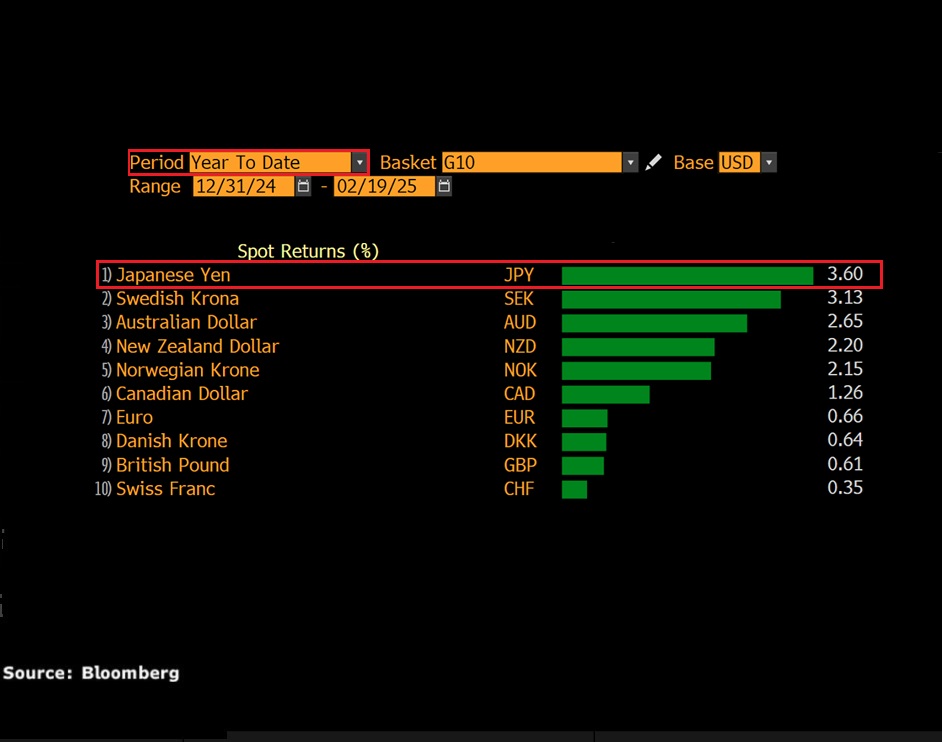

- Yen best performing G10 currency YTD

- USDJPY ↓ 2% MTD ahead of Japan CPI

- Traders see 62% chance BoJ hikes by June

- Japan CPI sparked moves of ↑ 0.3% & ↓ 0.4% over past year

- Bloomberg FX model: 74% USDJPY – (149.77 – 153.63)

The Japanese yen is the best-performing G10 currency in the year to date.

It’s gained 3.6% against the dollar, with prices trading around 151.60 as of writing.

Appetite for the Yen has been boosted by tariff fears with positive Japan data and hawkish BoJ officials fuelling the currency’s upside gains.

Note: Japan published stronger-than-expected GDP figures on Monday. GDP Annualized rose 2.8% in Q4 compared to the 1.1% estimate.

The yen could experience more volatility due to the FOMC meeting minutes this evening and Japan CPI report on Friday.

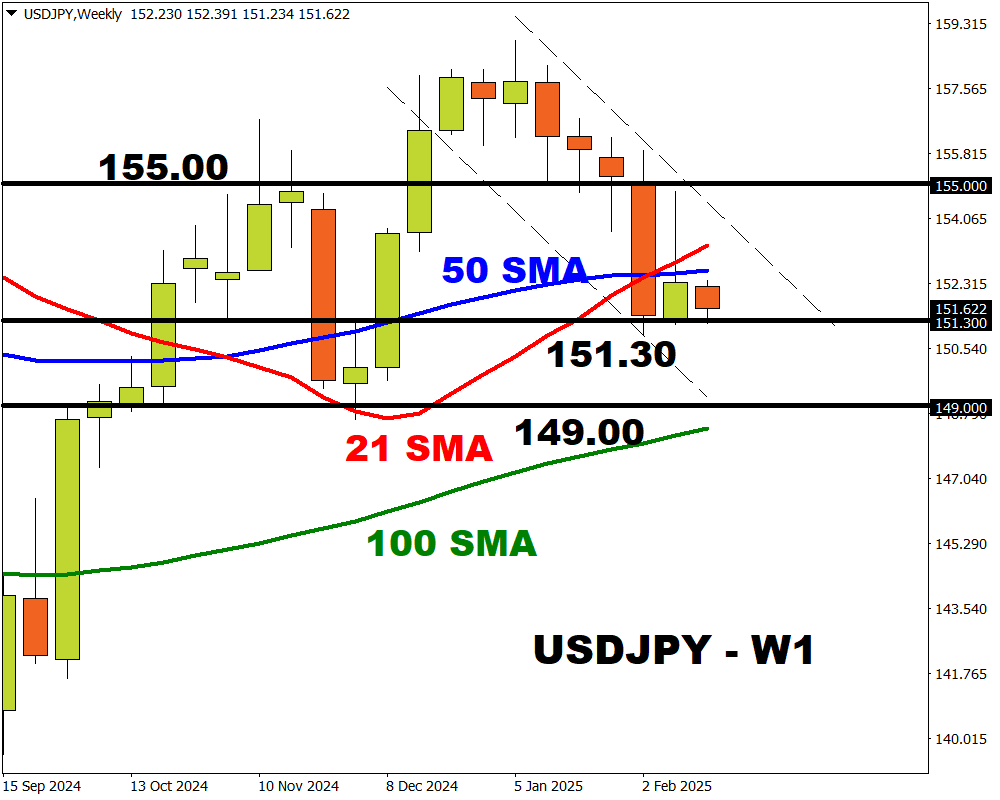

Taking a quick look at the technicals, prices are under pressure on the weekly charts with weakness below the 21 & 50-week SMA.

Considering how the Yen is expected to be the most volatile G10 currency versus the USD over the next one-week, this could provide fresh trading opportunities.

Here are 3 things that may trigger big moves:

1) FOMC meeting minutes

Fed Chair Jerome Powell has repeatedly stated that the Fed is in no rush to cut interest rates.

With consumer prices rising more than expected in January and Trump’s tariff drama fuelling inflation fears, the Fed is likely to adopt a cautious approach.

Traders are currently pricing in a 50% probability of a 25bp Fed cut by June with a cut only priced in by September.

- If the minutes reflect this caution, the dollar could appreciate – boosting USDJPY.

- However, any whiff of hawks could lend the dollar some support – weakening USDJPY.

Over the past 12 months, the Fed minutes have triggered upside moves of as much as 0.2% or declines of 0.3% in a 6-hour window post-release.

2) Japan January CPI report

The consumer price index, which measures headline inflation could offer clues about when the BoJ will hike rates.

Annual inflation is expected to jump 4.0% from 3.6% in the previous month, while the core reading (excluding food and energy) is seen rising 2.5% to 2.4%.

Traders are currently pricing in a 62% probability of a 25bp BoJ hike by June with a hike fully priced in by September 2025.

If the incoming CPI report triggers major shifts to these bets, it could translate to yen volatility.

Over the past 12 months, the Japan CPI has triggered upside moves of as much as 0.3% or declines of 0.4% in a 6-hour window post-release.

3) Technical forces

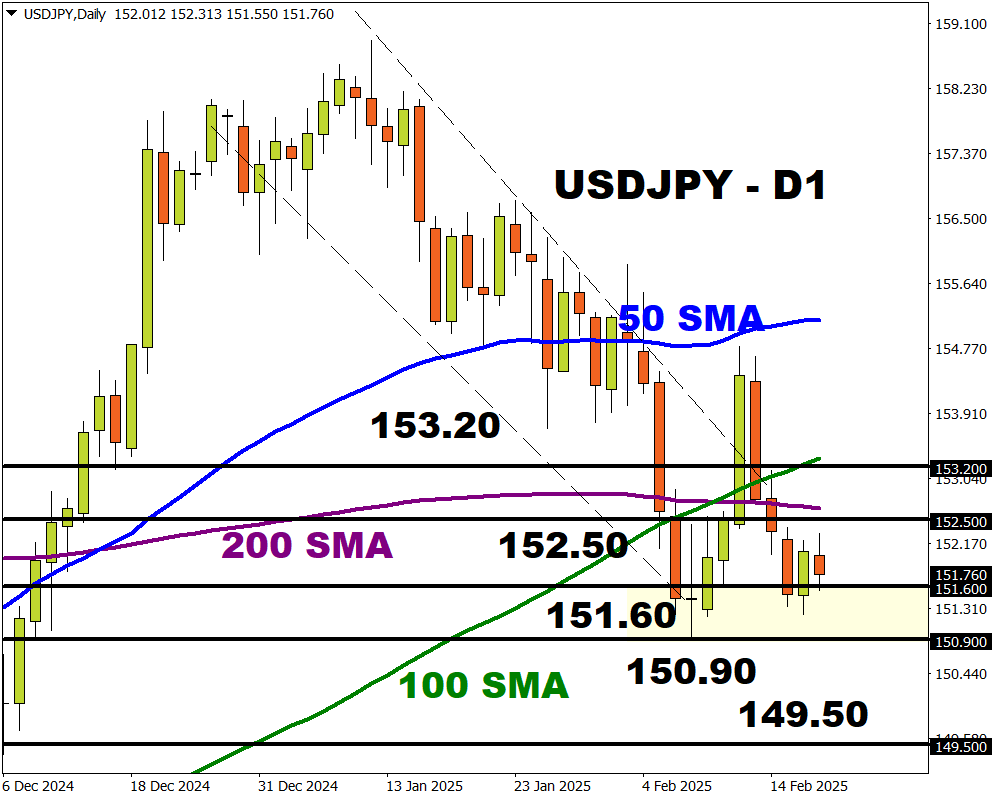

Looking at the charts, the USDJPY is down over 2% month-to-date, trading around support at 151.60.

- Sustained weakness below 151.60 could open a path toward 150.90 and 149.77 – the lower bound of Bloomberg’s FX model.

- Should 151.60 prove reliable support, this may trigger a rebound toward the 200-day SMA, 100-day SMA and 153.63 – the upper bound of Bloomberg’s FX model.

Bloomberg’s FX model points to a 74% chance that USDJPY will trade within the 149.77 - 153.63 range over the next one-week period.