-

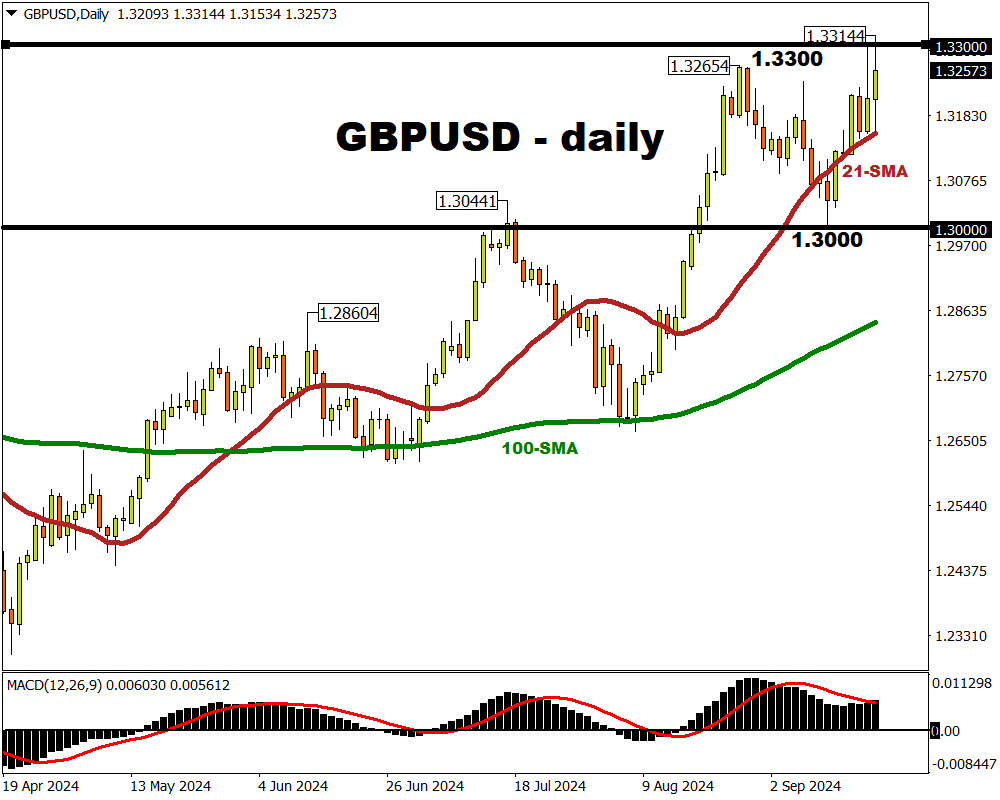

GBPUSD breached 1.330 for first time since March 2022

-

Bank of England kept rates unchanged at 5%, to be "careful" with future rate cuts

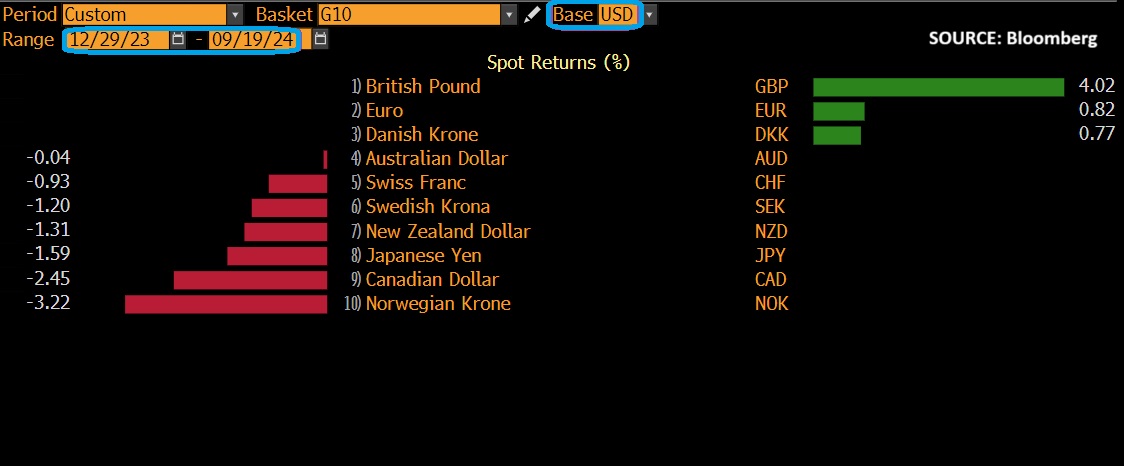

- GBPUSD now up 4% year-to-date; best G10 performer against US dollar so far in 2024

-

Forecast: GBPUSD to trade between 1.2721 – 1.3776 through year-end

- Fed reaction: US stock indexes, Bitcoin, and gold cheer Wednesday's jumbo US rate cut

GBPUSD has registered its highest levels since March 2022.

Shortly after the Bank of England decision today, this FX pair nicknamed “cable” briefly broke above the psychologically-important 1.3300 level.

The Bank of England voted 8-1 to keep its bank rate unchanged at 5% today, as widely expected.

Recall that the BOE already lowered its benchmark rates by 25 basis points last month (August 2024).

However, BOE Governor Andrew Bailey stressed that policymakers “need to be careful not to cut too fast or by too much”.

Such cautious language prompted markets to lower the odds of 50-basis points in BOE rate cuts for the rest of 2024, from 95% down to 73% at the time of writing.

In other words, the thought of UK interest rates not coming down as quickly as its peers, translated into a Pound that’s stronger on the day (Thursday, September 19th) relative to most of its G10 peers, including the euro, US dollar, Swiss franc, and Japanese yen.

GBPUSD path determined by BOE vs. Fed outlook

The BOE’s statement today was read in light of the Fed’s latest policy signals.

The US central bank cut its benchmark rates by 50-basis points on Wednesday, September 18th.

Although the Fed also preached a message of caution, not taking further 50-bps rate cuts for granted, markets are aware that the path for US interest rates is firmly pointed downwards.

Here’s how markets currently predict these two major central banks to act in the years ahead:

-

60% chance that the Fed will cut by a further 200 basis points by Q3 2025

- 46% chance that the BOE will cut by a further 150 basis points by Q3 2025

Overall, given the steeper path downwards for US interest rates relative to the UK, that has resulted in a stronger British Pound versus the US dollar (GBPUSD going up).

Bloomberg’s FX forecast model predicts 73% chance GBPUSD will trade within 1.2721 – 1.3776 until end-2024.

Already the Pound is the best-performing G10 currency against the US dollar so far in 2024.

Today's gains now bring GBPUSD's year-to-date advance to over 4%!

Markets still cheering Fed rate cut

Yesterday’s jumbo-sized Fed rate cut is still being cheered on by broader financial markets:

-

The US500 index, which tracks the S&P 500, has punched above 5700 for the first-time ever – an intraday record high|

-

XAUUSD (Gold) briefly took hold of the $2600 mark – yet another intraday record high

- Bitcoin has soared back up to $63,000 for the first time since late August 2024.

Now that markets have had time to digest the Fed's initially confusing move and messaging ...

The overall narrative is that the Fed has enough firepower to prevent a US recession - a thought that is spurring on riskier assets!