- Bitcoin ↓ 4% in September

- Pressured by US recession fears & ETF outflows

- Over past 12 months NFP triggered moves of ↑ 2.6% & ↓ 1.8%

- Cryptocurrency space may see heightened volatility on Friday

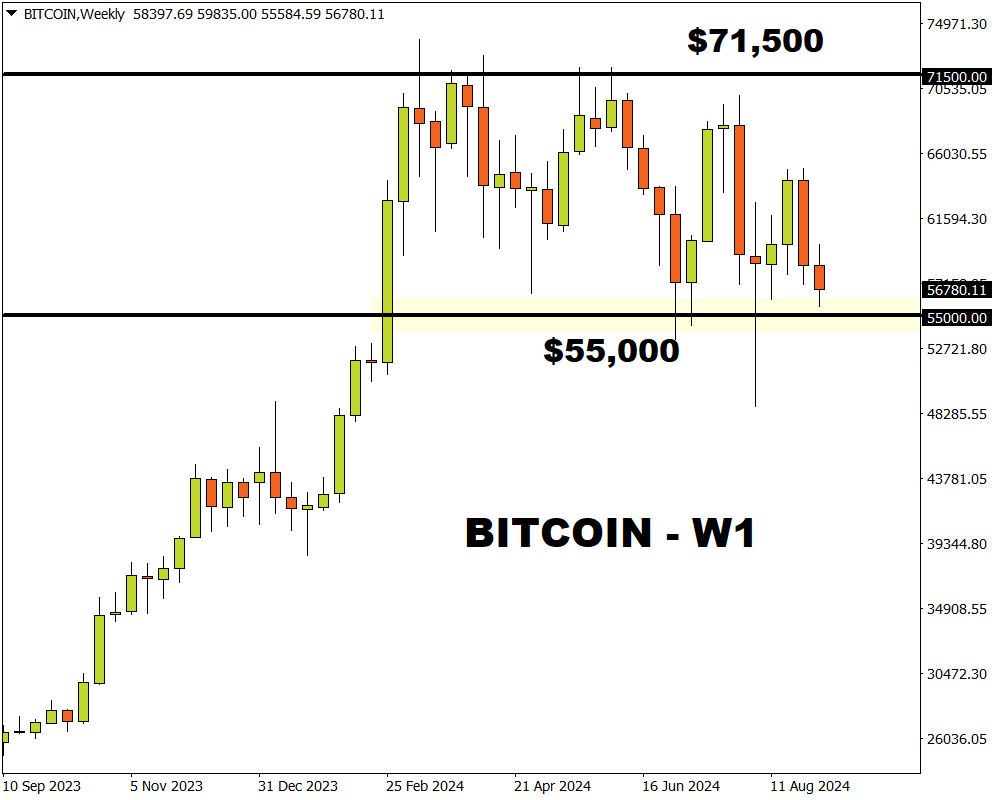

- Key technical level - $55,000

Could Bitcoin be preparing for a significant price move on Friday?

The World’s largest cryptocurrency has kicked off September on a shaky note with prices wobbling above the $55,000 support level as of writing.

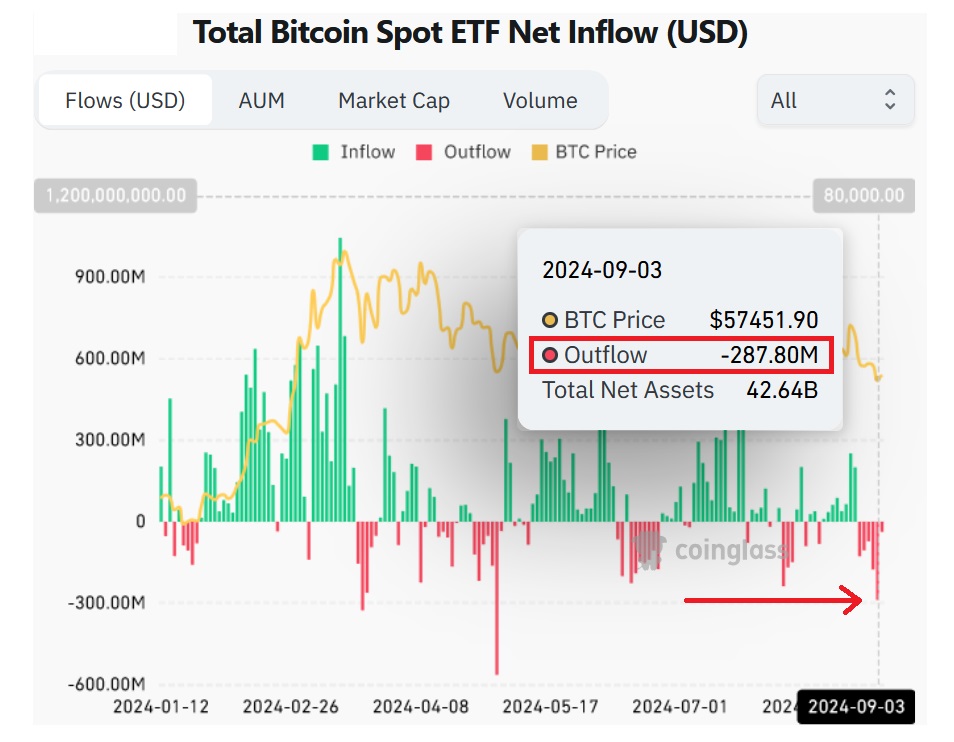

Looking at the charts, Bitcoin struggles to nurse deep wounds from last week’s selloff thanks to fears of a US recession. Significant outflows from exchange traded funds have rubbed salt into the wound, with bears in a position of power ahead of the US jobs report tomorrow.

According to data from Coinglass among other sources, Bitcoin ETFs saw more than $287 million outflows on Tuesday – its biggest day in four months!

Source: Coinglass

With all these bearish forces stacked against Bitcoin, a solid break below $55,000 could open the doors to further downside.

However, as covered in our week ahead report – the incoming NFP data has the potential to spark a market frenzy.

So be prepared for potential volatility across various asset classes, including cryptocurrencies.

Traders have fully priced in a 25-basis point Fed cut by September with the probability of a 50 basis point cut at 40%.

Any changes to these bets could impact cryptocurrencies which have displayed sensitivity to US rates.

Golden nugget: Over the past year, the US jobs report has triggered upside moves of as much as 2.6% or declines of 1.8% in a 6-hour window post-release.

What does this mean for Bitcoin?

- A jobs report that cools US recession fears and allows the Fed to move ahead with a 25bp cut in September could support Bitcoin prices.

- Should the US jobs data fan fears around a US recession, the risk-off sentiment may drag Bitcoin lower despite rising bets around a 50-basis point cut.

Friday is not only a big day for Bitcoin…

Ethereum which is the second largest cryptocurrency by market cap could see upside moves as much as 2.1% or decline of 2.4%.

Here is a list of how other cryptocurrencies may react to the US jobs report:

- AVALANCH: ↑ 4.2 % or ↓ 4.5%

- CARDANO: ↑ 3.3% or ↓ 4.1%

- SOLANA: ↑ 2.8 % or ↓ 4.5%

- CHAINLINK: ↑ 3.2 % or ↓ 4.0%

- DOGECOIN: ↑ 3.9 % or ↓ 3.5%

- LITECOIN: ↑ 3.0 % or ↓ 3.4%

- BITCOINC: ↑ 2.6 % or ↓ 3.1%

- POLYGON: ↑ 2.5% or ↓ 3.7%

- RIPPLE: ↑ 2.9% or ↓ 3.1%

- AXS: ↑ 4.0% or ↓ 3.5%

- BNB: ↑ 2.3% or ↓ 5.0%

- COSMOS: ↑ 2.6% or ↓ 4.0%

- POLKADOT: ↑ 3.5% or ↓ 4.0%

- UNISWAP: ↑ 3.5% or ↓ 5.0%

All cryptos listed above are offered by FXTM as Crypto CFD’s.

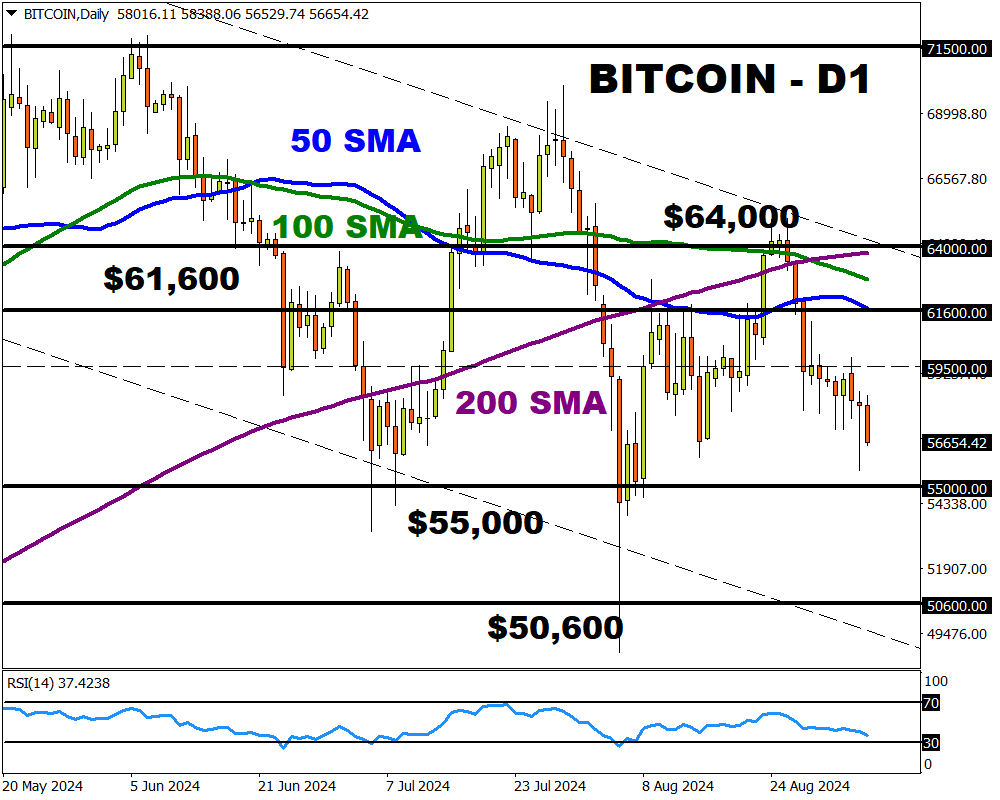

Technical outlook:

Bitcoin is under pressure on the daily charts with prices trading below the 50, 100 and 200-day SMA. However, the Relative Strength Index (RSI) is heading towards oversold territory - signalling a potential rebound down the road.

- A solid breakdown and daily close below $55,000 could encourage a decline toward $50,600.

- Should $55,000 prove to be reliable support, this could trigger a rebound back toward $59,500 and $61,600 where the 50-day SMA resides.