-

Today, US500 and US30 stock indexes hit respective all-time intraday highs

-

Better-than-expected US retail sales boost “economically sensitive” stocks

-

AU200 index broke above 8180 for its first time ever

-

Higher-for-longer RBA rates boost Australian banking shares

-

JPY, Arabica/Robusta, SG20, and SPN35 all touched multi-year highs this week

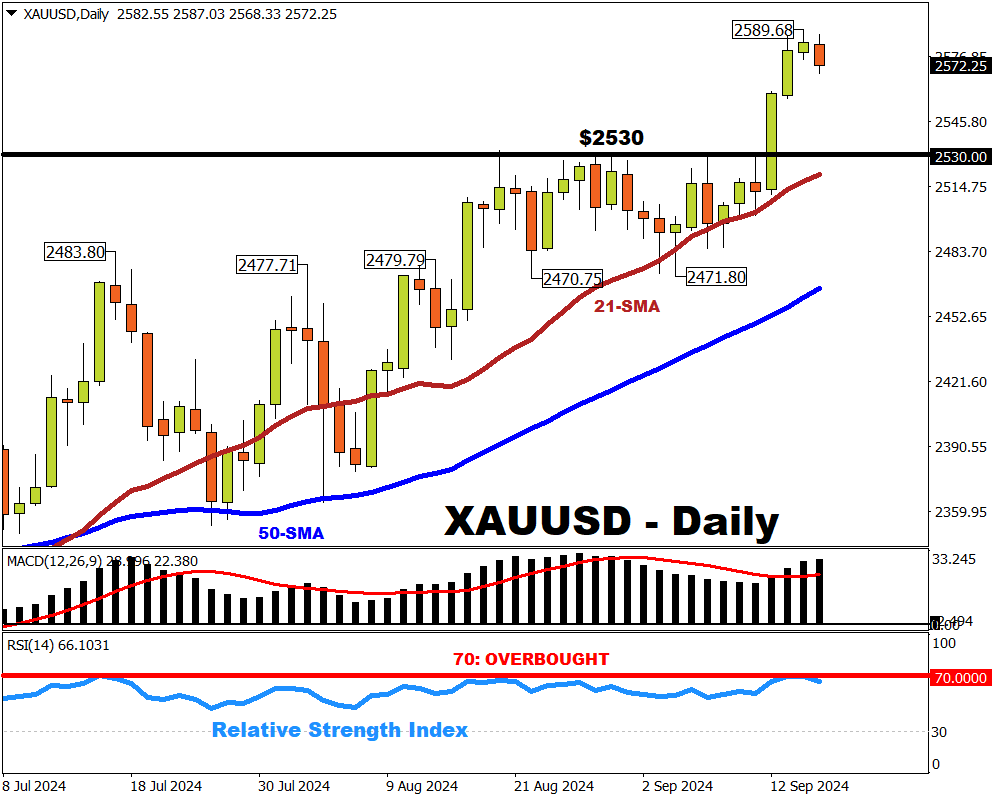

Much has already been made about gold hitting fresh record highs for much of 2024.

Although pulling back slightly from its all-time peak of $2589.68, gold still has plenty to boast about, having climbed 24.7% so far this year (at the time of writing).

But bullion is not alone.

Cast your sights away from precious metals, and you'll discover that …

Stock indexes are also punching their way to never-seen-before prices this week!

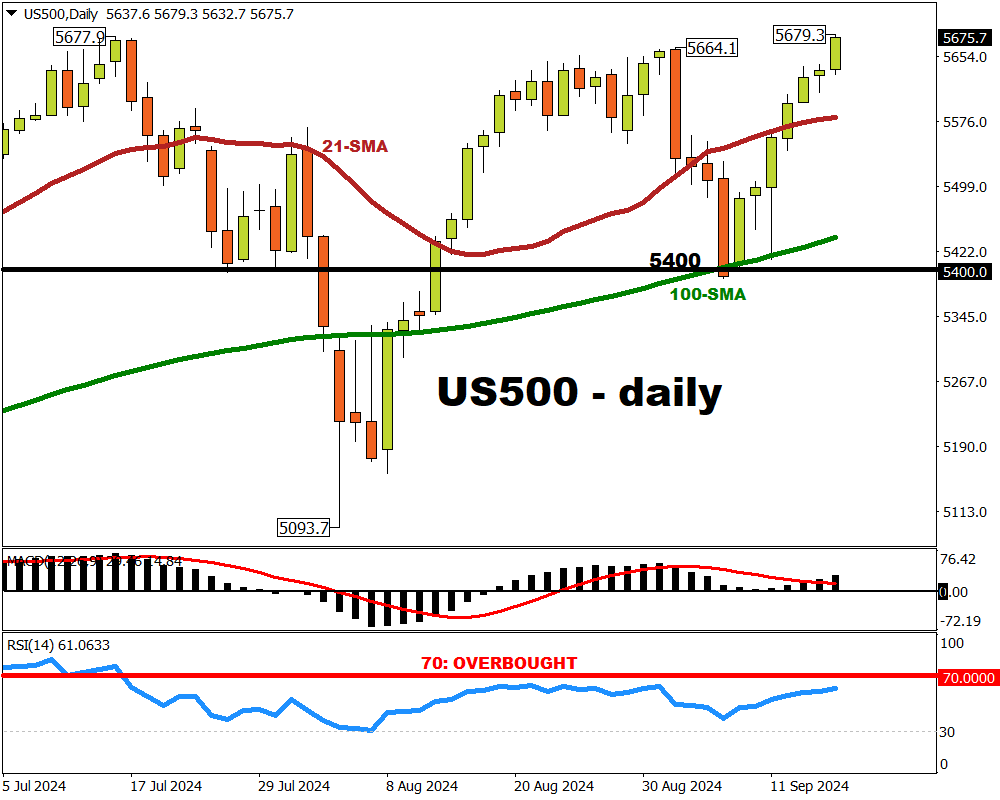

1) US500 index

Just minutes ago, the US500 index just traded at 5679.3, surpassing its previous record high (using intraday prices) of 5677.9 posted on July 16th.

The US500 tracks the benchmark S&P 500 index, which is a "basket" filled with 500 different industry leaders across the US economy, including Nvidia, JPMorgan & Chase, Exxon Mobil, Visa, and many many more.

At the time of writing ...

The S&P 500 has now risen 18.75% so far in 2024!

Also joining the US500 in the record-high club this week ...

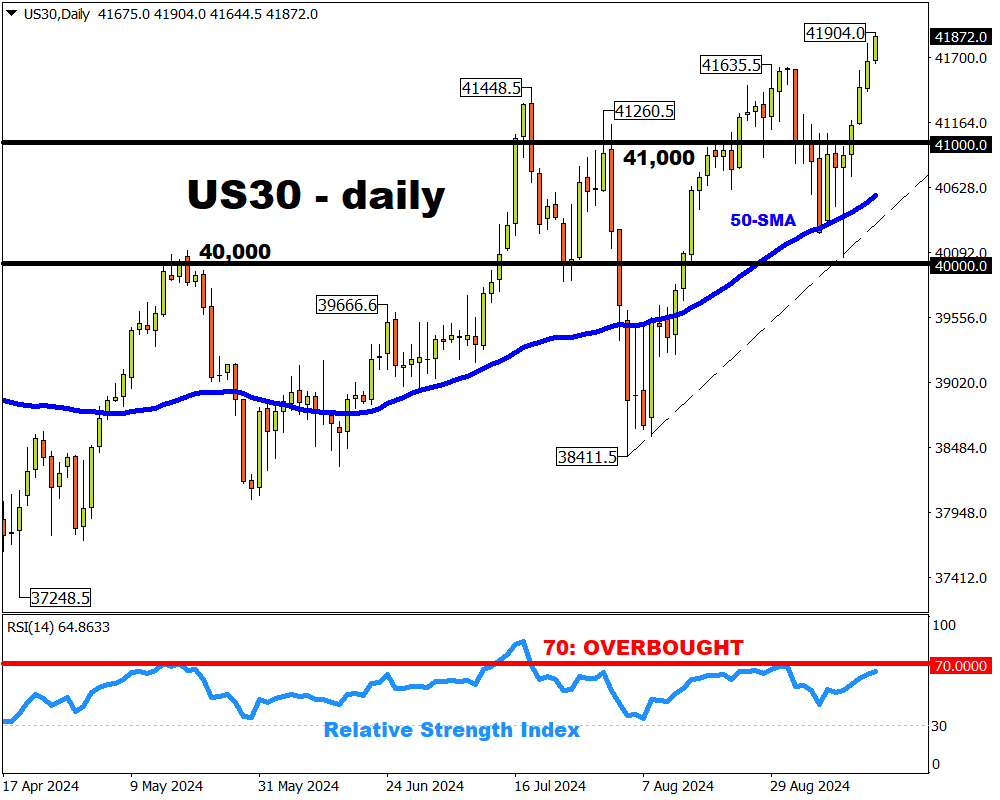

2) US30 index

Also today, the US30 index, which tracks the Dow Jones Industrial Average a.k.a. the "Dow", registered a price above 41,900 for the first time in its history!

This stock index is like a “basket” filled 30 different stocks, including household names such as McDonald’s, Johnson & Johnson, Procter & Gamble, Walmart, NIKE, and Coca-Cola.

At the time of writing ...

The Dow has risen by 10.75% so far in 2024!

Why are US stock markets climbing?

These indexes are filled with stocks of companies that are deemed to be “economically sensitive”.

That means these companies are expected to earn more money when the economy is doing well.

Just hours ago, US retail sales posted a positive surprise!

US retail sales in August grew by 0.1% compared to July 2024 (month-on-month), which suggests that the world's largest economy is holding up well.

Furthermore, the Federal Reserve – the US central bank – is set to lower interest rates very soon (likely on Wednesday, September 18th).

Lowered interest rates are intended to help business and households have more spending money, which should in turn improve the earnings of "economically sensitive" companies.

In short, the prices of these “economically-sensitive baskets” (stock indexes) have risen amid hopes of incoming Fed rate cuts that aim to support the US economy.

However, not all US stock indexes are created equal.

-

The NAS100 index, which contains many tech stocks (e.g. Nvidia, Meta, Microsoft, etc.) remains over 6% below its all-time high from July 2024.

-

The US400 index is less than 2% from its all-time high, also from July 2024.

- The RUS2000 index is over 9% below its all-time high from November 2021.

Outside of the US, other stock indexes are also moving into uncharted waters.

3) AU200 index

Today (Tuesday, September 17th), the AU200 index printed a price above 8180 for the first time in its history!

Today's price action helped it surpass its August 1st, 2024 intraday high by almost exactly 10 index points.

So far in 2024, the AU200 index has risen by 7.25%.

The AU200 index, which tracks the S&P/ASX 200 – Australia’s benchmark stock index, is mostly filled with banking/financial stocks.

Financials account for over one third (33.5%) of the total S&P/ASX 200 index.

Note that banks tend to make more money when interest rates are higher.

The Reserve Bank of Australia (RBA) – its central bank – has also expressed its preference for keeping its Cash Rate at a 12-year peak of 4.35% for longer.

The prospects of higher-for-longer interest rates in Australia have in turn boosted banking stocks, which propelled the AU200 index to a new all-time high.

NOTE: Markets currently predict that the RBA can only cut interest rates starting in December 2024, well after its G10 central bank peers such as the Bank of England, the European Central Bank, and likely the Federal Reserve as well.

Honourable Mentions:

(other high-flyers across asset classes)

-

Japanese Yen: briefly broke below 140 against the US dollar this week, its strongest since July 2023

-

SG20 index: highest since April 2022

-

SPN35 index: highest since July 2015

-

Arabica Coffee: highest since 2011

- Robusta Coffee: highest since 1970s