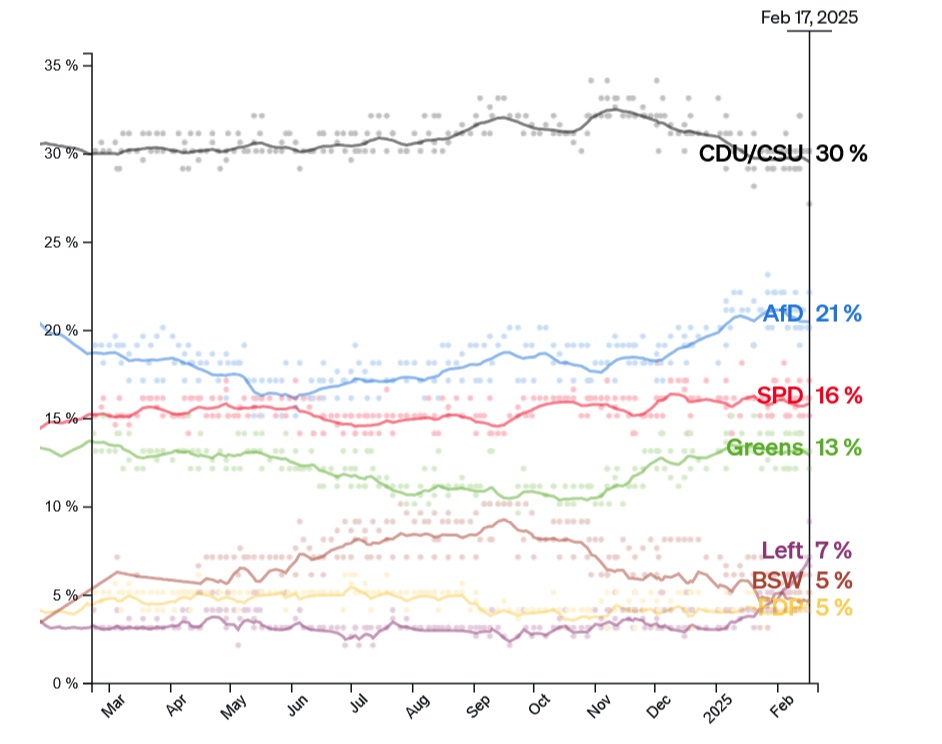

- Opinion polls point to CDU/CSU return to power

- GER40 ↑ 12% YTD, one of best performers in FXTM universe

- Fragmented parliament outcome could spark GER40 selloff

- Beyond politics, German data to move GER40 via ECB cut bets

- Technical levels: 22955.9, 22000, 21600

Europe's largest economy goes to the polls on Sunday 23rd February.

And the outcome will shape its political and economic outlook over the next few years.

Beyond Germany’s snap election, the week ahead is packed with key data and corporate earnings from across the globe:

Saturday, 22nd February

- US President Donald Trump speech

Sunday, 23rd February

- GER40: German federal election

Monday, 24th February

- GER40: Germany IFO business climate

- EUR: Eurozone CPI

- SG20: Singapore CPI

- UK100: BOE Deputy Governors Clare Lombardelli and Dave Ramsden speech

Tuesday, 25th February

- GER40: Germany GDP

- MXN: Mexico international reserves, current account

- TWN: Taiwan industrial production

- USDInd: US consumer confidence, Fed speech

Wednesday, 26th February

- TWN: Taiwan GDP

- NAS100: Nvidia earnings, Fed speech

- G-20 finance ministers and central bankers meet in Cape Town

Thursday, 27th February

- EUR: Eurozone consumer confidence, ECB minutes

- MXN: Mexico unemployment, trade balance

- SPN35: Spain CPI

- US500: US GDP, initial jobless claims, Fed speech

Friday, 28th February

- CAD: Canada GDP

- FRA40: France CPI, GDP

- GER40: Germany CPI, unemployment

- JP225: Japan Tokyo CPI, industrial production, retail sales

- USDInd: US PCE inflation, income and spending, Fed speech

What is happening?

Millions of voters in Germany will be heading to the polls on Sunday 23rd February to elect a new parliament.

Polls close at 6 pm, after which the first election result projections are published.

The lowdown…

Germany’s ruling coalition collapsed in November 2024 after Chancellor Olaf fired a key minister and called for a no-confidence vote. After losing this vote in December, this triggered a snap general election for 23rd February.

Who are the major players?

- CDU/CSU = Christian Democratic Union /Christian Social Union

- AfD = Alternative for Germany

- SPD = Social Democratic Party

- Greens = Green Party

- Left = Left Party

- BSW = Bündnis Sarah Wagenknecht

- FDP = Free Democratic Part

According to opinion polls, the CDU/CSU alliance is leading with around 30% support and is likely to return to power.

Note: No party will have enough seats to form a government alone, so a coalition needs to be formed that makes up more than 50% of the seats in the Bundestag.

Source: Politico

What does this mean?

A new government led by the CDU/CSU is seen as a market-friendly outcome with a stable coalition easing economic uncertainty.

Investors are banking on the prospect of lower corporate taxes, falling energy prices and less bureaucracy under their leadership to revive growth in Europe’s largest economy.

What could go wrong?

The election outcome is a fragmented parliament, resulting in fresh political uncertainty and exposing Germany’s economy to downside risks.

How will this impact European markets?

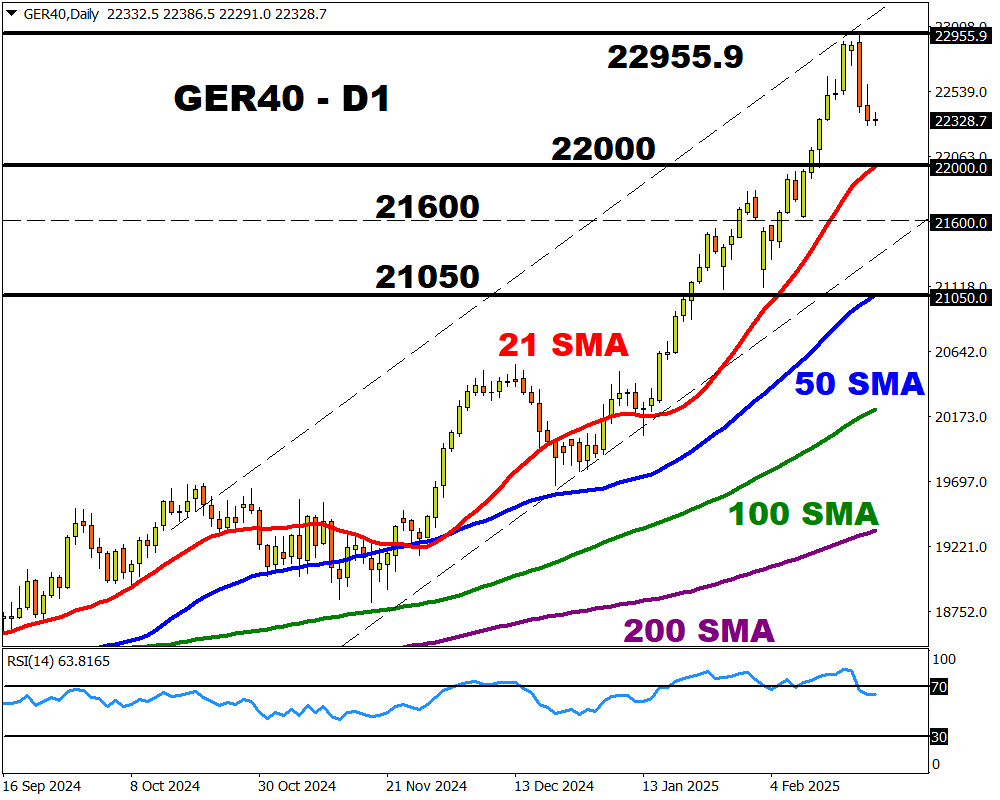

FXTM’s GER40 which tracks the benchmark DAX index has gained 12% year-to-date.

These gains have been fuelled by hopes around the next German government enforcing much-needed reforms to jumpstart Germany’s economy.

In the FXTM universe, the GER40 has outperformed most of its global peers:

- CHINAH: +18.6%

- HK50: +17.8%

- GER40: +12%

- SPN35: +11.8%

- EU50: +11.5%

- FRA40: +10%

- NETH25: +6.8%

- UK100: +6%

- AU200: +5.8%

- US500: +4%

- NAS100: +5%

- TWN: 2.7%

- RUS2000: +1.4%

- JP225: -2.8%

The GER40 which recently hit a fresh all-time high could see extended gains on a market friendly election outcome.

An unfavourable election outcome could spark a selloff as uncertainty over Germany’s political landscape fuels risk aversion.

German data dump could mean more volatility

Beyond politics, top-tier data from Germany throughout the week could bring more trading opportunities on the GER40.

On Monday, the latest IFO business climate figures will be published, followed by GDP on Tuesday and inflation report on Friday.

Traders are currently pricing in a 97% probability of a 25bp ECB rate cut by March with the odds of another cut by April at 62%.

- The GER40 could push higher if data boosts bets around faster ECB rate cuts.

- Should data cool bets around ECB rate cuts, the GER40 could trade lower.

Looking at the technical…

The GER40 is firmly bullish on the daily charts as there have been consistently higher highs and higher lows. Prices are trading above the 21, 50, 100 and 200-day SMA.

- Should the 21-day SMA prove reliable support, this may trigger a rebound toward 22500, the all-time high at 22955.9 and beyond.

- A break below 22000, may trigger a selloff toward 21600 and 21050.

By the way…

FXTM also offers the GER40 as a futures CFD named GER40H5 on our platform.

Trading futures as CFDs offer several advantages, particularly for longer-term traders. One of the biggest is the swap-free element – meaning you won’t need to pay swaps or related charges for keeping your position open overnight.

Click here for more information on futures trading with FXTM.