-

Brent, crude up over 3% respectively

-

Libya's rival government announces halt to its oil output and exports

-

Libya produces about 1.15 million bpd, 2-3% of OPEC+ output

-

Oil prices could climb to 50-day SMA on Libyan supply halt, weaker US dollar

-

Unwinding of this knee-jerk spike could see support around 21-day SMA

Brent and US Crude are soaring by about 3% each!

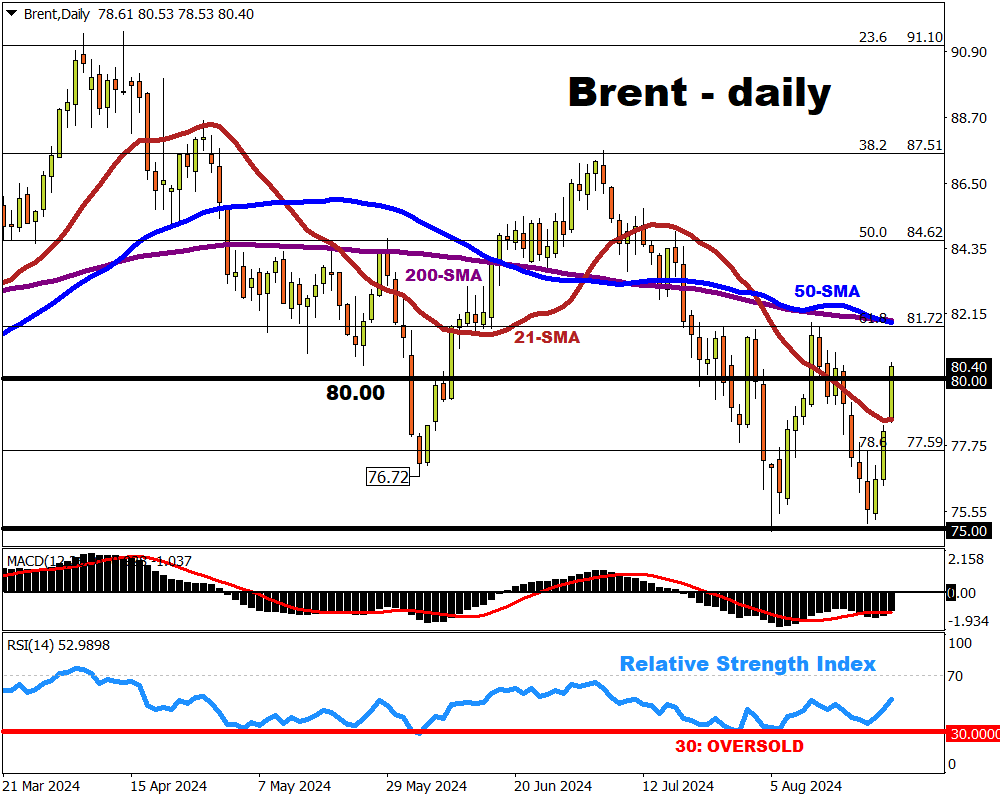

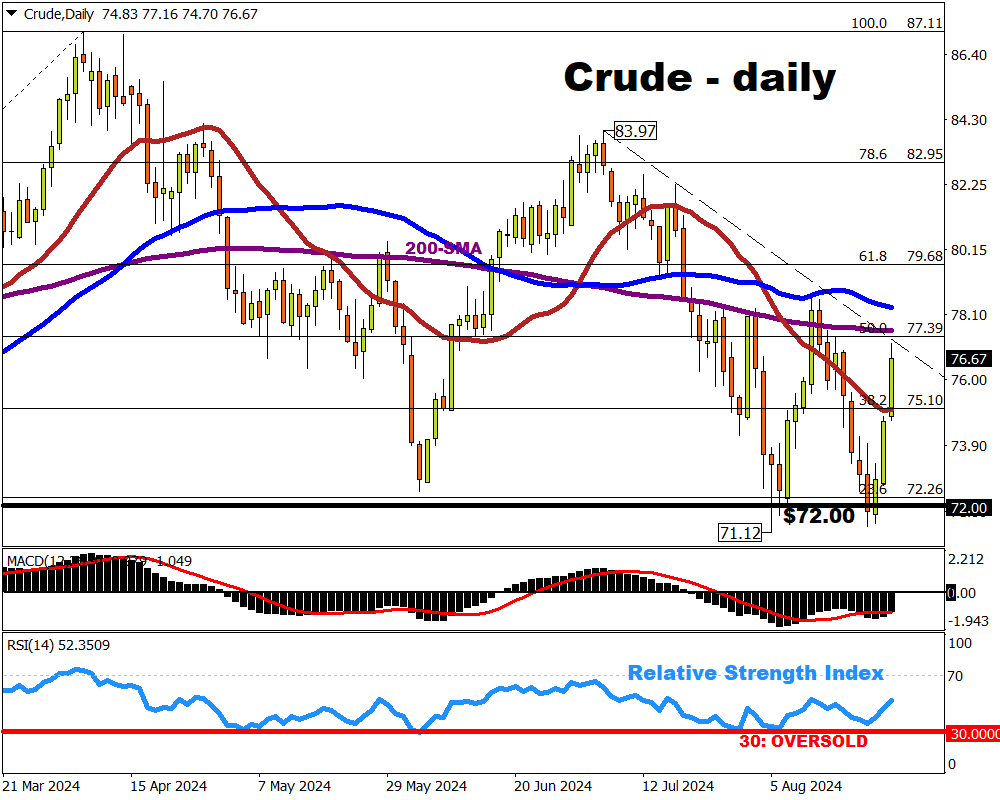

Looking at the charts, both of these oil benchmarks have now broken above their respective 21-day simple moving averages (SMAs).

Brent has now crossed above the psychologically important $80/bbl line ...

... while US Crude (WTI futures) is striving towards its 200-day SMA.

This price surge comes as Libya's rival (eastern) government ordered a stop to all oil production and exports.

What's the fuss about Libya's oil output?

Libya produces about 1.15 million barrels per day (bpd), which roughly accounts for 2-3% of total OPEC+ output.

Oil bulls are finding relief at the thought of lowered oil supplies into a global economy that's set for a slowdown, especially in China.

After all, oil prices have been weighed down since July by such persistent demand-side fears.

Furthermore, OPEC+ has plans to restore output starting in October, and more incoming supplies may yet tip global oil markets into a surplus (more oil supplied than demanded).

This situation that could be exacerbated if a return of Trump 2.0 to the White House then loosens the taps on US oil production.

To be clear, oil prices remain a far cry from their early-July peaks.

Despite the ongoing surge, Brent and Crude are still over 11% below their respective year-to-date highs.

Can oil keep soaring higher?

Potentially, but perhaps only for a short while.

Even prior to this reported halt on Libyan oil supplies, oil bulls were already rejoicing since this past Friday (August 23rd), after Fed Chair Powell all but confirmed that the US central bank will lower its benchmark rates starting mid-September. These rate cuts should support the US economy, and demand for oil.

However, oil's current surge may not last.

Note that the total OPEC+ output currently withheld from global markets stands around 2 million bpd. And OPEC+ has plans to restore this output by half a million (540,000) bpd starting in October.

If that 500k figure is ramped up, that could easily fill the gap left by Libya's halted production.

POTENTIAL SCENARIOS

-

BULLISH: If oil bulls can keep Brent above $80 / Crude above $77, that could see these oil benchmarks reaching for their respective 50-day SMAs.

- BEARISH: If Brent fails to stay above $80 / Crude above $77, that could see a swift pullback back to the 21-day SMAs for support.