- Bitcoin less than 2% away from 100k milestone

- up over 40% mtd; pushing 2024 gains to 133%

- Crypto market gained roughly $1 trillion since Trump election win

- Over past year US PCE triggered moves of ↑ 0.8% & ↓ 2.2%

- “OG crypto” bullish but watch out for geopolitical risk

Bitcoin is trading within striking distance of the landmark $100,000 level.

The “OG” crypto could hit this critical point within minutes, hours or even days.

Prices have been on a tear since Trump’s return to the White House, cutting through key resistance levels like a hot knife through butter.

As of writing, Bitcoin is:

- up over 40% this month

- up 133% since the start of 2024

- less than 2% away from the $100k milestone

Why is Bitcoin surging?

The crypto market has gained a whopping $1 trillion since Trump’s election victory on November 5th.

Gains have been powered by growing optimism over more industry-friendly regulations and a greater embrace of cryptos by the incoming Trump administration.

Just earlier this week, Bloomberg reported that Trump’s team was in talks about creating a new White House position dedicated entirely to cryptocurrency policy!

This has added to the growing optimism over the industry’s outlook under Trump.

With all the above discussed, Bitcoin is bound to remain a hot talking point in the final trading week of November along with key data from major economies:

Monday, 25th November

- GER40: Germany IFO business climate

- NZD: New Zealand trade

- SG20: Singapore CPI

- TWN: Taiwan industrial production

Tuesday, 26th November

- SG20: Singapore industrial production

- US500: US FOMC minutes, conference Board consumer confidence

Wednesday, 27th November

- CN50: China industrial production

- NZD: New Zealand rate decision

- USDInd: US PCE report, consumer confidence, initial jobless claims, GDP

Thursday, 28th November

- US markets closed: Thanksgiving holiday

- EUR: Eurozone economic confidence, consumer sentiment

- GER40: Germany CPI

Friday, 29th November

- CAD: Canada GDP

- GER40: Germany unemployment, Eurozone CPI

- JP225: Japan unemployment, Tokyo CPI, industrial production, retail sales

- TWN: Taiwan GDP

- Black Friday – start of US holiday shopping rush

Can Bitcoin charge higher?

Well according to Bloomberg, option traders have set their eyes on Bitcoin touching $100,000 by December 27th while prices are heavily bullish from a technical perspective.

Most importantly, Bitcoin and other cryptocurrencies have rallied on hopes that Trump will create a supportive US crypto regulatory framework.

- If Trump moves ahead with his plans in 2025, this could provide the crypto space another boost.

- However, any possible delays or worse Trump going back on his promises could spark a selloff across the crypto space.

What factors could move Bitcoin in the week ahead?

1) US October PCE report

Watch out for the incoming US PCE inflation data on Wednesday 27th November which could influence Bitcoin prices.

The Fed’s preferred inflation gauge – the core personal consumption expenditure index may impact bets around when the Fed will cut interest rates.

As of writing, traders are currently pricing in a 60% probability of a 25-basis point Fed by November.

Note: In general, cryptocurrencies are indirectly affected by interest rates because of their high risk.

Over the past year, the US PCE report has sparked upside moves of as much as 0.8% or declines of 2.2% in a 6-hour window post-release.

2) Geopolitical risks

Escalating Ukraine-Russia tensions could impact global risk appetite in the week ahead.

Russia has launched a new type of ballistic missile into Ukraine in response to Ukraine’s use of long-range US missiles earlier in the week.

- Any signs of escalating conflict could sour appetite for risk, hitting risk assets like Bitcoin as a result.

- Easing tensions may boost market sentiment – supporting Bitcoin prices.

3) Technical forces

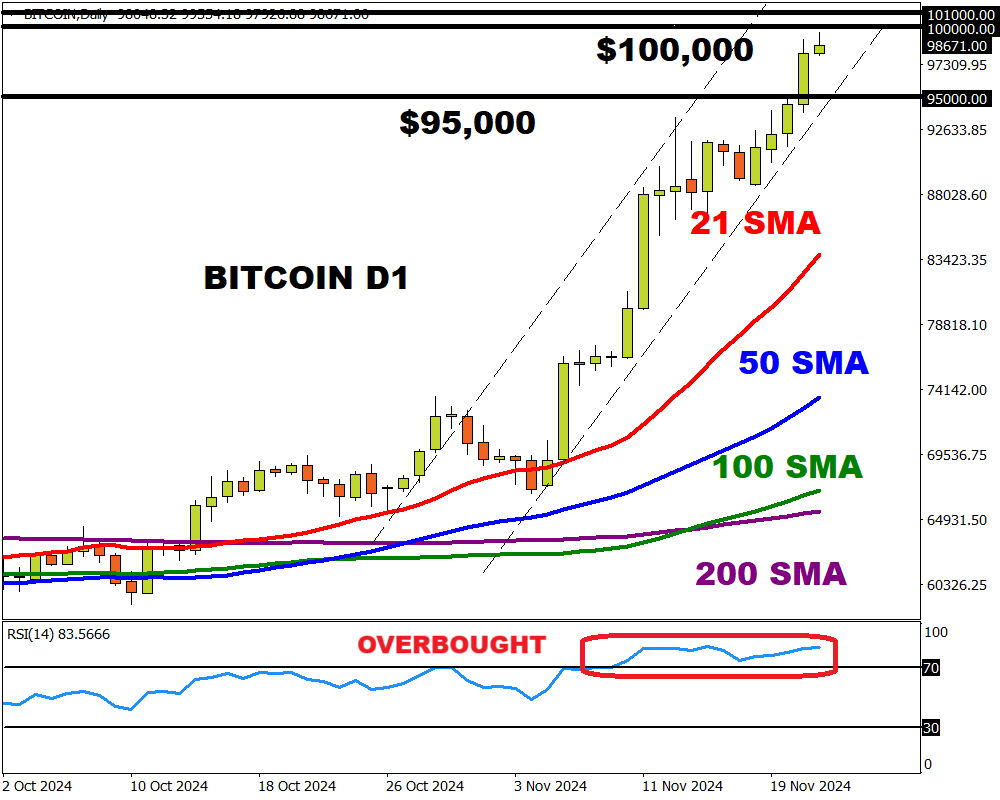

Bitcoin is firmly bullish on the daily charts as there have been consistently higher highs and higher lows.

Prices are trading above the 50, 100 and 200-day SMA but the Relative Strength Index (RSI) has been overbought over the past two weeks.

- A solid breakout and daily close above the psychological $100,000 level may open the doors to the next psychological round levels at $105,000 and $110,000.

- Should $100,000 prove reliable resistance, this may drag prices back toward $97,000 and $95,000.