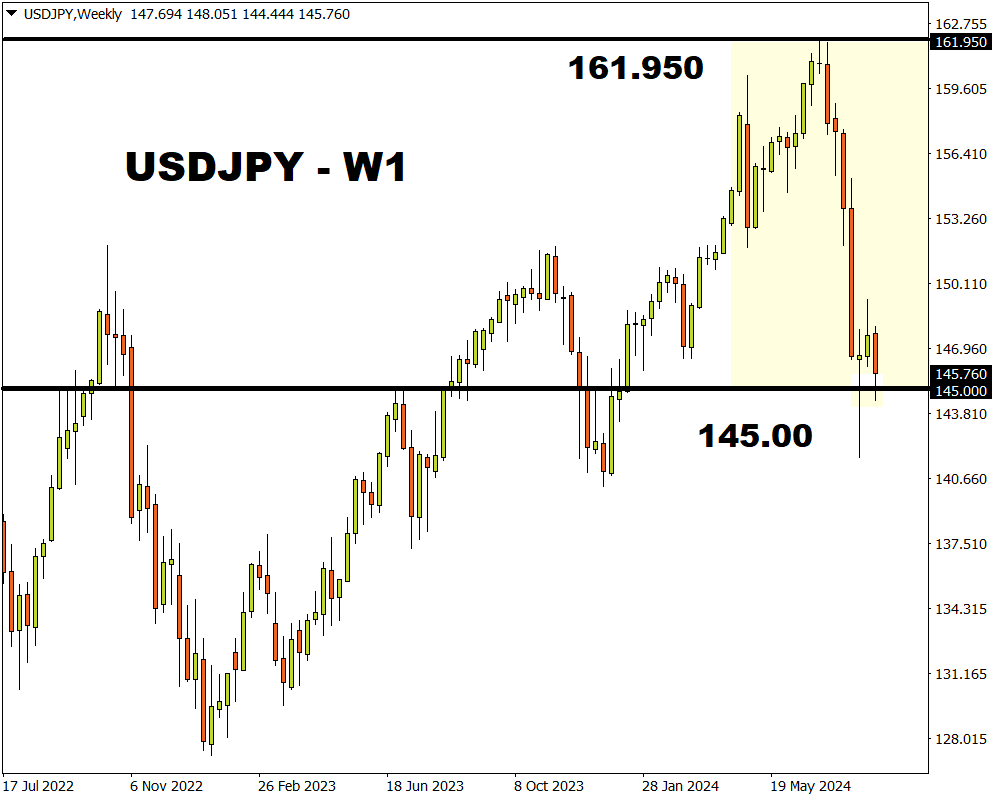

- USDJPY ↓ 3% month-to-date

- Ueda testimony + Powell speech in focus

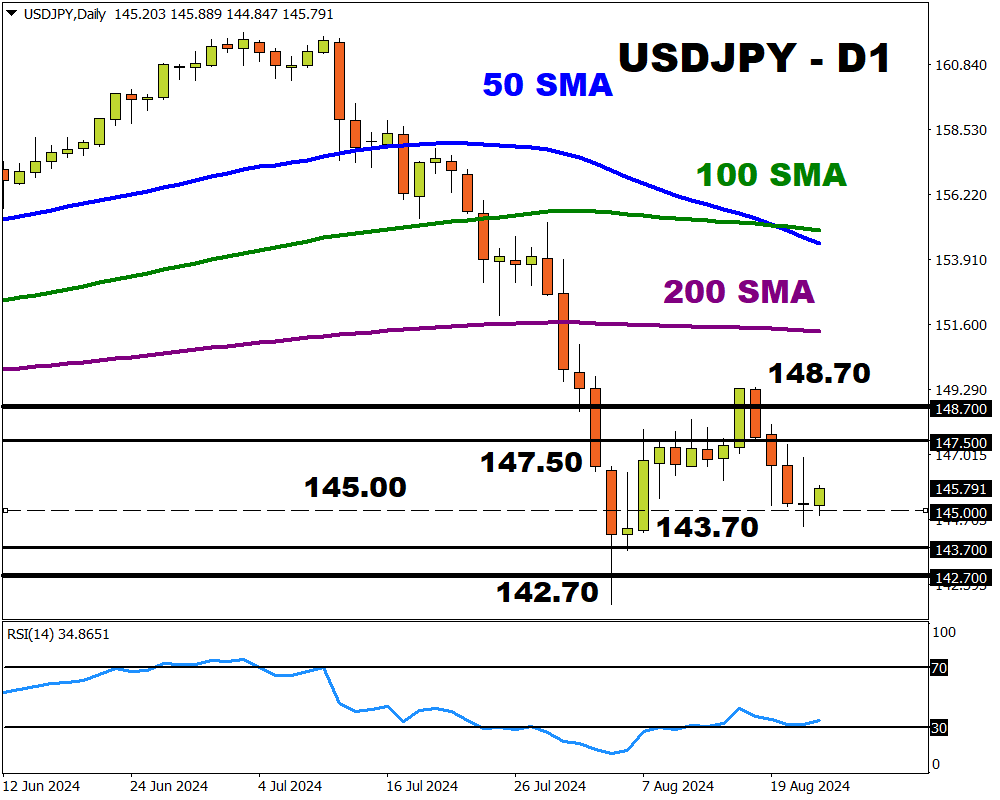

- Prices heavily bearish but RSI near oversold

- Bloomberg FX model: 73% - (142.70 – 148.67)

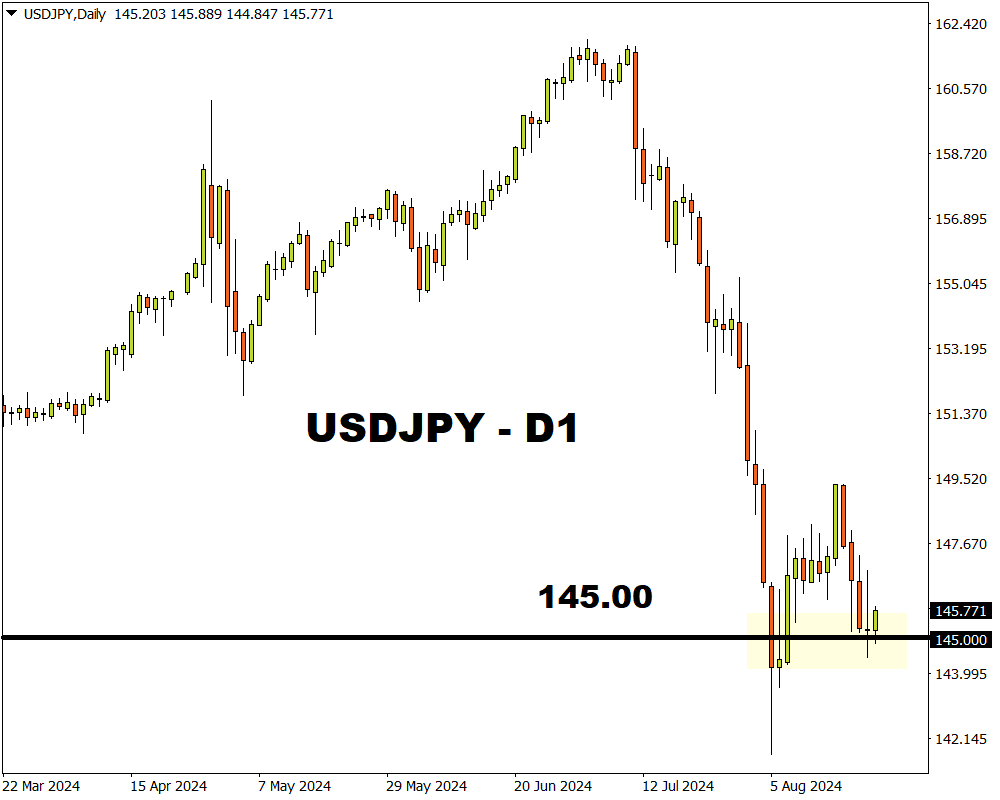

- Key technical level: 145.00

Check this out. The USDJPY could see big price swings on Friday!

That’s right, remarks by Bank of Japan (BoJ) Governor Kazuo Ueda and Fed Chair Jerome Powell are likely to inject the currency pair for fresh volatility.

With prices already hovering around a daily support level, the incoming risk events may trigger a possible breakout or technical bounce.

The lowdown…

The USDJPY has witnessed heavy selloffs over the past few weeks thanks to a hawkish BoJ and dovish Federal Reserve. Bears are certainly in power due to the divergence in the policy outlook between both central banks.

Since hitting a multi-decade top at 161.950, the currency pair has tumbled roughly 10%.

With all the above said, here are 3 things you need to keep an eye on:

1) BoJ Governor Ueda testimony

Governor Kazuo Ueda is expected to be grilled by lawmakers on Friday after the BoJ’s hawkish signals contributed to the global market selloff earlier this month.

Note: The BoJ raised interest rates at its July 2024 meeting to 0.25%.

This triggered the unwinding of the “carry trade” which allows investors to borrow the Yen cheaply and use that money to buy higher-yield assets – for example US shares.

Rising rates in Japan increased borrowing costs, ultimately triggering a selloff across global markets as investors dumped shares to raise cash to service interest rate repayments.

Given the market sensitivity to interest rate expectations, Ueda must strike a neutral tone to prevent any shocks.

- If he sounds too hawkish, this may strengthen the Yen and boost bets around the BoJ hiking rates. Should this result in the further unwinding of the carry trade, global markets could take a hit.

- However, if he comes across as too dovish – the yen may weaken – pushing the USDJPY higher.

Note: It will be wise to keep an eye on the incoming Japan CPI figures also published on Friday, something that may impact bets around what actions the BoJ take over the next few months.

2) Jackson Hole: Powell speech

As covered in our week ahead report, Powell’s big speech on Friday could rock global markets. He is expected to signal that a September cut is on the table with traders already pricing in a 25-basis point reduction next month.

Any fresh clues around what the Fed plans to do for the rest of 2024 may impact Fed cut expectations. Ultimately, the USDJPY’s outlook may be influenced by what’s said or not during Powell’s highly anticipated speech on Friday.

- Should Powell strike a firmly dovish note, this may send the USDJPY lower.

- If the central bank head is not as dovish as markets expect, the USDJPY may rebound.

3) Technical forces

Prices remain under pressure on the daily charts as there have been consistently lower lows and lower highs. Although the candlesticks are trading below the 50, 100 and 200-day SMA, the Relative Strength Index is flirting near oversold territory.

- A solid breakdown and daily close below 145.00 may encourage a decline toward 143.70 and 141.50.

- Should 145.00 prove to be reliable support, this could trigger a rebound toward 147.70 and 149.30.