Gold Price Outlook: XAU/USD

The price of gold pushes above the opening range for December as it carves a series of higher highs and lows, but bullion may track the November range amid the flattening slope in the 50-Day SMA ($2669).

Gold Price Pushes Above December Opening Range

The price of gold extends the advance from the start of the week to register a fresh monthly high ($2692), and the precious metal may reestablish the bullish trend from earlier this year as it continues to serve as an alternative to fiat currencies.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

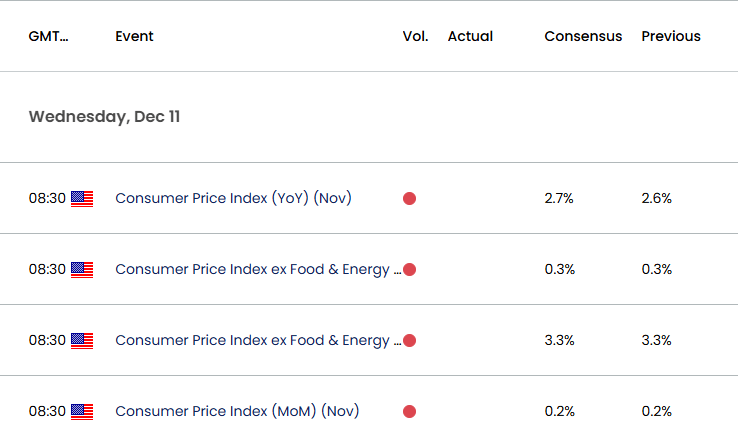

As a result, data prints coming out of the US may sway the price of gold as the Consumer Price Index (CPI) is anticipated to show the headline figure increasing to 2.7% in November from 2.6% per annum the month prior, while the core reading for inflation is seen holding steady at 3.3% during the same period.

US Economic Calendar

In turn, signs of persistent inflation may lead to a dissent within the Federal Reserve, and the threat of a policy error may keep the price of gold afloat as Chairman Jerome Powell and Co. pursue a neutral policy.

With that said, the price of gold may continue to carve a bullish price series as it pushes above the opening range for December, but bullion may track the flattening slope in the 50-Day SMA ($2669) should it struggle to retrace the decline following the US election.

XAU/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; XAU/USD on TradingView

- The price of gold trades to a fresh monthly high ($2692) as it extends the advance from the start of the week, with a break/close above the $2730 (100% Fibonacci extension) bringing the November high ($2790) on the radar.

- A breach above $2790 (50% Fibonacci extension) opens up $2850 (61.8% Fibonacci extension), but lack of momentum to break/close above the $2730 (100% Fibonacci extension) may keep the price of gold within the November range.

- Failure to hold above the $2630 (78.6% Fibonacci extension) to $2660 (23.6% Fibonacci extension) region may push the price of gold back towards $2590 (100% Fibonacci extension), with a breach below $2550 (61.8% Fibonacci extension) raising the scope for a move towards the November low ($2537).

Additional Market Outlooks

EUR/USD Monthly Opening Range Intact Ahead of ECB Rate Decision

USD/CAD Forecast: Canadian Dollar Vulnerable to BoC Rate Cut

GBP/USD Remains Susceptible to Bear Flag Formation

Australian Dollar Forecast: AUD/USD Eyes Yearly Low Ahead of RBA

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong