InterTrader Review (2026)

Regulator

What is InterTrader?

The InterTrader brokerage company was formed in 2012 with the main idea to provide fair, flexible and market-neutral trading. Trading execution is done by mirroring into the underlying market every position that client opens, while the company covers its risks hence you execute in a transparent way.

Unlike the traditional market-maker model, the client and the broker are not on opposite sides as with its market-neutral execution, the company loses when the client does, for this reason, InterTrader interested in client’s wins as well.

InterTrader Pros and Cons

InterTrader is a secure broker with easy account opening and flexible trading conditions. We admit good technology solutions also availability of social trading and low spreads.

On the negative side, there is no 24/7 support and good education, also trading instruments are limited.

10 Points Summary

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA |

| 🖥 Platforms | InterTrader, MT4, Sigma Trading |

| 📉 Instruments | Major trading instruments, Forex, Indices, Cryptocurrencies CFDs |

| 💰 EUR/USD Spread | 0.6 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | 0 US$ |

| 💰 Base currencies | Several currencies available |

| 📚 Education | Provided |

| ☎ Customer Support | 24/5 |

What type of broker is InterTrader?

All trader’s orders are anonymous so you interact with the market by placing orders inside the market spread. Therefore with InterTrader your trading costs are built into a spread while prices provided from the interbank and aggregated in liquidity pool that provides access to deep liquidity.

Or while trading forex CFDs on MT4 with the market price, a small additional commission will be paid per trade. On the web-based platform, and for spread betting and non-forex CFDs on MT4, this charge is added to the market price – the spread.

Awards

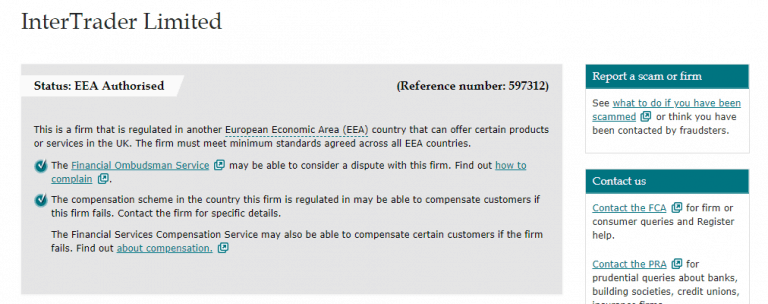

Is InterTrader safe or a scam

No, InterTeader is not a scam, it a regulated broker by toptier FCA with low-risk trading.

InterTrader is a trading name of InterTrader Limited that is owned and controlled by GVC Holdings PLC. While the GVC form one of the world’s largest listed multinational sports betting and online gaming companies listed on the London Stock Exchange, its entity InterTrader Limited authorized and regulated by the Gibraltar Financial Services Commission.

Along with that, the broker is fully regulated and conducts its services by the Financial Conduct Authority in the UK (Also read about UK headquartered Exness broker). With this model, the company maintains high standards and combined flexibility appropriate to any jurisdiction.

The security of client funds is essential to any customer, all transactions are handled responsibly and securely. All client funds transfer to InterTrader securely held in a segregated account, in accordance with the regulator’s money rules. Also, every customer protected by the Gibraltar Investor Compensation Scheme (GICS), up to €20,000 per client and an additional parental guarantee from bwin.party holdings Ltd.

Leverage

Since the InterTrader broker delivers its service through sharp respective regulatory guidelines of FCA, the allowed leverage levels depending on the specific statement the regulation provide. This means that the main entity of InterTrade may offer maximum leverage up to 1:30 for Forex instruments, 1:20 for non-major currency pairs, 1:5 for Stocks etc.

These levels were set recently due to a fact that FCA and European regulation significantly lower the leverage proposals as recognized potential high risks on using leverage of high ratios. Therefore, make sure to learn how to use leverage smartly and apply it in the best manner to your trading strategy.

Account types

The trading accounts at InterTrader categorized by the platform therefore brings Web and MT4 account types. Both accounts are offered on NDD model with tight spreads and available for spread betting.

Fees

InterTrader trading costs and pricing are mainly built into a spread, also broker aims to keep the spreads for all markets consistently low, also providing good conditions for withdrawal fees and non-trading fees too.

The market offering with InterTrader includes major trading instruments, but also you can buy or sell Cryptocurrencies CFDs on Bitcoin, Ether, Bitcoin Cash, Litecoin or Ripple, on the MT4 platform.

| Fees | InterTrader Fees | Core Spreads Fees | AvaTrade Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low | Low | Average |

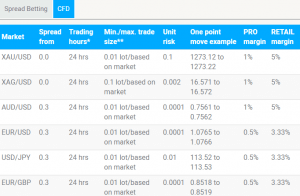

Spreads

InterTrader spreads gives one of the best value service as spreads are calculated by interbank market. EUR/USD spread are typically 0.6 pips, and UK 100 shares 0.1% per side.

Moreover, trading with InterTrade you may lower costs further, through the loyalty rebate TradeBack. As long as the trader has paid a combined spread cost during the month of over £500, regardless of how much have earned from positions, you will receive an automatic rebate.

See below typical spread for popular instruments, also see and compare fees to FP Markets.

| Spread | InterTrader Spread | Core Spreads Spread | AvaTrade Spread |

|---|---|---|---|

| EUR USD Spread | 0.6 pips | 0.6 pips | 1.3 pips |

| Crude Oil WTI Spread | 3 pips | 3 pips | 3 pips |

| Gold Spread | 4 | 4 | 4 |

| BTC/USD Spread | 0.60% | 0.70% | 0.75% |

Overnight fees

Another cost is a financing adjustment known as overnight fee or swap applied on forex and indices which is an interest cost of holding your position overnight. For forex the rate is calculated as the central bank interest rate plus 1%* for long positions or minus 1%* for short positions. For indices the rate is calculated as +/– 2.5%.

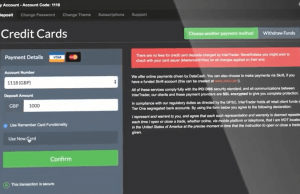

Deposits and Withdrawals

Clients of InterTrader are able to deposit and withdraw funds throughout three quick payment methods. Bank transfer, or by using the platform deposit through the credit / debit card or by a secure payment provider Skrill.

Minimum deposit

There is no minimum deposit required for InterTrader account, yet new position on account requires a deposit depending on instrument you would trade, known as margin.

InterTrader minimum deposit vs other brokers

| InterTrader | Most Other Brokers | |

| Minimum Deposit | $0 | $500 |

Withdrawal

InterTrader withdrawals are Credit Cards and Bank Wire, there are 0$ fees for any payments. Therefore, you may deposit and withdraw any amount is suitable for you, while the broker will not charge any additional fees for your payments. However, check with you payment provider as some fees may be charged by your payment provider himself.

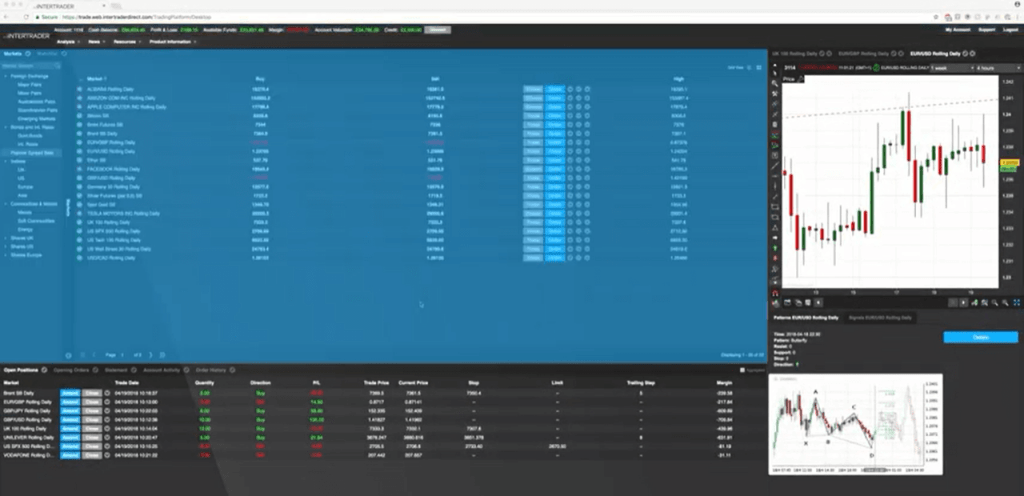

Trading Platforms

With InterTrader you are having a choice of proprietary web-based platform packed with free trading tools, or powerful mobile trading apps covering a wide range of smartphones and tablets, or the popular MT4 desktop or mobile platform.

While, InterTrader is an easy platform accessible from any browser, as well as Mobile App it offers spread betting and CFD trading with fully customizable, adaptable layouts and multiple watchlists. The prices are improved by the technology and the platform comes with advanced integrated trading tools, along with news and chart packages.

Social trading

Nevertheless, if you still prefer to use popular MetaTrader4 that comes along with analysis and strategy testing with the ability to run EAs for automated trading you are welcomed. Moreover, the platform allows usage of Fix API that connects own platform to the broker’s server, and AutoTrade Myfxbook to follow forex trading systems with proved track records.

And the last, but not the least there is an option to use social trading through ZuluTrade an automated, leading social trading platform that gathers more than 100,000 traders and allows to follow their signals for free. It’s a great tool especially for beginning traders that let to subscribe and learn better, as well to become a leader trader while others will be copying your trades.

Conclusion

In conclusion, having operated among the worldwide clients the InterTrader broker provides trusted online trading services and there is no issue about their reliability since the broker operates under strict regulatory requirements of FCA. Functioning on No Dealing Desk business model, traders at InterTrader are getting the best possible spreads on their trades. The technological solutions are on a high level too, while proposing various trading platforms and tools.