- Will Fed decision push US500 to fresh records?

- UK100 waits on BoE for next move

- JP225 could be rocked by BoJ meeting

- Watch out for other central bank meetings

If you thought the past few days were eventful, check out what’s in store for the week ahead!

A string of major central bank decisions may present fresh trading opportunities across financial markets:

Saturday, 14th Sept

- CN50: China property prices, retail sales, industrial production

Monday, 16th Sept

- CAD: Canada existing home sales

- USDInd: US empire manufacturing

Tuesday, 17th Sept

- CAD: Canada CPI

- GER40: Germany ZEW survey expectations

- JP225: Japan tertiary index

- SG20: Singapore trade

- US500: US industrial production, retail sales

Wednesday 18th Sept

- EU50: Eurozone CPI

- JP225: Japan machinery orders, trade

- ZAR: South Africa retail sales, CPI

- UK100: UK CPI

- US500: FOMC rate decision

Thursday, 19th Sept

- AU200: Australia unemployment

- NZD: New Zealand GDP

- UK100: BoE rate decision

- ZAR: SARB rate decision

- TWN: Taiwan rate decision

- USDInd: US Conf. Board leading index, initial jobless claims

Friday, 20th Sept

- CN50: China loan prime rates

- CAD: Canada retail sales

- EU50: Eurozone consumer confidence

- JP225: BoJ rate decision, CPI

We have our eyes on 3 indices that could be rocked by 3 central bank announcements:

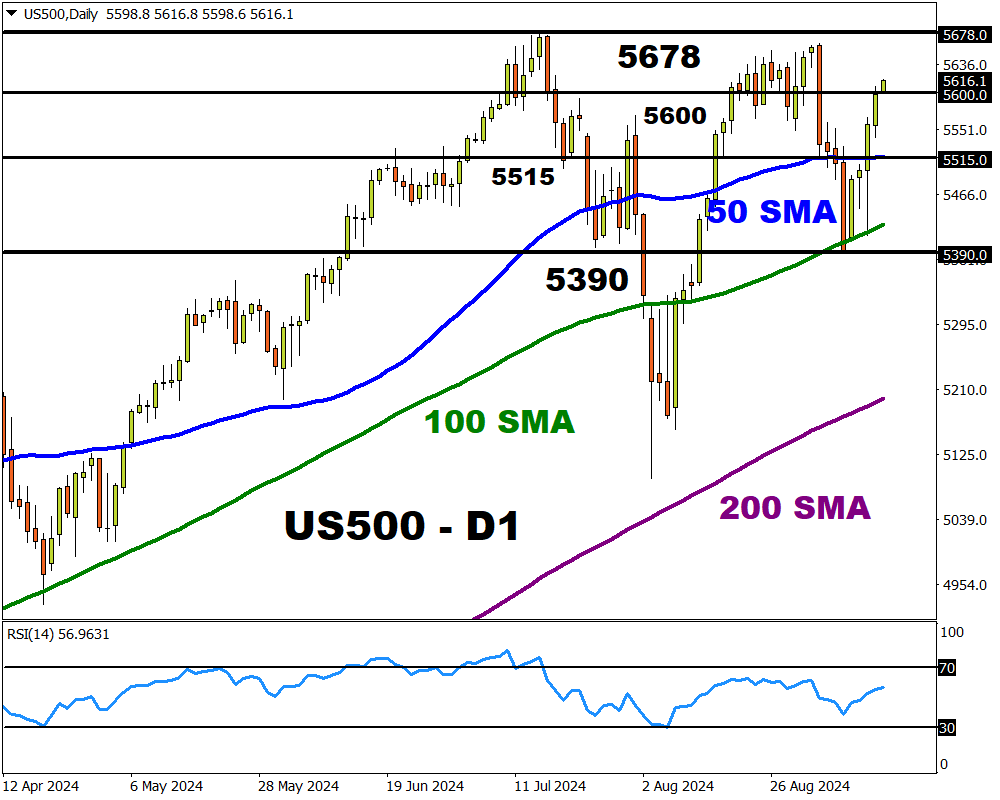

1) US500 set for fresh all-time highs?

FXTM’s US500 which tracks the S&P500 staged a strong rebound this week, rising 4% as data reinforced bets around lower US interest rates.

Although the Federal Reserve is expected to cut interest rates at September’s meeting, markets remain divided on the size.

Traders have fully priced in a 25-basis point cut with the odds of a 50-basis point cut around 45%.

The press conference and economic projections – especially ones for interest rates known as the dot plot may offer fresh insight into future moves.

Golden nugget: Over the past 12 months, the Fed decision has triggered upside moves of as much as 1.7% or declines of 1.2% in a 6-hour window post-release.

Looking at the technical picture, the US500 is trading just over 1% away from it’s all-time high at 5678. Prices are trading above the 50, 100 and 200-day SMA while the MACD is above zero.

- Key levels can be found at 5600 and the 50-day SMA.

2) UK100 to experience breakout?

After bouncing within a weekly range, the UK100 which tracks the FTSE100 index could experience a breakout.

This may be sparked by the incoming UK inflation data and BoE rate decision in the week ahead.

Markets expected the BoE to leave interest rates unchanged at 5% in September, so it’s all about the policy statement and how many MPC members voted to cut rates. This major risk could rock the British Pound, influencing the UK100.

Note: When the pound strengthens, it results in lower revenues for FTSE100 companies that attain their revenues from overseas – dragging the UK100 lower as a result. The same is true vice versa.

Golden nugget: Over the past year, the BoE decision has triggered upside moves of as much as 0.9% or declines of 0.8% in a 6-hour window post-release.

Talking technicals, it’s worth noting that the UK100 is trading roughly 3% away from its all-time high.

Weekly support can be found at 8130 and resistance at 8450.

- A decline below 8130 may signal a selloff toward 8000.

- While a breakout above 8450 could see the UK100 challenge fresh all-time highs.

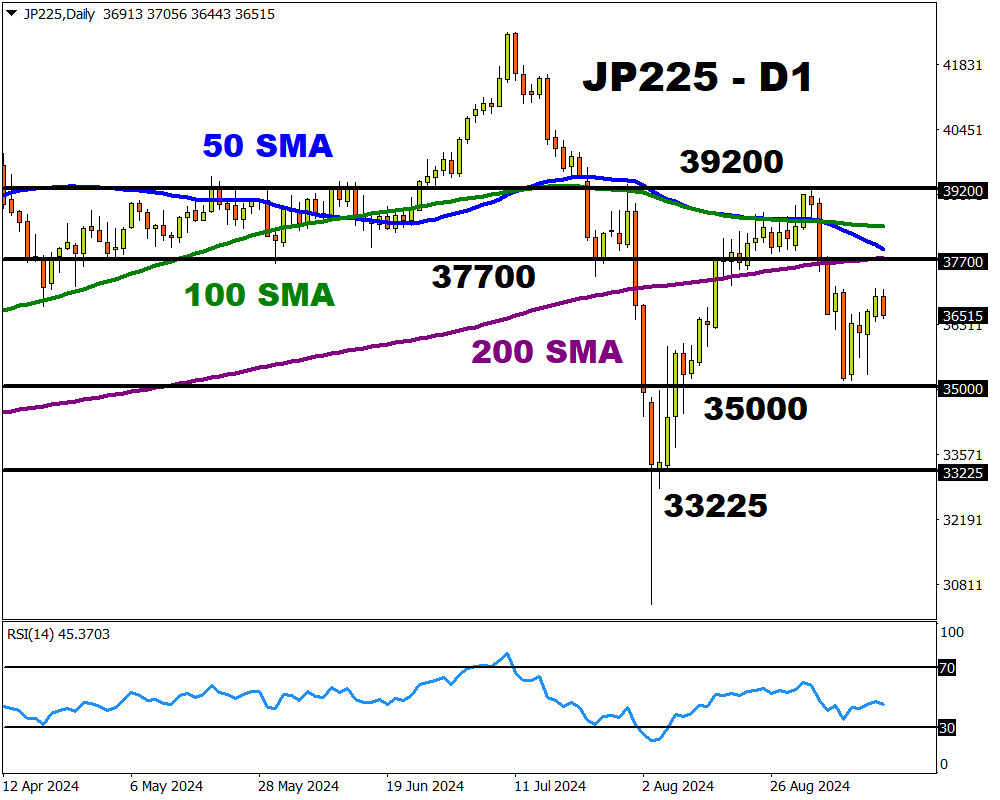

3) JP225 waits on BoJ decision

The JP225 could be injected with fresh volatility due to the BoJ meeting on Friday.

Note: The JP225 tracks the Nikkie 225 index and tens to weaken when the Yen strengthens, vice versa.

The BoJ is expected to leave interest rates unchanged at 0.25% in September with traders only seeing a 33% probability of another rate hike by the end of 2024.

Still, much attention will be directed toward the tone of the meeting and whether any clues are offered on future moves.

Rising inflationary pressures in Japan support the argument around higher rates. However, concerns over the US economy and possibly unwinding of the carry trades could keep hawks at bay. Whatever the outcome of the meeting, it is likely to influence the JP225.

Golden nugget: Over the past 12 months, the BoJ decision has triggered upside moves of as much as 2% or declines of 1.5% in a 6-hour window post-release.

Looking at the charts, resistance can be found at the 200-day SMA at 37700 and support at 3500. A breakout may be on the horizon.