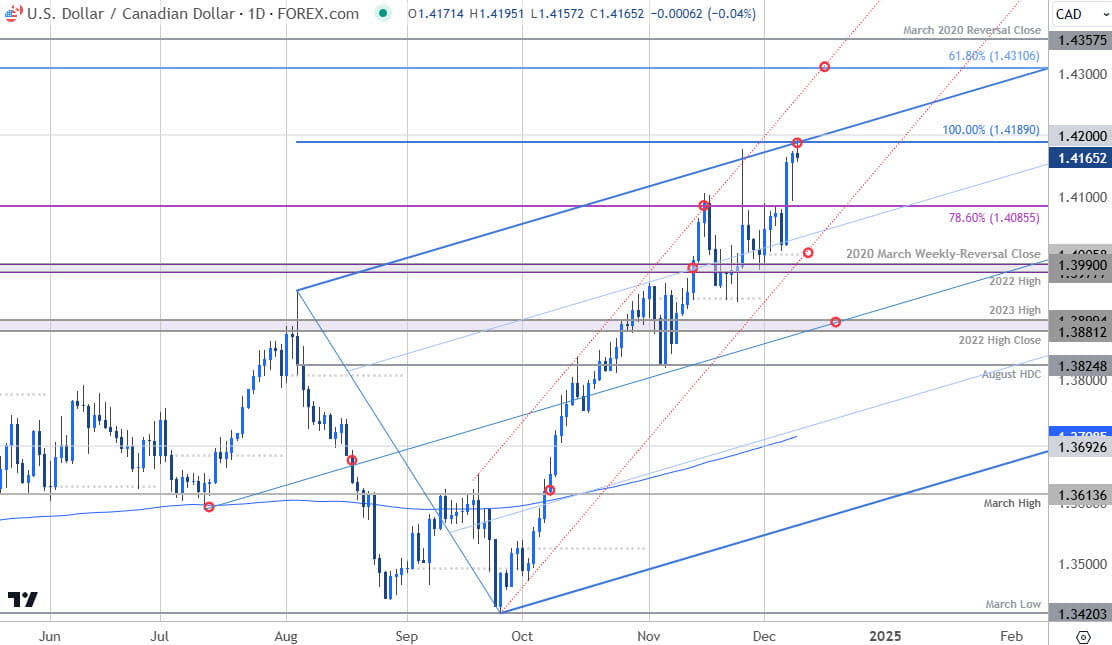

Canadian Dollar Technical Outlook: USD/CAD Short-term Trade Levels

- USD/CAD attempting third weekly advance- bulls stall at major technical resistance

- Bank of Canada interest rate decision / US CPI on tap- risk for major inflection ahead

- Resistance 1.4189-1.42 (key), 1.4310, 1.4350/57- Support 1.4085, 1.4005, 1.3978/90 (key)

The US Dollar has rallied more than 1.3% since the start of the month with the late-September rally testing major technical resistance today. The focus now shifts to major event risk tomorrow with the US Consumer Price Index (CPI) and the Bank of Canada interest rate decision on tap. Battle lines drawn on the USD/CAD short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Loonie setup and more. Join live on Monday’s at 8:30am EST.Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Technical Outlook: In last month’s Canadian Dollar Short-term Outlook we highlighted the threat for a deeper pullback in USD/CAD after price exhausted into confluent resistance and that, “Ultimately, losses would need to be limited to 1.3881 for the September uptrend to remain viable with a close above 1.4089 needed to mark uptrend resumption.” USD/CAD briefly registered an intraday low at 1.3927 before rebounding sharply higher with the advance stretching into confluent resistance today at 1.4189-1.42- looking for a reaction here with the immediate advance vulnerable while below.

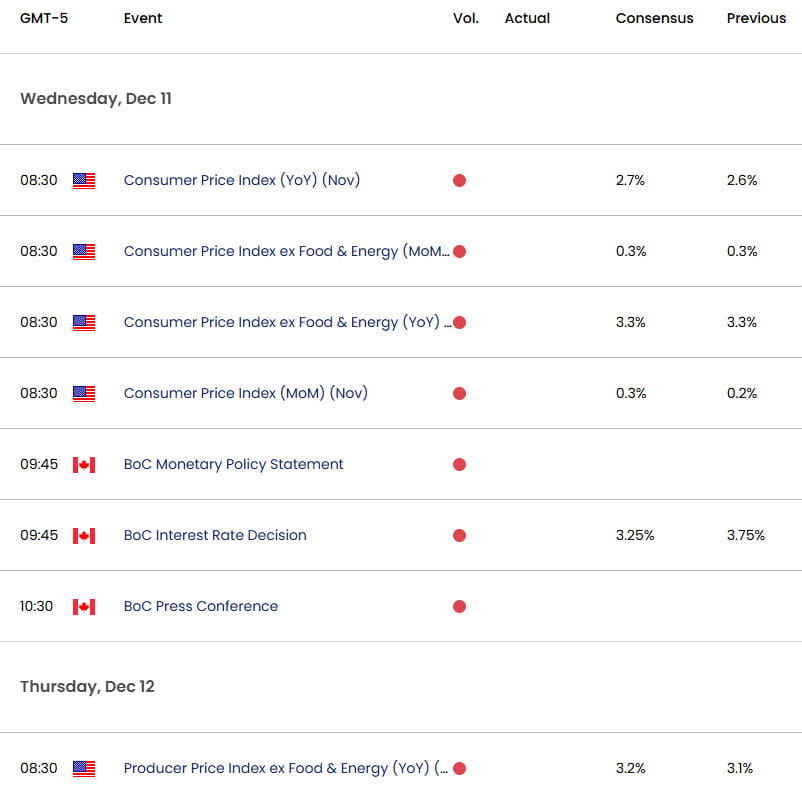

Canadian Dollar Price Chart – USD/CAD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Notes: A closer look at Canadian Dollar price action shows the USD/CAD continuing to trade within the confines of the ascending pitchfork we’ve been tracking off the September/October low. Note that the upper parallel further highlights resistance into the 1.42-handle and the focus is on a possible inflection off this threshold over the next few days.

A topside breach / close above would likely fuel another accelerated advance towards subsequent resistance objectives at the 61.8% extension of the 2021 advance at 1.4310 and the 88.6% retracement of the 2020 decline / 2020 high-week close (HWC) at 1.4350/57. Both level of interest for possible topside exhaustion IF reached.

Initial support now rests back at the 78.6% retracement at 1.0485 – a break below the median-line would threaten a larger correction within the broader September uptrend towards the objective monthly open at 1.4005 and 1.3978/90- a region defined by the 2022 high and the 2020 March weekly reversal close. We’ll reserve this threshold as our medium-term bullish invalidation level and a close below this pivot zone would suggest a more significant high was registered this week / a larger trend reversal is underway. Next major support consideration rests with the 2022 high-close / 2023 high at 1.3881/99.

Bottom line: USD/CAD has extended into confluent uptrend resistance with major event risk on tap tomorrow. From at trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops – losses would need to be limited to the median-line IF price is heading higher on this stretch with a close above 1.42 needed to fuel the next leg of the advance.

Keep in mind US CPI and the Bank of Canada (BOC) interest rate decision are on tap tomorrow. Markets participants are relatively split over the potential for 25 or 50 basis points- expect some volatility here. Stay nimble into the releases and watch the weekly close for guidance. Review my latest Canadian Dollar Weekly Technical Forecast for a closer look at the longer-term USD/CAD trade levels.

Key USD/CAD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Japanese Yen Short-term Outlook: USD/JPY Recovery at Trend Resistance

- Swiss Franc Short-term Outlook: USD/CHF Charge Uptrend Support

- British Pound Short-term Outlook: GBP/USD Bulls Emerge

- US Dollar Short-term Outlook: USD Bulls Eye Resistance Ahead of NFP

- Australian Dollar Short-term Outlook: AUD/USD Coils into Support

- Euro Short-term Outlook: EUR/USD Threatens Bear Market Rebound

- Gold Short-term Outlook: XAU/USD Recovery Eyes Pivotal Resistance

Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex