European shares pulsed with life on Wednesday, echoing the upbeat mood in Asian markets after Chinese tech giant Alibaba announced it will split into six business groups.

Easing concerns over the banking sector has contributed to the overall risk-on mood with US futures signalling a positive open. After the chaos witness over the past few weeks, it seems like a sense of normality has returned to markets with the attention back on key economic data and risk events. The next few days could be even more eventful, especially for US markets due to Fed speeches, Senate hearings on Silicon Valley Bank, and the Fed’s preferred measure on inflation.

Given the string of data and risk events expected from the US economy, our attention today falls on US indices with the weapon of choice none other than technical analysis.

S&P 500 approaches 50-day SMA

It has been a choppy week for the SPX500 thanks to fundamental forces.

Prices are trading above the 200 and 100-day Simple Moving Average (SMA) but just below the 50-day SMA. A solid daily close and breakout above 4000 could encourage a move higher toward 4050. Beyond this point, prices may test 4090. Alternatively, sustained weakness under 4000 could trigger a decline towards 3930.

Nasdaq 100 trapped within a range

A major breakout could be on the horizon for the NQ100 index. Although the index is trading well above the 50, 100, and 200-day SMA, prices seem to be consolidating. Support can be found at 12500 and resistance at 12850. A major breakout above 12850 could inspire an incline towards 13200. Should prices slip back towards 12500, this could trigger a decline back toward the 50-day SMA at 12280.

Bonus: Dow Jones bulls gather momentum

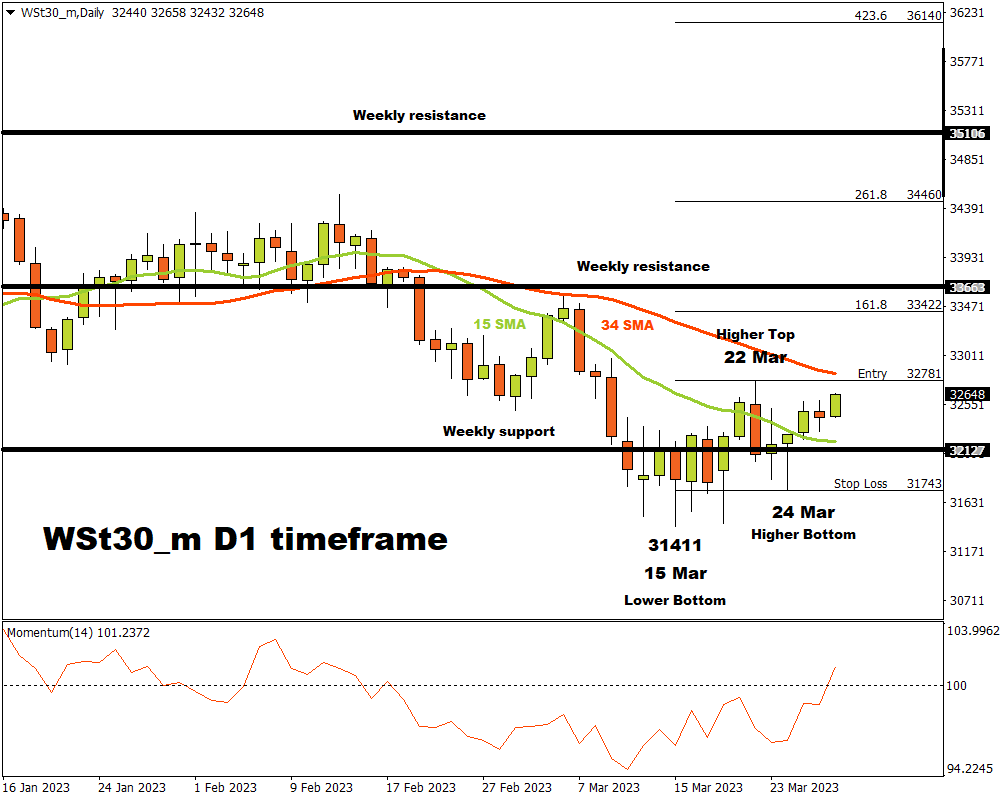

The WSt30 index on the D1 time frame started a new uptrend when the market structure changed after a last lower bottom formed at 31411 on 15 March. This happened inside a weekly support zone where the bulls found the price attractive and demand started increasing.

After the lower bottom at 31411, the price broke through the 15 Simple Moving Average and the Momentum Oscillator started moving towards the 100 baseline. Alert technical traders might have noticed this early indication that the bulls might be starting to gather momentum.

A higher top and possible critical resistance level formed on 22 March at 32781 after which the bears tried to take back control of the market. The weekly support zone held however and on 24 March at 31743 the bulls took over again with a higher bottom forming. At this stage, the Momentum Oscillator also crossed the 100 baseline as confirmation of the bullish drive.

If the bulls maintain their momentum and the price breaks through the critical resistance level at 32781, then three possible price targets can be calculated from there. Applying the Fibonacci tool to the higher top at 32781 and dragging it to the higher bottom in the weekly support area at 31743, the following targets may be considered. The first target is likely at 33422 (161%), with the second price target feasible at 34460 (261.8%) if the bulls can manage to break through the weekly resistance level on the way there. The third and final target is possible at 36140 (423.6%) with yet another weekly resistance as a hurdle in the path of the bulls.

If the price at 31743 is broken, the bullish scenario is undone and the scenario has to be re-evaluated.

As long as bulls retain their momentum, the outlook for the WSt30 on the D1 time frame will continue to the demand side.