- Gold ↑ 21% year-to-date

- FOMC minutes & Jackson Hole in focus

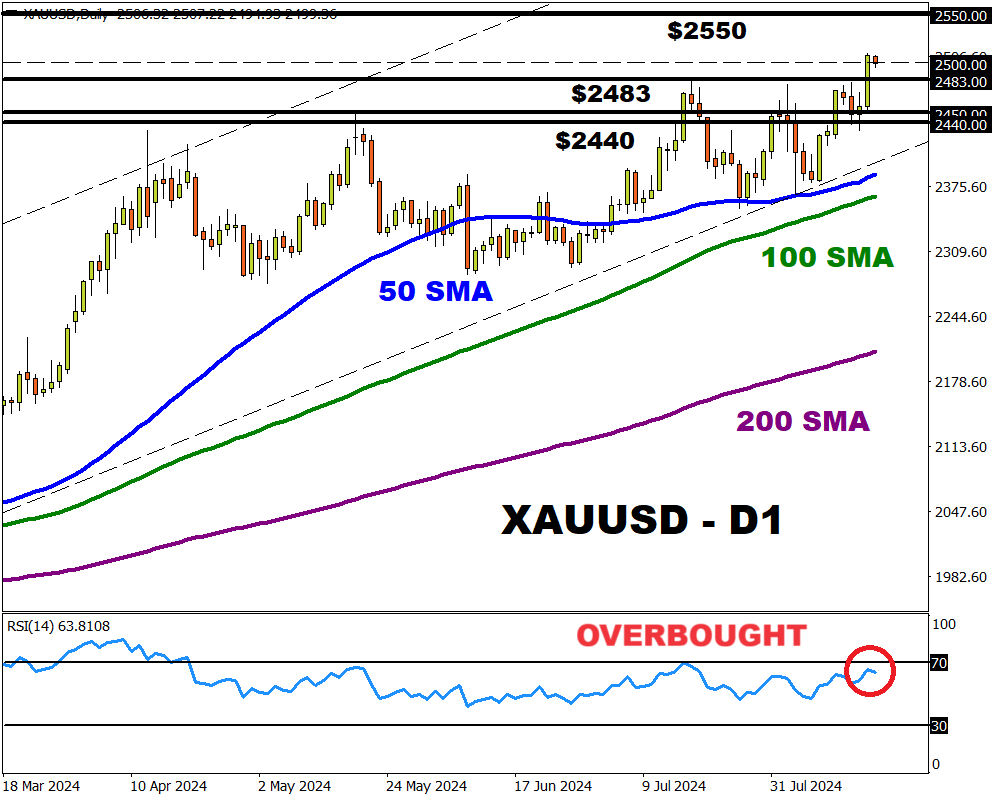

- Bullish but RSI overbought on multiple timeframes

- Bloomberg FX model: 73% XAUUSD – (2440.49 – 2567.13)

- Key technical level - $2500

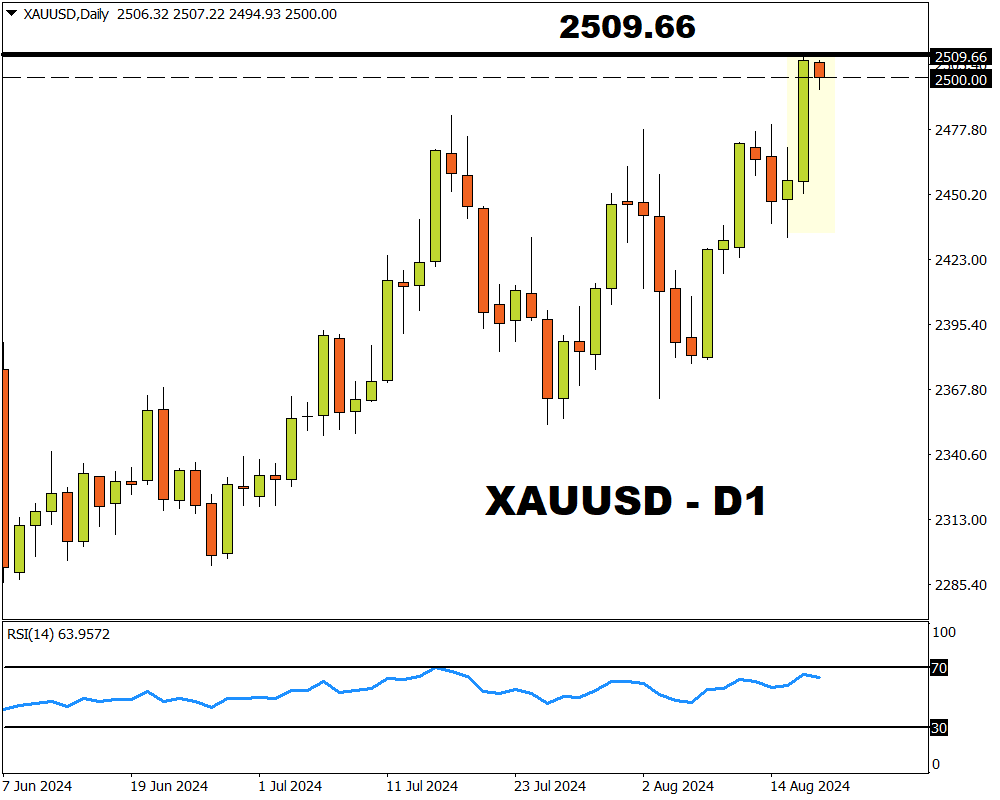

In case you missed it, gold surged over 2% last Friday to create a fresh all-time high above $2509!

Prices sprinted past the psychological $2500 level after disappointing US economic data boosted bets around faster and deeper cuts by the Fed. With the US dollar and Treasury yields on the back foot, it felt like everyone wanted a shiny piece of the zero-yielding metal.

Despite the shaky start to the new week, gold bulls remain in a position of power.

However, the Relative Strength Index on the daily, weekly and monthly are signalling that prices are heavily overbought. If the upside momentum loses steam, this could lead to a technical pullback.

Note: A technical pullback is a temporary pause or decline in an asset’s overall bullish trend.

In our mid-year review, we highlighted how gold’s outlook will be influenced by what actions the Fed takes in the second half of 2024. Much has changed since then with traders currently expecting one 25 bp rate cut by September, another 25 bp cut by November and a potential 50bp cut by December.

With all the above said, this promises to be another eventful week for gold.

Here are 3 factors that could spark volatility:

1) FOMC minutes + US Jobless claims

The aggressive price action witnessed last Friday shows how gold remains highly sensitive US interest rate expectations.

This could mean more volatility on the horizon, especially with the incoming FOMC minutes and US jobless claims. Last month, Fed Chair Jerome Powell struck a dovish tone and signalled that rate cuts were on the horizon during his press conference. Should the minutes mirror the same message, this could further support rate cut bets.

Regarding the US initial jobless claims report on Thursday, any weakness in the labour forces could reinforce expectations around faster and deeper cuts.

- Gold prices are likely to push higher if soft US data supports the case for lower rates.

- Should economic data print higher than expected, this may drag the precious metal lower.

2) Jackson Hole Symposium

As covered in our week ahead report, Jackson Hole is an annual event packed with central bankers, finance ministers and economists discussing pressing global economic issues. This year it will be held from August 22nd – August 24th.

On Friday 23rd August, Fed Chair Jerome Powell is expected to signal that a September rate cut is on the cards. This could mean fresh volatility for gold due to its sensitivity to US interest rates. Ultimately, the precious metal’s outlook could be influenced by what’s said or not during Powell’s big speech.

3) Technical forces

Prices are firmly bullish on the daily charts as there have been consistently higher highs and higher lows. The candlesticks are trading above the 50, 100 and 200-day SMA but the RSI is trading near overbought territory.

- Should $2500 prove to be reliable support, this may encourage a move towards the next psychological point at $2550.

- Sustained weakness below $2500, could open a path toward $2483, $2450 and $2440.