- Trump set to slap tariffs on Mexico, Canada and China

- FXTM’s EU50 ↑ 8% YTD, less than 4% away from records

- Trade war remains major risk to European equities

- Polymarket: 60% chance of tariff on Canada/Mexico by March

- Beyond Trump, EU data could impact EU50 via ECB cut bets

President Donald Trump is set to impose 25% tariffs on goods from Mexico and Canada on February 1st. A potential 10% tariff on Chinese imports is also in the mix.

The consequences of whether Trump delivers on his threats are huge for global markets.

If Trump’s tariffs lead to a trade war, this could crush risk assets and boost safe-haven demand.

While the week ahead is packed with top-tier data releases and corporate earnings, the tariff showdown could set the tone:

Saturday, 1st February

- Trump tariff deadline – Mexico, Canada, China

Monday, 3rd February

- AU200: Australia retail sales, building approvals

- CN50: China Caixin manufacturing PMI

- GER40: Germany HCOB Manufacturing PMI

- UK100: UK S&P Global Manufacturing PMI

- US500: US construction spending, ISM Manufacturing, Fed speak

Tuesday, 4th February

- NZD: New Zealand building permits

- US30: US factory orders, US durable goods

- NAS100: Alphabet earnings, Fed speak

Wednesday, 5th February

- CN50: China Caixin services PMI

- EU50: Eurozone HCOB Services PMI, PPI

- NZD: New Zealand unemployment

- SG20: Singapore retail sales

- USDInd: Fed speak

Thursday, 6th February

- AU200: Australia trade balance

- EUR: Eurozone retail sales

- GER40: Germany factory orders

- GBP: BoE rate decision

- US500: Amazon earnings, US initial jobless claims, Fed speak

Friday, 7th February

- CAD: Canada unemployment

- GER40: Germany industrial production

- JP225: Japan household spending

- TWN: Taiwan trade, CPI

- USDInd: US nonfarm payrolls, unemployment, University of Michigan consumer sentiment

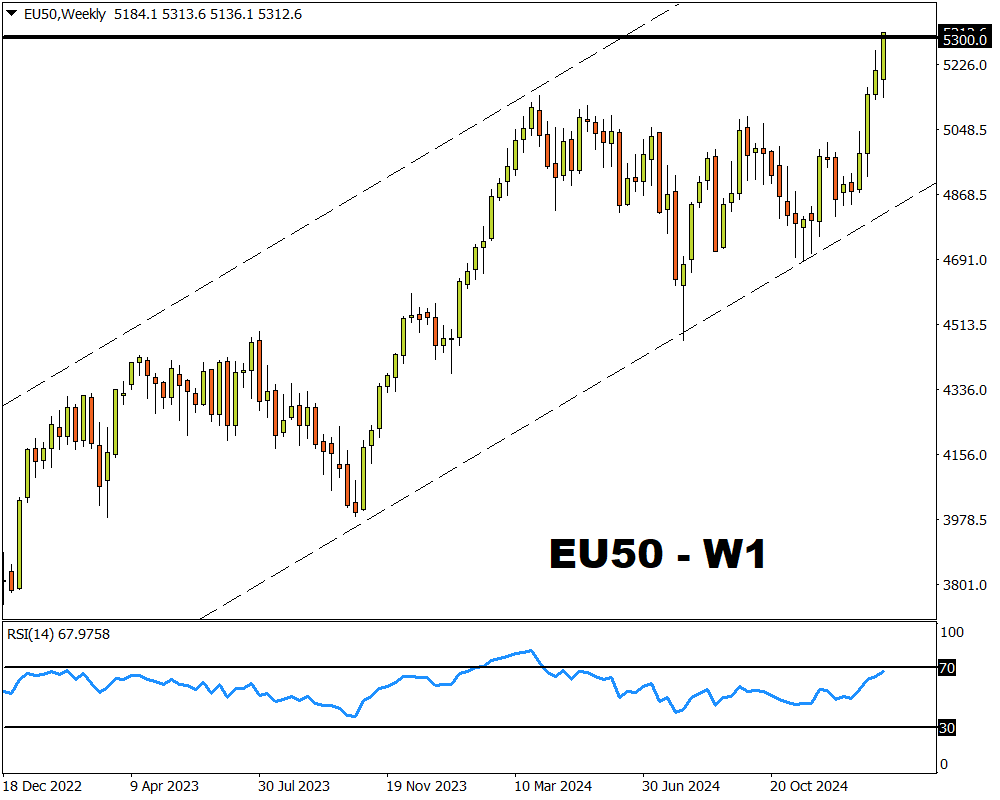

Our spotlight shines on FXTM’s EU50 which recently has touched its highest level since the year 2000.

The Index has gained over 8% year-to-date, boosted by a sharp rally in technology stocks and the European Central Bank’s 25bp rate cut on Thursday.

Note: FXTM’s EU50 tracks the underlying Euro Stoxx 50 index - which represents the performance of the 50 largest blue-chip companies operating within eurozone nations.

In our 2025 market outlook, we highlighted how Trump’s trade war could be a major risk to European equities.

Although Europe has been spared so far, repeated threats have been made and possible tariffs on China could trickle back down to Europe.

With all the above discussed, here are 3 forces that may jolt the EU50 next week:

1) Trump’s tariff deadline – Feb 1st

President Donald Trump’s deadline for slapping tariffs on Mexico, Canada and China is roughly 24 hours away.

If Trump moves ahead with his threats, this could spark risk aversion as trade war fears fuel concern over the global economy.

One thing to keep in mind is that Canada, Mexico and China have a window to negotiate with Trump before the tariffs take effect.

According to Polymarket, there is a 60% chance of 25% tariffs on Canada and Mexico being imposed by March 2025.

- FXTM’s EU50 could see a selloff if Trump slaps tariffs with the downside intensified by fading hopes around negotiations.

- Should Trump push the deadline, this could trigger a relief rally across markets – boosting FXTM’s EU50.

2) Key EU data

Top-tier data from the largest economy in Europe could shape expectations around ECB rate cuts.

On Thursday 30th January, the ECB cut interest rates by 25 basis points and warned of headwinds to the Eurozone economy.

Traders are currently pricing in another 25 bp ECB cut by March with the odds of another move by April at 87%.

Should incoming data from Germany and across Europe support the case for deeper cuts in 2025, this could support FXTM’s EU50.

3) Technical forces

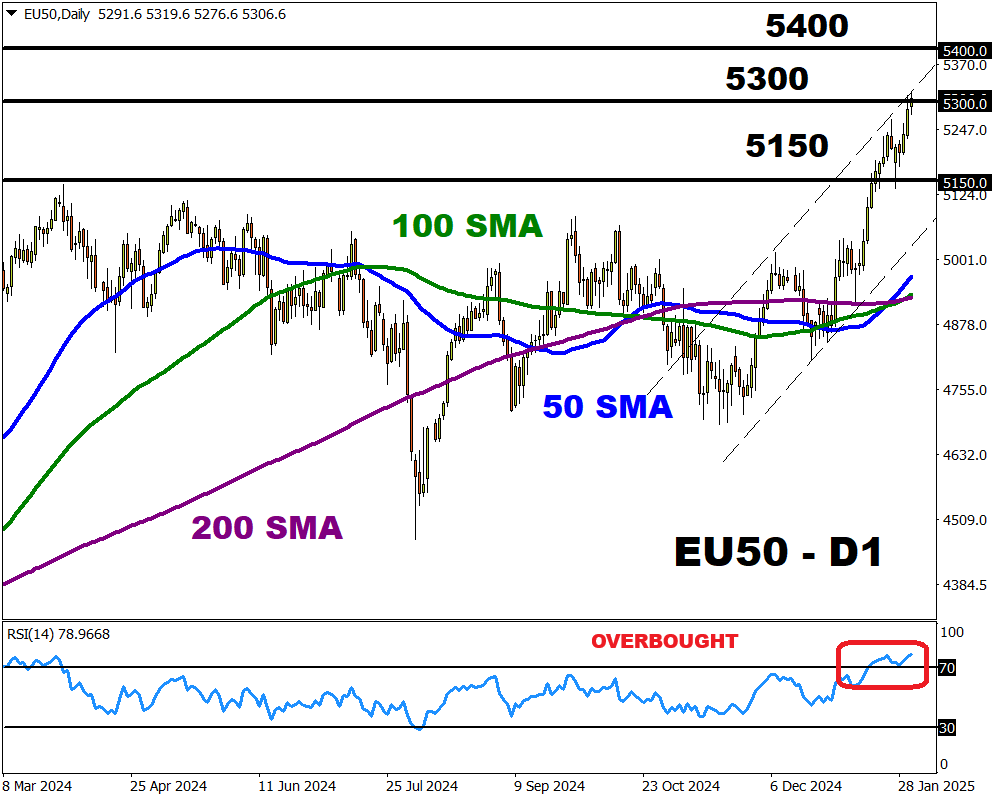

Prices remain firmly bullish on the daily charts. The candlesticks are trading firmly above the 50, 100 and 200-day SMA but the RSI is deep within overbought territory.

Note: FXTM’s EU50’s all-time high is at 5522 – created in March 2000.

- A solid daily close above 5300 may send prices toward the next psychological level at 5400.

- Should 5300 prove reliable resistance, prices may slip back toward 5150.