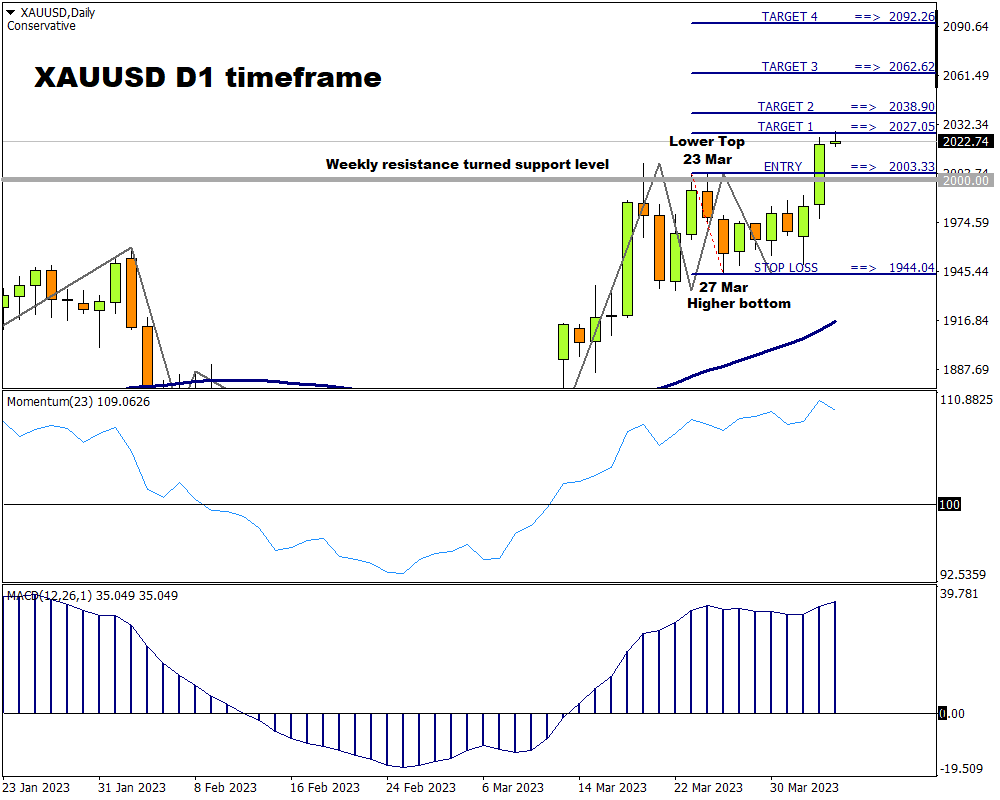

The Gold market was in an undisputed uptrend trend on the D1 time frame until a lower top formed at $2003.33 on 23 March.

After the lower top, the bears tried their best to end the bullish rule by driving the price down but they failed on 27 March when a higher bottom formed at 1944.04.

Although not a classic early stage of a new trend, technical traders would have noticed the weekly resistance level at $2000 and this, combined with both the Momentum and the MACD (Moving Average Divergence Convergence) oscillators being in bullish territory, could have alerted them to a possible long opportunity if the price broke through the weekly resistance level.

On 4 April the price broke through the $2000 level and 4 possible price targets (based on the FXTM trading signal format) could have been calculated from there. Attaching the Fibonacci tool to the lower top at $2003.33 and dragging it to the higher bottom at $1944.04, the following targets were calculated. The first target was estimated at $2027.05 and this was triggered on 5 April. The second price target can be expected at $2038.90, the third at $2062.62, and the fourth and final target at $2092.26.

If the support level at $1944.04 is broken, the current scenario is invalidated and the risk must be managed very carefully.

As long as the price continues to make higher tops and bottoms, the outlook for the Gold market will remain bullish.

(The scenario above and the chart below is based on the FXTM Trading Signals that can be accessed by clients on their MyFXTM profile).