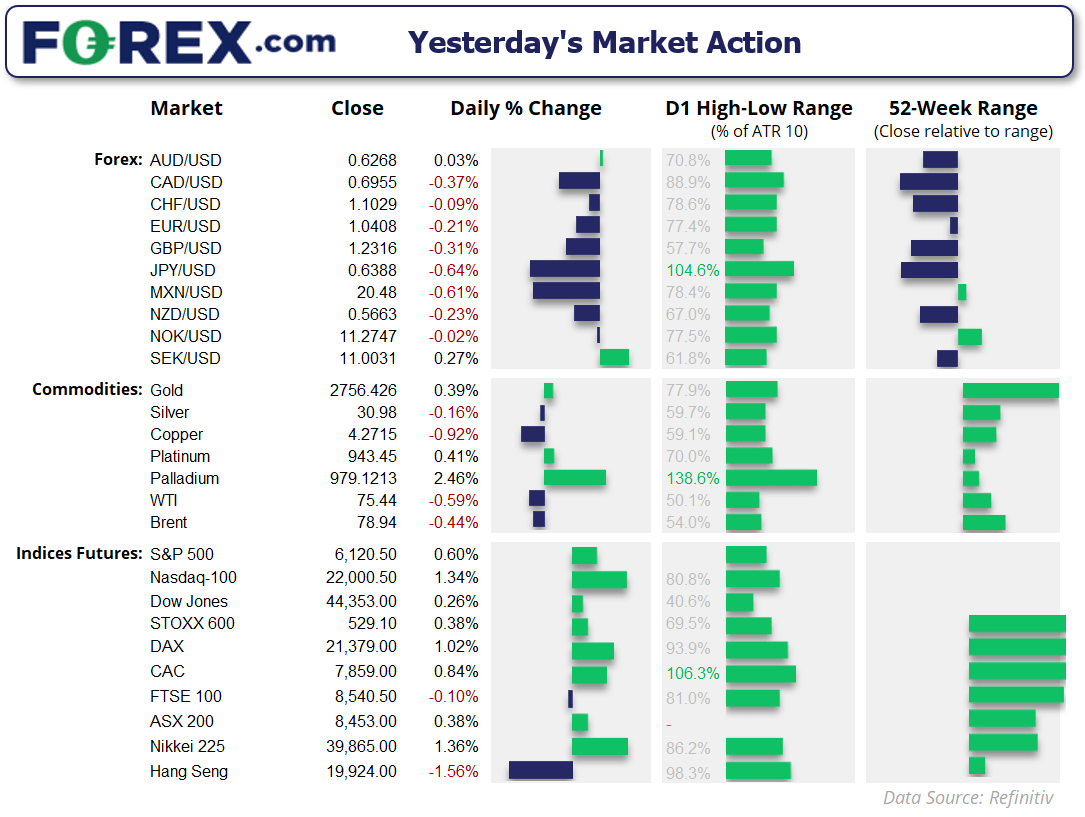

President Trump’s first full day in office was not met with the levels of volatility that headlines of the past few months would have suggested. With the exception of USD/JPY (which landed on its ATR), daily ranges for FX majors landed around 70% of their 20-day average. Gold, silver and copper were between 60% to 80% while Wall Street indices also fell short of their usual daily ranges.

Still, the S&P 500 closed within 4 points of its record high and printed an intraday record high. Although its small bearish pinbar on the cash market does not exactly wreak of a pending breakout, but it does make me wonder what could knock it from its perch.

Despite the lack of volatile carnage, AUD/JPY reached both of my upside targets based on the assumption of a bull-flag breakout, and while my bullish bias for AUD/USD is yet to spring into action, a move to the 0.6350 following a small pullback remains favoured.

We are likely in for another quiet Asian session looking at the calendar. And outside of a surprise US jobless claims report, may need to rely on the whims of Trump or headlines from the WEF to generate some volatility ahead of tomorrow’s BOJ report.

Economic events in focus (AEDT)

- 10:50 – JP trade balance

- 11:30 – AU business confidence

- 16:00 – SG CPI

- 19:00 – World Economic Forum Annual Meetings

- 22:00 – UK Industrial Trends Orders

- 00:30 – US Jobless Claims

Gold technical analysis:

The yellow metal has risen nearly 7% since the December low, yet I remain unconvinced it will simply take out the new high in one foul swoop. The US dollar index has found some stability once again at 107.55, and while gold technically closed above the December high, it lacked the enthusiasm of a decisively bullish breakout. A bearish divergence has also formed on gold’s daily RSI (2)

I’m not looking for a deep retracement for gold, but if the USD gains traction then it could prompt a bit of a shakeout towards 2077 – 2715 before it heads for the 2800 handle. But it is at these levels that we might see a bit more of a correction.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge