- Bitcoin ↑ 4.3% month-to-date

- US election developments & US data in focus

- Over past year jobless claims triggered moves of ↑ 1.5% & ↓ 2.0%

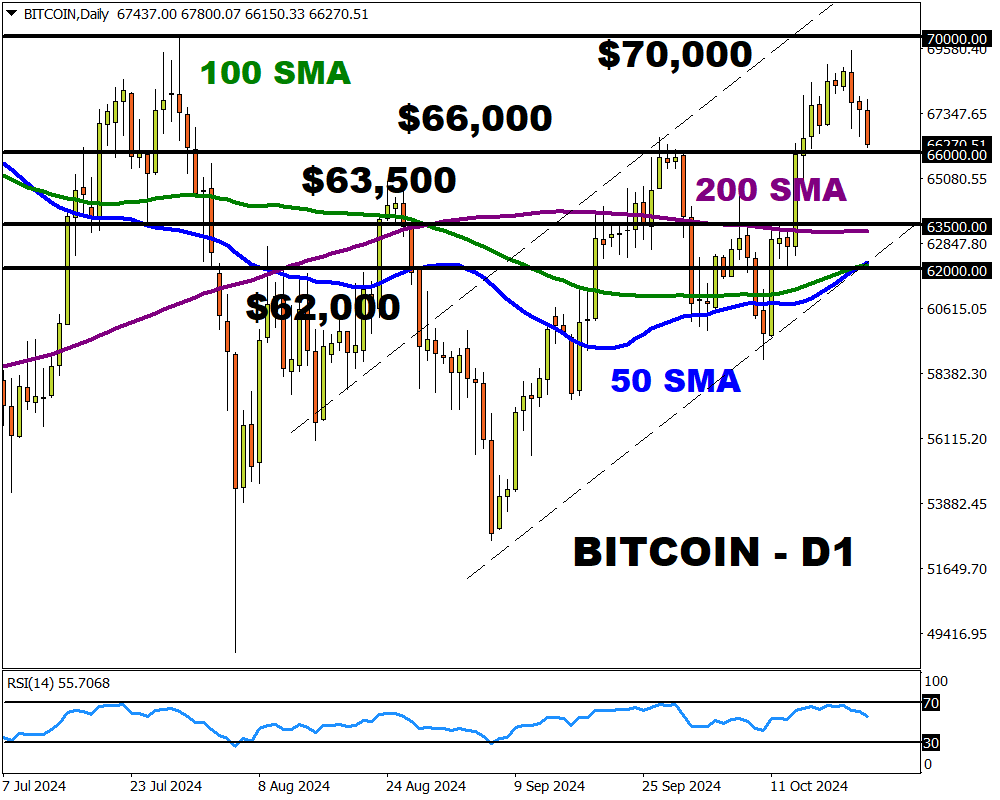

- Key levels of interest - $66,000 and 200-day SMA

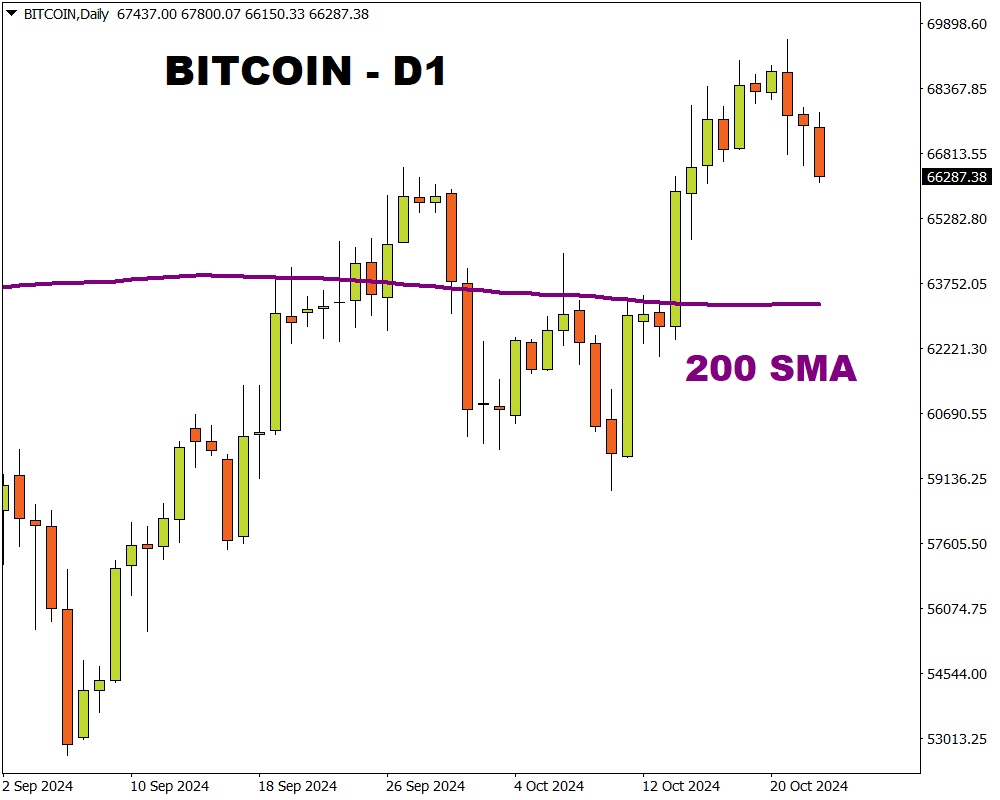

This week, Bitcoin nearly touched $70,000 before tumbling on cooling Fed rate cut bets.

Despite falling as low as $66,150, prices are still up roughly 4% month-to-date – trading comfortably above the 200-day SMA.

Market bets of 50 basis points worth of Fed cuts by the end of 2024 have been shaved by signs that the US economy remains strong. Expectations were further dampened by Fed speakers who signaled for slower rate cuts. This development weighed on riskier assets such as cryptocurrencies which remain sensitive to US interest rates.

Traders are currently pricing in a 92% probability of a 25-bp cut by November and 65% probability of another 25-basis point move by December.

Still, Bitcoin bulls could draw support if inflows into ETFs continue to rise ahead of the US election less than 2-weeks away.

Republican candidate Donald Trump is widely known to be pro-crypto while Kamala Harris has pledged to support the crypto industry. So, there is growing consensus that Bitcoin stands to gain regardless of who wins the presidential race.

According to Bloomberg, option traders are boosting bets that Bitcoin will hit an all-time of $80,000 by the end of this month regardless of the election outcome. This represents a 17% move from current prices around $66,400.

In the meantime, the cryptocurrency could see more volatility this week thanks to a string of key US data:

Wednesday, 23rd October

- Fed Beige book

Thursday, 24th October

- US jobless claims, S&P Global PMIs

Golden nugget: Over the past 12 months, the initial jobless claims have triggered upside moves as much as 1.5% or declines of 2% in a 6-hour window post-release.

Friday, 25th October

- US durable goods, University of Michigan consumer sentiment

Golden nugget: Over the past 12 months, the University of Michigan consumer sentiment has triggered upside moves as much as 2.1% or declines of 1.9% in a 6-hour window post-release.

Should the incoming data influence bets around how many times the Fed will cut rates in Q4, this may translate to price swings in Bitcoin.

Looking at the technical picture,

Bitcoin remains in a bullish channel on the daily timeframe. However, prices may be in the process of creating a new higher low. The Relative Strength Index (RSI) recently touched 70 – indicating that prices were at one point overbought.

- A breakdown below $66,000 could trigger a decline toward the 200-day SMA near $63,500 and $62,000.

- Should $66,000 or the 200-day SMA prove to be reliable support, prices may rebound back toward the $70,000 region.