ACY Capital Review (2025)

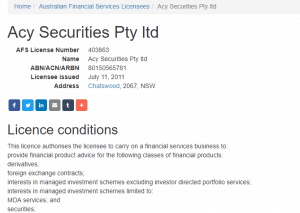

Regulator

What is ACY Capital?

ACY Capital is a Sydney, Australia based Forex and CFD trading provider which along with main purpose offering education on a range of trading techniques and strategies developed for both novice traders or experienced ones, retail or corporate.

The company brings trading service solutions with an aim to support those who would like to be successful in the market, by the open access to everything that is needed. Since the beginning of their operation, ACY is in cooperation with OANDA as a provider of educational services, which is one of the biggest world Forex broker. However, due to the company expanding, ACY serves an additional office in Shanghai and Shenzhen, China, which brings an efficient service to customers even further.

The ACY Capital provides execution through No Dealing Desk model, performed with no dealer intervention with no requotes through streamed real time prices presented with tight forex spreads, high speeds and low latency.

ACY Capital Pros and Cons

ACY Capital provides quality trading conditions, education and selection of platfroms. Spreads are good and account opening is fully digital.

Negative points are slightly limited instrument range, also proposal vary according to the entity and there is no 24/7 support.

10 Points Summary

| 🏢 Headquarters | Australia |

| 🗺️ Regulation | ASIC |

| 🖥 Platforms | MT4, MT5 |

| 📉 Instruments | Forex, Gold and Silver CFDs, Index CFDs, Oil or Gas CFDs |

| 💰 EUR/USD Spread | 0.8 pips |

| 🎮 Demo Account | Provided |

| 💳 Minimum deposit | 100 US$ |

| 💰 Base currencies | AUD, USD |

| 📚 Education | Huge educational department |

| ☎ Customer Support | 24/5 |

Is ACY Capital safe or a scam

No, ACY Capital is not a scam, it provides safe trading environment since ACY Capital is an ASIC (Australia) authorized broker which complies with the requested regulations, learn more why trade with ASIC regulated brokers by the link.

In accordance with regulatory requirements, all client funds are kept in segregated accounts of the tier-one bank that ensures that the funds can’t be used for any other purpose.

Also, the broker complies with strict policies in regards to operation, payments and all provided transactions ensuring trustable operation. Yet, ACY went even further while provides Professional Indemnity Insurance for up to 2.5M$ in any claim.

Leverage

While trading with ACY Capital you are able to operate with powerful tool leverage, which increases your potential gains through its possibility to multiple initial accounts. Yet, learn how to use leverage correctly, as leverage may increase your potential loses as well.

While trading with ACY Capital you are able to use high leverage levels like 1:200, 1:400 or 1:500 for professional proved traders, since Australian regulation ASIC still allows these ratios to be used.

Trading Instruments

Margin trading including Forex with 40+ currency pairs, Gold and Silver CFDs with commission free super-tight spreads, Index CFDs and Oil or Gas CFDs. Through their established ECN/ STP execution model you will get at truly competitive costs with an averaged spread EUR/USD 0.8 pips, Gold 0.20$ and Oil 0.025.

In addition, the broker supports its clients with the full range of services that includes a huge educational department that was timely rewarded by awards. The daily market analysis videos and reviews, market news, customizable courses and a variety of advanced educational tools.

Accounts

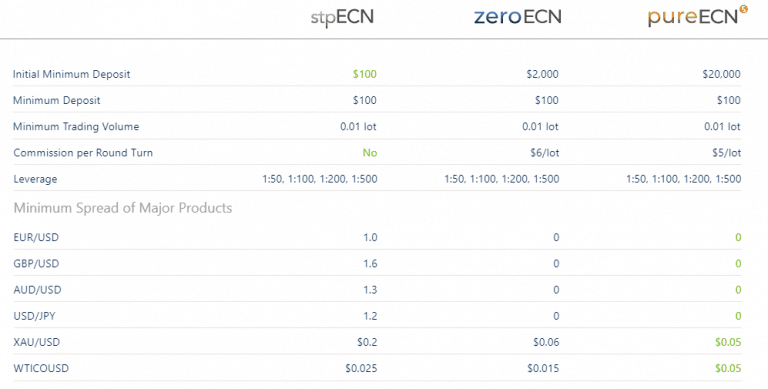

ACY developed three account types with a choice between an account with spreads only basis through stpECN account or with a commission by zeroECN and pureECN accounts. Account types are not defined only by the technology they use and more competitive pricing according to the trading size, but also with a deposit and qualification requirements.

Fees

ACY Capital pricing is different depending on account type, mainly built into a spread, also we compare below full costs including funding fees, inactivity fee, etc.

| Fees | ACY Capital Fees | Skilling Fees | BDSwiss Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Average | Low | Average |

Spreads

ACY Capital spreads presented by the account type you trade with, as an example you may refer to the table below for averaged spread offering, which is starting from 0 pip spread. There is no commission for stpECN Account, while zeroECN Account includes the commission fee of $6 USD per lot and pureECN Account charges fee of $5 USD per lot.

Also, always consider rollover or overnight fee as a cost, which is charged on the positions held longer than a day. As well you may compare fees to another popular broker Pepperstone.

| Asset | ACY Capital Spreads | Skilling Spread | BDSwiss Spread |

|---|---|---|---|

| EUR USD Spread | 1 pip | 1 pip | 1.5 pip |

| Crude Oil WTI Spread | 0.025$ | 7 | 6 |

| Gold Spread | 40 | 59 | 25 |

MAM accounts

For corporate clients or managers, ACY developed a range of MAM or PAMM accounts, that brings a unique solution for traders who are managing multiple accounts simultaneously that makes management an easy process. The accounts comply with an MT4 platform through flexible distribution and trading performance managed through an intelligent allocation model.

Trading Platforms

As a majority of technological forex companies, the ACY Capital chooses to mainstay at industry leader MetaTrader4. MT4 offers one of the best possible experiences in trading through one-click trading option, automatic trading systems that are performed with the support of EAs, risk controls and a variety of powerful functions.

The platform provides real-time experience through the powerful charts feature, which MT4 is famous for along with built-in free technical indicators to support various trading tactics with real-time requotes.

You may also use different versions of the platform that are suited for each one needs via desktop or web versions, along with mobile applications. Moreover, ACY Capital supports newer version MT5 too, which brings even more sophisticated possibilities on trading performance and offers truly competitive conditions for various strategies.

Last, but not the least is a range of contests and competitions that ACY Capital held on a regular basis allowing you to learn and polish skills with interesting opportunities and even gain very valuable prices. Tack the most recent contests through the official website to engage into one of them.

Deposits and Withdrawals

What is also great, ACY made account management easier by its developed CLOUDHUB, which is a client portal with a variety of services to both retail and corporate clients. The HUB allows to monitors the account performance, conduct transactions and view the statistical data.

For the funding methods themselves, there are various payment options which accept Credit/debit card, Fasapay/Duko Wallet, Skrill, China Union Pay and Bank Transfers (incl. Internet Banking Transfer)

ACY Capital minimum deposit

ACY Capital minimum deposit is 100$ at the beginning, which also depend on the account type you are planning to trade with.

ACY Capital minimum deposit vs other brokers

| ACY Capital | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawal

Traders can withdraw from ACY Capital by submitting a withdrawal request at any time, while withdrawal options of ACY Capital don’t charge for funding account by bank transfer. However, for withdrawals, International Transfer (Your receiving bank account is outside of Australia) will incur $25 USD service charge per withdrawal, Skrill – 3% merchant fee per withdrawal, yet free withdrawal allowed for Australia local bank transfer up to three times per month.

Conclusion

Final thoughts about ACY Capital concludes a good broker customer-centric online trading provider. As long as the ACY is an ASIC regulated broker, there are no doubts about their compliance with the laws and reliability. Also, there is extensive education developed with good level of expertise. STP trading access conducts offering through the competitive, the most common markets and allowance to use any suitable strategy through a quite low spread.