Even as we await the pivotal US jobs report due later today (Friday, April 7), while noting that US stock markets have the day off on this Good Friday, traders and investors are also keenly aware of the slate of market-moving events due over the coming week.

The incoming US inflation data as well as the earnings announcements by Wall Street banks may trigger fresh volatility for the S&P 500 in the week ahead.

Monday, April 10

- IMF/World Bank spring meetings

- USD: Speech by New York Fed President John Williams

- Markets closed in UK, Europe, Hong Kong, and Australia

Tuesday, April 11

- AUD: Australia March business confidence, April consumer confidence

- CNH: China March CPI and PPI

- EUR: Eurozone February retail sales

- USD: Fed Speak - speeches by Chicago Fed President Austan Goolsbee, Philadelphia Fed President Patrick Harker, and Minneapolis Fed President Neel Kashkari

Wednesday, April 12

- CAD: Bank of Canada rate decision

- USD: US March CPI, FOMC meeting minutes, speech by Richmond Fed President Thomas Barkin

Thursday, April 13

- AUD: Australia March unemployment, April inflation expectations

- CNH: China March external trade

- EUR: Eurozone February industrial production; Germany March CPI (final)

- GBP: UK February GDP, industrial production, trade balance; BOE chief economist Huw Pill speech

- USD: US weekly initial jobless claims; March PPI

Friday, April 14

- SPX500_m: US earnings season kicks off with Wall Street banks

- USD: US March retail sales, industrial production; April consumer sentiment

Here’s a breakdown of these two major events that are set to influence the S&P 500 over the coming week:

1) US March consumer price index (CPI) due Wednesday, April 12

The CPI is the index used to measure overall inflation, i.e. the change in prices that consumers pay for goods and services.

And here’s what markets are forecasting for this tier-1 data:

-

CPI year-on-year (March 2023 vs. March 2022): 5.2%

(an official 5.2% print would mark a slowdown from February’s 6% y/y figure)

-

Core CPI year-on-year: 5.6%

(core CPI measures the changes in consumer prices excluding more volatile items such as food and energy, as their prices tend to fluctuate more)

-

CPI month-on-month (March 2023 vs. February 2023): 0.2%

(an official 0.2% print would mark a slowdown from February’s 0.4% m/m figure)

-

Core CPI month-on-month: 0.4%

(an official 0.4% print would mark a slowdown from February’s 0.5% m/m core CPI)

Overall, stock bulls (those hoping prices will move higher) want to see further evidence that US inflation is slowing down.

After all, stubbornly elevated inflation has been enemy #1 of the US central bank, the Federal Reserve.

And the Fed has raised US interest rates by 475 basis points over the past 12 months in a bid to quell inflation that was running at a multi-decade high.

And the S&P 500, with its higher concentration of US tech stocks, generally, does not like the prospects of US interest rates moving higher if the Fed is forced to prolong its fight against still-stubborn inflation with even more rate hikes.

How might the SPX500_m react to the US inflation data?

-

If the inflation numbers come in higher than market forecasts, then the SPX500_m may be dragged lower, as markets fear more incoming Fed rate hikes.

- If the inflation numbers come in lower than market forecasts, then the SPX500_m may be pushed higher, should markets rejoice over the prospects of Fed being almost done with its rate hikes.

2) US bank earnings released on Friday, April 14th

Once every quarter, companies whose shares are listed on the US stock markets have to reveal to the public how well it performed financially during the previous quarter.

This period is known as “earnings season”.

And the official curtain raiser is the results out of JPMorgan, the largest US bank.

Also on Friday, other financial heavyweights such as Wells Fargo, BlackRock, and Citigroup are also due to announce their respective earnings.

Why are US bank earnings important for the S&P 500?

-

Financial stocks account for nearly 13% of the S&P 500.

Given its weight, the market’s reactions to the earnings out of JPMorgan and its peers should have a big influence on how the SPX500_m fares overall leading into next weekend.

-

The health of US banks is widely used as a barometer for the health of the broader US economy. Hence, if US banks are struggling to earn profits, that may suggest deteriorating growth for the world’s largest economy, especially as recession fears are festering across global financial markets.

-

And lest we forget the recent US banking crisis.

Q1 2023 was certainly a tumultuous time for US banks, as three regional banks collapsed (Silicon Valley Bank, Signature Bank, Silvergate) while the likes of First Republic Bank were left teetering.

Then came Wall Street to the rescue.

JPMorgan, Wells Fargo, and Citigroup were among the big US banks that pledged US$30 billion of cash for First Republic Bank in order to prevent yet another collapse.

Hence, any further commentary from these banking C-suites next week about potentially further contagion, or the risk of a wider US banking/financial crisis that ramps up the risk of a recession, would be closely scrutinised by the markets.

How might the SPX500_m react to the US banks’ earnings?

-

If the earnings exceed market expectations, then the SPX500_m may be pushed higher.

- If the earnings disappoint, then the SPX500_m may be dragged lower.

Week Ahead: all still calm for US stock markets?

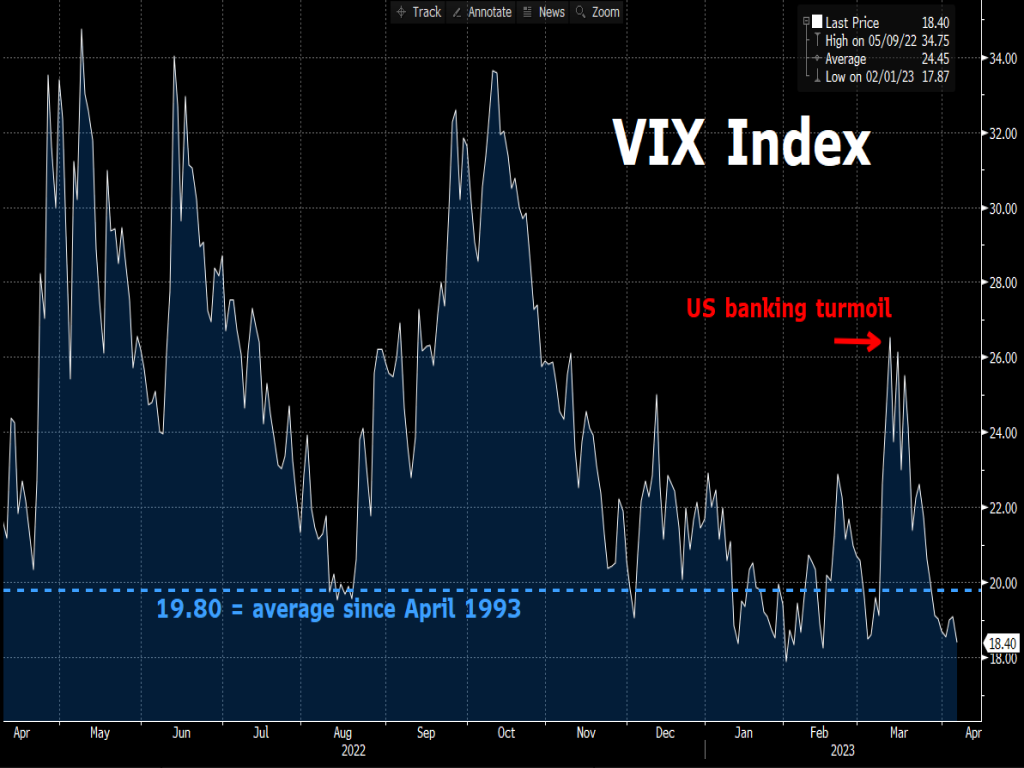

Let’s consider the VIX index, which measures how much volatility is expected for the S&P 500 over the next 30 days.

The VIX index is also more commonly known as the stock market’s “fear gauge”.

Note that the 30-day period ahead not only includes the upcoming CPI print and US earnings season, but also the Fed’s next decision on its interest rates due May 3rd.

Yet, the US stock market appears rather sanguine despite such looming event risks, with the VIX index rooted around its lowest levels so far this year.

With the VIX now at 18.40, that’s also lower than the 19.80 level that’s been its average reading over the past 30 years.

Still, that doesn’t mean that we’ll see guaranteed calm next week.

The vigilant trader and investor will certainly be paying close attention to the incoming CPI and earnings results, and awaiting potential opportunities that may be uncovered.

Key levels for SPX500_m

RESISTANCE:

-

4146.9: latest cycle high

-

4156.3: 50% Fibonacci retracement from 2022’s plummet (between record high in January 2022 and October’s trough).

- 4197.3: February 2023 intraday high

SUPPORT:

-

4070 – 4080: recent cycle low and early March intraday high

-

50-day simple moving average (SMA)

- 4,000: psychologically-important level, also close to the 38.2% Fib level