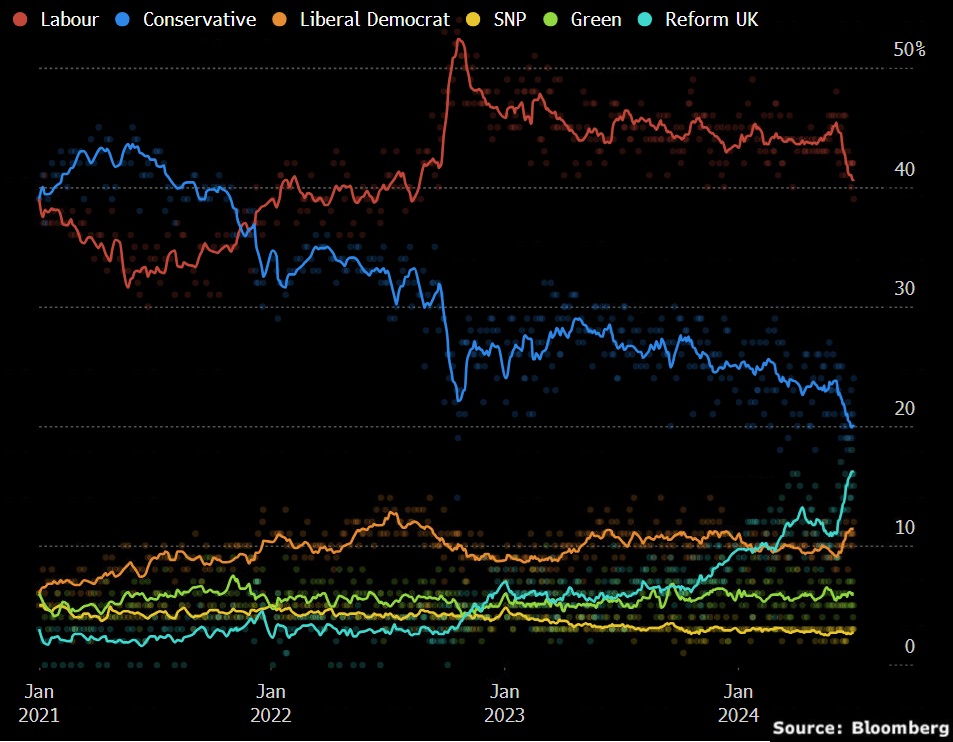

According to opinion polls, the opposition Labour Party leads the Conservatives by around 20 points and is on course for a historic landslide victory.

What does this mean?

It could mean Labour returns in power for the first time since 2010 when led by Gordon Brown.

How might this impact the UK?

Labour has pledged to deliver economic stability with tough spending rules, boost growth, build more homes and create jobs.

If the party can fulfill these promises, confidence in the UK’s economic outlook may brighten.

What could go wrong?

Polls have been wrong before with elections full of surprises.

- Despite what the polls are showing, the current government (Conservatives) stays in power.

- Or a hung parliament situation where no party has a majority of seats – leading to coaling governments after the election. The last time this happened was in 2017.

How will this impact UK markets

Broadly speaking, the market-friendly outcome appears to be a Labour victory.

This is the expected result with Labour’s pledge of fiscal discipline seen boosting investor sentiment in the longer term.

How about the Pound & FXTM’s UK100?

- In the short term, a Labour win could boost the British Pound but hit the UK100.

- A shock result that sees the current government stay in power may weaken the Pound, supporting the UK100 as a result.

Note: Over 80% of the revenues from FTSE100 companies come from outside of the UK.

So essentially, when the pound appreciates, it results in lower revenues for those companies that acquire sales from overseas – dragging the UK100 lower as a result. The same is true vice versa

Technical outlook

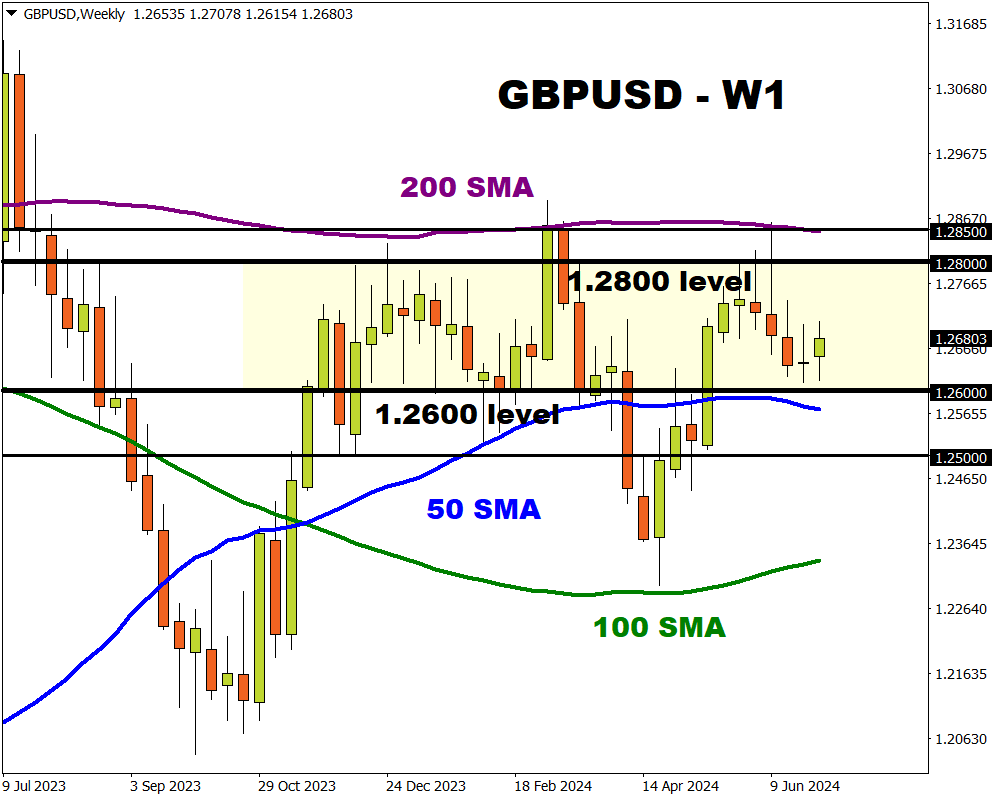

GBPUSD

Prices remain in a wide range on the weekly charts with support at 1.2600 and resistance at 1.2800.

- A breakdown below 1.2600 could see a decline towards 1.2500

- Should 1.2600 prove to be reliable support, prices may retest 1.2800

According to Bloomberg’s FX forecast model, there’s a 77%% chance that GBPUSD trades within the 1.256- 1.2800 range over the next one-week period.

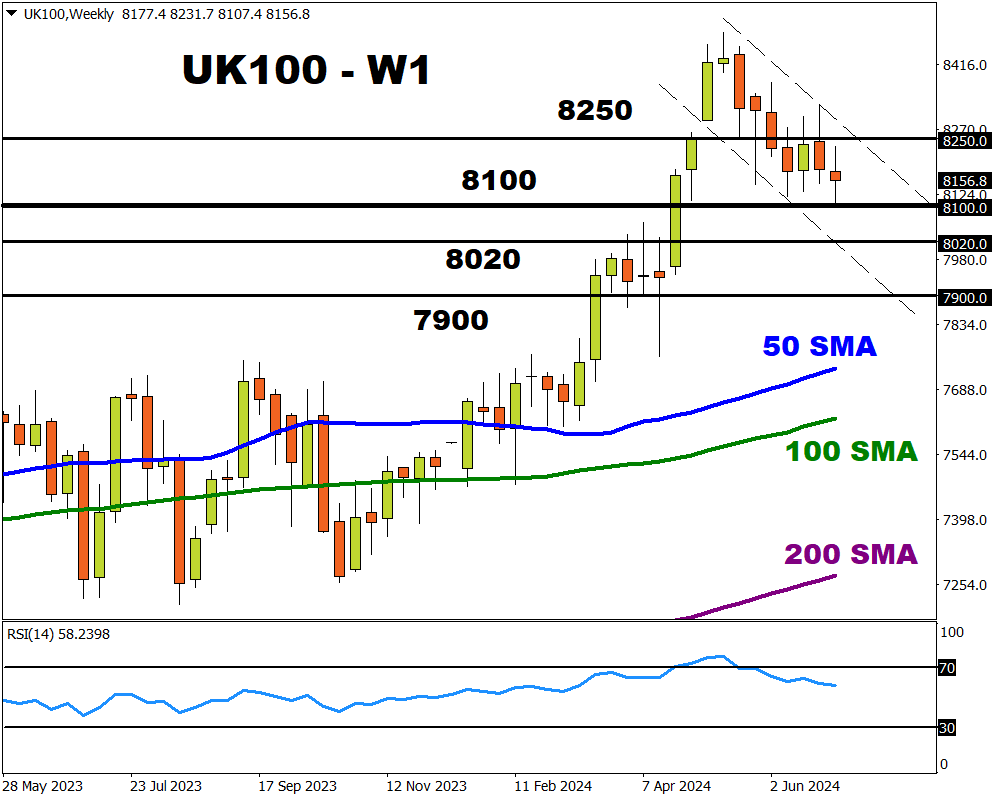

UK100

FXTM’s UK100 is under pressure on the weekly charts with bears eyeing the 8100 level.

- A solid break below 8100 could signal a decline toward 8020 and 7900.

- Should 8100 prove to be reliable support, prices may rebound toward 8250.