- Markets remain divided about size of Fed cut

- USDInd on breakout watch ahead of Fed decision

- Watch out for BoE and BoJ rate decisions this week

- GBPUSD & USDJPY could see significant price swings

With just hours until the Federal Reserve prepares for its first rate cut since 2020, markets remain split on the size!

An unexpected jump in U.S. retail sales yesterday initially cooled bets around a 50-basis point move. However, the odds are back to roughly 66% this morning according to Fed Funds Futures.

Looking beyond the rate decision, much focus will be on Powell’s press conference and economic projections – especially the dot plot which may provide fresh clues into future policy moves.

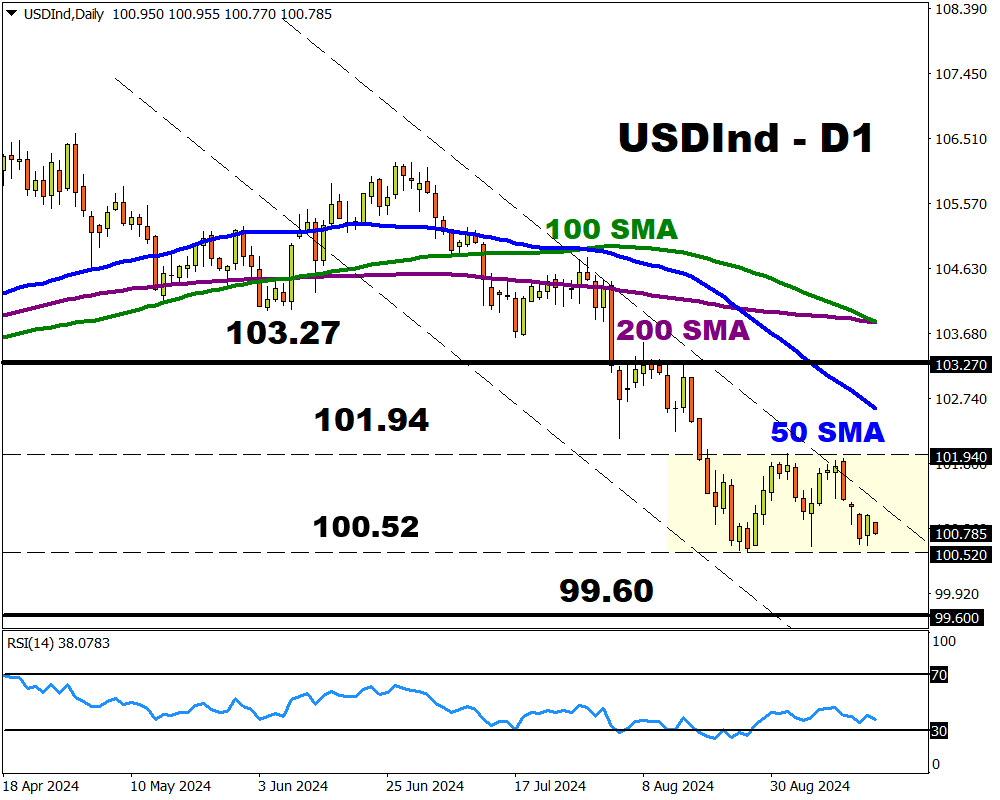

This brings our attention to the USDInd which could experience a significant breakout. Support can be found at 100.52 and resistance at 101.94 as mentioned two weeks ago.

Golden nugget: Over the past 12 months, the Fed decision has triggered upside moves of as much as 0.4% or declines of 0.7% in a 6-hour window post-release.

Whatever the outcome of the Fed decision, it has the potential to trigger fresh volatility across global markets.

But it does not end here…

On Thursday, it’s all about the Bank of England rate decision with the Bank of Japan under the spotlight on Friday.

As extensively covered in our week ahead, the BoE is widely expected to leave rates unchanged in September with the first cut expected by November.

However, what was not mentioned was how this could impact the GBPUSD.

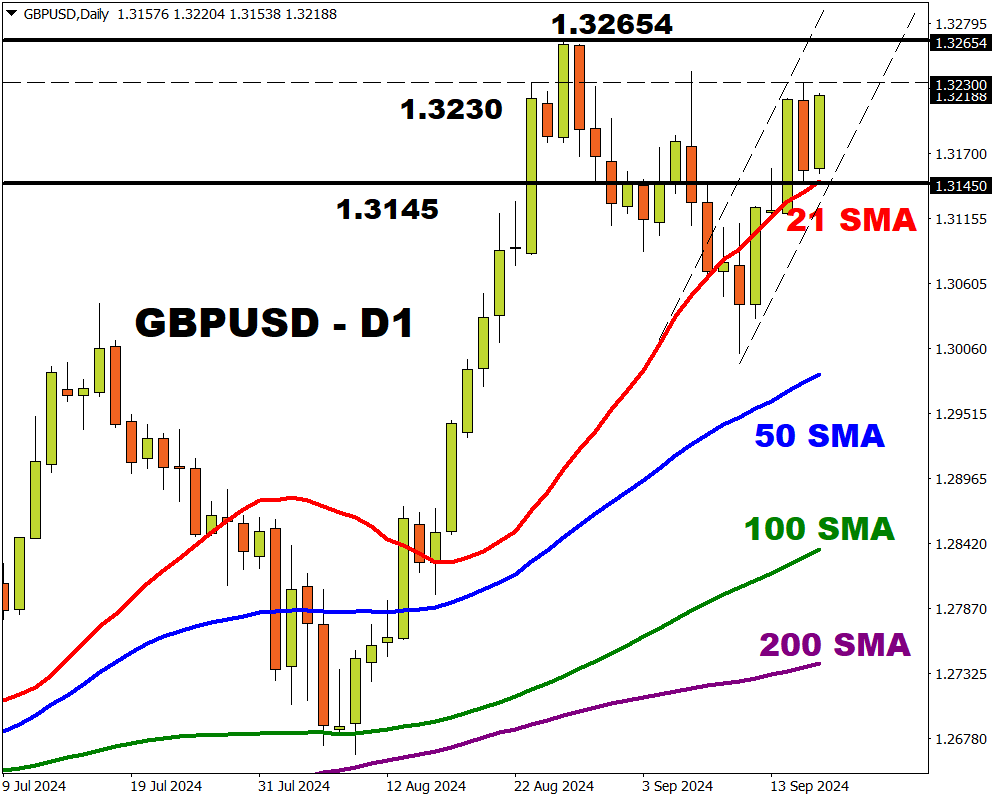

This major currency pair is trading near a 2-week high, supported by a weaker dollar ahead of the Fed’s rate decision this evening.

With the BoE expected to leave interest rates unchanged and the Fed seen cutting rates, this combination could empower GBPUSD bulls. Still, how markets react to the policy statement and MPC member votes could affect how the currency pair concludes the week.

Golden nugget: Over the past 12 months, the BoE decision has triggered upside moves of as much as 0.6% or declines of 0.4% in a 6-hour window post-release.

Talking technicals…

The GBPUSD is trading roughly 0.5% away from it’s 2024 high with bulls in the driving seat.

- A strong breakout above 1.3230 could open a path back toward 1.3265 and 1.3300.

- Should 1.3230 prove reliable resistance, this could trigger a decline to the 21-day SMA at 1.3145.

Regarding the BoJ rate decision on Friday...

Investors will be on the lookout for fresh clues on future policy moves. As of writing, traders are only pricing in a 33% probability of a BoJ hike by the end of 2024 with the odds jumping to 70% by May 2025.

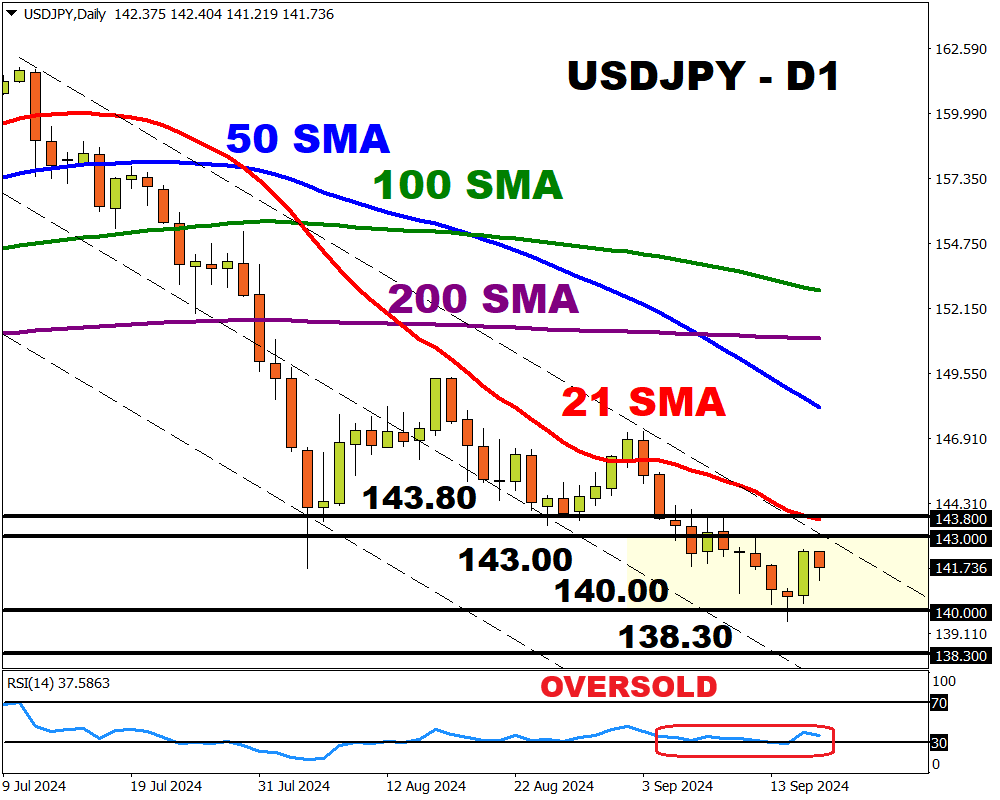

Still, the Yen is the best performing G10 currency against the USD this month with the USDJPY respecting a bearish trend.

Golden nugget: Over the past 12 months, the BoJ decision has triggered upside moves of as much as 1.1% or declines of 0.5% in a 6-hour window post-release.

Prices are trading below the 21, 50, 100 and 200-day SMA while the Relative Strength Index (RSI) is flirting near oversold territory.

- A breakout above 143.00 may open a path towards the 21-day SMA at 143.80.

- Should prices secure a daily close below 140.00, bears may target 138.30.