DJIA Forecast: The Dow Declines After the NFP

- The 44,000-point barrier has been surpassed in the short term; however, movements have remained neutral in this zone.

- The Dow lost points after the publication of the NFP, which registered 227k.

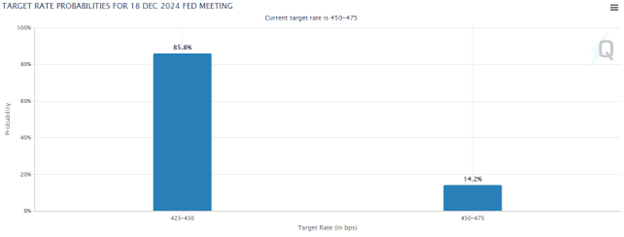

- The CME indicates a probability of over 85% for a FED interest rate reduction, an event that could create upward pressure on the Dow Jones in the short term.

The Dow has managed to surpass the 44,000-point barrier and currently maintains steady growth of just over 7% since November. However, a recent slowdown in movements has been observed, with a drop of approximately 1% following the release of the NFP data last Friday.

The Employment Dilemma

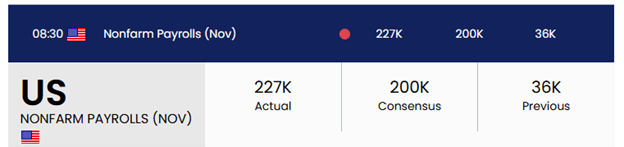

The data published last Friday, December 6, shows that the trend of new jobs reflected in the NFP remains bullish. The previous figure was around 36k, while the current figure shows a significant increase, reaching 227k and even surpassing the forecast of 200k.

The published data could establish an important connection with the Federal Reserve, as the rapid increase in employment, combined with the holiday season, could lead to a rise in consumption in the United States in the coming weeks. This, in turn, could influence the FED's Board of Governors' short-term decisions, potentially adopting an aggressive approach to maintaining the interest rate. Consequently, the Dow Jones outlook could turn bearish following these events.

Latest NFP Data

Source: FX Street

The annual Consumer Price Index (CPI) for the United States, to be published this Wednesday, is expected to stand at 2.7% year-over-year, slightly above the 2.6% recorded in November. An increase above expectations could negatively impact the outlook for the Dow Jones Industrial Average (DJIA), as investors may anticipate monetary policy adjustments from the Federal Reserve to control inflation. That said, the Central Bank might consider slowing the pace of interest rate reductions, which could influence consumer behavior and, consequently, affect the Dow Jones.

Inflation this week

Source: FX Street

What to Expect from the Next FED Decision

In recent days, FED Chair Jerome Powell has stated that the expectations for interest rate reductions are currently being met. However, there is no indication that this trend will accelerate in upcoming decisions.

Low interest rates are a key factor in maintaining confidence in equity index markets, which is a necessary step for indexes to sustain a strong upward trend in the long term.

FED Decision Probability Chart

Source: Cmegroup.com

According to the CME Group's probability chart, around 85% of current estimates suggest a rate cut to the 4.25%–4.5% range, while only about 14.2% predict that the rate will remain at its current level of 4.5%–4.75%. Thus, the Dow Jones is likely to remain in a neutral zone while investors prepare for the final decision on December 18. Since the rate cut is already anticipated, the market will focus on Powell's comments following the decision. If the approach aligns with previous decisions (allowing more room to lower interest rates), it is likely that the Dow will maintain its long-term upward trend. However, if the stance indicates steady interest rates for upcoming meetings, the Dow may face downward pressure as the market is expecting a series of rate reductions.

Dow Jones Technical Forecast

The Dow Jones Industrial Average (DJIA) has maintained a steady upward trend, recently reaching an all-time high of 45,000 points during the last five sessions. However, daily oscillations have remained around 0.6%, indicating a neutral stance among investors in the resistance zone of 44,000 points.

Source: Tradingview.com

-

Steady Trend: Since August, the price of the DJIA began a stable upward trend near 38,000 points. Currently, the price has continued to rise, reaching the consolidation zone at 44,000 points. The simple moving averages of 50 and 100 daily periods consistently remain below price movements, indicating that, for now, no significant bearish correction threatens to break the current trend.

-

Indicator Divergence: A Bearish divergence is currently observed between higher highs in price and steady highs in RSI levels, indicating that price acceleration is outpacing the momentum reflected by the indicators. This suggests a potential slowdown in bullish momentum, which could impact the trajectory of the current bullish trend.

Additionally, the MACD line is crossing below the Signal line, and the MACD histogram has started showing negative values, indicating that the bullish momentum from recent days has ended, creating room for bearish action. Both events could signal potential bearish corrections for the Dow Jones in the upcoming sessions.

-

Key levels:

- 44k points: Current resistance zone on the chart; movements above this level could confirm bullish strength and the continuation of the current trend.

- 43,100 points: Closest support on the chart and a tentative zone for bearish correction oscillations.

- 41,700 points: Distant floor; oscillations at this level could jeopardize the bullish trend's strength and may even bring it to an end.

The inflation rate and the next Federal Reserve (FED) decision will be key factors in determining whether the Dow Jones Industrial Average (DJIA) can once again reach its all-time high of 45,000 points in the upcoming sessions.