- Yen dominates G10, best performer this week

- Oil rides on supply risk, ↑ over 1.7% week-to-date

- Gold ↑ almost 5% MTD, 2% away from $3000 milestone

Caution gripped US markets on Thursday after weak forecasts from Walmart Inc. dented risk sentiment.

In the FX space, the yen maintained its grip on the throne amid rising bets around the BoJ hiking rates sooner rather than later. Oil prices remain supported by supply concerns while gold’s $3000 dream could become a reality.

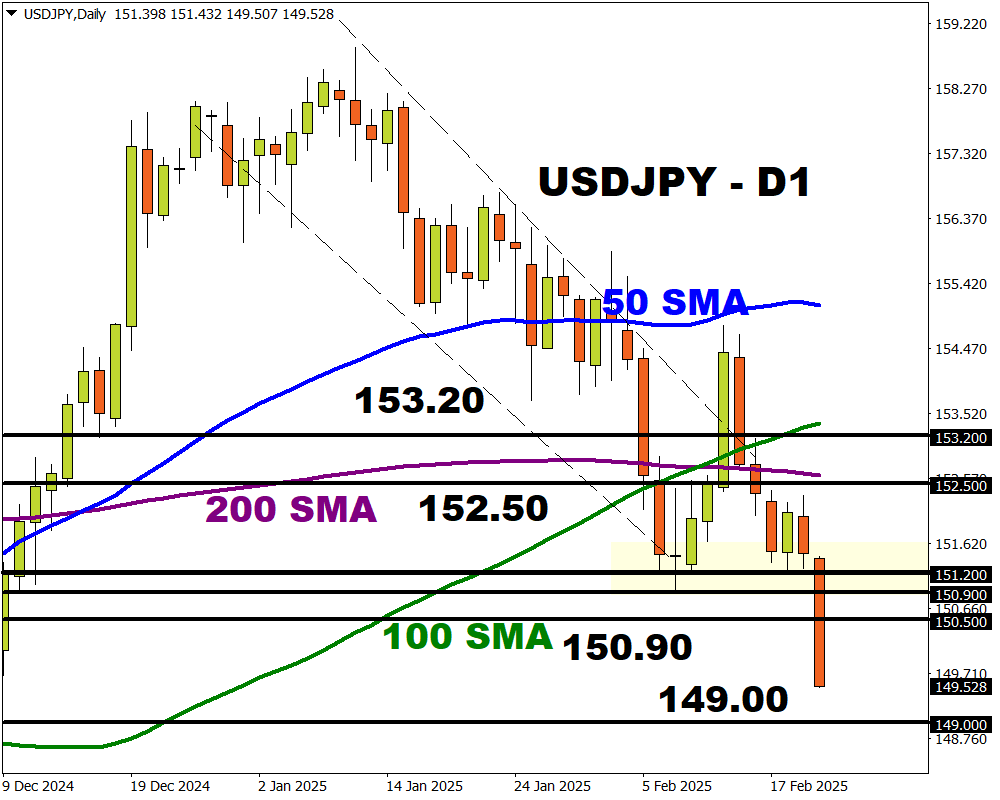

Yen dominates G10 space

The Yen is the best-performing G10 currency this week, gaining over 1.5% against the dollar.

Appetite for the currency has been boosted by market expectations around the BoJ hiking interest rates sooner than initially expected. At the end of last week, traders were pricing in less than a 55% probability of a BoJ hike by June. This has now jumped to nearly 60% ahead of the CPI figures on Friday early trading.

As covered earlier in the week, signs of rising inflationary pressures in Japan could reinforce BoJ hike bets – ultimately boosting the USDJPY.

Prices are already bearish on the daily charts with the next key level of interest at 149.00.

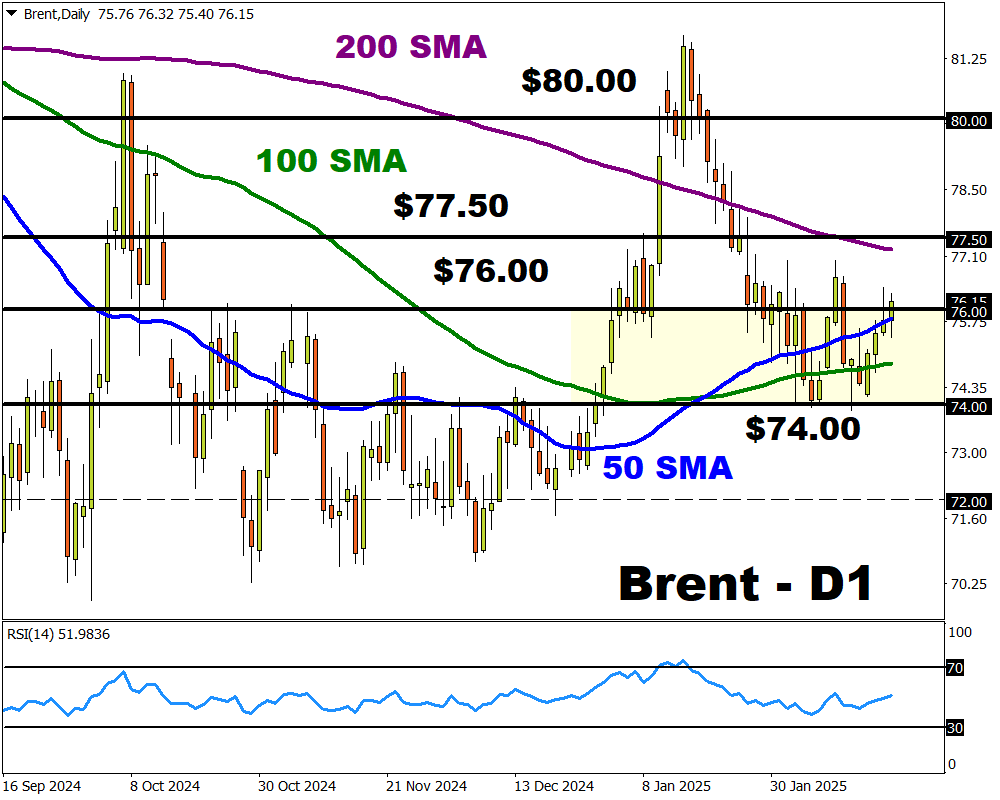

Oil bulls ride on supply risk

Oil benchmarks have gained over 1.7% this week due to concerns about tighter supply in the markets.

A weaker dollar, reduced oil flows through a key Kazakh pipeline and hopes of a possible OPEC+ output hike delay continue to fuel upside gains. Nevertheless, Trump’s trade drama and concerns over the global economy could obstruct bulls down the road.

Looking at the charts, Brent is testing resistance at $76. A daily close above this level may open a path toward the 200-day SMA at $77.20.

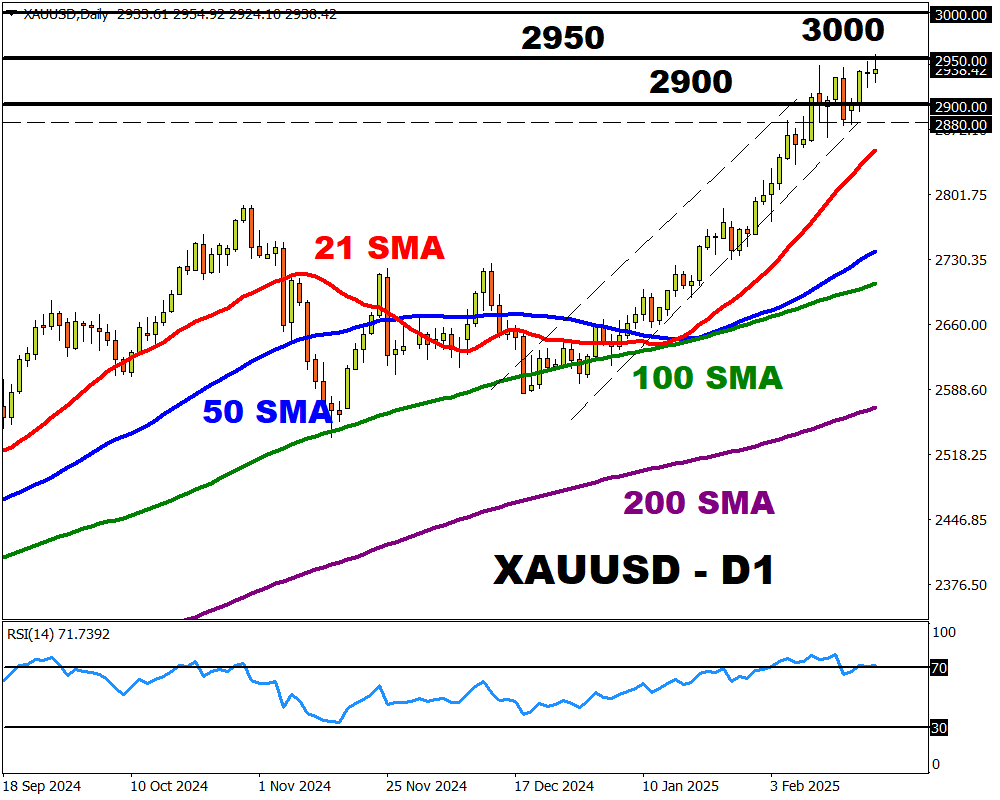

Gold kisses fresh all-time high

Gold has done it again, hitting a fresh all-time high at $2954.92 this morning. The precious metal continues to draw strength from Trump’s trade drama with a weaker dollar feeding the bullish momentum. Prices are up almost 5% month-to-date, pushing 2025 gains to nearly 12%.

Technicals show that bulls are certainly in control, but prices are heavily overbought.

- Sustained weakness below $2950 could trigger a decline back toward $2900.

- If bulls can push prices beyond $2950, the next key level will be the milestone of $3000.