- Bitcoin ↓ 4.2% month-to-date

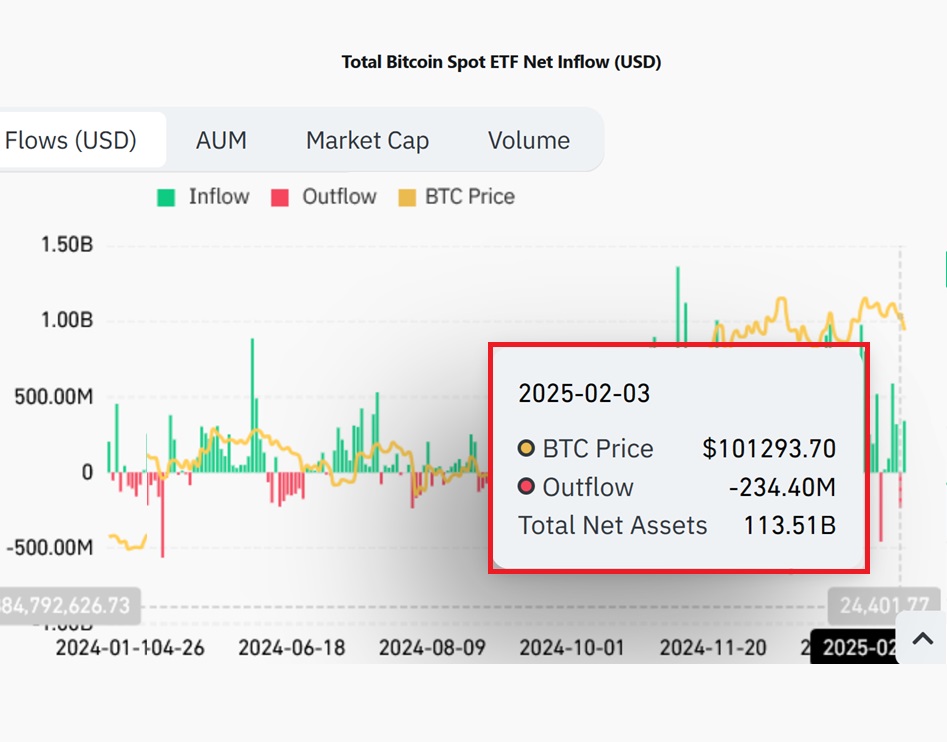

- Trade fears trigger $235 million outflows from Bitcoin ETFs

- Over past year NFP triggered moves of ↑ 3.2% & ↓ 2.3%

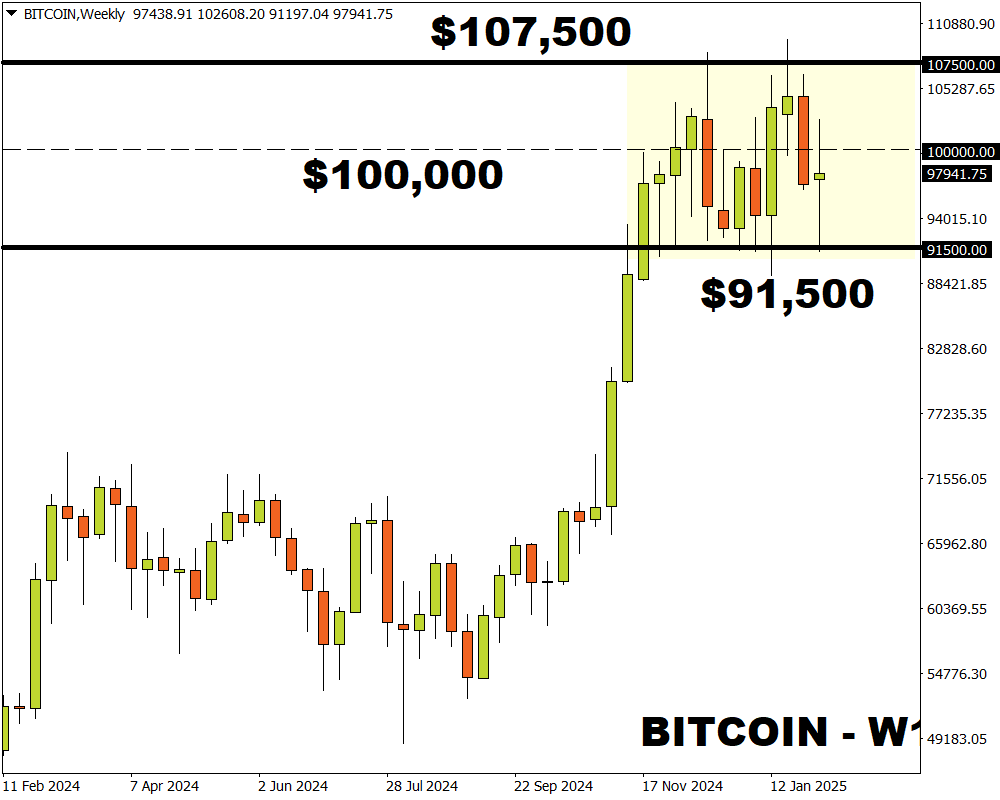

- Trapped in W1 range: support $91,500, resistance $107,500

- Key level of interest: $100,000

It's been a rollercoaster week for Bitcoin.

Over the weekend, the “OG” crypto slumped 5% after Trump slapped 25% tariffs on Mexico and Canada, in addition to 10% tariffs on China.

Prices staged a sharp rebound on Monday as investors cheered his decision to delay 25% tariffs on Canada and Mexico for a month after successful negotiations.

However, Bitcoin and other cryptos tumbled yesterday amid sizzling trade tensions between the world’s two largest economies.

Note: Trump’s 10% tariff on China went into effect on Tuesday 4th February. China has announced retaliatory tariffs against the US, set to take effect on February 10th.

Trump’s tariff drama has left markets uneasy, haunting investor attraction for riskier assets.

This was reflected in the massive $235 million outflows from Bitcoin ETFs on Monday. However, a whopping $341 million in inflows was recorded on Tuesday thanks to tariff hopes.

Source: Coinglass

Beyond trade developments, the incoming NFP report on Friday could spell more volatility for Bitcoin.

The US economy is expected to have created 170,000 jobs in January, compared with the 256,000 seen in December. Average wages are expected to cool 3.8% YoY while the unemployment rate to remain unchanged at 4.1%.

A disappointing jobs print could strengthen the argument around lower US interest rates, boosting Bitcoin which has shown sensitivity to US rates. The same can be said vice-versa.

Note: Traders are currently pricing in a 40% probability of a 25bp rate cut by May with this jumping to 80% by June.

Over the past year, the US jobs report has triggered upside moves of as much as 3.2% or declines of 2.3% in a 6-hour window post-release.

It’s not only Bitcoin that may see big swings on Friday…

- AVALANCH: ↑ 4.0 % or ↓ 4.5%

- CHAINLINK: ↑ 4.0 % or ↓ 4.5%

- DOGECOIN: ↑ 4.0 % or ↓ 4.1%

- CARDANO: ↑ 3.8% or ↓ 4.4%

- BITCOINC: ↑ 3.8 % or ↓ 4.0%

- SOLANA: ↑ 3.4 % or ↓ 3.1

- POLYGON: ↑ 3.4% or ↓ 4.0%

- RIPPLE: ↑ 3.0% or ↓ 3.7%

- ETHEREUM: ↑ 3.0% or ↓ 3.3%

- LITECOIN: ↑ 2.9 % or ↓ 4.0%

All 10 cryptos listed above are offered by FXTM as Crypto CFDs.

Technical outlook…

Bitcoin remains trapped within a range on the weekly charts with support at $91,500 and resistance at $107,500.

Prices are under pressure on the daily charts, trading below the 21 and 50-day SMA.

- A solid close above the 50-day SMA at $99,000 could trigger a move back toward the psychological $100,000 level and 21-day SMA at $103,000.

- A decline below the 100-day SMA at $94,500 may trigger a selloff toward $91,500 and $90,000.