- China’s Politburo signals “moderately loose” monetary and “more proactive” fiscal policy, echoing GFC-era language

- Hang Seng futures rally 1,500+ points, stalling at near November highs

- China A50 futures break 50-day average but lack volume, bullish breaks eyed for confirmation

Overview

China’s Politburo has reintroduced language regarding the outlook for monetary and fiscal policy last used during the GFC, sparking an immediate market reaction given the shift back then delivered what was the largest fiscal stimulus program on record prior to the pandemic.

On the monetary front, “prudent” policy is out and “moderately loose” is in, while fiscal policy will be “more” proactive, rather than just “proactive”. It might seem insignificant, but the signal is likely to set off a wave of speculation as to what may be delivered next year, pointing to a potential extension of the bullish moves seen Monday.

With the industrial metals covered in an earlier note, this will focus on the technical lay of the land in two of the most popular index futures linked to China, the Hang Seng and A50.

Hang Seng: watching price action, volumes

Source: TradingView

Hang Seng futures have rallied over 1500 points since the announcement came through late Monday, breaking through the 50-day moving average along the way. Ahead of the day session reopening, the rally stalled at 21377, the high of November 8 – that should be the initial focus of traders.

If the price break above 21377, 21663 should be on the radar, a minor level that acted as support and resistance earlier this year. A break above that would open the door for a run towards 23334, the double-top set in October.

RSI (14) and MACD have been generating bullish signals for a while, meaning the bullish breakout may have legs. At the very least, the momentum picture favours buying dips and bullish breaks near-term. One thing to keep an eye on is traded volumes going through, with sustained bull runs of the recent past accompanied by a decent lift in turnover. That’s not been evident yet.

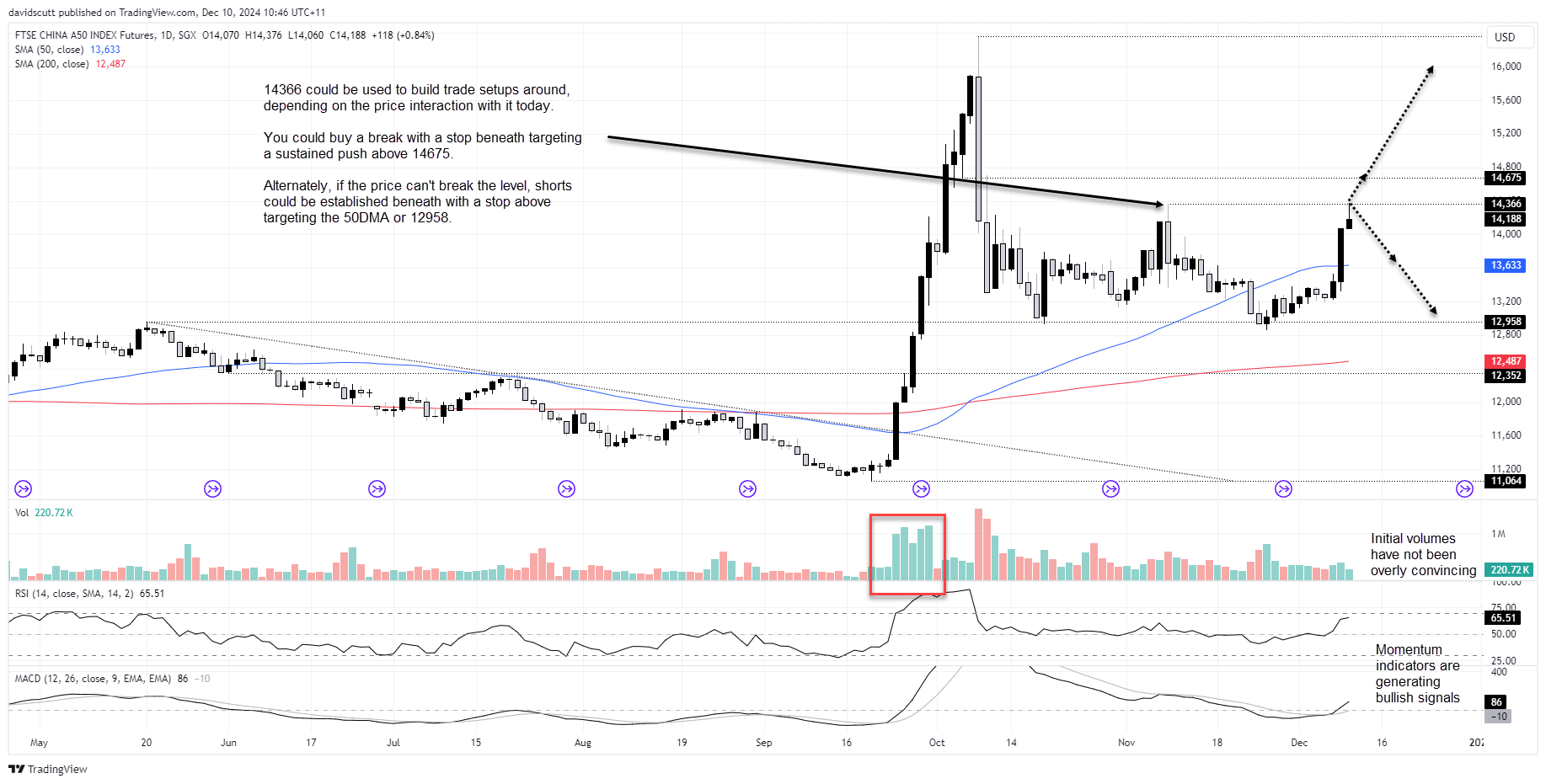

China A50: big move but lacking underlying oomph

Source: TradingView

China A50 futures look similar to Hang Seng futures on the daily timeframe, with the price jumping above the 50-day moving average before stalling at 14366, the high of November 8.

A break of 14366 puts 14675 in play, a minor level that acted as support and resistance earlier this year. Beyond, an extension of the bullish move would bring the October high of 16360 into play. On the downside, known support is scare until the 50-day moving average at 13633 with 12958 after that.

RSI (14) and MACD may be generating bullish signals but they’re not overly convincing yet. Nor have we seen the large lift in traded volumes that have accompanied sustained bullish runs in the past. As such, the preference would be to wait for bullish breaks before initiating any trades, allowing for tight stops to be place beneath for protection against reversal.

-- Written by David Scutt

Follow David on Twitter @scutty