- USDInd ↑ 0.3% WTD, trapped in range

- Over past year US CPI triggered moves of ↑ 0.7% & ↓ 0.4%

- ECB decision could spark more volatility

- Technical levels = 105.50 & 106.80

FXTM’s USDInd is on standby mode ahead of the US inflation report on Wednesday 11th December.

Bulls have held their ground despite last Friday’s soft US jobs report boosting Fed cut bets.

Note: FXTM’s USDInd tracks the US Dollar Index. This measures how the dollar performs against a basket of six different G10 currencies, including the Euro, British Pound, Japanese Yen, and Canadian dollar.

The US November job report revealed:

- Nonfarm payrolls increased 227,000 last month from 12,000 in October.

- The unemployment rate edged to 4.2% from 4.1%.

- Average hourly wages unchanged at 4.0% YoY and 0.4% MoM.

This report reinforced bets around lower US rates with traders now pricing in an 86% probability of a 25-bps cut in December.

Still, FXTM’s USDInd is up roughly 0.3% week-to-date and trading around 106.30 as of writing.

Geopolitical risk in the Middle East and political uncertainty in Korea could be factors supporting the dollar.

In addition, the European Central Bank, Bank of Canada and Swiss National Bank are expected to cut interest rates this week.

Note: The Euro accounts for almost 60% of the USDInd weighting, 9% of the Cad and roughly 4% of the Franc.

A weaker euro, cad and franc could push the dollar index higher and vice versa.

Redirecting our attention back toward the inflation reading:

US November CPI report

The November US Consumer Price Index (CPI) report on Wednesday, December 11th may impact bets around how aggressively the Fed cuts rates in the new year.

- CPI is projected to rise 0.3% month-on-month in November from 0.2% prior.

- Rise 2.7% year-over-year from the 2.6% prior.

- Core: to remain unchanged at 0.3% month-on-month.

- Core: unchanged at 3.3% year-on-year.

Over the past year, the US CPI report has triggered upside moves of as much as 0.7% or declines of 0.4% in a 6-hour window post-release.

- The USDInd could slip on signs of cooling price pressures.

- A hotter-than-expected CPI report could push the USDInd higher.

Keep an eye on the technicals

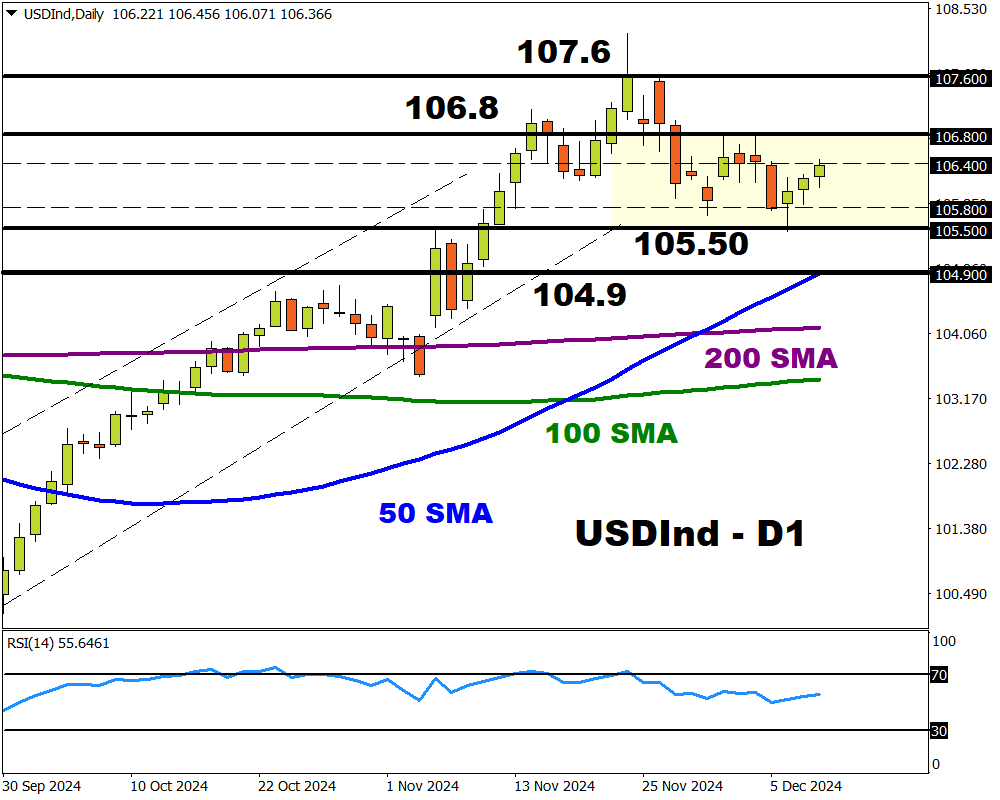

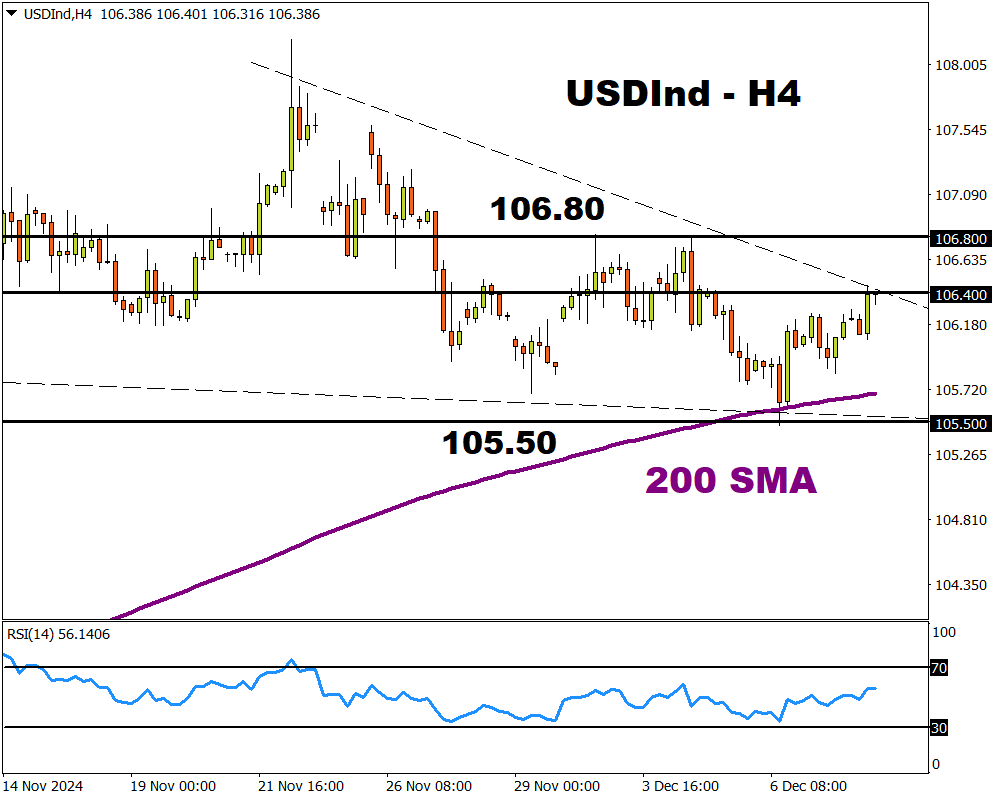

Prices remain in a range on the daily charts with support at 105.50 and resistance at 106.80.

- A sold breakout above 106.40 may signal a move toward 106.80 and 107.60.

- Should prices slip below 105.80, bears may be encouraged to target 105.50 and the 50-day SMA at 104.80.